Polyester Nylon Flame Retardant -Will weak polyolefin margins improve this year? 04-08-2023 - Arhive

Polyester Nylon Flame Retardant

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

Weak polyolefin margins will not improve this year

Weak polyolefin margins are expected to persist throughout the year, according to Thomas Gangl, CEO of Borealis, as he reflects on the challenging developments in the Chemicals & Materials business during the first six months of 2023. The market had already shown signs of deterioration in Q4 of 2022, with hopes of a recovery in 2023 now dashed by a combination of high volatility and weak prices, exacerbated by China’s failure to bounce back after the end of the zero-Covid policy.

The root causes of the present results can be traced back to inflation and the cost-of-living crisis, which have significantly impacted the entire industry. Attempted supply management by OPEC did little to alleviate the situation, as the chemical industry remained heavily affected. Moreover, pressure from imports and a lack of anticipated demand surge during the spring further contributed to the declining sales volumes, which were down by 5%. Polyester Nylon Flame Retardant

The company’s nitrogen business faced a challenging period, with significantly lower sales of fertilizers and melamine. However, this segment’s troubles are expected to improve in the following quarters as the sale to Agrofert was successfully completed in July, valuing the business at €810 million on an enterprise value basis.

Borealis reported an operating profit of EUR 84 million in the first half of 2023, compared to EUR 936 million in the same period last year. The contribution from joint ventures and associated companies was also lower, with only €60 million generated in the first half of 2023 compared to €256 million during the same period in 2022.

The significant drop in operating profit was mainly attributed to inventory effects, where products stocked in lower price environments suffered adverse impacts in a falling price environment. This accounted for about €350 million of the €550 million drop. Despite the decline in margins for standard products, specialty products maintained stable margins, validating the company’s strategy to increase their share through innovation.

The Strong Foundation Performance Excellence program, implemented last year, is proving effective in mitigating the impact of challenging market conditions. Measures taken under this program are expected to result in an overall positive impact of approximately €100 million this year.Polyester Nylon Flame Retardant

Despite the difficult market conditions, Borealis remains optimistic about its projects. The Baystar joint venture, comprising a new cracker and polyethylene plant, has been completed, and the PE plant is now operational. Additionally, the company’s acquisition of Rialti, an Italian polypropylene compounder and recycler, further strengthens Borealis’ circular portfolio for PP and its commitment to sustainability.

On the sustainability front, Borealis is making strides towards reducing its carbon footprint and expanding its use of green energy. The company recently launched Stelora, a new engineering polymer produced from renewable feedstock, catering to customers seeking more sustainable materials for various applications. Polyester Nylon Flame Retardant

However, Gangl expresses concern that the current price and margin environment make it challenging for customers to shift towards circular volumes. Affordability becomes a pressing issue for customers in certain industry segments, potentially hindering progress towards sustainability goals.

Despite the challenges, Borealis remains committed to providing sustainable solutions. The company recognizes that different customers have varying sustainability needs, with some prioritizing biobased feedstock materials and others focusing on recycling volumes. As they continue their sustainability journey, Borealis strives to offer tailored solutions to meet diverse customer demands.

In conclusion, the first half of 2023 proved to be an eventful and challenging period for Borealis, with weak polyolefin margins persisting due to high volatility, weak prices, and economic uncertainties.

Despite the downturn, the company remains committed to innovation, sustainability, and meeting customer needs in a rapidly evolving market. By focusing on strategic initiatives and sustainable solutions, Borealis aims to navigate through these challenging times and emerge stronger in the future. Polyester Nylon Flame Retardant

BASF Releases Groundbreaking Life Cycle Assessment Study on Sustainable Mozzarella Packaging

In a pioneering move towards sustainable packaging solutions, BASF, a global leader in chemical manufacturing, has published a comprehensive Life Cycle Assessment (LCA) study on the environmental impact of mozzarella packaging produced from various alternative raw materials. The study evaluates the environmental performance of food-grade plastics derived from chemically recycled or renewable sources and compares different packaging formats in a comprehensive life cycle analysis. A panel of three independent experts has reviewed the study, ensuring the validity and reliability of the findings.

Dr. Paul Neumann, the Head of New Business Development & Sustainability Polyamides Europe at BASF, highlights the significance of this research in understanding the holistic environmental impact of mozzarella packaging. By analyzing both the packaging format and the raw material source, BASF aims to identify opportunities for minimizing environmental footprints. Polyester Nylon Flame Retardant

One crucial observation from the study is the considerable impact of the packaging format on its environmental performance. The rigid tray packaging system, comprising a mono polypropylene tray with a multi-layer lid film, exhibited the highest environmental impact across most categories when compared to flexible multi-layer packaging. The latter, which utilizes significantly less raw material, presents an appealing alternative with reduced packaging waste generation.

Working in collaboration with partners Südpack and Sphera, BASF explored the utilization of sustainable feedstocks in flexible multi-layer mozzarella packaging. By incorporating BASF’s sustainable mass-balanced polyamides Ultramid® Ccycled®, derived from chemically recycled feedstock, and Ultramid® BMBcert, derived from renewable sources, along with polyethylene, the study showed that a substantial reduction in environmental impacts, particularly CO2 emissions, can be achieved. This finding emphasizes the importance of embracing circular economy principles and prioritizing the use of recycled or renewable raw materials in packaging.

The study also delved into several technical and methodological scenarios, such as using green electricity and implementing chemical or mechanical recycling at the end of the product’s life. Polyester Nylon Flame Retardant

These additional analyses aim to provide a more comprehensive understanding of the potential environmental implications of various packaging practices.

The LCA study adhered to international standards for Life Cycle Assessment (ISO 14040:2006 and 14044:2006) and for Carbon Footprint of Products (ISO 14067:2018). By following these guidelines, the research ensures that the findings are rigorous, transparent, and comparable with other studies conducted worldwide.

BASF’s commitment to sustainability and environmentally responsible practices is further underscored by their broader efforts in the field of chemical recycling. They have conducted a global review of LCA studies on chemical recycling from 2003 to 2023, focusing on the carbon footprint of pyrolysis. This comprehensive assessment, available as “Life Cycle Assessment (LCA) for ChemCycling®,” contributes valuable insights to advance the sustainable recycling of plastic waste.

The publication of this LCA study marks a significant milestone in BASF’s journey towards providing innovative and sustainable packaging solutions. By shedding light on the environmental impact of different packaging formats and raw materials, BASF aims to drive change across the industry, encouraging the adoption of greener alternatives that minimize waste and reduce greenhouse gas emissions.

In conclusion, BASF’s latest Life Cycle Assessment study serves as a beacon of progress in the realm of sustainable packaging solutions. Through their research, they have demonstrated the potential of flexible multi-layer packaging with recycled or renewable raw materials in significantly reducing the environmental footprint of mozzarella packaging. Polyester Nylon Flame Retardant

As the world grapples with the challenges of plastic waste and climate change, studies like these provide valuable insights for businesses, policymakers, and consumers in transitioning towards a more sustainable and eco-friendly future.

Recyclers under pressure as downward price trend continues

No sign of a reversal in sight

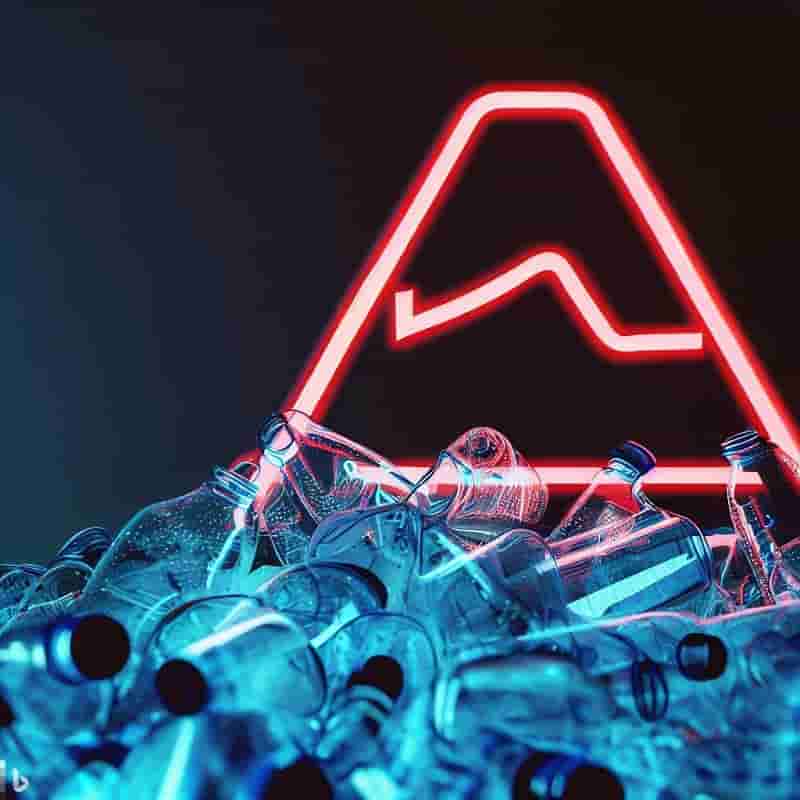

European recycled standard thermoplastics prices declined further in June and the downward price pressure has continued into July. Recycled plastics prices are under severe pressure because of persistent weak demand caused by the economic stagnation throughout Europe and competition from the falling cost of off-spec virgin plastics and cheaper imported recyclate.

At the same time, weak demand has led to a surplus supply situation, despite many recyclers curbing output to limit a build-up of inventories.

The market position for R-PET is particularly perilous. As the cost of virgin PET has fallen by €700/tonne since July 2022 converters have increasingly been switching to using a larger volume of standard material, despite a similar reduction in R-PET prices over the same period. A price war has subsequently developed between R-PET and virgin PET which makes it very difficult to operate the recycling plants economically.

In June, R-PET clear flake prices crashed €150/tonne, clear food-grade pellet prices fell by €100/tonne and coloured flake prices were €50/tonne down on the previous month.

Other recycled plastics classes also continue to suffer from declining prices due to very weak demand, competition from virgin material and lengthening supply.

In June, R-HDPE blow moulding prices declined €50/tonne while injection moulding grades fell by €30/tonne. Polyester Nylon Flame Retardant

R-LDPE natural film prices fell €60/tonne with R-LDPE translucent film prices down by €40/tonne. R-PP homopolymer and copolymer prices declined €70/tonne in June with R-HIPS prices €20/tonne lower than in the previous month

Recycled plastics prices remain under downward pressure during the first two weeks of July. Market fundamentals are unlikely to change significantly this month, although the beginning of the summer holiday season is likely to depress demand even further.

Recycled polyethylene terephthalate (R-PET)

In June, R-PET prices remained under heavy pressure because of continuing weak demand, the lower cost of bottle scrap, competition from virgin PET and cheaper imported material. Clear flake prices fell by €150/tonne, clear food-grade pellet prices were down by €100/tonne and coloured flake prices fell by €50/tonne.

Demand remains extremely low as a result of competition from the falling cost of virgin PET and competitively-priced imports from the Far East. Furthermore, the soft drinks sector has failed to increase seasonal demand in line with expectations due to unfavourable weather conditions during the early summer months.

Material availability is more than sufficient despite recyclers continuing to curb production while imports have added to the growing supply surplus.

In July, R-PET prices are likely to fall further due to continuing low demand and competition form the lower cost of virgin material. Polyester Nylon Flame Retardant

Recycled high-density polyethylene (R-HDPE)

R-HDPE prices continued to slide in June because of ongoing demand weakness and plentiful supply. R-HDPE coloured blow moulding prices dropped by €50/tonne with black injection moulding prices down by €30/tonne over the month. Demand remains extremely low with the construction industry in particular failing to recover as expected. Recyclers have responded by curbing output even more to avoid a further build-up of stocks.

In July, R-HDPE prices are expected to fall again as the start of the holiday season puts additional downward pressure on demand.

Recycled low-density polyethylene (R-LDPE)

In June, R-LDPE prices continued on a downward trend. R-LDPE natural film prices fell by €60/tonne, translucent film prices fell by €40/tonne and black extrusion pellet prices were down €10/tonne.

R-LDPE film prices were adversely impacted by ongoing demand weakness and continued replacement by the lower cost of ‘off-spec’ virgin material from post-industrial sources. Recyclers are implementing even harsher production cutbacks to avoid a build-up of excess stock levels. Yet, the availability of base material and recyclate continues to exceed demand. Polyester Nylon Flame Retardant

The downward price trend continues into July with demand adversely impacted even further by the holiday season.

In conversation with…Kelheim Fibres

Sustainable Nonwovens talks to Dr Marina Crnoja-Cosic, Director New Business Development, Marketing and Communication, at Kelheim Fibres.

Sustainable Nonwovens: Kelheim Fibres has undergone a transformation from being a mere supplier of speciality fibres to an innovative partner in the textile and nonwovens industry. Could you tell us more about this development?

Marina Crnoja-Cosic: Many decades ago, we realized that we couldn’t succeed in Germany by producing standard fibres. That’s why we focused heavily on specialties and generated numerous functional fibre innovations. As a result, we now have a product range comprising 15 main fibre types and over 100 different fibre types

Now, we have taken a step further. Polyester Nylon Flame Retardant

It is no longer enough to simply present the market with a great new fibre with new functionality. We can’t leave it to chance whether someone notices it and says, “I could use this in my product.” Not to mention that it takes far too long for a new fibre to find its way into an end product using this approach. Therefore, we recognized the need to go beyond the role of a pure supplier and actively engage as an innovation partner in the industry to meet market demands.

SNW: And how do you implement that?MCC: We understand the importance of identifying unmet customer needs and providing solutions. Our open innovation approach plays a crucial role. We actively monitor trends and identify application areas where our fibres can deliver value to consumers, fulfilling unmet needs.

Then, we develop a solution approach specifically to address these, in collaboration with partners along the value chain. Our role in this process is to align our existing fibre types precisely with the processing requirements and desired functionality of the end product.

In addition to offering tailored and functionalized specialty fibres, we also provide our entire expertise, technical capabilities, innovative spirit, commitment, and industry and scientific institute connections. Polyester Nylon Flame Retardant

This is particularly advantageous when collaborating with startups. I consider collaboration with startups very important. They bring innovative thinking and the speed we need to quickly bring new solutions to the market. However, their founders often lack the technical knowledge, which we provide as an industrial partner.

SNW: Can you tell us more about the current product developments at Kelheim Fibres

MCC: Unlike in the past, I’m not going to present our latest fibre types. Instead, I’ll talk about holistic concepts we have developed in partnership with others. And there’s a lot to tell.

For instance, just this year, we have collaborated with nonwovens specialist Sandler and hygiene product manufacturer pelzGroup to develop a plastic-free panty liner, which will soon be available in the market under the brand COSMEA.

We are also very proud of the result of our collaboration with Italian textile machinery manufacturer Santoni. We have developed a concept that enables the production of bio-based period underwear. Polyester Nylon Flame Retardant

Our speciality fibres used to make the period underwear ensure extremely high performance, while Santoni’s textile machinery enables highly efficient, energy- and waste-saving manufacturing. We are currently seeking a partner to commercialize this project.

We are also working with the Recycling Atelier of ITA Augsburg. The goal is to make recycled cellulose fibres processable into new nonwovens by blending them with our sustainable viscose fibres.

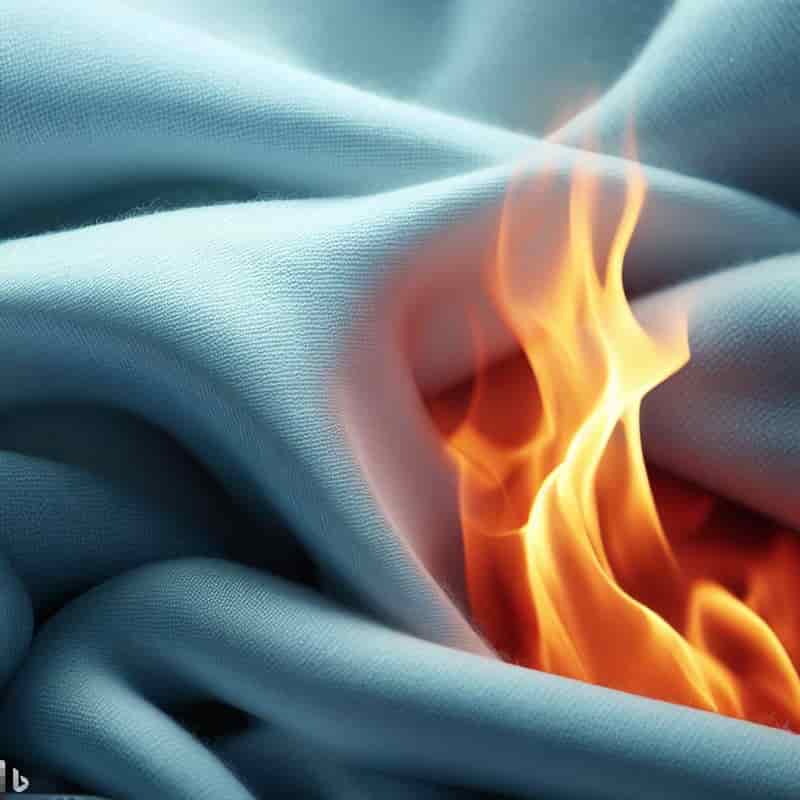

Polyester and Nylon Flame Retardant: Enhancing Safety without Compromising Performance

Introduction

In today’s fast-paced world, the textile industry continues to innovate, offering a wide range of materials that cater to various needs and applications. Polyester and nylon are two popular synthetic fibers known for their versatility and durability. However, their flammability has raised concerns about safety, especially in contexts where fire hazards are a significant risk. To address this issue, the development of flame retardant treatments for polyester and nylon has become a crucial focus. This article delves into the world of polyester and nylon flame retardants, exploring their importance, methods of application, and how they contribute to enhancing safety without compromising performance.

Understanding the Need for Flame Retardancy

Flame retardancy refers to the ability of a material to resist or delay the spread of flames when exposed to a fire source. Polyester and nylon, being synthetic fibers, are inherently more flammable compared to natural fibers like cotton or wool.

When ignited, they tend to melt and continue burning, which can exacerbate a fire and pose a significant safety risk. Polyester Nylon Flame Retardant

In various industries, such as transportation, interior furnishings, and protective clothing, it is crucial to ensure that the materials used meet stringent fire safety standards. Flame retardant treatments play a vital role in achieving these standards, providing a valuable layer of protection against potential fire-related accidents.

Flame Retardant Techniques for Polyester and Nylon

- Chemical Additives: Chemical flame retardants are often applied to polyester and nylon fibers during the manufacturing process. These additives work by interrupting the combustion process, releasing flame-inhibiting gases or forming a protective char layer on the surface of the material. Halogenated flame retardants were commonly used in the past, but due to environmental concerns, there has been a shift towards more sustainable and eco-friendly alternatives.

- Nanocoatings: Nanotechnology has opened up new possibilities in flame retardancy. Nanocoatings based on materials like graphene, silica, or metal oxides can be applied to the surface of polyester and nylon fibers, creating a barrier that hinders the spread of flames. Polyester Nylon Flame Retardant

- Nanocoatings offer a promising approach as they can provide effective flame retardancy without compromising the material’s other properties.

- Intumescent Coatings: Intumescent flame retardants are substances that expand when exposed to heat, forming a protective insulating layer that shields the underlying material. These coatings are particularly useful for fabrics, as they can be applied as a finish, ensuring the fabric retains its original appearance and texture.

Balancing Safety and Performance

One of the key challenges in developing flame retardant treatments for polyester and nylon is striking the right balance between safety and performance. Flame retardants must be effective in preventing or slowing down the spread of flames, but they should not compromise the material’s desirable properties such as strength, flexibility, and comfort.

Modern advancements in flame retardant technology have made it possible to achieve a higher level of safety without sacrificing performance.

Manufacturers now have access to a diverse range of flame retardant options that can be tailored to meet specific industry needs. By selecting the appropriate flame retardant treatment, they can ensure their products adhere to safety regulations without compromising on quality. Polyester Nylon Flame Retardant

Conclusion

Polyester and nylon are widely used in numerous applications due to their exceptional properties, but their flammability has been a cause for concern. Flame retardant treatments have emerged as a crucial solution to enhance safety in various industries while maintaining the performance characteristics of these synthetic fibers.

With ongoing research and advancements in flame retardant technology, we can expect even more efficient and eco-friendly solutions in the future. As consumers and industries prioritize safety, the integration of flame retardant treatments in polyester and nylon products will undoubtedly continue to play a vital role in safeguarding lives and properties from potential fire hazards. Polyester Nylon Flame Retardant

The search for eco-friendly flame retardants has gained momentum in recent years, driven by growing environmental concerns and a shift towards sustainable practices. Several eco-friendly flame retardants have been developed, each with its unique advantages. Some of the most notable options include:

- Phosphorous-based flame retardants: Phosphorous-based compounds are among the most environmentally friendly flame retardants available. They work by releasing phosphoric acid when exposed to heat, which forms a protective char layer, inhibiting the spread of flames. These compounds are relatively less toxic and have lower environmental persistence compared to traditional halogenated flame retardants.

- Nanoclays: Nanoclays are natural mineral-based flame retardants that can be incorporated into polymer materials, including polyester and nylon. They act as barrier agents, forming a protective shield that slows down the combustion process. Nanoclays are renewable, biodegradable, and have low toxicity, making them an eco-friendly choice.

- Bio-based flame retardants: Derived from renewable resources such as plants, these bio-based flame retardants offer a sustainable alternative to traditional additives. Examples include lignin-based flame retardants, tannins, and other natural extracts. Bio-based flame retardants are renewable, biodegradable, and have the potential to reduce the environmental impact associated with flame retardant treatments. Polyester Nylon Flame Retardant

- Ammonium Polyphosphate (APP): APP is a popular eco-friendly flame retardant used in various applications, including textiles and plastics. It releases ammonia and polyphosphoric acid when exposed to heat, creating a protective layer that prevents the spread of flames. APP is considered non-toxic, and its environmental impact is relatively lower compared to halogenated alternatives.

- Melamine-based flame retardants: Melamine derivatives, such as melamine cyanurate and melamine polyphosphate, are effective and eco-friendly flame retardants. They decompose upon exposure to heat, forming a char layer that acts as a barrier to flames. Melamine-based flame retardants have low toxicity and exhibit good thermal stability.

- Inorganic flame retardants: Certain inorganic compounds, such as aluminum hydroxide and magnesium hydroxide, act as flame retardants by releasing water vapor when exposed to heat, cooling down the material and suppressing flames. Inorganic flame retardants are abundant in nature, non-toxic, and have minimal impact on the environment. Polyester Nylon Flame Retardant

When selecting eco-friendly flame retardants, it is essential to consider factors such as performance, cost, and compatibility with the intended application. While these alternatives are generally considered more sustainable than traditional flame retardants, it is crucial to assess their specific environmental impact on a case-by-case basis.

Additionally, ongoing research and innovation continue to explore new eco-friendly flame retardant options, aiming to further reduce environmental concerns and enhance safety across various industries.

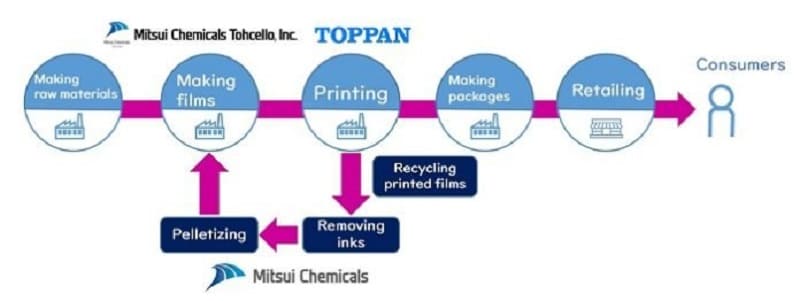

Advancing Horizontal Recycling: Joint Pilot Testing for Flexible Packaging Film

Introduction

Toppan, a global provider of integrated solutions, Mitsui Chemicals Tohcello, a manufacturer and distributor of film products, and Mitsui Chemicals, a Japanese chemicals company, have joined forces in a pilot testing initiative to establish technologies and operational infrastructure for the horizontal recycling of flexible packaging materials. This endeavor aims to leverage the growth of the flexible packaging materials industry and promote the recycling of flexible packaging film.

The Need for Horizontal Recycling

The Japanese government’s Resource Circulation Strategy for Plastics sets ambitious targets for the transition to reusable or recyclable plastic designs by 2025. Among the milestones for 2030 is the goal that 60% of plastic containers and packaging should be reused or recycled, while the recycling of plastic resources should be doubled.

To achieve these milestones, a focused effort on recycling and reuse is essential, starting from 2025. Polyester Nylon Flame Retardant

The RePLAYER Renewable Plastics Layer System

In May 2022, Mitsui Chemicals introduced the RePLAYER Renewable Plastics Layer System, which aims to recover film waste from flexible packaging material converters. This innovative system involves removing any ink from the waste, converting the remaining material into pellets, and then manufacturing new flexible packaging film from these pellets. This forward-looking initiative laid the groundwork for the joint pilot testing announced on August 2, 2023.

The Joint Pilot Testing

In December 2022, Toppan, Mitsui Chemicals Tohcello, and Mitsui Chemicals initiated discussions to embark on a joint pilot testing project. The fiscal year 2023 marked the beginning of full-fledged testing, with the primary focus on the recycling of printed BOPP film. Toppan generated BOPP film waste during printing adjustments, which Mitsui Chemicals recovered for the recycling process. Mitsui Chemicals further removed the printed material and converted it into pellets, which were then transformed into recycled BOPP film by Mitsui Chemicals Tohcello. Polyester Nylon Flame Retardant

Evaluating Quality and Eco-Friendly Practices

Toppan played a crucial role in evaluating the quality of the recycled BOPP film. Special attention was given to its suitability for printing, lamination, and the creation and filling of flexible pouches. In the lamination process, an eco-friendly adhesive from Mitsui Chemicals was utilized, aligning with the commitment to sustainability.

Future Implementation and Impact

The joint pilot testing initiative is aligned with the Ministry of the Environment’s Resource Circulation Strategy for Plastics, with the aim to have this innovative technology fully implemented in society by fiscal year 2025. By achieving this, the three companies will significantly contribute to Japan’s circular economy and further the cause of horizontal recycling in the flexible packaging materials industry.

Conclusion

The joint effort by Toppan, Mitsui Chemicals Tohcello, and Mitsui Chemicals in pilot testing horizontal recycling for flexible packaging film represents a significant step forward in addressing the environmental challenges posed by plastic waste. By combining their expertise and resources, these companies aim to establish the necessary technologies and infrastructure for effective recycling while contributing to the realization of the Japanese government’s ambitious recycling goals. Polyester Nylon Flame Retardant

The success of this initiative will not only advance the recycling of flexible packaging materials but also serve as a model for other industries seeking sustainable solutions to the global plastic waste problem.

INEOS and Sinopec Successfully Form 50/50 Joint Venture for Tianjin Nangang Ethylene Project in China

INEOS, a global petrochemical company, has reached a significant milestone by completing the formation of a joint venture with Sinopec for the Tianjin Nangang Ethylene Project. The collaboration was initially announced in December 2022 and has now come to fruition, with the project currently being developed by Sinopec and expected to commence operations by April 2024, as reported by Hydrocarbonprocessing.

This joint venture marks a pivotal step in the progress of the petrochemical deals forged by both parties back in July and December of the previous year. It exemplifies the deepening relationship and growing cooperation between Sinopec and INEOS, two major players in the global petrochemical industry. Polyester Nylon Flame Retardant

The petrochemical complex, which is part of the joint venture, encompasses a 1.2 million metric tons per annum (mtpa) cracker and includes a new 500,000 metric tons per annum (ktpa) High-Density Polyethylene plant licensed to produce INEOS pipe grade products. Additionally, there are 11 other derivative units that contribute to the overall capabilities and production of the complex.

The successful completion of this agreement is a testament to the dedication and expertise of both INEOS and Sinopec in driving the project forward. By combining their resources and knowledge, the two companies are positioning themselves to capitalize on the growth opportunities in the Chinese petrochemical market.

It is worth noting that this venture aligns with a broader strategic move by TotalEnergies and INEOS to optimize their respective stakes in production assets and logistics infrastructure in eastern France. This realignment aims to achieve a better balance between ethylene production and internal consumption. Through this exchange of interests, TotalEnergies aims to enhance integration between its petrochemical sites at Feyzin, near Lyon, and Carling in eastern France. On the other hand, INEOS seeks to strengthen its operations at the Lavera site on the Mediterranean coast, improving efficiency and integration within its operations. Polyester Nylon Flame Retardant

The partnership between INEOS and Sinopec goes beyond just a business transaction; it signifies a strengthening alliance in the global petrochemical landscape. By leveraging their expertise, technological capabilities, and regional presence, both companies are better positioned to navigate the dynamic challenges and opportunities that arise in the petrochemical sector.

As the world’s energy and chemical demands continue to grow, collaborations like these are instrumental in driving innovation and addressing sustainability challenges. With both INEOS and Sinopec committed to sustainable practices, their partnership will likely play a crucial role in promoting eco-friendly solutions and reducing the industry’s environmental footprint.

Moreover, the joint venture’s focus on producing INEOS pipe grade products highlights the importance of high-quality materials in critical sectors such as construction and infrastructure. These materials are essential for building safe and reliable structures, emphasizing the significance of the Tianjin Nangang Ethylene Project beyond its immediate scope. Polyester Nylon Flame Retardant

As the petrochemical industry evolves, investments in new and efficient production facilities become increasingly crucial. The Tianjin Nangang Ethylene Project is well-positioned to address the growing demand for petrochemical products in the region and contribute to the economic growth of China.

In conclusion, the successful formation of the 50/50 joint venture between INEOS and Sinopec for the Tianjin Nangang Ethylene Project marks a significant milestone in the global petrochemical landscape. It reflects the close relationship and increasing collaboration between the two companies and their commitment to driving sustainable solutions in the industry. The project’s completion and subsequent operation will undoubtedly bring positive impacts to the Chinese petrochemical market, further cementing INEOS and Sinopec’s role as major players in the sector.

Polyester Nylon Flame Retardant