Recycled-plastic – Composites 06-05-2022 - Arhive

Recycled-plastic – Composites

-Intelligent packaging: A novel frontier for effective plastic waste management

How might intelligent packaging emerge as a new frontier for plastic waste management? Aditi Basu, marketing head at Future Market Insights, explores how companies are using blockchain, RFID, and AI to enhance the collection, sorting, and recycling of plastic waste – turning it into a valuable commodity that can facilitate environmental and socioeconomic change.

Many governments and non-governmental organizations (NGOs) alike agree that single-use plastics account for a majority share in issues related to environmental stewardship. Ocean debris, damaged marine life, and congested landfills are all signs of a plastic management issue. Recycled-plastic – Composites

With plastic waste piling up on land and in the ocean, there has been a spike in interest in alternative packaging materials, such as paper, glass, and metals, which plastics have mostly replaced over the previous several decades. However, even when a considerable amount of recycled material is utilized, these plastic-free solutions often have a greater carbon footprint than conventional plastics.

While sustainable packaging is expected to stay at the top of consumers’ concerns in 2022, debates around plastic reusability models and the future of throwaway plastics are likely to heat up.

To address this issue, packaging companies are introducing intelligent packaging that tackles plastic waste management, sorting, and collection issues, promotes circularity, and reduces the carbon footprint of their packaging. According to Future Market Insights’ (FMI) report, ‘Intelligent Packaging Market’, demand for intelligent packaging will reach US$46.7 billion over the next decade.

Do we really need intelligent packaging?

The 21st century has witnessed an exponential rise in the adoption and usage of plastic packaging, thus generating tremendous amounts of waste. Plastic waste is now considered an environmental hazard; microplastics are now found in the deepest point of the ocean. Also, the increased production of disposable plastic items has stressed the world’s ability to recycle and reuse.

As per the FMI’s whitepaper, ‘Intelligent Packaging for Circular Economy’, developed in collaboration with Graham Packaging and Avery Dennison, around 9.2 billion tonnes of plastic have been manufactured globally, out of which only 9% is recycled.

Developing and lower-income countries are severely affected by plastic pollution as their recycling systems are generally low capacity. Developed economies have poor recycling rates and are struggling to recover abandoned plastic packaging. As of 2022, a quarter of worldwide plastic waste is incinerated while 40% is disposed of in landfills.Recycled-plastic – Composites

-Pontetorto chooses Q-Cycle by Fulgar

First collection of sports and fashion fabrics made with high-tech yarns obtained from end-of-life tyres is now available.

Leading Italian warp knitted fabrics manufacturer Pontetorto, an historical textile group from Tuscany celebrating its 70th anniversary this year and a leading business in the sportswear and fashion world, has teamed up with Fulgar, a leading producer of man-made, innovative and increasingly sustainable yarns. Fulgar was chosen as the ideal partner for a new project aiming at supporting the circular economy in the textiles industry. Recycled-plastic – Composites

Presented for the first time at the upcoming Performance Days show, Pontetorto’s new collection of fabrics for activewear and fashion has been entirely made from Fulgar’s revolutionary Q-Cycle yarn.

Q-Cycle is an eco-sustainable yarn obtained from end-of-life tyres, which are considered to be among the most difficult manufactured items to be disposed of, and also a highly polluting factor at a global level. Each year in Europe alone, 1.37 million tonnes of tyres (40% of total production) are not in fact recycled but are instead mainly incinerated with high CO2 emissions.

“Our commitment towards a sustainable textile industry,” underlines Marco Toccafondi, Head of Pontetorto Sports line, constantly pushes us to both looking for high level partners within the supply chain and finding cutting-edge solutions capable of either accelerating this process and really making the difference for us as a textile manufacturer and for our customers. This is what made Fulgar an interesting partner company while recognizing Q-Cycle as an example of a virtuous story which we hope will be best welcomed by the market.”

Q-Cycle yarn is the result of an innovative chemical recycling technology, the pyrolysis, which is part of BASF’s ChemCycling recycling project and Fulgar’s spinning technology.

Pyrolysis can be applied to any plastic waste that cannot be recycled mechanically such as end-of-life tyres and also allows the material to be returned to its virgin state. This technology is two-fold virtuous by being self-sufficient: the waste portion which cannot be transformed into raw material is pyrolysed into gas and used to generate the energy required for the entire recycling process. The recycled content is allocated to the final product by using a third-party controlled mass balance approach.Recycled-plastic – Composites

-May contract price of styrene in Europe increased by EUR84 per ton

The contract price of styrene monomer in Europe has been agreed at EUR2,169 per tonne for May deliveries, up EUR84 per tonne from the previous month’s level amid rising quotations of crude benzene, ICIS said.

The contract price was negotiated on a free-board (FOB) Amsterdam-Rotterdam-Antwerp (ARA) delivery basis.

The rise in styrene prices followed an increase in the cost of natural gas and the contract price of benzene as a feedstock, which reached an annual high this month.

Earlier it was reported that the contract price of styrene monomer in Europe was finally agreed at the level of EUR1,725 per ton for March deliveries, which is EUR93 per ton higher compared to the level of the previous month amid an increase in quotations of raw materials – benzene. Recycled-plastic – Composites

Styrene is the main raw material component for the production of polystyrene (PS).

-TOMRA: Breaking bottlenecks of recycled plastic content

Brand owners and packaging converters in the plastics industry are facing major bottlenecks in recycled content availability. To overcome this challenge and meet ambitious recycling targets, recyclers and material sorting facilities (MRFs) are using advanced technologies to produce feedstock for high-grade applications, expanding their business opportunities.

As legislation continues to push for a reduction in plastic waste, the demand for high-quality recycled plastics are at a record high. Plastics are durable, efficient, and convenient, which makes them hugely beneficial to consumers and businesses alike. Making plastic products and packaging more sustainable is the challenge of our time. As brand owners look to increase the share of recycled content to reduce their production emissions and satisfy consumer demands, they are met with a new set of challenges. High-grade applications like automotive and packaging require high-quality recycling processes and advanced sorting technologies to effectively source feedstock from post-consumer and post-industrial plastic waste.

Demand vs. recycled content availability

In 2020, worldwide plastic production amounted to 367 million metric tons (mt). Europe produced 55 mt of plastic, with 70% of the total market demand coming from the largest countries, using 40.5% of the material for packaging production. In the quest to create a circular economy for plastics, the share of virgin material in manufacturing should be reduced and replaced by secondary raw materials. this, however, is easier said than done.Recycled-plastic – Composites

Plastic recycling has certainly had its share of bad publicity, not least due to downcycling – after all, there is a limited demand for items such as park benches, flowerpots and speed bumps. The recycling industry, working in collaboration with members of plastic value chains, has now made it possible to create virgin-like recycled content with advanced mechanical recycling. Not only does this prove to be an economically feasible and practical alternative to primary materials, it also gives recyclers and MRFs the opportunity to create new revenue streams. Even in the case of highly contaminated plastic waste streams, like municipal solid waste (MSW), it is now possible to source quality feedstock that can be used to create new products.

The S&P Global Platts Analytics predicts that by 2030 more than 1.7 million metric tons of virgin polymers will be replaced by mechanically recycled plastics – compared to 688,000 mt in 2020. To date, only a tiny portion of recyclates have found their way into the production of new materials. Most of the recyclates are used for lower-grade applications. So, how can industries such as automotive, food and beverage, and cosmetics ensure a reliable supply of high-quality recycled feedstock? Bridging the gap of material shortages starts with effective collection of recyclables.

Deposit Return Systems (DRS), for instance, are a global best practice for the recycling of beverage containers in a closed-loop system. There is not a one-size-fits-all solution: to achieve circularity, complementary solutions are needed to capture other products made of plastic, like post-consumer film packaging. Mitigating contamination and increasing the quantities of recovered recyclates across all waste streams is crucial to the future of plastics.

New developments in legislation

A harmonized approach is required to enable greater plastics circularity and provide a long-term supply of recycled content for the market to reduce dependency on primary materials. For instance, many countries consider or already introduced Extended Producer Responsibility Schemes (EPR), which give producers significant responsibility for the product’s lifecycle – from design to the post-consumer stage of its lifecycle. These policies incentivize producers to consider environmental factors when manufacturing packaging and to contribute to a reduction of the products’ environmental impact. Legislation plays a fundamental role in supporting infrastructure investment, including effective collection, sorting, and recycling of plastic waste. Plastic directives and mandatory recycled content targets can establish the proper framework for prioritizing circularity and breaking the bottleneck of feedstock recovery.Recycled-plastic – Composites

Binding frameworks constitute a major and necessary intervention in the market. They support sustainable waste management and stimulate the industry to increase the use of recyclates while securing demand and infrastructure investment.

The Plastic Packaging and Packaging Waste Directive, introduced by the European Union in 1994, is among the legislation that defines recycled content targets, creating end markets for secondary raw materials. The directive makes it mandatory for packaging producers to use at least 50% recycled content in the production of new plastic packaging by 2025 and more than 55% by 2030. In 2021, the EU introduced a Single-Use Plastics Directive requiring a minimum of 25% of recycled content in PET bottles by 2025 and a separate collection target of 77%. Countries with DRSs are a best practice: Germany achieves a 98% collection rate for PET and the Netherlands follows closely with 95%.

As much as it seems that we are headed towards a circular economy, we have a long way to go. According to Zero Waste Europe, new bottles only contain 17% of recycled PET (rPET), on average. Meanwhile, 69% of other PET products are made with rPET from beverage bottles – diverting materials from the intended closed-loop process. Ideally, plastic materials should be recycled multiple times in the same application to ensure adequate supply for production for as long as economically feasible.

-Composites are also climbing up the slope

European production returned to pre-pandemic levels last year, after losing 15% of volumes between 2018 and 2020. The uncertainties of the global scenario weigh on the future.

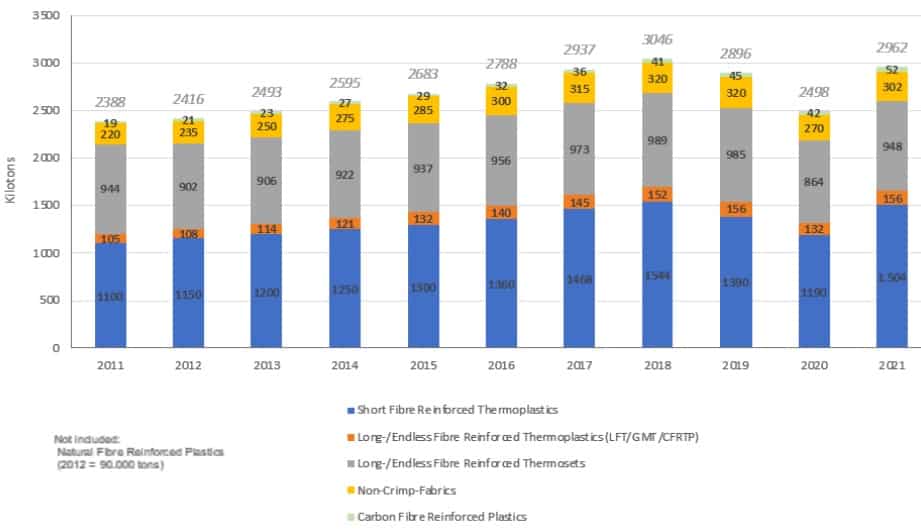

The German association of composite materials AVK (Industrievereinigung Verstärkte Kunststoffe) has disclosed at JEC World the data referring to 2021 relating to the European market of composite materials and fiber-reinforced plastics, with thermosetting or thermoplastic matrix.

The first positive fact is that the sector recovered its pre-pandemic levels last year, returning to a path of growth that began in 2013 and ended abruptly with the advent of Sars-Cov-2. The European production of composites in fact decreased by more than 15% between 2018 and 2020, but last year the trend reversed, recording a growth of +18.3% and thus approaching the pre- crisis.

In absolute terms, consumption reached 12.1 million tons worldwide last year, with just under 3 million tons referring to the European market (graph below). The rest is divided between Asia (50% of the total) and the United States, which with 25% cover a share similar to that of Europe.Recycled-plastic – Composites

As regards the main applications, over half of composite and fiber-reinforced materials have found use in the transport sector (52.8%), followed by electrical / electronic (18.4%), construction (18.7%) and, distance, sports and leisure (8.5%).

The thermosetting matrix composites represent 1,250,000 tons on the European market, equal to 43%, mainly intended for applications in transport and construction. The thermoplastic composites segment is more dynamic, with 1.66 million tons and two thirds of volumes destined for the automotive and transport sectors.

More details are provided in the table below:

As regards the main European market for thermosetting composites, Germany, last year 242,500 tons were used, equal to 19.4% of the total. In second place the aggregate of Eastern European countries with 226,000 tons (18.1%). Italy and the Iberian Peninsula (Spain and Portugal) go head to head, each with a share of around 14%.

The segment of carbon fiber reinforced composites is also worthy of interest, which last year recorded growth of + 23% over 2020, reaching 147,500 tons worldwide, one third of which referring to Europe (52,000 tons).

Russian oil ban despite shortages Recycled-plastic – Composites

-May contract price of benzene in Europe increased by EUR45 per ton

The May contract price of benzene in Europe rose to EUR1,175 per tonne, up EUR45 per tonne from April, ACCORDING TO ICIS.

The price was confirmed by three sellers and two buyers, and this is the highest level since May 2021.

The price of the May contract was agreed in US dollars at USD1,232 per tonne and converted to euro at the agreed exchange rate EUR1= USD1,049.

Earlier it was reported that Eneos (formerly JXTG Nippon Oil & Energy), part of the structure of Eneos Holding, a major producer of petrochemical products in Japan, set the May contract price of benzene in Asia at USD1,180 per ton, which is USD15 per ton lower compared to the contract price of April.Recycled-plastic – Composites

Benzene is the raw material for the production of styrene, which, in turn, serves as the main raw material for the production of polystyrene (PS).

Recycled-plastic – Composites