Batteries-Recycling – Green-Hydrogen 17-11-2022 - Arhive

Batteries-Recycling – Green-Hydrogen

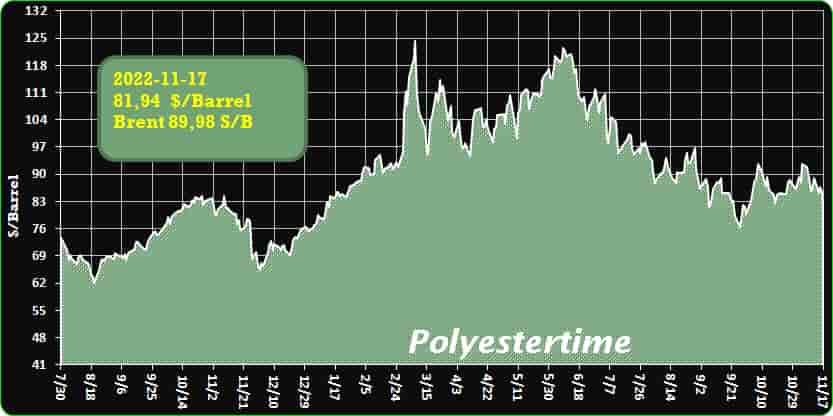

Crude Oil Prices Trend

Crude Oil Prices Trend Polyestertime

-Because European batteries may cost less than Chinese ones

The swirling technological progress of the sector can break the balance we are used to: this is what is happening

The world of batteries, as we know, today is largely in the hands of the Asian giants. But things have already started to change. In fact, there are more and more Western big names (and startups), Europe in the lead, working to break this balance to the sound of GWh and research.

One way to conquer the sector can certainly be to be able to design batteries which, instead of rare earths and the “usual” critical raw materials, adopt cheaper and easier to find materials. Sodium and sulfur, for example, could take the place of lithium or cobalt. But not only. Batteries-Recycling – Green-Hydrogen

We need an alternative to lithium-ion

The fact is that nickel, manganese, lithium and cobalt, materials used for the lithium ion batteries that we all carry in our pockets, are in many cases controlled by Chinese companies, which before others have worked to ensure solid supply chains. Benchmark Mineral Intelligence, a British specialist consultancy, estimates that China currently accounts for 75% of the world’s cobalt refining capacity and 59% of lithium processing capacity.

Furthermore, due to the growing demand, the prices of these elements have increased significantly in the last period. This means that finding a disruptive technology can represent a huge growth opportunity.

Battery pack assembly at Volkswagen’s Battery Manufacturing Unit in Chattanooga, Tennessee

Moreover, there are also those who predict that in the coming years the automotive industry may face a shortage of supply of lithium batteries compared to the boom in demand. So, having alternatives like sodium-ion batteries or lithium-sulfur batteries could help avoid any bottlenecks.

You save up to 60%

The beauty is that with these new technologies it could be possible to have accumulators with performances similar to the current ones with cost savings of the order of 60%. To do this, clearly, research plays a fundamental role. The skills could therefore be the most important “raw materials” of Europe and the States, also in terms of recycling and reuse of batteries already produced.

Sulfur accumulators, for example, still have problems with their duration, as they degrade very quickly. Sodium ion batteries, on the other hand, still have an insufficient energy density for applications in the automotive field: to guarantee adequate mileage they would have to be too heavy and bulky. There is still a lot to do then. Batteries-Recycling – Green-Hydrogen

Lyten’s Lytcell EV lithium sulfur battery

But progress is there. Likewise, there are many startups – such as the German Theion, the British Faradion or the American Lyten – which are making great strides, also thanks to substantial and indispensable public or proven funding. A revolutionary discovery could come from these and other startups, capable of giving Europe or the United States an edge over China. However, China is not at all watching, as demonstrated by CATL, the world’s leading battery manufacturer, which says it is ready to market a sodium-ion battery as early as 2023. The game is open.

Speaking of newly developed batteries

• The economic aluminum-sulfur battery is approaching: the discovery of MIT

• From Texas the sodium-sulphur battery for low cost electric cars

• The European sodium battery that wants to break the Chinese record

• Will sodium batteries “kill” lithium? No, that’s why

-OE tire demand picks up as automotive chip shortage begins to ease

Automotive market bouncing back “quicker than expected” in US

But tire makers have mixed views about rate of recovery following two years of disruption

The global microchip shortage that has crippled the automotive industry over the past two years is seemingly easing, although major tire manufacturers have mixed views about the speed of recovery. Batteries-Recycling – Green-Hydrogen

Bridgestone, for instance, said global OE tires sales had turned to a “significant year-on-year increase” in the three months to 30 Sept on “improved vehicle production conditions” at automotive companies.

In the OE truck & bus tire segment, the Japanese group said, “demand continued to recover from the impact of semiconductor shortages from second quarter onward.”

“As production at automobile companies began to recover, demand for tires also showed signs of recovery in the third quarter,” Bridgestone added in its 10 Nov financial results statement.

Meanwhile, Pirelli also reported strong growth in the OE segment, driven by a 10% year-on-year increase in the ‘high-value’ large rim-sized tires.

According to the Italian tire maker, the gains were supported by “strong recovery in car production”, particularly due to government financial stimuli in China.

For its part, Michelin linked a 26% year-on-year increase in third quarter OE passenger car and truck tire volumes partly to ‘improvements in the semiconductor environment.’ The recovery in OE demand was seen mainly in North America and China.

Yokohama Rubber Co. (YRC) “struggled” with a number of challenges during the first nine months of 2022, including rising raw materials costs and reduced vehicle production “necessitated by the shortage of semiconductor devices.”

However, YRC also noted an overall increased OE sales during the nine-month period in both passenger car and commercial tire segments, as “automakers began to redouble production output to compensate for earlier reductions.” Batteries-Recycling – Green-Hydrogen

Likewise, Sumitomo Rubber Industries (SRI) noted sluggish OE demand in first nine months in the local Japanese market, as a result of the “ongoing production cuts at auto manufacturers, which mainly stemmed from the global shortage of semiconductors.”

-Europe has a secret weapon to become a leader in batteries

The global challenge of raw materials can be won thanks to recycling, but work must be done: the debate at the Automotive Business Summit

If China has a dominant position in the field of battery production, Europe can change its fate and establish itself as a leader by leveraging its expertise in more modern products. In the Automotive Business Summit digital conference organized by Il Sole 24 Ore, a panel wanted to take stock of the current situation and possible future developments of Made in the EU accumulators.

To photograph what is happening a series of experts who spoke about technology, support from institutions and the circular economy. But let’s go in order.

The redemption of Europe

“To counter China’s excessive power over battery production – recalled Silvia Bodoardo, professor at the Polytechnic University of Turin – we have created the European Battery Alliance, an association which aims to attack a market worth 250 billion dollars ‘year. It was created, more precisely, to encourage the development of a battery industry that creates new generation, safer, longer lasting and more sustainable products”.

In a certain sense, Europe has the task of focusing on products that are more complicated to make, but which will allow us to take a huge step forward in electric mobility. The Old Continent will have to focus on new chemical formulas and architectures that favor the recovery of precious materials. Batteries-Recycling – Green-Hydrogen

Batteries like mines

“Let’s start with a clarification – Bodoardo continued – there are no rare earths properly speaking in batteries. Those are present in the magnetos of electric motors. There are critical materials in batteries, those that are scarcely available or have a significant environmental impact. They are still present, but their use is decreasing thanks to new technologies that allow us to overcome certain obstacles. For example, cobalt is present below 3% by weight but will disappear”.

Europe will also have to optimize recycling processes. Because today exhausted accumulators (even after the second life) are still few, but in the future they will represent an indispensable resource. Bodoardo has very clear ideas on this aspect: “Today’s batteries will be the mine for tomorrow’s batteries. We look at the lead. The lead in today’s batteries is 100 years old.” The same will happen for nickel, cobalt, lithium and all other useful materials. And so, farewell also to fears about China and its raw materials.

From recycling to solid state

Sergio Iorio, managing director of Italmatch, a company operating in the chemical field, also took part in the round table. Iorio explained that Italy is working hard on the issue of recycling and selective recycling techniques have been developed which allow materials such as nickel and cobalt to be recovered in purity. In the future it will be possible to do the same with lithium, which is very similar to other elements and requires chemical methods yet to be developed.

In Italy we are also working on the solid state and trying to make a contribution to the definition of a technology that will allow us to take a big step forward on the issue of accumulators for electric cars. Batteries-Recycling – Green-Hydrogen

From theory to practice

The problem, as Simone Vellucci, director general of the Ministry of Enterprise and Made in Italy (ex Mise, to understand) underlines, is that a lot of research is done in Italy but one remains untied from production areas.

The energy storage systems made with the batteries of the Mercedes eCitaro electric buses

“Italy has received substantial research funding – explained Vannucci – but we have to work on the industrial front. The PNRR and the Automotive Fund can come to our aid, which supports the renewal of the vehicle fleet and projects related precisely to production. In total we are talking about over 8 billion euros: the tools are there, and they work, but the road is still long”.

Between circular economy and competition

Giacomo Vigna, director of Circular Economy and Policies for Eco-sustainable Development of Mimit, concluded: “In the world of batteries of the future, the circular economy plays a very important role. For this, batteries that are easy to recycle should be designed. They will be rules that must be respected by everyone”

From this point of view, we will also have to work in order to have rules of fair competition with international producers, otherwise our producers will be in difficulty. We therefore need an effective system of customs controls. Vigna said: “There is a fruitful discussion that will lead to the so-called European battery decree: a measure being defined which aims to introduce a series of guarantees on products that can be used in Europe.A minimum content of recycled materials, just to give an example. It should enter into force in 2023”. Batteries-Recycling – Green-Hydrogen

The European battery industry:

- Because European batteries may cost less than Chinese ones

- Thus the electric car pushes the recycling industry

- Green light to the Spanish pole for the Volkswagen electric car

- BASF ready to produce battery materials in Germany

-Saudi Aramco, Pertamina strike hydrogen and ammonia deals

Cooperation involves pre-feasibility study for development of a clean ammonia and hydrogen value chain

Saudi Aramco and Indonesia’s state-owned Pertamina have signed a deal to jointly work on projects involving the hydrogen and ammonia value chains.

Aramco in a statement on Monday said the companies signed a “memorandum of understanding (MoU) outlining future cooperation across the key pathway of the energy transition” on the sidelines of the G20 Summit in Bali, Indonesia.

The agreement “involves a pre-feasibility study that aims to assess the possibility of cooperation related to the development of a clean ammonia and hydrogen value chain”, the company noted. Batteries-Recycling – Green-Hydrogen

“The study will explore investment viability and jointly develop commercialisation options including, but not limited to, business organisation and commercial structures for clean ammonia and hydrogen in Indonesia,” Aramco said.

It added that the study is “expected to be conducted over the next two years, and depending on outcomes may be developed further”.

“It includes potential carbon capture, utilisation and storage (CCUS) at Pertamina group’s existing facilities and other agreed potential locations,” the statement claimed.

Mohammed Y Al Qahtani, senior vice president of Aramco’s downstream business said the company’s ambition is to achieve net-zero Scope 1 and 2 greenhouse gas emissions across its wholly owned operating assets by 2050.

“Our work in developing new ammonia and hydrogen energy pathways will be pivotal in achieving that goal while helping to advance an affordable, equitable and more sustainable transition for all,” he said.

Nicke Widyawati, Pertamina president director noted the company has developed a decarbonisation programme through CCUS, and hydrogen and ammonia are expected to play a key role in a future climate-neutral economy.

-SABIC launches new polycarbonate copolymers for photovoltaics

Petrochemical manufacturer, SABIC has launched a polycarbonate-based copolymer resin, well-suited for photovoltaic connector bodies. Batteries-Recycling – Green-Hydrogen

SABIC claims the new LNP EXL9334P copolymer resin achieves the highest comparative tracking index, delivers low-temperature ductility, good dimension stability, excellent heat resistance, good durability and weather resistance and flame retardance.

SABIC believes this specialty resin surpasses competitive materials such as glass-reinforced nylon, polyphenylene ether (PPE) and standard PC.

SABIC’S Director of business management, Joshua Chiaw said: “Our next-generation LNP EXL9334P resin grade, which meets stringent international standards for 1.5 kilovolt components, can facilitate adoption of this efficient, cost-effective technology. In addition to addressing changing industry requirements, this new material supports our sustainability strategy by helping to promote greater use of renewable solar energy.”

The emergence of 1.5 Kv PV systems is a major industry trend that offers efficiency improvements and potential system cost reduction. However, the transition from 1.0 Kv to 1.5 Kv systems is also leading to more-stringent performance and safety standards for all components.

Such safety measures have been a major focus for the company while developing new technology, Jenny Wang, Director, Formulation and Application said: “Developing a flame-retardant copolymer that could achieve the highest CTI level was difficult, but our experts were up to the challenge”

-Covestro Partners with China’s Coleitec to Develop PU Composite Materials

The collaboration has already borne fruit with the development of the polyurethane (PU) HP-RTM process for mass production of an EV battery pack cover.

Materials supplier Covestro and Chinese high-tech enterprise Coleitec have signed a strategic cooperation agreement to accelerate the application development of polyurethane (PU) composite materials and further strengthen market-oriented cooperation.

Coleitec is committed to providing high-performance and lightweight composite solutions, while Covestro is the inventor of PU. Batteries-Recycling – Green-Hydrogen

The two companies launched the high-pressure reaction transfer molding (HP-RTM) PU battery pack top cover and successfully realized mass production at a major battery manufacturer. This cooperative research and development has pioneered the application of PU composites in the new energy vehicle battery pack field.

The PU battery pack top cover reportedly scores highly on mechanical properties, high temperature and humidity aging, xenon lamp aging, acid and alkali resistance, high-temperature resistance, and insulation properties. The new PU HP-RTM process is a lightweight solution that meets the requirement of “replacing steel with plastic.” Thanks to its physical properties and low density, the thinnest part of the cover measures just 0.8 mm, significantly reducing overall weight. It is 60% lighter than high-strength steel, 20% lighter than aluminum alloy, and 50% lighter than SMC composites.

The HP-RTM process employs automated layup to improve production efficiency and reduce manufacturing costs. Further, a life cycle analysis shows that the HP-RTM process reduces carbon emissions compared with the traditional metal process.

Dr. Irene Li, Covestro head of R&D at the Tailored Urethanes Business Entity in Asia Pacific said: “This is a new PU application in the field of new energy vehicles. It took us only 18 months from development to mass production, which is a gratifying achievement of Covestro and Coleitec. We believe that the strategic cooperation with Coleitec will enable more innovative PU applications to be implemented in the downstream value chain.”

Covestro and Coleitec will further cooperate under this strategic agreement, utilizing global research and development resources in the automotive industry. There are two significant areas of focus:

Increase PU performance and exploit the advantages of PU resins to expand their suitability for more applications.

Develop applications using bio-based raw materials to reduce carbon emissions and promote the circular economy. Batteries-Recycling – Green-Hydrogen

Markus Mingenbach, vice president of PU Specialties at the Tailored Urethanes Business Entity of Covestro, said: “The signing of the strategic agreement signals the beginning of a much deeper partnership between both companies. We look forward to further developing cost-efficient and tailor-made PU solutions in the domain of new energy vehicles, solar energy, and energy storage. Only through deep collaboration with foresight can we achieve our vision of a circular economy.”

Dr. Peng He, Chairman of Coleitec, said: “As a fast-growing technology-based enterprise, innovative product development is the top priority of Coleitec’s development. Through full cooperation with Covestro, we have jointly developed and expanded new applications of polyurethane materials in the field of new energy vehicles and provided innovative, functional, economical, and lightweight product solutions for end customers, giving them a sharp competitive edge over others.

-Russia price cap could threaten India oil supplies

India would be one of the countries most exposed if Russia refuses to sell crude oil at the capped price under proposed sanctions to be imposed by the United States and the European Union, said Reuters.

In 2021, India was the world’s third-largest crude importer (214 MMt) after China (526 MMt) and the United States (305 MMt) (“Statistical review of world energy”, BP, 2022).

India and China rely on imports by tanker from the Middle East, Russia and other regions, in contrast to the United States, which receives most of its imports by pipeline from neighboring Canada. Batteries-Recycling – Green-Hydrogen

India’s domestic crude and condensate production has been stuck at 30-40 MMt per year for the last two decades, data from India’s Ministry of Petroleum and Natural Gas shows.

By contrast, domestic petroleum consumption has doubled to 202 MMt in 2021 from 103 MMt in 2002 (“Snapshot of India’s oil and gas data”, Petroleum Planning and Analysis Cell, Nov. 10).

In the first ten months of 2022, India consumed a seasonal record 182 MMt, surpassing the previous peak of 178 million in 2019, before the pandemic.

As a lower-middle income country experiencing rapid industrialization and urbanization, India’s consumption is growing fast but its consumers are very sensitive to both price changes and the economic cycle.

Consumption has been growing by around 7% per year in the last 12 months, though there were signs of a possible slowdown to around half that rate in October.

We remind, India’s Petronet LNG plans to set up a greenfield petrochemical complex consisting of a 750,000 tonnes/year propane dehydrogenation unit (PDH), a 500,000 tonnes/year polypropylene line (PP) and other facilities for the import, storage and transfer of ethane and propane at Dahej, in western Gujarat state, said the company.

Batteries-Recycling – Green-Hydrogen