Bio-ABS – Recycled-Polylefins 12-11-2022 - Arhive

Bio-ABS – Recycled-Polylefins

-Wood secures FEED for first large-scale green hydrogen production facility in Mosjoen in Norway

Wood has been awarded the front-end engineering design (FEED) scope for Gen2 Energy’s green hydrogen production facility, located in Mosjoen in northern Norway, said the company.

Gen2 Energy is a Norwegian company dedicated to developing, building, owning and operating an integrated value chain for green hydrogen. The company targets having several large-scale production facilities for green hydrogen, making it easy and cost efficient for consumers to adapt to green hydrogen.

As a leader in hydrogen production solutions, Wood will apply its decades of hydrogen expertise and breadth of project implementation capabilities to develop the new 100MW plant – the first large-scale commercial green hydrogen production facility in Norway.

The award follows Wood’s initial conceptualisation of the plant as well as other production facilities that Gen2 Energy is developing to accelerate the distribution of hydrogen produced in Norway via zero-emission renewable energy to the UK and across Europe.

Due to good access to low-priced electricity, Mosjoen in Vefsn municipality in northern Norway is an excellent place for large-scale production of green hydrogen. The first phase of Gen2 Energy’s plan is to build a 100MW plant with a continuous production of around 45 tonnes of green hydrogen per day. Bio-ABS – Recycled-Polylefins

This contract will be delivered by Wood’s existing teams in Norway, with support from the company’s global experts from within its operations and projects business units. Wood will execute the FEED study jointly with personnel from Gen2 Energy.

-Technology to “see” into commercial batteries

Monitoring and studying battery chemistry is crucial to improving battery design

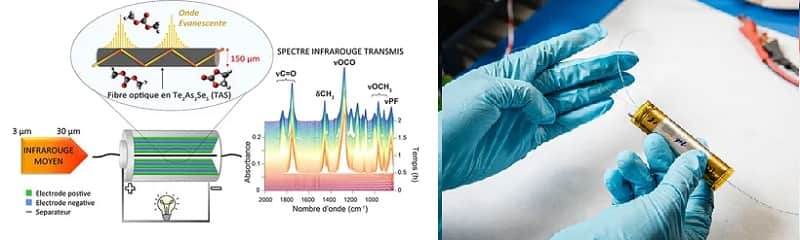

A multidisciplinary research team involving scientists from Collège de France, CNRS, Université Rennes 1 and Université de Montpellier has developed a method to track the chemistry inside a battery, live, and throughout its multiple charges and discharges. Presented in Nature Energy on November 7, 2022, this technology paves the way for improving the performance and design of future batteries.

Batteries offer the ability to store energy in chemical form: during charging, the current forces chemical reactions and energy is stored, then during discharging a spontaneous electrochemical reaction causes the electrons to move back through the system. Energy is released to create an electric current. Bio-ABS – Recycled-Polylefins

Controlling and studying the chemistry of a battery is therefore crucial to understanding how it works, but also to improving its design. While this is easy to do in the laboratory, it is much less easy when it is integrated into a system. But a multidisciplinary research team1 led by scientists at the Solid State and Energy Chemistry Laboratory (CNRS/Collège de France/Sorbonne University) has just developed a method for monitoring the chemistry of a commercial battery, live, during its charge or discharge.

The technology, presented in a paper published in Nature, relies on the transport of infrared light in chalcogenide glass optical fibers placed through a battery. The interaction of this light with the constituents of the battery makes it possible to identify and follow the chemical molecules present around the fiber.

The researchers were thus able to observe the evolution of the electrolytes as well as the insertion/extraction of sodium-lithium ions in the electrodes according to the charge. And this while it was in use, a first! With this system, the scientists were also able to study the interface between the electrolyte and the negative electrode material called Solid electrolyte interphase (SEI). This layer, which conducts ions and insulates electrons, determines the longevity of the batteries. In particular, the team was able to follow in situ the nature of the chemical species involved in the nucleation and growth of the SEI that takes place during the very first charge of a battery.

From a practical point of view, these results open the way to a facilitated and improved design of batteries. Currently, the optimization of electrolytes and charge test protocols is time consuming to find the best option for an ideal SEI, and thus improve the longevity of a battery. With this new method, it is possible to quickly and accurately see how each component of the recipe evolves, interacts with the others and influences the performance of the battery.

-MEGlobal will launch the Indian contract price from 2023

MeGlobal, a major producer of monoethylene glycol (MEG), will introduce an Indian contract price (ICP) from 2023, which is used in settlements under contracts with Indian customers,ICIS reports.

According to a source in the company, the ICP for the next month will be nominated in the second half of this month.

Currently, the company uses prices based on CFR (cost and freight) terms of China’s major ports. Bio-ABS – Recycled-Polylefins

The source added that the purpose of the ICP launch is to satisfy the growing market of India and to abandon the binding to the Chinese market.

Earlierit was reported that MEGlobal, the world leader in the production of monoethylene glycol (MEG) and diethylene glycol (DH), nominated the November contract price of MEG for Asia at USD810 per ton, which is USD10 per ton below the level of October. The price was named on the terms of delivery of CFR Asia.

MEG, along with terephthalic acid (TPA), is one of the main raw materials for the production of polyethylene terephthalate (PET).

According to theScanPlast review, in August the total estimated consumption of PET in Russia for the reporting month amounted to 77.71 thousand tons, which is 15% higher than last year’s figure. In January-August of this year, the total estimated consumption of PET decreased by 2% compared to the same period a year earlier and amounted to 542.80 thousand tons.

MEGlobal, with a total capacity of 4.5 million tonnes of MEG per year, is a subsidiary of EQUATE Petrochemical Company (EQUATE), part of the EQUATE Group.

-Resin Price Report: Market Turns Slightly Bullish

Inventory drawdowns, which have been substantial, could give producers renewed pricing power.

Spot resin trading continued to improve in the first week of November, with completed volumes exceeding those from the last week of October, which was already the best tally since May, reports the PlasticsExchange in its Market Update.

While the spot market is still generally well supplied across most commodity-grade resins, the flow of fresh railcar offers has diminished. Strong underlying demand has been developing — the PlasticsExchange notes that it is working customer orders for a couple dozen railcars of off-grade polyethylene (PE) and polypropylene (PP), but at prices not seen for several weeks. Some buyers may have missed the boat and price expectations need to be adjusted higher, suggests the Chicago-based resin clearinghouse.

Prime PE, PP prices hold steady

A wide range of prices were quoted and transacted across the PlasticsExchange trading platform, and while levels were slightly firmer this past week, they did not move the needle. Official prices for Prime PE and PP held steady, an indication that this market has been establishing a broad floor. PE contracts rolled flat in October, while PP contracts are decreasing $0.15/lb on average, mostly attributed to a price decrease in polymer-grade propylene (PGP). Production margins also contracted. A PE price increase is on the table this month, again, but it is rare to see one implemented in November. The PlasticsExchange does not expect to see a big change in November PP contracts based on stable spot PGP and somewhat better balanced supply/demand dynamics. But the month is still young. Bio-ABS – Recycled-Polylefins

There are signs of a notable change in market sentiment: After a long and steep downtrend since May and more recent pricing stability, the market seems to be shifting into the mildly bullish zone. The feeling is that the market has already come down so hard and is now stabilizing while supplies tighten, there is relatively little downside risk at this point. “We do not think that the spot market is necessarily poised for an immediate sharp and steep run up,” adds the PlasticsExchange. “For that, we need to see significantly better buying develop, and not just processors procuring resin to restock, but actual stronger throughput driven by improved consumer demand.”

In the meantime, producers have slashed operating rates, limiting new production, while at the same time purging surplus inventory into the export market, PE more so than PP. It has been indicated that producers intend to maintain restricted production through the end of the year; if so, the inventory drawdowns, which have already been substantial, can soon shove supply below demand, providing producers with renewed pricing power.

Robust PE resin trading

PE trading began strong in November, with healthy volumes of material changing hands across most major commodity grades. Higher volumes could have been achieved had there been better availability for some of the more obscure commodity PE grades. Suppliers had relatively few Generic Prime railcars to offer and asking prices didn’t budge. There was little followup by sellers, and scant interest in discounting as margins already have been squeezed.

While off-grade prices inched higher, Prime prices held flat for a fourth consecutive week. There was a steady flow of normal demand and some light restocking beyond typical usage, but robust and widespread demand has not developed, as high inflation and economic uncertainty linger. Bio-ABS – Recycled-Polylefins

Though Houston warehouses remain stuffed with material, much of it has been pre-sold into the export market awaiting shipment. Houston traders are keeping uncommitted inventories somewhat thin, and their asking prices for Prime packaged material edged a tad higher, as carrying costs including storage and interest rates continue to rise along with the upcoming year-end tax. It seems that producers have remained disciplined with their throttled back production through October, as supplies have been tightening. The PlasticsExchange anticipates another major drawdown, adding that it will be very interesting to see upcoming production, sales, and inventory figures.

PP trading reaches highest level since June

PP trading built on last week’s momentum, and completed volumes increased significantly to their highest level since June. Prime prices held steady for the third week in a row, while off-grade prices rose a couple of cents. Homo-polymer PP (HoPP) supplies remain ample, and there was a good flow of both Prime and off-grade railcars; fresh co-polymer PP (CoPP) offers were scarce, although producers were still taking Prime orders for material through the end of the year.

Widespec HoPP was the main mover — there was solid demand for both quick truckloads and railcars still to ship. CoPP sales would have been better if more well-priced resin had been made available. For the first time in months, PP contracts appear steady, as monomer prices capitulated in October and have already recovered enough to note fair value in PGP contract levels. Some margin erosion could still be justified, as spot fell faster than contracts, but if reactor rates have remained reduced, producers will rightly dig in firm.

While there are bullish signs building in the market, there is still plenty of uncertainty looming at the processor level, which is leading to subdued demand, potentially hampering a recovery. Do note, though, that processor resin stocks have also dwindled, so there would be plenty of pent-up buying if sentiment were to turn outright bullish, writes the PlasticsExchange in its Market Update. Bio-ABS – Recycled-Polylefins

-Ascend makes strategic investment in recycler

Buys majority stake in Circular Polymers LLC.

Nylon 6/6 resin maker Ascend Performance Materials has purchased a majority stake in California-based carpet recycler Circular Polymers LLC.

Lincoln-based Circular recycles post-consumer, high-performance polymers including nylons 6 and 6/6, polypropylene and PET. The business will be renamed Circular Polymers by Ascend.

Circular Polymers reclaims and reprocesses post-consumer carpet via a unique technology and has redirected about 85 million pounds of waste from landfills into new goods since 2018.

Circular Polymers employs about 60 at a plant in Lincoln.

In a news release, officials with Houston-based Ascend said the deal provides the firm with a consistent supply of high-quality post-consumer materials for its ReDefyne-brand sustainable nylon resins, which it launched at the recent K 2022 trade show. Ascend has committed to reducing its greenhouse gas emissions by 80 percent by 2030.

Circular has worked closely with materials companies in the past. In 2019, it agreed to provide PET for Eastman Chemical Co. Bio-ABS – Recycled-Polylefins

“We are focused on helping our customers reach their sustainability goals, and [Circular Polymers] provides materials that offer strong performance with a considerably smaller environmental footprint,” President and CEO Phil McDivitt said.

“Since we launched ReDefyne, the demand for our circular products has been significant across all segments of our business, including automotive, consumer, electronics and high-performance fibers and textiles,” he added.

Circular Polymers founder and CEO David Bender will stay on as CEO and will own the remainder of the company.

“Since 2018, we have focused on improving the sourcing and processing of post-consumer high-performance polymers,” Bender said. “Having Ascend on board will accelerate our growth and ensure these materials go back into new long-term, high-performance applications.” Bio-ABS – Recycled-Polylefins

The acquisition is Ascend’s second of 2022. In May, the firm bought the compounding business of Indian materials firm Formulated Polymers Ltd. That deal included a manufacturing site in Chennai and several warehouses across India.

Earlier this year, Ascend announced plans to build a plant making nylon feedstock hexamethylene diamine in Lianyungang, China. That plant will be Ascend’s first chemical production facility outside of the U.S., as well as the firm’s largest non-U.S. investment.

Ascend ranks as a global leader in nylon 6/6 resins and compounds.

-Mechanically and/or Chemically Recycled Polylefins Debut at K2022

ExxonMobil, Nova Chemicals and Braskem are among the latest polyolefin suppliers that are developing such new resin portfolios.

Among the latest polyolefin resin producers to have joined-in with the development of new porfolios of mechanically recycled and/or chemically recycled resin grades, and discussed at K 2022, are ExxonMobil, Nova Chemicals, and Braskem.

▪ ExxonMobil presented its new line of Exxtend resins produced with its Exxtend technology for advanced recycling of plastic waste which produces certified-circular polymer. The company aimed to introduce the first such materials by year’s end from its new plant, initially focusing on food packaging and the hygiene market. Key sources say their goal to show the range of solutions supporting the circular economy including mechanical recycling, chemical recycling and design for recyclability approaches. Key sources indicate that the new Exxtend portfolio will extend to pretty much all of its polyolefins including LDPE, LLDPE, HDPE and PP homopolymer and copolymer resins. At K 2022, the company highlighted demonstrations that included a certified-circular high-performance food-grade pouch with digital traceability from resin to end-product, which included the use of its new Exceed S LLDPE made with Exxtend technology, and, a hypothetical circular solution that could turn medical products into automotive parts and then back into certified-circular polymers. Bio-ABS – Recycled-Polylefins

The former involved a five-layer, 45-micron fully recyclable freezer film pouch suitable for high-performance food-grade packaging that incorporates certified-circular Exceed S performance LLDPE made using Exxtend technology. As reported previously, Exceed S delivers industry-leading combinations of stiffness and toughness while being easy to process. Working collaboratively with Reifenhäuser (extrusion technology), Twintag (universal unique identifiers), Comexi (flexible packaging printing and converting) and R-Cycle (plastics recycling technology), the pouch includes documentation and digital traceability along the value chain. With one scan, digital traceability tracks certification for compliance; helps eliminates manual data entry; helps identify packaging for recycling in communities with programs and facilities in place that collect and recycle plastic packaging; and is aligned with open tracing standards. Product information can be exchanged from source to finished product and beyond, supporting the path of a circular economy.

▪ Nova Chemicals launched EX-PCR its new, mechanically recycled LLDPE. It contains 100% post-consumer recycled polyethylene (rPE) and offers highly versatile design flexibility making it an ideal solution to lower the carbon footprint of packaging and address climate change. Nova’s rPE is sourced from distribution center flexible film, which includes a blend of back-of-store stretch and front-of-store consumer drop off. Source materials are processed with state-of-the-art technology reportedly resulting in a low odor, consistent, and stable product. Nova’s proven technical expertise can help guide customers to incorporate rPE and maintain the necessary level of performance while also creating recyclable flexible packaging that remains in the PE stream through a design for recycling approach. Bio-ABS – Recycled-Polylefins

Said Anna Rajkovic, Nova’s circular economy market manager. “Through customer trials and applications development at our Center for Performance Applications in Calgary, we have successfully incorporated our new rPE resin in various end-use format. We’re excited to commercialize this resin and build a more sustainable polyethylene portfolio for our customers and brand owners.”

▪ Braskem introduced its new Wenew brand, described as a complete ecosystem dedicated to promoting and realizing the circular economy. On the one hand, the ecosystem is a label for products made with recycled content. On the other hand, Wenew is an umbrella brand under which not only products but also many other offers and various initiatives are gathered. A core focus of Wenew is to develop and promote high-quality circular products, such as polymers-including all PE resin grades and chemicals produced from mechanical recycling, advanced recycling or as a result of Braskem’s traditional production process. The goal is always to ensure maximum quality when used in Braskem’s new products and can thus act as role models for broader use throughout the industry.

-Recognition for Pact’s billion bottle recycling project

Pact Group has won a major sustainable project award for bringing Australia’s biggest and most advanced PET plastic recycling facility to life.

Pact was awarded the Australian Institute of Project Management’s Sustainable Project Management Achievement Award for NSW for the $50 million Circular Plastics Australia (CPA) PET plastic recycling facility in Albury. Bio-ABS – Recycled-Polylefins

The CPA facility is a joint venture between Pact, Cleanaway Waste Management, Asahi Beverages, and Coca-Cola Europacific Partners (CCEP).

A team from Pact project managed the build, which was delivered safely, on time and under budget on a greenfield site during a period of major global challenges, including the COVID-19 pandemic, supply chain pressures, and the blockage of the Suez Canal.

Despite these challenges, it took one year and five days to establish the site, construct the facility, install the equipment and services, commission the machinery, and train a new team.

The facility, which commenced operations in February 2022, has the capacity to recycle the equivalent of around 1 billion 600ml PET plastic beverage bottles each year into high-quality food-grade resin.

Cleanaway collects, sorts, and delivers PET plastic waste from kerbside collection bins and container deposit schemes to the Pact-operated facility for recycling. The recycled resin is then used by Asahi and CCEP to manufacture new beverage bottles, and by Pact to make new beverage bottles and food packaging.

Pact Group CEO Sanjay Dayal said it was a great honour for the Pact team to be recognised for its commitment to driving the circular economy in Australia.

“Brand owners and consumers alike are demanding packaging that is made from recycled material and is recyclable. We have collaborated with industry partners to create Australia’s largest state-of-the-art PET recycling facility to respond to those needs,” Dayal said.

“The world-class CPA PET recycling facility in Albury ensures we are taking responsibility for our plastic waste, reducing the need to import virgin plastic resin and minimising harm to the environment for future generations.”

The CPA joint venture is building a second PET recycling facility with similar capacity in Melbourne, which is due to commence operations in the first half of 2023.

The CPA PET project in Albury was supported by a $5 million grant through the NSW Government’s Waste Less, Recycle More initiative, and the Australian Government’s Recycling Modernisation Fund. Bio-ABS – Recycled-Polylefins

-CHIMEI to launch Ecologue™ bio-ABS products with ISCC PLUS approval in 2023

CHIMEI Corporation’s factory in Tainan, Taiwan, has obtained International Sustainability and Carbon Certification (ISCC) PLUS for ABS, SAN, MS (SMMA), HBR, and SSBR products.

A Taiwan-based performance materials company that designs and manufactures advanced polymer materials, synthetic rubbers, and specialty chemicals, CHIMEI Corporation is adding a range of International Sustainability and Carbon Certification (ISCC) PLUS approved bioplastics to its newly released Ecologue™ sustainable materials portfolio.

CHIMEI is developing bioplastics that are either made from bio-based resources or will decompose after use. As a result, these materials will reduce its waste and fossil fuel consumption. Bio-ABS – Recycled-Polylefins

ISCC PLUS adopts a mass balance approach to ensure that renewable materials are correctly calculated and used in production processes. It ensures traceability throughout the entire supply chain, from raw materials to the final product, providing a global standard for product sustainability.

CHIMEI is preparing to replace some of the fossil feedstock used in its polymer production with bio-based feedstock. They are tracking this renewable feedstock throughout their production line to comply with the ISCC PLUS mass balance approach, and building partnerships to ensure a greener value chain.

Approval from ISCC PLUS reinforces the renewable plastics value chain, which CHIMEI has been building together with Neste, Idemitsu Kosan, and Mitsubishi Corporation, allowing CHIMEI to introduce new, renewable biomass materials that can effectively replace fossil feedstock in plastic production.

The ISCC PLUS approvals apply to ABS, SAN, MS (SMMA), HBR, and SSBR products, which are produced at CHIMEI’s factory in Tainan, Taiwan. CHIMEI will officially launch ISCC PLUS bio-ABS products, under the Ecologue trademark, in the first half of 2023.

“Reaching carbon neutrality is a top priority for CHIMEI, and it should be paramount for everyone in our supply chain,” says Andrew Hsieh, CHIMEI Sustainable Material Solutions Manager. “By opting for materials that are made from renewable, biomass feedstock, a brand can significantly reduce the carbon footprint of its products, and distance itself from the oil industry. As more brands opt for sustainable material solutions, like bioplastics, their decision will reverberate upstream into manufacturing industries where it can really make a massive impact.”

CHIMEI Corporation first received the ISCC PLUS approvals during K 2022, the world-leading trade fair for plastics and rubber. News of receiving the ISCC PLUS was initially shared with guests at the Ecologue™ Talks event in K fair, which were attended by many of CHIMEI’s global supply chain partners.

Bioplastics are one of three innovation areas in CHIMEI’s Ecologue™ sustainable materials portfolio. CHIMEI’s ongoing bioplastic innovations include biodegradable materials, which have the potential to replace single-use plastics in the near future. CHIMEI aims to expand its bioplastic offerings over the coming years. Bio-ABS – Recycled-Polylefins

Production is an ongoing innovation area in CHIMEI’s Ecologue™ sustainable materials portfolio. This includes carbon capture and utilization at CHIMEI facilities. Of the three innovation areas at CHIMEI, recycling has proffered the most development; featuring optical-grade, chemically recycled MMA, and mechanically recycled PCR materials.

Bio-ABS – Recycled-Polylefins