Biorecycling-of-Plastics-and-Textiles 22-07-2022 - Arhive

Biorecycling-of-Plastics-and-Textiles

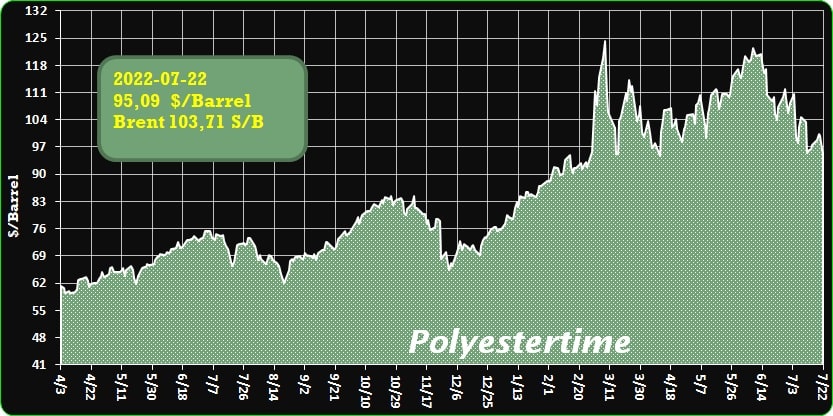

Crude Oil Prices Trend

Jeff Maguire, Director – Packaging Collection and Recycling – Australia, the Pacific and Indonesia, at Coca-Cola Europacific Partners (CCEP) explains how the company is setting up a directly funded fair and responsible collection model which embraces the work of the informal waste collection sector. Introduction

This year marks a milestone for CCEP in the recovery of used plastic beverage packaging and expansion of recycling infrastructure to drive circular economy outcomes in the region, with the planned opening of Amandina Bumi Nusantara, the first recycling facility in Indonesia with a food-grade recycled plastic output.

The facility is a PET plastic recycling joint venture between Coca-Cola Europacific Partners (CCEP) and Dynapack Asia, and also incorporates the work of Mahija Parahita Nusantara, the non-profit social foundation set up by both organisations. The foundation supports the creation of collection infrastructure via the development of collection micro-enterprises – and is centred on social enterprise and community support. It provides feedstock for the facility and, crucially, also supports the informal waste-picker community with stable employment and vital social care. Through Mahija, we ensure that its operations adhere to human rights principles and regulations in the waste collection supply chain, such as eliminating child labour and providing safe work environments.

We’ve taken this step to build the Amandina facility and bring together a network of local waste pickers and collection centres through the Mahija foundation voluntarily, but we are not just acting alone. We also work alongside the voluntary producer responsibility organisation, Indonesia Packaging Recovery Organization (IPRO). IPRO’s focus is on driving collection progress at scale working with the beverage industry, local government, and throughout the plastics value chain. And we are part of Indonesia’s National Plastic Action Partnership (NPAP), a multi-stakeholder effort to make progress on the national targets on plastic waste.

Separate from the rPET facility, we also implement various activities to manage post-consumer waste, focusing on three areas: Collection, Education, and Partnership. We conduct waste collection programmes such as the daily Bali Beach Clean Up (BBCU) programme, in place since 2007. We also work with local communities and schools to educate them on the importance of waste segregation, and develop community waste management organisations and waste banks.

Our goal in Indonesia is two-fold: to establish an effective collection solution that delivers high quality feedstock for recycling, thereby making progress towards circular outcomes for PET bottles, while also stabilising feedstock pricing and ensuring fair and responsible collection practices for waste collectors.

The challenge of plastic pollution in Indonesia

Data from NPAP highlights the scale of the challenge that Indonesia faces. The region generates 6.8 million tonnes of plastic waste every year with a massive 61% remaining uncollected. This plastic waste is derived from a variety of sources, with around 8% comprised of food and non-food bottles. In 2021, our own PET plastic footprint in Indonesia was 37,000 tonnes.

Indonesia is also the second largest ocean plastic polluter – about 620,000 tonnes of generated plastic waste leaks into lakes, rivers and the sea. To tackle the problem, the Indonesian government set out an ambitious roadmap in 2020 to divert waste from landfill and oceans. Its National Waste Management Policy & Strategy seeks to ensure 70% of waste is properly managed and marine plastic litter is reduced by 70%, both by 2025.

-Trinseo Introduces Sustainable ALTUGLAS™ R-LIFE Acrylics

Portfolio will include recycled, reused, and bio-based solutions

Trinseo, a specialty material solutions provider, announced its new series of sustainably-advantaged materials for the European marketplace — ALTUGLAS™ R-Life Acrylics. ALTUGLAS™ R-Life is an umbrella brand that will include chemically and mechanically recycled, reused, and bio-based polymethyl methacrylate (PMMA) for cast and extruded sheets, resins, and compounds.

Trinseo, a specialty material solutions provider, announced its new series of sustainably-advantaged materials for the European marketplace — ALTUGLAS™ R-Life Acrylics. ALTUGLAS™ R-Life is an umbrella brand that will include chemically and mechanically recycled, reused, and bio-based polymethyl methacrylate (PMMA) for cast and extruded sheets, resins, and compounds.

The series launched with the following:

- ALTUGLAS™ R-Life Extruded Acrylic Sheets– with a minimum of 75 percent mechanically recycled, reused PMMA scrap material

- ALTUGLAS™ R-Life Cast Acrylic Sheets – with a minimum 75 percent chemically recycled PMMA cast sheet

- ALTUGLAS™ R-Life Acrylic Resins– with both 50 percent and 80 percent chemically recycled monomer from PMMA waste

The materials can be used in a broad range of application areas in Retail/POS, Lighting, Interior Architecture, Furniture and Design, Building and Construction, and Transportation.

“With ALTUGLAS™ R-Life we look at sustainability broadly — as any number of solutions that might enable a customer to achieve positive sustainability outcomes,” said Aldo Zanetti, Global Sustainability Manager, Engineered Materials. “We plan for ALTUGLAS™ R-Life to be a growing and dynamic series; proven, with scientific tools such as LCA, to have a measurable environmental impact.”

For each ALTUGLAS™ R-Life sustainable solution, the Global Warming Potential (GWP) was calculated through a Life Cycle Analysis (LCA). By replacing fossil with sustainable content there is a reduction in GWP of 35% for cast sheets with 75% sustainable content and 53% for extruded sheets with 75% sustainable content, and 24% for resins with 50% sustainable content resins and 38% with 80% sustainable content.

ALTUGLAS™ R-Life Extruded Acrylic Sheets is an ALTUGLAS™ CO2NET™ product with CO2 emissions reduction greater than 50% over its virgin, fossil-based equivalent.

Both chemically recycled ALTUGLAS™ R-Life Cast Acrylic Sheets and Acrylic Resins as well as mechanically recycled, reused ALTUGLAS™ R-Life Extruded Acrylic Sheets are processed with technology that assures the same mechanical, aesthetic, and optical properties of a fossil equivalent. The chemically recycling method used involves PMMA waste depolymerization where the material is converted to its original methyl methacrylate (MMA) monomer.

ALTUGLAS™ R-Life joins Trinseo’s broad portfolio of sustainably-advantaged materials. These materials as well as Trinseo’s sustainability initiatives are included in the company’s 2022 Corporate Sustainability Report released earlier this month.

Trinseo is committed to solutions for plastic waste by partnering with the value chain, and developing and sharing innovative recycling technologies and approaches. Since its acquisition of Altuglas International the company has been a member of European Union initiatives MMAtwo , focused on constructing a novel PMMA recycling value chain, and REVOLUTION , an automotive industry led project to apply recycled PMMA and other plastics to electric vehicles.

-Carbios Strengthens Its World Leadership in the Biorecycling of Plastics and Textiles

Carbios and TBI publish an article in a prestigious scientific journal: Biophysical Journal

Exceptional achievement of research work on the use of Nuclear Magnetic Resonance (NMR) spectroscopy for understanding PET depolymerization enzymes

Carbios (Euronext Growth Paris: ALCRB), a pioneer in the development of enzymatic solutions dedicated to the end-of-life of plastic and textile polymers, announces the publication of an article entitled “An NMR look at an engineered PET depolymerase” in the scientific journal Biophysical Journal. The scientists at Carbios and at the Company’s renowned academic partner, The Toulouse Biotechnology Institute (TBI) are at the forefront of enzymatic research and innovate every day in order to optimize the end of life of plastics and textiles.

The article describes the use of Nuclear Magnetic Resonance (NMR) spectroscopy to study the thermal stability of PET depolymerization enzymes and the mechanism of adsorption of the enzyme on the polymer. Biorecycling-of-Plastics-and-Textiles

This innovative approach, which required months of development, is a world first and opens up new ways of improving these enzymes. This publication confirms Carbios’ international lead in the development of the most efficient enzymes for the depolymerization and recycling of plastics

Prof. Alain Marty, Chief Scientific Officer of Carbios and co-author of the article, explains: “I am very proud of this work at the interface between two sciences, enzymology and NMR, carried out by TBI and Carbios teams. Nearly 25 researchers are currently working on our unique enzymatic technology. It is based on academic collaborations with the world’s leading experts in their fields. This publication confirms the technological lead of Carbios.”

Dr. Guy Lippens, CNRS Research Director and co-author of the article, adds: “Nuclear Magnetic Resonance (NMR) is an extraordinary biophysical technique for visualizing an enzyme directly in solution. Our study is the first to use NMR as a complementary technique to crystallography and molecular modeling to observe a PETase.

-PKN ORLEN evaluates a potential investment in petrochemicals with Aramco and SABIC

PKN ORLEN has confirmed it is discussing with Aramco and SABIC the possibility of collaborating in investments in various petrochemical business segments, said Euro-petrole. Biorecycling-of-Plastics-and-Textiles

An existing triparty MoU will be extended to evaluate a potential joint development of a large-scale mixed feed steam cracker and downstream derivatives integrated with the Gdansk refinery. Moreover, PKN ORLEN and Aramco continue to explore areas of cooperation in the field of research and development.

‘Potential investments, the implementation of which we are analysing together with our strategic partners, including the construction of a large-scale steam cracker with derivative installations, generates CAPEX of several billion dollars. We still have a full feasibility and the engineering studies and final investment decisions ahead of us. If they are successful to the satisfaction of all parties, we could ultimately jointly implement projects that will allow us to fully integrate the refining and petrochemical segments and take advantage of the Gdansk refinery’s capabilities.

Combining the experience of PKN ORLEN and Saudi Aramco and SABIC groups, knowledge, technology as well as access to markets and the use of the systematic increase in the demand for petrochemicals will enable us to jointly increase the value of our companies. Biorecycling-of-Plastics-and-Textiles

In this way, we will build lasting foundations for cooperation and development on the petrochemical market of Central Europe and beyond,’ says Daniel Obajtek, President of the PKN ORLEN Management Board.

‘We look forward to continuing our efforts with PKN ORLEN and SABIC to assess the joint development of a large-scale petrochemical project integrated with Gdansk refinery,’ says Mohammed Y. Al-Qahtani, Senior Vice President, Downstream, Saudi Aramco.

PKN ORLEN for the last four years has been conducting the largest petrochemical investments in its history. They include, among others extension of the Olefin III Complex at the Production Plant in Plock. It is a key project within the strategic Petrochemical Development Program and the largest petrochemical investment in Europe in the last 20 years. The latest technologies are used in the construction of the complex, which will allow, among others, to increase energy efficiency, including a reduction by 30 percent CO2 emissions per tonne of product.

The investment is part of the merger of PKN ORLEN and Grupa LOTOS, as the Gdansk refinery will be supplier of a large volume of petroleum products for the petrochemicals produced in the Complex. They are to be the basis for the production of all everyday items, including cleaning, hygiene and medical products, as well as synthetic fibers for the production of clothing or protective masks. They are also needed for production of car parts, components of household appliances and electronic devices.

The main element of the investment in the extension of the Olefin Complex will be the construction of a new steam cracker. The capacity of the already existing steam cracker is 640 thousand tonnes. The investment envisages increasing its actual production capacity to 1,040 million tonnes, or about 60 percent. The total production of petrochemicals, which currently amounts to over 5 million tonnes in the ORLEN Group, will increase by over 1 million tonnes. Biorecycling-of-Plastics-and-Textiles

In turn, in July this year, the company has signed an agreement to take over a part of the business related to the production and sale of LDPE polyethylene belonging to the largest domestic producer of plastics – Basell Orlen Polyolefins, in which it is a shareholder. LDPE polyethylene is a product with a wide range of applications. It is most often used for the production of films, bags, canisters and food packaging. The production capacity of the acquired assets is 100 thousand tonnes per year, which means that PKN ORLEN alone, as the only producer of LDPE polyethylene in Poland, will cover approx. 1/3 of the domestic demand for this product.

The demand for petrochemical products will grow, driven by the growing world population, economic growth and a change in the structure of demand for raw materials used in industry.

The upward trend also applies to Poland, which uses more and more every year, and their consumption per capita is still significantly lower than in Western Europe. According to estimates, by 2050, the global demand for high-margin petrochemicals is expected to increase by as much as approximately 80 percent. Biorecycling-of-Plastics-and-Textiles

-Contract prices of TPA in Europe for supplies in June increased by EU204 per ton

Contract prices for TPA in Europe for shipments rose in June amid rising raw material costs, ICIS said.

Thus, the June contract price of the TPA contract in Europe increased by EU204 per ton and reached EUR1,313-1,347 per ton, FD NWE (north-western Europe).

The agreement occurred simultaneously with an increase in the June contract prices of paraxylene raw materials. Biorecycling-of-Plastics-and-Textiles

Earlier it was reported that the average capacity utilization at Chinese plants for the production of purified terephthalic acid (TPA) increased in the week ended July 8, 1% higher compared to the level of a week earlier and amounted to 78%.

TPA is one of the main components for the production of polyethylene terephthalate (PET).

-UK recycler upgrades with Stadler

J&B Recycling’s most recent upgrade further improved quality and increased capacity.

Altshausen, Germany-based Stadler designed and built a dry mixed recyclables sorting plant in Hartlepool, United Kingdom, for J&B Recycling in 2008 and has since supported the company in a continuous improvement of the plant.

“We continually improve the plant, and our focus is producing the best quality material possible,” says Matt Tyrie, operations director at J&B Recycling.

The composition and density of the material stream are evolving constantly. “Over the years, the amount of cardboard has significantly increased,” says Benjamin Eule, director at Stadler UK Ltd. “Sorting plants are receiving bigger volumes of packaging generated by the growth of online shopping and deliveries. Another change that is having an impact is the switch to different printing techniques in magazines, which makes it more difficult to separate the ink from the fiber. Plastic packaging is also changing, with multilayers, and bottles with different types of sleeves resulting in detection becoming more challenging. Metals have also evolved since we first designed the plant in 2008, with a shift from aluminum to ferrous metal in drinks packaging, and the increasing volumes of coffee capsules which contain aluminum.” Biorecycling-of-Plastics-and-Textiles

For this reason, sorting plants must be able to process multiple materials flexibly while delivering the consistently high purity rates demanded by the recycling industry, Stadler says. The plants’ designs also need the flexibility to accommodate subsequent upgrades and modifications to meet the changing requirements.

Eule says, “The J&B Recycling plant was originally designed to process 12 [metric tons per] hour, with Stadler trommel screens, conveyors and ballistic separator taking care of the mechanical presorting, preparing the material flow for effective downstream processing. Conveyors make sure that the material is sent efficiently to the next sorting process and bunker storage conveyors hold the product before being baled.”

-Natural decay for plastics through biotransformation

Avgol has been working with Polymateria, a spin-out from Imperial College London, which has pioneered the ‘biotransformation’ process which has the potential to enable the most commonly-polluted plastic items to be safely returned to nature.

Using this new process, a nonwoven fabric can be modified to react to certain triggers to then begin a cascade process to enable the fundamental chemical transformation of its polymer resins into a wax that is readily degraded by natural bacteria, microbes and fungi normally found in the environment. Biorecycling-of-Plastics-and-Textiles

“The transformation is triggered through the combined effects of the natural elements of decay – air, moisture, heat and sunlight,” explained Avgol’s vice-president of nonwovens marketing Nick Carter, demonstrating the process at the recent Techtextil show in Frankfurt. “Once triggered, the material will transform into a low molecular weight wax structure leaving no microplastics or toxic residue behind.

“In addition, if the product comprising the biotransformation technology is disposed of in the normal way, and facilities are available, it can then be recycled by readily available means.”

-Major Asian manufacturer cuts August PVC prices for delivery to China and Southeast Asia

A major Northeast Asian producer has cut price offers for August shipments of polyvinyl chloride (PVC) to China and Southeast Asia by USD230 per tonne due to low demand, ICIS reported.

Now its price offers for August deliveries to these regions are USD930 per ton, CF China.

On a franco-to-board (FOB) basis for Northeast Asia, price offers are USD880 per tonne for Southeast Asia and remote regions. Biorecycling-of-Plastics-and-Textiles

There is no discount on August deliveries.

Weak demand in India’s main import market, as well as an increase in the supply of spot materials from China, affected consumer sentiment in the region.

Earlier it was reported that a large producer from Northeast Asia reduced price offers for August supplies of polyvinyl chloride (PVC) to India by USD230 per ton due to low demand. Declining demand in India for PVC for pipe production due to the country’s rainy season, as well as weak demand in China, are factors contributing to the downward market sentiment.

Biorecycling-of-Plastics-and-Textiles