Engineering plastics Plastic Waste – Borealis-Backed Waste Management Initiative Achieves Economic Self-Sufficiency in Indonesia 08-08-2023 - Arhive

Engineering plastics Plastic Waste

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

Polyplastics, a prominent engineering plastics manufacturer headquartered in Japan, has unveiled a groundbreaking sustainability initiative known as Duracircle

This innovative program marks a significant stride in the realm of recycling engineering plastics, demonstrating the company’s dedication to environmental responsibility. Through the Duracircle initiative, Polyplastics will pioneer a recycling service, slated to commence operations in March 2024. This service empowers Polyplastics’ clientele to contribute to a circular economy by repurposing industrial waste materials generated during their production processes.

Renowned for producing specialty plastics like acetal copolymer (POM), polyphenylene sulfide (PPS), and liquid crystal polymer (LCP), Polyplastics has a far-reaching impact across diverse sectors, including medical, automotive, electrical, and electronic industries. However, the management of plastic waste, especially in these sectors, has posed substantial challenges. Disturbingly, Plastics Recyclers Europe (PRE) has revealed that, of the vast 3 million tonnes of waste originating from electrical and electronic equipment in 2017, a mere 300,000 tonnes underwent recycling within specialized European facilities. This alarming statistic underscores the urgent need for effective recycling solutions within these industries. Engineering plastics Plastic Waste

Polyplastics’ Duracircle recycling service is poised to revolutionize the landscape by introducing a novel approach to plastic recycling. It deviates from traditional methods by embracing the concept of “re-compounding.” This terminology is chosen deliberately to signify its capacity to enable horizontal recycling – an intricate task given the stringent quality requirements of engineering plastics. This approach is tailored to address the unique characteristics of engineering plastics, aiming to preserve their superior quality even in the recycling process.

The recycling process at the core of Duracircle will revolve around pre-consumer materials. Polyplastics intends to harness these materials from the production processes of its customers, encompassing materials that don’t meet conformity standards and excess production components like hot runners. These materials will undergo mechanical recycling, undergoing transformation into premium-grade pellets. These pellets are engineered to be seamlessly reintroduced into the production cycle of the customer’s plants, enabling a closed-loop recycling mechanism.

Polyplastics is keenly aware of the need to maintain the integrity of recycled materials. By using pre-consumer materials, the company can exercise precise control over the traceability of these inputs. This meticulous approach ensures that recycled material remains uncontaminated and adheres to the highest quality standards.

A spokesperson from Polyplastics has stated that they are actively collaborating with customers to develop post-industrial recycling processes, preserving traceability even as they scale up operations to involve multiple customers, factories, or segments.

The Duracircle re-compounding service is designed to encompass a comprehensive range of features beyond the recycling process itself. Engineering plastics Plastic Waste

These include robust quality assurance measures, technical support services, and facilitation in obtaining relevant certifications. By offering these services, Polyplastics aims to streamline the integration of recycled materials into its customers’ production cycles, enabling a seamless transition to sustainable practices.

Polyplastics’ ambitions extend beyond the borders of Japan. While the company has not explicitly specified the markets, it envisions expanding its recycling service to, its global footprint suggests that it’s likely to include regions like China, Malaysia, Taiwan, and Germany, where it operates manufacturing facilities. Furthermore, Polyplastics has set its sights on extending its recycling technologies to post-consumer materials, further amplifying its positive impact on plastic waste reduction.

In essence, Polyplastics’ Duracircle initiative signifies a transformative step forward in the world of engineering plastics. By pioneering a re-compounding service that is focused on quality and sustainability, the company is heralding a new era of responsible plastic waste management. As the initiative takes flight in 2024, it holds the promise of reshaping industrial practices and contributing to a more circular and sustainable future.

Borealis-Backed Waste Management Initiative Achieves Economic Self-Sufficiency in Indonesia

In a significant development, Borealis and Systemiq have jointly announced the successful transition of Project Stop in the Jembrana Regency of Bali, Indonesia, to a state of financial sustainability. Engineering plastics Plastic Waste

This milestone achievement is now paving the way for the project’s management to be handed over to the local government for continued oversight and operation.

The genesis of Project Stop dates back to 2019 when Borealis and Systemiq forged a partnership with the government of Jembrana, a regency situated in the southern region of Bali. Their shared objective was to launch a groundbreaking initiative geared towards curbing waste generation and stemming the flow of plastic waste into the environment. This collaboration, which received funding from the Alliance to End Plastic Waste, bore fruit with the establishment of Project Stop – a comprehensive program focused on tackling the complex issue of plastic pollution and waste leakage.

Indonesia’s alarming standing as the world’s second-largest plastic polluter, trailing only behind China, necessitated swift and innovative action. The United Nations, in a 2020 report, highlighted that the Southeast Asian nation was accountable for an astonishing 3.2 million tonnes of unmanaged plastic waste annually. Shockingly, a substantial portion of this waste – approximately 1.29 million tonnes – was found to find its way into the ocean, exacerbating the global marine pollution crisis. Engineering plastics Plastic Waste

Despite these challenges, Indonesia has undertaken an ambitious commitment to reverse this trend. The nation set forth a roadmap to slash ocean plastic pollution by a remarkable 70% by 2025. This strategy encompasses a multifaceted approach that encompasses reducing plastic production and consumption, minimizing leakage into both terrestrial and aquatic environments, fostering behavioral shifts among citizens, and strengthening financial mechanisms to support these endeavors, with international collaboration serving as a crucial pillar.

The significant strides made by Project Stop in Jembrana have underscored the effectiveness of this collaborative approach. The initiative has facilitated formal waste collection services for over 124,800 individuals, with waste being systematically sorted for recycling and composting at a cutting-edge material processing facility (MRF) located near the Negara municipality. Notably, the MRF boasts an impressive daily processing capacity of 50 tonnes of post-consumer waste, both organic and inorganic. Moreover, the initiative has been a wellspring of economic opportunity, generating 86 permanent jobs within the local community while effectively managing over 12,959 tonnes of waste, including a substantial 1,528 tonnes of plastic. Engineering plastics Plastic Waste

Project Stop has adopted a comprehensive strategy that spans door-to-door campaigns aimed at behavioral change, the distribution of waste bins to encourage pre-sorting at households, and the employment of dedicated waste collectors tasked with transporting sorted waste to the material processing facility.

Nicholas Kolesch, Vice President of Projects at the Alliance to End Plastic Waste, expressed satisfaction at reaching a pivotal juncture in the project’s journey, highlighting its status as one of the early beneficiaries of alliance funding. The momentous achievement of delivering a fully functional and financially viable waste management system to the Jembrana Regency was hailed as a crucial stepping stone in the broader fight against plastic pollution.

The success story in Jembrana echoes the achievements of similar initiatives in Muncar and Pasuruan, which were earlier handed over to local governments for autonomous operation. The outcomes and performance of these projects under local management have yet to be disclosed. Engineering plastics Plastic Waste

The local government of Jembrana, according to Borealis, has wholeheartedly embraced the project’s ethos, embracing full ownership and demonstrating proactive plans for service expansion. The significance of Project Stop extends beyond its immediate impact, serving as a cornerstone for the advancement of circular waste management systems both regionally and nationwide. The learnings derived from Project Stop have already influenced other systems seeking to emulate its achievements.

Project Stop’s inception in 2017 was a collaborative endeavor between Borealis and Systemiq. The initiative enlisted a team of Indonesian experts specializing in waste management, plastic recycling, organic waste handling, behavior modification, and program governance. This team worked closely with local government authorities to conceive and implement a low-cost waste management framework that benefits households and institutions alike. Engineering plastics Plastic Waste

Reflecting on this journey, Thomas Gangl, CEO of Borealis, stressed the success of their cooperative approach. He lauded the collective efforts of partners such as the Alliance to End Plastic Waste, Systemiq, and the Jembrana Regency, which collectively demonstrated the viability of an efficient and cost-effective waste management model. Gangl emphasized that this success served as an inspiration for the alliance to continue scaling waste management systems across Indonesia based on the invaluable lessons derived from Project Stop. Engineering plastics Plastic Waste

The CEO underscored that collaboration remains paramount to expanding waste management solutions for the betterment of communities and the environment, and emphasized that there was no time to waste in this crucial endeavor.

Exploring Synergy Between c and Renewable Energy: Propelling Green Innovations in the Technology Sector

The technology industry is progressively embracing eco-conscious advancements, honing its focus on biobased plastics and renewable energy solutions. This shift towards sustainability serves as both a response to burgeoning environmental concerns and a strategic maneuver to cater to a more environmentally aware consumer demographic.

Biobased plastics, derived from renewable resources like plants, algae, and even bacteria, are emerging as a viable substitute for conventional petroleum-derived plastics. These inventive materials deliver equivalent functionality to their traditional counterparts but with a substantially reduced carbon footprint. The fabrication process of biobased plastics entails converting biomass into bio-polymers, which can be molded into diverse shapes and forms. Engineering plastics Plastic Waste

This approach not only enhances sustainability but also harbors the potential for carbon neutrality, as the carbon dioxide emitted during the breakdown of these materials can be reabsorbed by the very plants utilized in their production.

The tech sector’s intrigue in biobased plastics is unsurprising, given its heavy reliance on plastic components. From smartphones and laptops to wearables and household appliances, plastic pervades the realm of tech products. By adopting biobased plastics, tech enterprises can considerably mitigate their environmental impact while simultaneously appealing to eco-sensitive consumers.

Concurrently with the rise of biobased plastics, the technology sector is intensifying its dedication to renewable energy. Tech titans such as Google, Apple, and Microsoft have made substantial headway in transitioning their operations to renewable energy sources, like wind and solar power. These corporations discern that renewable energy is not only a more sustainable option but also economically viable, harboring the potential for substantial long-term savings. Engineering plastics Plastic Waste

Furthermore, the tech industry is leveraging its inventive prowess to engineer novel technologies capable of harnessing renewable energy more efficiently. Progressions in battery technology, for instance, empower the storage of solar and wind energy for periods when these sources aren’t available. Similarly, enhancements in energy management systems allow tech entities to optimize energy consumption and curb wastage.

The convergence of biobased plastics and renewable energy within the tech sector marks a momentous stride towards a more sustainable future. By embracing these environmentally friendly innovations, tech companies are not only curbing their ecological impact but also laying a positive precedent for other sectors to emulate.

However, it’s crucial to acknowledge that these innovations aren’t devoid of challenges. The production of biobased plastics, for instance, demands substantial biomass volumes, potentially posing risks of deforestation and other ecological concerns if not managed judiciously. Similarly, the transition to renewable energy necessitates substantial investments and infrastructural upgrades. Engineering plastics Plastic Waste

Despite these hurdles, the technology industry’s allegiance to sustainability is palpable. With sustained research and development, biobased plastics and renewable energy possess the capacity to revamp the sector and make notable contributions to global sustainability endeavors. As we progress, it will be captivating to witness the evolution of these environmentally friendly innovations, shaping the trajectory of the technology industry.

Plastic Waste Management – Collaboration is Key

Plastic waste has become one of the most pressing environmental challenges of our time. With millions of tons of plastic waste being generated each year, finding effective and sustainable solutions for its management is critical. Greenback Recycling Technologies, a UK-based company, has taken a significant step forward in addressing this issue with its innovative chemical recycling approach. The company has developed decentralised small-scale modular units that can be deployed locally to process plastic waste efficiently.

Greenback’s first fully commercial-scale recycling plant was established in Mexico in collaboration with Nestlé Mexico, marking a successful milestone. Now, the company is set to expand its operations by constructing a second unit at the same location, with the support of the Alliance to End Plastic Waste (AEPW). This partnership aims to increase capacity to handle up to 6,000 tonnes of plastic waste, making a significant impact in the fight against plastic pollution. Engineering plastics Plastic Waste

Philippe von Stauffenberg, CEO and founder of Greenback, and Nicholas Kolesch, the AEPW’s vice president of Projects, spoke about the collaboration and the technology behind Greenback’s approach. The company’s modular units use microwave-induced pyrolysis, a process developed by Enval, to break down plastics into solid, liquid, and gaseous components. The gas produced is harnessed for power generation, minimizing CO2 emissions and energy usage. Moreover, the process is versatile, capable of handling a wide array of complex plastic packaging materials.

One of the advantages of Greenback’s technology is its potential to produce pyrolysis oil suitable for creating food-grade plastics. The company is actively working with the petrochemical industry to ensure that the pyrolysis oil can be utilized in this manner. Although the current production volume of pyrolysis oil may be limited, future plans include scaling up to achieve 100% recycled content plastics.

The collaboration between Greenback and the AEPW highlights the importance of partnerships in tackling plastic waste management effectively. The AEPW, as a non-profit organization, provides critical support through funding, technical expertise, and knowledge sharing. By fostering collaboration and bringing innovative solutions to the table, the AEPW aims to create a circular economy for plastics and ultimately end plastic waste in the environment. Engineering plastics Plastic Waste

Moreover, Greenback’s approach emphasizes trust and traceability in the recycling process. The company has developed eco2Veritas™, a blockchain-based system that ensures complete transparency and certification throughout the recycling value chain. This system not only verifies the authenticity of recycled content but also enables voluntary extended producer responsibility arrangements with brand owners.

The success of Greenback’s technology can help drive demand for recycled plastics, especially for lower value plastics that are often overlooked. By creating a market for flexible plastics, these materials can be diverted from landfills or incineration, significantly reducing their environmental impact.

Looking ahead, Greenback plans to expand its operations to various regions worldwide, creating a network of collection and recycling plants near sources of plastic waste. With the AEPW’s support, the company aims to realize these ambitious plans and scale up innovative solutions for plastic circularity on a global scale.

In conclusion, plastic waste management requires collaborative efforts from various stakeholders, including innovative companies like Greenback and supportive organizations like the AEPW. By embracing technological advancements and promoting sustainable practices, we can work together to tackle the plastic waste crisis and create a cleaner and greener future for our planet. Engineering plastics Plastic Waste

Resin Price Erosion May Have Hit Bottom

The resin markets turned tepid the last full week of July, reports the PlasticsExchange in its Market Update. The flow of fresh railcar offers that had been slowing the past couple of weeks dried up to a mere trickle and asking prices came in a couple cents higher than recent levels. Engineering plastics Plastic Waste

While demand was not gangbusters, a steady stream of orders came through, some for normal monthly quantities, some to fill in for late railcars — which seems to have become another norm — while others sought to score some great month-end deals to replenish resin stocks. Some buyers had unrealistic expectations that the market would just continue lower, but the price erosion seems to have stopped.

Possible steep rise in PE export prices

Producers have indicated that their polyethylene (PE) export prices would rise by $0.03 to 0.05/lb in August on the heels of strong demand and limited availability. Consequently, resellers pulled back some offers while others raised prices by a few cents. The PlasticsExchange said it had a hard time replacing the resin that it sold last week, and its asking prices for both PE and polypropylene (PP) rose a penny, pretty much across all grades. After an extended period of de-stocking, resin inventories have tightened up throughout the supply chain.

“We have been vocal that a bottom could be forming and have nearly doubled our market-making inventory during July, citing more upside potential than downside risk from this level,” writes the PlasticsExchange in its weekly update. Engineering plastics Plastic Waste

PE trading activity was good, but completed volumes only finished average. Transactions were spread among high-density and linear-low-density PE and EVA resins, with a little low-density (LD) PE thrown in for good measure. Fresh railcar offerings were light, and hard searches through the reseller community also revealed limited availability. Some of the PlasticsExchange’s typical suppliers turned around and instead asked it for resin.

Prime PE prices rose one cent nearly across the board, though LDPE for injection, which is still mostly tight, trimmed a cent toward realigning with other grades. Outside of the usual export opportunities to Latin America and Asia, interest from Europe has also started to emerge. July PE contracts have mostly been agreed at a three-cent decrease, but have not been finalized. If contracts do peel off the three, it will bring contracts back to steady for the year after rising $0.06/lb in Q1 and receding $0.03/lb in Q2.

Aquafil Spa, a leading company in the industry, has experienced a decline in revenues during the first half of the year, reporting a decrease of 11 percent compared to the same period in the previous year

The dip in revenues can be attributed to a combination of factors, including reduced quantities sold and a decline in sales prices. Engineering plastics Plastic Waste

The decrease in quantities sold was a significant contributing factor to the overall revenue decline. Quantities sold during the first half of this year were 11 percent lower than in the same period last year. This reduction in demand was a result of various factors, including a slowdown in end consumption and the process of inventory reduction by customers. The European reference context, in particular, proved to be more challenging than expected during the second quarter, leading to a sudden and marked reduction in demand.

Moreover, the decline in sales prices also impacted the company’s revenues. The sales prices were adjusted to align with the lower prices of raw materials and other cost factors, especially energy and transportation costs. The market’s general weak situation also played a role in the decrease, as it caused a sharp decline in raw material prices, which returned to mid-2021 levels. As a result, the selling prices of Aquafil had to follow this trend, leading to a temporary worsening of margins due to the high unit carrying value of inventories formed in the previous year.

Despite the challenging market conditions in Europe, the company managed to maintain satisfactory numbers in the U.S. and Asia Pacific regions. Demand and quantities sold in these regions were in line with the previous year’s figures, providing some stability for the company. Engineering plastics Plastic Waste

One positive development during the first half of the year was the progress in the engineering plastics project. Despite the weak market conditions, the project is moving steadily towards its set targets and is expected to achieve its goals within the fiscal year. This progress is a promising sign for the company’s future growth.

Looking ahead, Aquafil expects an improvement in demand from the BCF (Bulk Continuous Filament) sector in the EMEA (Europe, Middle East, and Africa) region during the summer. The inventory reduction in this sector is anticipated to be mostly completed, which should lead to increased demand and potentially improved revenues.

To address the challenges posed by the market conditions and to ensure financial stability, Aquafil has undertaken major debt containment initiatives. These initiatives began in the previous year and have focused on rationalizing working capital and completing the investment cycle that started in past fiscal years. These efforts are aimed at maintaining a strong financial position and supporting the company’s growth in the long term.

In conclusion, Aquafil Spa faced a challenging first half of the year, with declining revenues due to reduced quantities sold and lower sales prices. The European market proved to be particularly difficult, impacting demand and raw material prices.

However, the company has shown resilience in other regions and made progress in its engineering plastics project. With ongoing debt containment initiatives and a focus on financial stability, Aquafil aims to navigate these challenges and continue to grow in the future. Engineering plastics Plastic Waste

How additive manufacturing is disrupting the injection moulding industry

Read on to discover how additive manufacturing can disrupt the injection moulding industry.

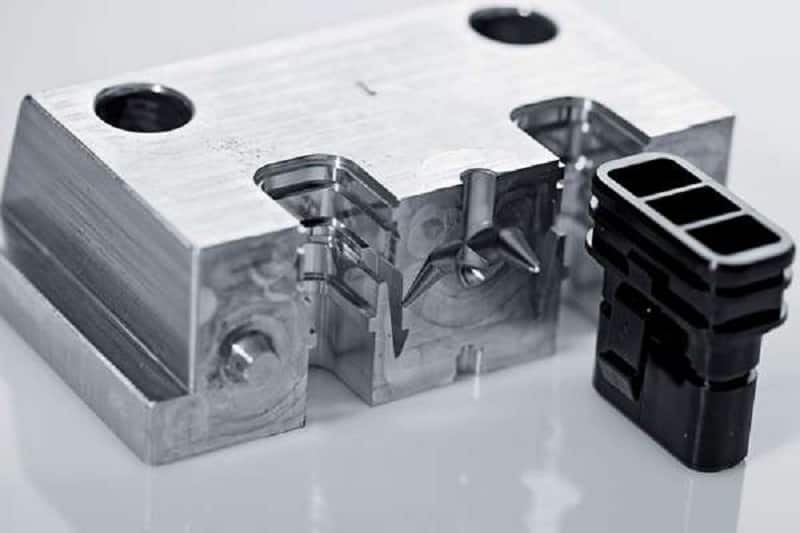

Next, as metal moulds are cut with extremely accurate CNC systems, the moulds can be fabricated with exact precision and with incredibly smooth surface features. This is essential when producing parts with high tolerances consistently.

Metals are great for thermal conductivity, which means that the heat from the injected plastic can be dissipated quickly, allowing the mould to cool down faster. Faster cooling means faster cycle times, and more parts can be produced for a given time when compared to moulds made from materials with low thermal conductivity.

Finally, metal moulds are highly versatile, meaning they can fabricate a diverse range of products, ranging from small components such as phone cases to larger, complex parts such as vehicle dashboards. Engineering plastics Plastic Waste

As a result, injection moulding is suitable for a wide variety of industries, including automotive, consumer goods, medical, and aerospace.

Of course, all of these benefits come at a cost. That cost is calculated based on multiple factors, with the most significant factors being the area of the mould base and the complexity of the part being moulded, the latter being related to the number of surfaces (or machining operations) required to get the mould formed to the correct shape.

Engineering plastics Plastic Waste