PA6-Compounds – PP-recycling 12-01-2023 - Arhive

PA6-Compounds – PP-recycling

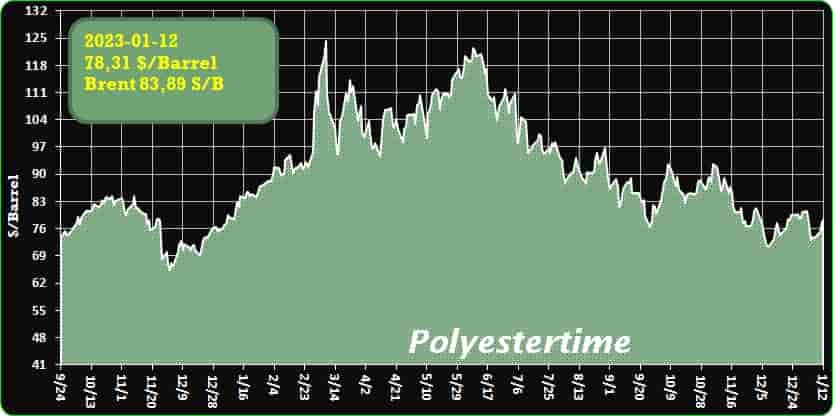

Crude Oil Prices Trend

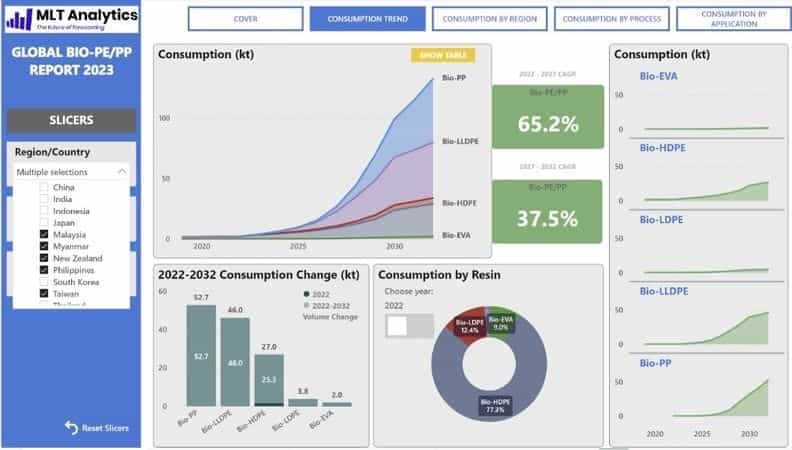

-New MLT Analytics report forecasts stellar growth for bio-based polyolefin market

According to a new report from Singapore-based MLT Analytics, the next decade will be one marked by exponential growth for the bio-based polyolefin market around the world.

Driven by a potent combination of consumer demand for more sustainable materials and the far-reaching sustainability ambitions and targets of the polyolefin suppliers, the global market for bio-based polyolefins is forecast to multiply by a factor of more than 20 between 2022 and 2032, reaching a volume of more than 4.7 million tonnes.

“2022 was a breakout year for bio-polyolefins in that we saw a notable diversification in the supplier base, with emerging suppliers developing and augmenting their commercial presence in the market, and adding to the dominant presence of incumbent producer Braskem,” said MLT Analytics CEO and co-founder Stephen Moore. “We also saw the bio-PP market more than triple in scale between 2021 and 2022 as mass balance-based polymer production kicked off in Europe and Japan,” he added. PA6-Compounds – PP-recycling

The coming decade will see the advent of myriad end-use applications for these materials, including existing mainstream bio-polyethylene applications such as extrusion coating, shopping bags, and blow-moulded containers, and emerging bio-polypropylene applications such as hygiene, housewares, and rigid and flexible packaging.

Most global polyolefin suppliers have announced sustainable polyolefin targets, typically to be achieved by 2030, that involve a mixed slate of polymers derived from bio-based, chemically-recycled, and mechanically-recycled feedstocks. And while the latter two routes may be preferred by some resin producers, brand owner and consumer pressures look like ensuring bio-based polyolefins will play a notable role in achieving sustainability targets.

However, according to Moore, the European Commission’s current proposals for a new Packaging and Packaging Waste Directive (PPWD) constitute a potential complicating factor to market growth for bio-polyolefins.

“The Commission has essentially signalled its preference for C14 assay over mass balance as the preferred means of measuring bio content, and added that bio-based plastics should target durable applications such as pipe and automotive, thereby functioning as carbon sinks. I don’t believe this is a stance that will be acceptable to bio-polyolefin suppliers given their investment in the mass balance approach.”

On the bio-polyolefin supply side, the leading incumbent supplier—Braskem—is being joined by a stable of European, Japanese, and Korean suppliers, with Dow Chemical also increasing its presence via production assets in Europe. “Bio-polyolefins are major components of Korean and Japanese suppliers’ sustainability strategies, and they will have ready access to export-oriented markets in Asia Pacific,” noted Moore.

“In fact, by 2032, we expect the Asia Pacific region to overtake Europe in consumption of bio-polyolefins.” PA6-Compounds – PP-recycling

He pointed out that bio-polyolefin suppliers also need to ensure they can secure sufficient bio-feedstocks to polymerise their products for the market. “Most bio-refineries focus on production of bio-fuels, with bio-naphtha being a lower priority by-product,” he said.

-QatarEnergy and Chevron Phillips Chemical sign a $6 billion petrochemicals deal

QatarEnergy and Chevron Phillips Chemical signed a $6 billion deal to construct an integrated polymers complex in Ras Laffan Industrial City Qatar.

The companies created a joint venture called Ras Laffan Petrochemicals in which QatarEnergy will own a 70% equity share and Chevron Phillips Chemical will own the remaining 30%.

The 435-acre project site will include an ethane cracker with a capacity of 2080 KTA of ethylene which, according to the press statement, is the largest ethane cracker in the Middle East. It will also include two high-density polyethylene derivative units with a total capacity of 1680 KTA. PA6-Compounds – PP-recycling

“This marks QatarEnergy’s largest investment ever in Qatar’s petrochemicals sector and the first direct investment in 12 years. It will double our ethylene production capacity, increase our local polymer production from 2.6 to more than 4 million tons per annum, and place the utmost emphasis on sustainable growth and the environment,” Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs and the President and CEO of QatarEnergy, said.

Chevron Phillips Chemical will provide project management services, the construction began in June 2022, and the operations are expected to start in late 2026. The engineering, procurement, and construction of the ethane cracker will be executed by a joint venture between Samsung Engineering CO and CTCI Corporation. Tecnimont S.p.A. will execute engineering, procurement, and construction for the polyethylene units.

–DSM-ADVENT-LANXESS – According to the Commission, the transaction does not raise any competition concerns.

The activities will flow into a joint venture between Lanxess and Advent.

The European Commission has cleared the acquisition of the engineering plastics businesses of DSM (DEM, DSM Engineering Materials) and Lanxess (HPM, High-Performance Materials) by private equity firm Advent International, a plan announced in spring 2021 (read more item).

The Commission considered that the transaction does not raise competition concerns, as the markets for the supply of polyamide 6-based high performance plastics and related compounds, where the parties’ businesses overlap, will remain sufficiently competitive even after the ‘acquisition. PA6-Compounds – PP-recycling

The transaction is part of the formation of an engineering materials joint venture between Lanxess and Advent, the name of which is not yet disclosed, but which will consist of three broad divisions: Performance Materials, comprising the Performance Polymers businesses of DEM and Engineering HPM Plastics; Specialty Materials, where the Specialties (DEM) and Tepex (HPM) units will be conferred; Intermediates, which will concentrate the intermediates of Lanxess and the Polymer & Films activities of DSM Engineering Materials (read the article).

A new headquarters will be established in the surroundings of Düsseldorf, alongside those already present in Geleen, the Netherlands (DEM) and Dormagen in Germany (HPM). Once operational, the joint venture will have a turnover of around 3 billion euros and will have around twenty production sites and fourteen research and development centres.

In the intentions of the two partners, Advent will hold control of the new company, with a minimum stake of 60%, while the remaining share capital will be in the hands of Lanxess.

–Pvc contract prices in Europe have decreased significantly

– Contract prices for polyvinyl chloride (PVC) in Europe have fallen significantly this year amid low demand, ICIS said.

At the same time, export prices, on the contrary, rose as supplies from the United States and Asia decreased.

The domestic market in Europe was dominated by weak demand in the fourth quarter of 2022, with production costs also declining towards the end of the year due to lower gas and electricity prices. PA6-Compounds – PP-recycling

Monthly contract prices for PVC declined in December due to weak demand from the construction industry combined with a seasonal lull. Prices decreased by EUR50-80 per ton. Annual contract prices for 2023 are also down significantly from 2022 amid a gloomy demand picture that is expected to persist in the new year, according to market sources.

The outlook for PVC demand and the construction sector as a whole remains downward in 2023 due to the growing likelihood of a recession in Europe and abroad, continued low demand in China, likely further volatility in the electricity and gas markets, and inflation, which is not expected to decline at most until next year.

SPOT PVC prices in Europe rose significantly in January due to more limited supply from the US and Asia. Price offers were in the range of USD800-900 per ton, CFR Turkey for PVC with K = 67.

PVC prices in the US continued to recover amid limited supply due to VCM issues in India.

Earlier it was reported that the spot market for polyvinyl chloride (PVC) in Asia is likely to face some problems in 2023. Market participants hope that domestic conditions in China will improve after the New Year holidays according to the lunar calendar at the end of January 2023, when the winter seasonal lull ends.

However, while long-term demand for PVC in China is expected to grow as real estate projects resume, there is likely to remain some ongoing uncertainty about how the country will cope with COVID-19. PA6-Compounds – PP-recycling

According to the ScanPlast review, according to the results of eleven months of this year, the estimated consumption of unmixed PVC in Russia amounted to 816.36 thousand tons, which is 8% less than in 2021. The emulsion and suspension PVC markets showed a decrease in demand, but the largest drop in demand was in emulsion.

-A large producer of PVC from Northeast Asia raised prices for February deliveries to China and Southeast Asia

A major manufacturer in Northeast Asia has raised its offerings for February shipments of polyvinyl chloride (PVC) to China and Southeast Asia from Jan. 11, ICIS reported.

Offers for deliveries in February are USD885 per tonne, CFR China and USD880 per tonne, CFR South East Asia. On fob (free-to-board) Northeast Asia terms, the offer is USD840 per ton. There is no discount for February shipments.

Earlier it was reported that the average capacity utilization at Chinese plants for the production of purified terephthalic acid (TPA) decreased by 2% in the week ended December 16, compared with the level of a week earlier and amounted to 63%. Average production utilization was lower compared to the previous week, mainly due to the shutdown for maintenance of the Sichuan Shengda plant, despite the restart of production of Oriental Petrochemical. PA6-Compounds – PP-recycling

According to the ScanPlast review, the estimated consumption of PET in October of this year decreased by 16% compared to a year earlier and amounted to 58.53 thousand tons (against 69.28 thousand tons in October 2021). According to the results of ten months of 2022, 680.14 thousand tons of PET were processed in Russia, which is 1% less than the same indicator last year.

-TotalEnergies joins Nextloopp recycling initiative

Nextloopp, the UK-based global, multi-participant PP recycling project launched by Nextek Ltd in October 2020 has welcomed TotalEnergies as its newest member.

Nextloopp, the UK-based global, multi-participant PP recycling project launched by Nextek Ltd in October 2020 has welcomed TotalEnergies as its newest member. The Nextloopp initiative brings together 48 companies from the plastics value chain with the aim of creating food-grade recycled polymer through the use of advanced mechanical recycling technology. Ultimately the project proposes to close the loop on food-grade PP.

TotalEnergies’ participation and the extensive technical capabilities in creating circular solutions for PP resins which they are bringing into the initiative strengthens the project as a whole, according to Professor Edward Kosior, the founder and CEO of both Nextek Ltd and Nextloopp. PA6-Compounds – PP-recycling

“They contribute to the growing body of expertise in controlling the properties and formulation of their range of both virgin and recycled PP for a myriad of applications,” he said.

Nextloopp is the outcome of eight years of research and commercial trials, during which new technology was developed, which enabled food-grade PP to be efficiently and cost-effectively sorted from post-consumer material. After sorting the material, it undergoes a decontamination step that is rigorous enough to allow the polymer to comply with stringent food-grade standards. Nextloopp has recently completed a landmark study of background contamination of post-consumer PP packaging for its submissions to food safety authorities in Europe (EFSA), in the United States (USFDA) and in the United Kingdom (UK FSA).

TotalEnergies has joined the initiative, among others, to meet the growing customer demand for high-quality recycled polymers. The company says that the technology will enable it to further expand its recently launched RE:use polymers range, which features products containing mechanically recycled raw materials.

“This initiative will allow us to go one step further in developing technologies to produce food-grade recycled material from advanced mechanical recycling and broaden our options for projects that contribute to our ambition to produce 30% circular polymers by 2030,” said Nathalie Brunelle, Vice President Polymers at TotalEnergies.

-Resin : Prices Rise to Start New Year

Resin prices rose for the first time in months to begin the new year, spurred by restricted supply, improving sentiment, and rising monomer costs, particularly for polymer-grade propylene (PGP), reports the PlasticsExchange in its Market Update. Another force majeure was issued for polyethylene (PE) as a result of winter storm Elliot, which now makes two each for PE and polypropylene (PP). PA6-Compounds – PP-recycling

Demand was seen from both resellers and processors, and purchase orders began to flow in to secure material, mostly for immediate needs as downstream inventories dwindled. There were few fresh offers in the spot market, as many market participants, including some producers’ sales forces, remained on holiday the first week of January. Limited railcars of off-grade PE and PP were available, while January domestic prime offerings should begin to show in the next week.

The same held true in the export market, as some buyer inquiries floated in. But exporters had not yet received January pricing and availability, although PE was indicated $0.03/lb above December levels. Chinese buyers have reportedly been actively procuring material again, providing some support to the market. Producers are out with price increases for January contracts, and PP indeed will see a sizable jump, as monomer costs have been running higher. It remains to be seen if the supply/demand dynamic has come back enough toward balance to determine if the PP margin increase or PE increase will see some implementation this month, writes the PlasticsExchange.

PE resin prices add $0.02/lb

The PE market was fairly active, considering the holiday-shortened week — demand was good, fresh supply was light, and prices added $0.02/lb. The PlasticsExchange said it was challenged to fill buyer demand, as prime railcars were elusive, but managed to find off-grade railcars that met customer needs. Prime truckload orders also were satisfied by the Chicago-based resin clearinghouse, which expects sellers to return from their holiday break and be back to the market next week with fresh supply, although it does not expect to see much material. CP Chem suffered equipment damage related to winter storm Elliot on one of its units at the Cedar Bayou plant, which is their largest. It issued a force majeure on all PE produced at that plant. Ineos had issued a force majeure on its high-density (HD) PE the previous week. PA6-Compounds – PP-recycling

The production disruptions came after North American PE producers had been running reactors at significantly reduced rates since September to reduce surplus resin inventories that had been weighing on prices. Nearly three-quarters of a billion pounds were cleared out through November, which is meaningful, and the PlasticsExchange said it expects the December production decline and inventory draw to be substantial. Though spot levels eroded in the fourth quarter amid price consolidation, contracts managed to hold steady these past three months. Producers are now all out with January increase nominations that range between $0.06 and 0.08/lb. It will be interesting to see if the reduced inventories throughout the supply chain and processors need to restock amid more bullish sentiment will be enough to turn the tide to achieve some level of implementation.

PP resin prices jump $0.04/lb

PP prices jumped $0.04/lb the week of Jan. 2 on the heels of rapidly rising monomer costs. Deals were done for both railcars and packaged material, and co-polymer outstripped homo-polymer. Buyers were engaged from the get-go, according to the PlasticsExchange. Some came to fill urgent needs after an extended period of slack demand, while others scooped up well-priced material that was still available as monomer prices rallied sharply, suggesting that a January price increase will be imminent.

PP producers have cut reactors rates sharply since September, and the November inventory drawdown was the largest since the winter storm of 2021; similar results are expected from December, especially considering the short-lived, and somewhat impactful winter storm that swept through the petrochemical-producing gulf area a couple weeks ago. The severe cold weather brought about force majeure declarations for PP from both Ineos and Pinnacle. PA6-Compounds – PP-recycling

The American Chemistry Council December sales figures have not been released yet, but aggregate domestic PP sales were dismal from September through November, about 100 million pounds per month less than the trailing 12-month average. Some of that can be attributed to slower throughput, and some to processors just working down their on-hand resin stocks as prices slid.

-StoreDot opens California innovation hub to accelerate development of semi-solid state batteries

Israel-based StoreDot, a developer of extreme fast charging battery technology for electric vehicles, officially opened its first US research facility in Irvine, California. The new lab facility will be used to speed up StoreDot’s development of semi-solid battery technology and battery material research. PA6-Compounds – PP-recycling

The company chose the location to access the wealth of talent in the US West Coast and to strengthen the company’s relationship with US-headquartered electric vehicle manufacturers.

The US team is headed by StoreDot’s global Chief Science Officer Dr David Lee. Dr Lee and his team will work in tandem with StoreDot’s Israel-based R&D headquarters, enabling it to scale up globally and remain firmly on track for its 100inX strategic technology roadmap.

Announced last year, the roadmap will see the delivery of mass-produced battery cells capable of 100 miles of range in five minutes of charge by 2024, 100 miles in three minutes by 2028 and 100 miles in two minutes by 2032.

StoreDot is currently yielding positive feedback from multiple global car makers after shipping 300 Wh/kg in EV form factor for real-world testing last year. These cells achieve a world-leading consecutive extreme-fast charging of above 1,000 cycles demonstrating a Silicon-dominant chemistry with no battery degradation due to XFC.

StoreDot has a growing network of strategic global partnerships and investors, spanning the entire battery ecosystem. To date it has received investments from global automotive manufacturers including Daimler, Ola Electric, Polestar, VinFast and Volvo Cars.

PA6-Compounds – PP-recycling