Pakistan on path of bankruptcy 07-03-2023 - Arhive

Pakistan on path of bankruptcy

-Pakistan on path of bankruptcy, could textile industry be the savior?

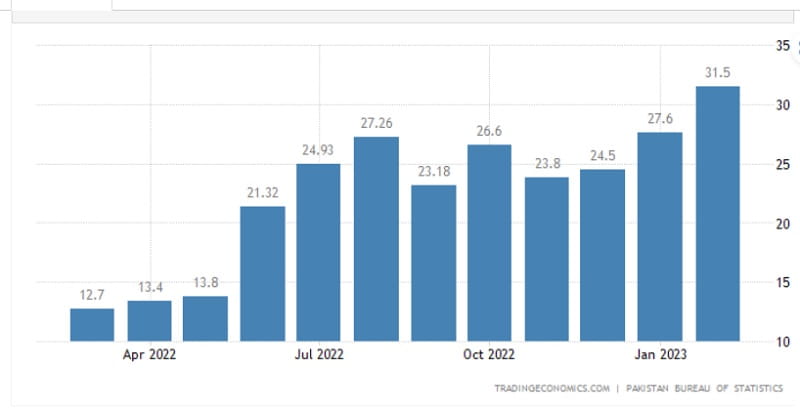

Bottoming foreign exchange and rising inflation

A recent public speech by Khawaja Asif, Pakistan’s defense minister, in which he declared that “It (default) has already taken place. We are living in a bankrupt country,” quickly set tongues wagging. Pakistan is facing one of its worst economic crises since independence. Its public debt stands at nearly $294 billion, or 90% of gross domestic product. By March, nearly $20 billion in debt payments are due, making default almost certain. Reserves held by the central bank have recovered slightly to $3.258 billion, but that would cover only three weeks of imports.

The poorly-developed export industry is the main cause for Pakistan’s foreign exchange shortage, while the interest rate hike becomes the last straw that breaks the camel’s back. With the rapid rise of the US interest rate, Pakistan’s huge debt falls into an infinite cycle of compound interest. Pakistan on path of bankruptcy

Coupled with the worst floods in 30 years and a worsening security situation, Pakistan is currently experiencing both natural and man-made disasters. Compared with the exchange rate in April last year, the Pakistani rupee has fallen about 29.4% against the dollar, indicating a decline in its ability to pay for imports.

Credit : Trade Economics

Meanwhile, for Pakistan, which is highly dependent on food and energy imports, a prolonged war between Russia and Ukraine, coupled with a weakening currency, have triggered a series of violent inflation. Pakistan’s import business is undoubtedly the most hit by the insufficient foreign exchange reserves. Due to the lack of dollars to pay for imports, containers gradually pile up in the port, which contain either food needed by domestic residents or raw materials necessary for by Pakistan’s downstream factories. The disruption of the supply chain of imported goods further pushes up the prices in Pakistan. The inflation rate reaches 27.55% in January 2023, and some experts predict it will peak at 33% in the first half of this year. Pakistan on path of bankruptcy

Trade surplus of Pakistan’s textile and apparel gradually shrinking

Currency collapse, debt default, social unrest and other intractable problems are pushing Pakistan to the brink of bankruptcy. Can the textile industry, one of Pakistan’s export pillars, help it out of the mire? According to the latest data released by Pakistan Customs, Pakistan’s textile and apparel exports in 2022 stand at 18.667 billion US dollars, bringing a cumulative trade surplus of about 11.386 billion US dollars to Pakistan and making a huge contribution to the liquidity of Pakistan’s foreign exchange. In January 2023, textile and apparel exports of Pakistan fell slightly to $1.322 billion, down 2.53% from December last year, while textile and apparel imports also edged down $357 million.

As can be seen from the chart above, the foreign exchange earning capacity of Pakistan’s textile industry has been waning in recent months. The monthly trade surplus of Pakistan’s textile industry has narrowed to below $1 billion since last December. Exports of both knitwear and bedding for the end-user market and yarn as raw material have declined significantly. One reason is that the demand in major export destinations such as Europe and the United States is declining. Pakistan on path of bankruptcy

Another reason lies on the overwhelmed large amount of high-cost cotton imported earlier, which has led to inferior export competitiveness of Pakistan’s textile industry compared with previous years.

The foreign currency earned by Pakistan’s textile industry is crucial for its domestic foreign exchange liquidity despite that it only makes a small dent in the country’s rising debt. Notwithstanding, at a time when global developed economies are facing recession, major textile exporters including China and Vietnam are also under sales pressure. Therefore, in 2023, the extremely fierce competition will accelerate the development of more self-dependent industries in Pakistan in order to strengthen the ability to earn foreign exchange through exports, which may help Pakistan resist the subsequent systemic risks. Fortunately, Pakistan has recently reached a further agreement with the International Monetary Fund, and there may be some inflows of foreign currency later to meet the urgent needs. Pakistan has also expressed that it would broaden sources of revenue and cut down expenses through raising interest rates, increasing taxes, canceling energy subsidies and so on to make up for the fiscal deficit. Pakistan on path of bankruptcy

Credit :Fair Observer

Enzymatic technologies – Indorama IVL 06-03-2023