Plastic-bottles-to-textile-yarns 03-08-2022 - Arhive

Plastic-bottles-to-textile-yarns

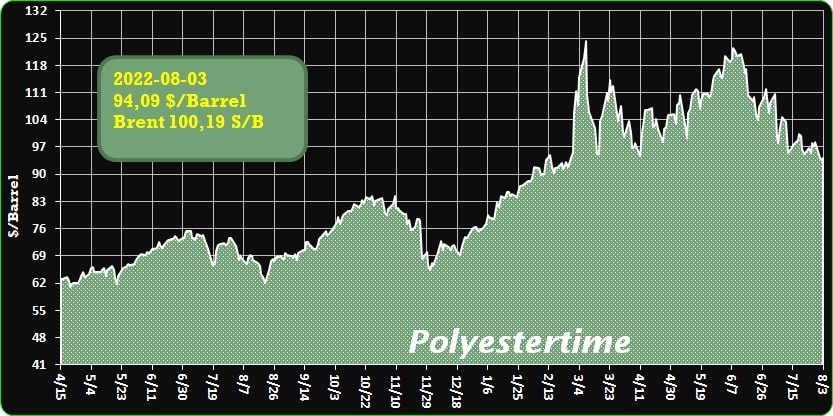

Crude Oil Prices Trend

-Amut completes recycling project in Romania

Amut has completed the commissioning of a recycling plant for Pet Star Recycling, part of Pet Star Group, together with Pet Star Holding, a leading producer of preforms for PET bottles, in Romania. The company developed a customised solution aimed at delivering high performance.

The new washing line fork PET processing with 3,000kg/h total output is equipped with the Amut’s patented De-Labeller together with theFriction Washer, and presents the front-end sorting system sized to sort clear/light blue bottles from a stream including up to 14/15% of coloured ones suitable to treat 5,500kg/h of inlet material.

“From the very beginning, we have implemented the bottle-to-bottle concept to increase the recycling potential of untapped plastic waste and its reuse in a new production process. That’s why we chose a strong partner, as Amut, which provided us modern and innovative sorting and washing technology which allows

-Manjushree Technopack acquires Hitesh Plastics

Manjushree Technopack, India’s largest manufacturers of rigid plastic packaging backed by Advent International, has acquired Bangalore-based Hitesh Plastics. According to the agreement MTL will acquire the business operations and manufacturing facilities of Hitesh Plastics. Plastic-bottles-to-textile-yarns

Hitesh Plastics is the leading manufacturer of plastic caps and closures in India.

MTL enters the highly specialized caps and closure market with this acquisition, bolstering its position as an end-to-end integrated rigid plastic packaging player.

Hitesh Plastics processes over 1200 tons of PP and PE annually to produce over 10 billion CSD, Hot-Fill, Warm-Fill, and water closures. It is a major supplier to companies like PepsiCo, Tata-Himalayan, Amul, and others.

MTL will also add the acquired company’s two new plants in Jalgaon, Maharashtra, to its existing list of 21 plants in India. This will push MTL’s total manufacturing capacity beyond 200,000 MT per year, solidifying its market leadership.

Speaking about the acquisition, Thimmaiah Napanda, MD and CEO of Manjushree Technopack Limited, said “We are excited to continue our journey of rapid growth and meaningful diversification within the rigid plastics sector. In recent years, MTL has successfully complemented its organic growth with synergistic acquisitions, and we intend to continue to do so opportunistically. To date, Caps and Closures has been the missing piece in MTL’s product suite for the beverages segment, and we are excited to add it to our portfolio in a sizable and margin accretive manner through the acquisition of Hitesh Plastics. We believe this will make us a one stop shop for all RPP requirements and further deepen our relationship as strategic partners, to some of the country’s largest beverage companies.”

-Sidel expands in East Africa with new Nairobi office opening

Sidel has expanded its presence in Africa with the opening of a new office in Nairobi, Kenya. The move increases its support for its customers in East Africa, a key market for Sidel and one of the continent’s fastest-growing regions.

Sidel has been serving the African market for many years. Building on this, the new East Africa office will enable it to drive development in the region by working more closely with customers to provide them with dedicated engineering capability and on-the-ground customer service. Plastic-bottles-to-textile-yarns

“East Africa continues to show impressive market growth in Sidel’s core business areas of beverages, food, home and personal care packaging,” says Vishal Gupta, Managing Director for Sidel Services East Africa.

“This is more than an office, it’s a symbol of our commitment to the African market, to our customers and to developing the skilled local engineering and operational talent pool.

Sidel prides itself in offering global experience paired with local expertise. Here we are investing in the country and the region, partnering for growth whilst increasing customer satisfaction.”

-China’s PP demand growth: A bubble that may have burst beyond repair

WAS IT JUST an almightily big bubble that cannot now be re-inflated, even if Beijing follows through on its plans to inject $148bn in loans into the country’s troubled real estate sector? Plastic-bottles-to-textile-yarns

Once confidence has gone, such an intangible thing, there is a risk it cannot be restored. The old “put option” was that the government would always effectively intervene to stabilise real estate, the main source of investment and savings in China because of weak pensions provision. What happens if faith in the put option fades away?

The scale of the problem was highlighted in the July pH Report: Bloomberg’s current view of Chinese banks’ exposure to property loans. Its $9.3tn number. This is almost certainly an under-estimate, given that all the major players – developers, borrowers, local governments etc – have an interest in minimising the risks. But even $9.3tn represents almost two-thirds of China’s GDP last year”.

Confidence in real estate and the broader economy seem to have also been undermined by the zero-COVID policies. A stop/start recovery appears inevitable until or unless China develops an effective mRNA vaccine and administers the vaccine to the point where lockdowns and mass testing are no longer necessary.

Back to real estate. As I highlighted in January, there appears to be a close link between the rise of China’s demand for petrochemicals and polymers since 2009 and the country’s big increase in Total Social Financing, the People’s Bank of China’s broad measure of credit availability. A big portion of the surge in lending has gone into real estate.

And as I’ve been arguing for many years, China punches above its weight in terms of per capita petrochemicals demand versus its per capita income. . In 2021, its nominal per capita income was $14,096 and was $21,364 in terms of purchasing power parity, according to data quoted by Wikipedia Plastic-bottles-to-textile-yarns

This compared with the US where nominal 2021 per capita GDP even just in nominal terms was $69,288, according to IMF data quoted by Wikipedia. And yet in polypropylene (PP), as the chart below illustrates, China’s per capita consumption overtook the US in 2019.

-Plastic bottles to textile yarns – an Indian company is converting 125MT of PET bottles into yarn

India-based PET bottle recycler RSWM Ltd transforms waste bottles into textiles at an astonishing rate. Rob Coker spoke to Chief Managing Director Riju Jhunjhunwala to find out how.

How important is the plastics recycling sector to India’s economy, as well as its natural environment? Plastic-bottles-to-textile-yarns

According to The Central Pollution Control Board (CPCB), India, the plastic waste generated is around 3.5 million tonnes per year. Out of this roughly around 12 per cent is incinerated and 78 per cent goes to landfills. Plastic waste is blocking the drainage systems, threatening marine life and generating health risks for residents. It is a big menace for the nation and costing the country billions of dollars every year in terms of lost opportunities in ecotourism, increasing the potential for climate changes and thereby unleashing the wrath of nature, resulting in droughts and floods. Therefore one of the biggest challenges faced by India is to recycle its plastic before it pollutes its water bodies and causes irrevocable damage to the naturally endowed tourism destinations in the country. India has recently passed a resolution banning single use plastic to arrest the degradation caused by plastic pollution.

We, however, are able to convert this threat into an opportunity. Opportunity to create value out of waste and generate employment – not just in textiles, but also in ancillary industries like waste collection and transportation. It’s a very tiny beginning but with greater acceptance and awareness, this could become a global phenomenon supported by India. And then it could be a big boost to the national economy overall.

How big a problem is plastics pollution currently in India?

There is both a hidden and a visible impact of plastic pollution. The visible impact is the clogging of water bodies and hygienic issues caused by litter in the streets. The invisible impact is far larger – fisheries that contribute to around one per cent of the GDP and employ around 14 million people is in danger as the water bodies become clogged with plastic, killing the aqua and marine life. Climate changes fuelled directly and indirectly by the plastic pollution threatens the farming community which employs – directly and indirectly – around 50 per cent of the population. Tourism is another area that is being severely impacted. Tourism, which contributes around five per cent of the country’s GDP and employs around 15 per cent of the people, could be seriously impacted by plastic pollution. Plastic-bottles-to-textile-yarns

–Shock U-turn from Citi: Worst-case scenario for Eurozone is coming true – Deep recession inevitable

Today, Citigroup made a significant change in its assessment of the course of the European economy, stressing that the worst-case scenario is now the main one for the region, with the deep recession hitting with certainty and noise. As it notes, its recent assessment of a mild recession in the eurozone has become overly optimistic with gas prices having risen a further 30% and key economic indicators pointing to a 2011/12 or even 2008/ 9. Policy action can still avert the worst, but a deeper recession and prolonged weakness will now be hard to avoid.

Thus, Citi reduces its forecasts for GDP growth for 2023 to -1% for the euro zone and -2% for Germany, while a recession of 0.9% is also forecast for Italy. A return to the pre-pandemic path of economic potential seems unlikely unless monetary-fiscal policy coordination brings about a significant acceleration of investment, as he underlines.

A deep recession is coming

In the wake of the escalating conflict between Russia and the EU, but also the lingering effects of the pandemic and tighter economic conditions, key economic indicators have hit new lows and point to a far worse outcome than a mild recession.

Over the past week and a half, almost all indicators of eurozone economic activity have taken a decisive turn for the worse. The composite PMI fell to 49.4, the European Commission’s economic sentiment index (ESI) to 99.0. Both were much weaker than forecast and broke above critical levels (50 and 100, respectively) for the first time since February 2021. Both remained far from recession territory, which we see at 48 and 95, respectively, but other key indicators suggest this is unlikely to last.

On July, Germany’s Ifo index, a good indicator for investment, bottomed out in the 2008/9 crisis. The growth rate of the tight M1 money supply (cash and overnight deposits of households and non-financial firms), adjusted for inflation, fell below -1% year-on-year in June. The last time this happened in 2008, euro area GDP contracted at a rate of 1% annually three quarters later. Plastic-bottles-to-textile-yarns

There are many headwinds for the economy that are global in nature, Citi points out. These include the effects of the pandemic, such as ongoing supply chain disruptions or significant change in consumer demand. Global tightening of financial conditions due to expectations of central bank interest rate hikes are also playing a role.

But the geographic distribution of the shock clearly shows that the shock originates in northeastern Europe. This suggests that the main driving force behind European developmental weakness is ultimately the conflict with Russia. It has caused a sharp rise in energy costs, increased uncertainty, caused new supply disruptions and reduced trade. The first two headwinds in particular are now significantly exceeding Citi’s expectations immediately after the invasion of Ukraine at the end of February. So avoiding recession is no longer the main scenario.

The dip in consumer confidence to new historic lows in July remains particularly impressive, emphasizes the American bank. Although business confidence is beginning to catch up with consumer confidence, the gap between the two remains historically high. “We are particularly concerned by the data from the German GfK survey this week that households may increase saving. The survey tends to correlate well with Germany’s actual household savings rate and currently shows a recovery in savings from around 12% of disposable income to near pandemic levels of 20%, he notes. This time, it is voluntary rather than forced saving, which makes it less likely that it will be spent in the short term. It could mean that households are responding to rising prices by saving more for retirement. Precautionary savings in a recession and fears about job security may also play a role. Plastic-bottles-to-textile-yarns

-New PBT Compound Designed for High-Voltage Connectors

The halogen-free flame-retardant and hydrolysis-stabilized grade retains electrical properties under challenging conditions.

Plastic components are often exposed to high temperatures along with very strong currents and high voltages in the powertrain or battery of electric vehicles, as well as in the charging infrastructure of electromobility. Connectors, for example, must maintain electrical insulation under these conditions and not allow tracking to occur.

Lanxess has tailored a new PBT (polybutylene terephthalate) compound for demanding high-voltage connectors that is halogen-free flame-retardant and hydrolysis-stabilized. “One strength of the structural material is that its outstanding electrical properties are hardly dependent on temperature and moisture in the typical operating conditions of high-voltage connectors. It can be used at temperatures up to 150°C,” explains Bernhard Helbich, Technical Marketing Manager, Key Accounts, at Lanxess’ High Performance Materials business unit. Plastic-bottles-to-textile-yarns

The compound is a first representation of the new Pocan BFN HR product range and is characterized by a high level of volume resistance and dielectric strength. For example, the latter is well over 30 kV per millimeter at temperatures up to 140°C (IEC 62431-1). In the CTI test (Comparative Tracking Index, IEC 60112), the material achieves CTI A 600, the highest class possible according to the standard. Elevated tracking resistance reduces the risk of short circuits and defects caused by creepage currents and caters to the growing need for miniaturized connectors.

“But it can also be used at voltages higher than 600 V. The connector design for direct current systems can be optimized for up to 1,500 V in accordance with the design guidelines of the IEC 60664/VDE 0110-1 standard,” says Helbich. The tracking resistance of the compound also hardly diminishes after long-term thermal aging at 120°C or after climate testing.

-Coca-Cola to transition green plastic portfolio to

clear PET bottles in North America

The Coca-Cola Company has announced that Sprite bottles will begin the transition from green to clear PET in North America with the aim of increasing the material’s likelihood of being recycled into new beverage bottles, while its remaining green plastic portfolio will make the switch in the coming months.

According to The Coca-Cola Company, Sprite is shifting all of Sprite’s plastic PET packaging from its signature green colour to clear PET in North America, beginning on August 1st 2022. Plastic-bottles-to-textile-yarns

The company explains that while green PET is technically recyclable, it is more often converted into single-use items like clothing and carpeting that cannot then be recycled again into new PET bottles. During the sorting process, green and other coloured PET is often separated from clear material to avoid discolouring the recycled food-grade packaging required to make new PET bottles.

Julian Ochoa, CEO of R3CYCLE, which is working with Coca-Cola Consolidated to enable bottle-to-bottle recycling, adds: “Taking colours out of bottles improves the quality of the recycled material.

“This transition will help increase availability of food-grade rPET. When recycled, clear PET Sprite bottles can be remade into bottles, helping drive a circular economy for plastic.”

In addition to transitioning to clear bottles, The Coca-Cola Company says that Sprite is introducing a new visual identity system, featuring a revamped logo and packaging design intended to provide a consistent ‘look’ around the world. Sprite’s packaging graphics will apparently retain the brand’s recognizable green hue and include prominent “Recycle Me” messaging.

Coca-Cola North America’s entire green plastic portfolio — including packaging for Fresca, Seagram’s and Mello Yello — is expected to transition to clear PET in the coming months.

In the same announcement, The Coca-Cola Company says another of its North American brands, DASANI, will roll out bottles made from 100% recycled PET (excluding caps and labels) for its 20-oz and 1.5-litre singles and 10-oz and 12-oz multipacks. This shift will reportedly include all DASANI bottles in Canada. Plastic-bottles-to-textile-yarns

Plastic-bottles-to-textile-yarns