Plastic packaging – Recycling – MEG 22-03-2023 - Arhive

Plastic packaging – Recycling – MEG

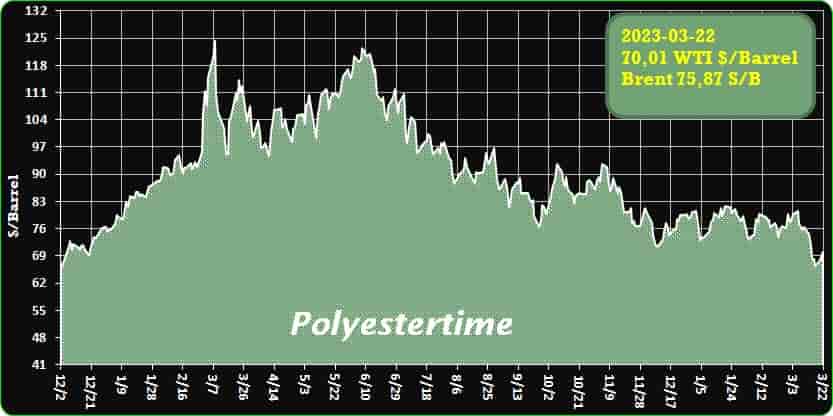

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

-85% of plastic is not recycled because costs exceed new material

Despite the recycling campaign, especially bottles, in the US only 5% of more than 50 thousand tons will be recycled in 2021.

Around 85% of plastic packaging worldwide ends up in landfills and is not recycled. In the United States, the world’s biggest plastic polluter, only about 5% of the more than 50 million tons of plastic waste produced in 2021 will be recycled, according to Greenpeace. Plastic originates from petroleum or natural gas. Contrary to the image that many people might have, recycling is intense and growing, in fact costs are high, and recycling plastic is more expensive than buying new.

Global plastic production will triple by 2060 and plastic materials will multiply as a source of pollution in the oceans, where they severely affect marine life. And eventually they return to humans, in the form of microplastics that contaminate fish and shellfish and are ingested with them. Plastic packaging – Recycling – MEG

Pledges from major plastic producers such as food companies Nestle and Danone to promote recycling and include more recycled plastic in their bins have largely disappeared. No data for Argentina. Several beverage brands run campaigns claiming that their bottles are made from recycled plastic.

-Bio-based alternatives for the AHP sector

Speciality viscose manufacturer Kelheim Fibres will demonstrate how its innovative bio-based fibres offer a environmentally friendly solution for a wide range of applications across the AHP sector at the upcoming INDEX exhibition.

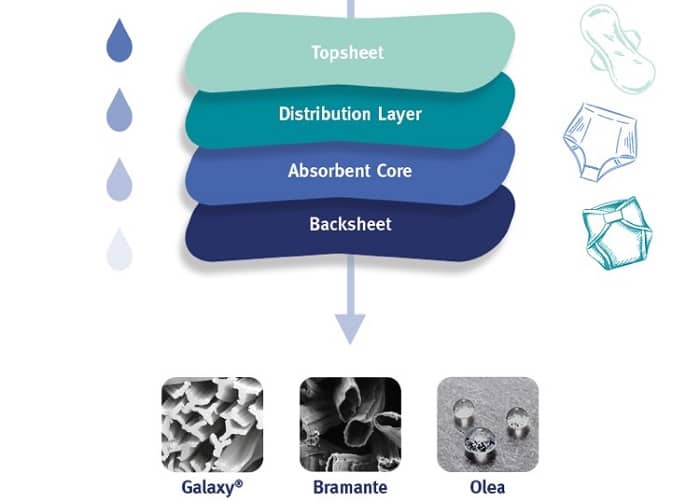

Absorbent hygiene products such as diapers, sanitary pads, and incontinence products are an integral part of daily lives. Plastic packaging – Recycling – MEG

However, most of these products contain synthetic components and contribute to the global plastic waste problem. The search for alternatives is becoming increasingly urgent. The catch, says Kelheim, is that only innovations that offer the same performance and reliability as conventional products can be successful in the market. After all, no one wants to compromise in such a sensitive area as personal hygiene.

Kelheim Fibres is currently working on various development projects to design fully biobased AHP (absorbent hygiene product) concepts that do not compromise on performance. In this area, the company continues to focus on its wood-based specialty fibres, which the tampon industry has trusted for decades. However, the requirements for AHP products differ, as each layer must fulfill a specific function. For example, the topsheet comes into direct contact with the skin, while the ADL layer needs to quickly distribute the liquid, and the absorbent core must be particularly absorbent to achieve an optimal storage of the liquid. Plastic packaging – Recycling – MEG

To meet these requirements, Kelheim Fibres has developed a range of functionalized specialty fibres, including hydrophobic Olea, trilobal Galaxy, and the hollow fibre Bramante. These specialty fibres ensure optimal results in every layer of the AHP product.

-Evonik Invests in Interface Polymer’s Additives for Sustainable Plastics

Interface Polymers’ Polarfin additives shown to simplify to the processing of plastics such as mixtures of PE and PP.

Evonik has invested in the British company Interface Polymers Ltd., whose Polarfin additives reportedly simplify the processing of plastics such as mixtures with PE or PP. At the same time, Interface Polymers’ technology has been shown to make it possible to recycle such plastics. Plastic packaging – Recycling – MEG

As a specialty chemicals company, Evonik is working on solutions for the circular economy at many levels. Polyethylene and polypropylene are versatile and widely used plastics because of their low weight and durability. However, their poor compatibility with other materials is a drawback. So far, costly and time-consuming surface preparation was the only solution. The unique Polarfin additive technology developed by Interface Polymers is said to make such preparation unnecessary. Moreover, it greatly reduces the amount of additives needed. As a result, mixed plastics are easier to recycle.

Interface Polymers was established in 2016 to commercialize inventions made in the Department of Chemistry at the University of Warwick in Coventry (UK). A core competency of this company is the use of its Polarfin technology to make the surface of polyolefins compatible with other materials. Diblock copolymers combine PE and PP with polar materials to improve their compatibility with metals, ceramics, and other plastics. This offers advantages in recycling of mixed plastics, adhesion of paints inks and glues to plastic surfaces, and dispersion of materials within molded plastics.

Said Evonik’s head of venture capital Bernhard Mohr, “Many modern applications would be unthinkable without plastics, but recycling them is still a big challenge.

Interface Polymers’ additive technology offers a solution and is an excellent fit with Evonik’s Circular Plastics Program.”

The Sustainability Tech Fund launched by Evonik in 2022 is adding Interface Polymers to its investment portfolio. In this way, the Evonik Group is strengthening its technological expertise to realize its sustainability goals. Plastic packaging – Recycling – MEG

-Hi Fabrique Group acquires Tessitura Monti Spa’s India business

Bengaluru-based cotton fabric manufacturer Hi Fabrique Group on Monday announced the acquisition of the India business of Tessitura Monti Spa, an Italian company engaged in the spinning, weaving and processing of textiles, for an undisclosed amount.

Tessitura Monti India Pvt Ltd (TMIPL), is a wholly-owned subsidiary of Tessitura Monti Spa, Italy, which is globally one of the finest manufacturers of processed luxury and high-value cotton fabric, said a statement.

The deal will help the domestic firm Hi Fabrique (HF) Group, which has a “significant market share” in India’s high-value yarn-dyed shirting fabrics market.

According to industry sources, the deal is estimated to be around Rs 205 crore. International brands like Hugo Boss, Charles Tyrwhitt, Polo Ralph Lauren, Hackett, Prada, Gucci, Thomas Pink, Tailor man and Café Coton etc. are customers of TMIPL. Besides, TMIPL has a facility at Kolhapur, Maharashtra, which was mainly set up for exports, but it also supplies locally. Plastic packaging – Recycling – MEG

“The Kolhapur unit supplies 20 per cent of its production to domestic markets which, in turn, is being used by brands like Blackberry, Zodiac, Raymond’s, Louis Phillipe, Van Heusen, Nautica, Calvin Klein, Tommy Hilfiger etc,” it said. Started in 1993 by Jodhraj to cater to garment exporters in Bengaluru, HF Group is India’s largest stockist of premium cotton shirting-ready fabric.

It caters to over 500 brands like Louis Phillipe, Van Heusen, Blackberry, Park Avenue, Siyaram, Peter England, US Polo, Arrow, Basics, Pan America, Turtle, French Crown, Hamer cop, Amazon, Myntra, Lifestyle etc. Jodhraj has been appointed as Chairman of Tessitura Monti India.

He said: “With this acquisition, we will be able to leverage the strengths of both companies to create a more robust and diversified product portfolio. By combining our expertise, resources, and talent, we will be better positioned to meet the evolving needs of our customers and deliver innovative solutions that exceed their expectations.”

-Starlinger recycling technology shortlisted for Plastics Recycling Awards Europe

Starlinger recycling technology has been shortlisted for the Plastics Recycling Awards Europe 2023 for their new RecoStar PET art recycling line in the category “Product Technology Innovation of the Year”.

In technical development, Starlinger says, the focus of recycling technology has always been on achieving high production efficiency and keeping energy consumption and maintenance time as low as possible: The newly conceived PET bottle-to-bottle recycling system RecoStar PET art does not only consume 25 % less energy compared to the previous model, it also requires 46 % less maintenance time, has a 21 % smaller machine footprint, and a production output increase of 15 %. In total, bottle-to-bottle recyclers can save about 21 % in production costs with the new system, according to the company.

In addition to supplying FDA, Efsa and brand owner-approved PET recycling technology, Starlinger also offers recycling solutions for a variety of other post-consumer plastic scrap and industrial plastic waste. Plastic packaging – Recycling – MEG

The specially developed odour reduction process ensures smell-reduced regranulate from post-consumer olefins such as PP and PE which are a widely used material for e.g. milk or detergent bottles. The company’s scope of supply also includes recycling solutions for agro- and geo-textiles, nonwovens, heavily printed and hygroscopic plastic films, or waste from textile production.

-Plastic packaging firms to see softer demand

The demand for plastic packaging will likely be weaker this year, weighed down by the anticipated slowdown in the global economy.

Nevertheless, plastic packaging players will likely see some relief, as sustainable margins and easing cost pressures could help their bottom lines.

Given the muted outlook, Kenanga Research reiterated its “neutral” view on the sector.

“The demand outlook for plastic packaging sector in 2023 is not favourable in the first half of the year due to slower global economic growth and lingering supply chain disruptions affecting end-users’ operation and hence the demand of plastic packaging,” the brokerage said in a recent report. Plastic packaging – Recycling – MEG

“We foresee a moderate utilisation rate of 50%-65% across the board in the first half despite the labour shortage issue being partially resolved,” it added.

According to Kenanga Research, despite the soft patch in the first half of this year, plastic packaging players would likely maintain their margins as a result of the companies’ ongoing positioning towards higher-margin products, and the declining cost of input resin.

On the recent hike in electricity tariff, the impact would likely be manageable, as electricity only made up 4%-6% of the total production cost of plastic packaging players, it noted.“

-February meg contract price in Europe increased by EUR40 per tonne

The February contract price of monoethylene glycol (MEG) in Europe has been agreed at EUR830 per tonne, which is EUR40 per tonne higher than in January, ICIS reports.

The price was agreed on the terms of free shipping (FD) in Northwest Europe (NWE).

Negotiations between buyers and sellers were delayed due to disagreements over pricing.

The first price reconciliation for March appeared along with the full approval for February, but it has not yet been fully confirmed. Plastic packaging – Recycling – MEG

Buyers pay attention to the reduction of spot prices; meanwhile, raw material costs for February and March rose.

The contract price of ethylene in Europe for March was set at EUR1,290 per tonne, which is EUR30 per tonne more than in February. The contract price of ethylene in Europe for February increased by EUR85 per ton compared to January.

In order for agreements to be considered fully confirmed, a minimum configuration of 2 + 2 producer-consumer is required.

Earlier it was reported that MEGlobal, the world leader in the production of monoethylene glycol (MEG) and diethylene glycol (DH), nominated the March contract price of MEG for Asia at USD860 per ton, which is USD20 per ton higher than in February.

MEG, along with terephthalic acid (TPA), is one of the main raw materials for the production of polyethylene terephthalate (PET). Plastic packaging – Recycling – MEG