Recycled-prices -Flame-Retardant 02-11-2022 - Arhive

Recycled-prices -Flame-Retardant

Crude Oil Prices Trend

-New Flame-Retardant Additives and Characterization Techniques

Spain’s plastics technology center AIMPLAS is conducting research into the use of non-halogenated additives from renewable sources that won’t degrade during the production process.

The building and construction and automotive sectors, among other industries, increasingly use polymers in addition to so-called traditional materials, such as metal and metal by-products, and organic, stone and soil-based materials.

The main advantage of polymers is the combination of their low weight and various functionalities, including thermal and acoustic insulation, watertightness, and resistance, as well as the multiple sizes and finishes that are available. They also have a downside, however — flammability, which must be taken into account when establishing active and passive safety and protection systems in the event of fire in the immediate area. To address this problem, polymeric materials can be modified to make them flame retardant and, thus, considerably improve their fire performance.

This used to be accomplished by combining polymers with halogenated compounds. Most of these compounds are now prohibited, because they release toxic gases when they burn. Today, compounders and plastics processors use non-halogenated flame-retardant additives such as aluminum, phosphorus, and magnesium. The problem is that fossil-based raw materials such as phosphorus, a limited resource, are consumed to synthesize these additives. It is estimated that affordable reserves of phosphorus will be depleted in less than a hundred years.

Research is now underway to obtain flame-retardant additives from renewable sources. These additives are not halogenated and, therefore, have low toxicity, and are combined with renewable materials instead of petroleum-based products. One drawback is that these additives have poor resistance to high temperatures, which causes them to degrade during the manufacturing process.

Microencapsulation is one method to prevent degradation that is used in the food, cosmetics, and pharmaceuticals sectors to increase thermal stability and control the migration rate, if needed. The encapsulation technique also has been applied in recent years to polymer processing. Recycled-prices -Flame-Retardant

Once flame-retardant polymers have been synthesized and developed, they may be used in building and construction, as well as the mobility and transportation and electrical and electronics sectors.

-Wastefront wins grant for tire-derived oil purification project

Project to develop catalyst-based process for purifying pyrolysis oil from waste tires

Norwegian waste tire recycling company Wastefront As has been awarded a €2 million grant to develop a catalyst-based oil purification process.

The grant from Eureka Eurostars – a funding-programme for business collaborations in commercialising innovative products – was awarded to Hyfuel, a joint project between Wastefront and Swedish chemical engineering company Hulteberg.

As part of the project, the companies aim to develop a catalyst technology to purify pyrolysis oil extracted from end-of-life tires (ELTs). Recycled-prices -Flame-Retardant

The initiative will enable Wastefront to optimise some of the characteristics of tire-derived oil to make it a suitable biofuel replacement for diesel fuel.

“This marks an important step in Wastefront’s mission to improve oil quality and sustainable solutions portfolio,” the company said in a 1 Nov statement.

With the grant, Wastefront said it will accelerate the development of efficient solutions to tackle large-scale tire wastes and a scientific processes to create a ‘circular tire economy’.

Backed by energy giant Vitol, Wastefront secured planning permission in January 2022 to build the £100 million (€120 million) tire recycling plant in Sunderland, which is set to be commercially operational by 2025.

At full capacity, the plant will be able to manage 20% of the UK’s total ELTs through processing 80,000 tonnes annually.

-Weak demand pushes prices lower

Recyclers consider reducing output or shutting plants

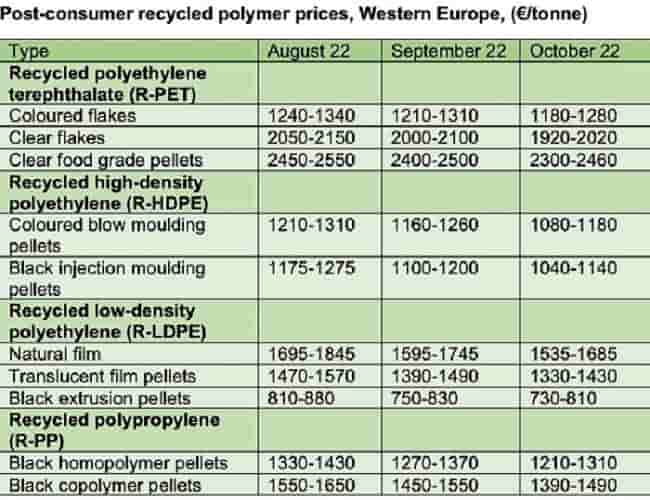

Recycled plastics prices fell across the board during September and October. The economic downturn and fear of a recession have severely weakened demand. In addition, as the cost of virgin polymers tumbled in recent months, a number of converters and brand owners elected to switch from recyclate to lower-priced virgin material for products where sustainability is not a key selling point.

In view of the weak demand and falling prices, recyclers have been unable to pass through higher energy costs onto converters. As a result, the profitability of plastics recycling has been undermined. Recyclers are responding by either taking an unprofitable line out of production or by completely shutting down recycling facilities.

The cutback in production has so far been insufficient to stabilise recycled plastics prices due to the very weak demand. Hence, material availability has been sufficient to meet overall demand over the last two months.

R-PET clear flake and clear food grade pellet prices have fallen by €120-130/tonne over the last two months. R-PET coloured flake prices, where demand has been more resilient, have only fallen by €40-50/tonne. R-LDPE film prices have fallen by €140-160/tonne since the start of September. R-HDPE prices have fallen by €130-140/tonne over the same period. R-PP copolymer prices are down by €150/tonne with R-PP homopolymer prices down by €120/tonne. R-HIPS prices have fallen by €140/tonne.

Weak end user demand and further switching by some consumer goods producers from recycled to lower-priced virgin material is likely to put further downward pressure on recycled plastics prices in November. To achieve better market balance and restore price stability, more recyclers are expected to consider either reducing production or shutting down recycling facilities altogether.Recycled-prices -Flame-Retardant

Recycled polyethylene terephthalate (R-PET)

R-PET prices have been quite resilient to the impact of declining demand in recent months but succumbed to lower sales in September. Clear R-PET pellets and clear flake prices declined by €50/tonne while coloured flake prices dropped by €30/tonne.

Demand weakened further at the start of the low season and the high price levels also deterred sales. Some converters switched to lower-priced standard PET for products that had not been advertise for their sustainability credentials.

There was ample supplies of bottle scrap to meet demand; bottle scrap prices softened by around €25/tonne.

In October, the price decline for clear R-PET pellets and clear flake materials gathered pace with price rebates of around €70-80/tonne. R-PET demand was low at the start of the off-season for the beverage industry. Coloured flake prices, where demand was more resilient, fell by only €20-30/tonne. Overall, production was sufficient to cover contracted volumes despite some production cutbacks.

Recycled low-density polyethylene (R-LDPE)

R-LDPE prices fell sharply in September on weakening demand. Film grades were discounted by €80-100/tonne while black extrusion grade pries dropped by €60-70/tonne. Recyclers largely failed in their attempt to pass through higher energy costs onto buyers. As a result, many recyclers are being forced to either trim production or shut down facilities in order to stem losses. Nevertheless, material availability remained generally adequate.

A downturn in the economy has dampened overall demand for recyclate and some brand owners have opted to switch to lower-priced off-spec standard material, where feasible.

R-LDPE prices have maintained a downward trajectory in October due to continued weak demand and competition from lower-priced virgin material. As a result, recyclers were unable to pass through higher energy costs. As profitability has been squeezed even further, a number of recyclers have either reduced production or shut down facilities altogether. Recycled-prices -Flame-Retardant

Recycled high-density polyethylene (R-HDPE)

In September, R-HDPE prices fell again as a result of weak demand and competition from virgin material. Coloured blow moulding pellet prices were down by €50/tonne and black injection moulding pellets prices fell by €80/tonne. Recyclers’ attempts to factor in higher energy costs largely failed.

Recyclers of HDPE are suffering from very low demand as a result of the economic slowdown and switching of product from recyclate to lower-priced standard material, where possible. Automotive and E&E were the worst performing end use sectors for R-HDPE products.

In October, weak demand and growing competition from falling standard HDPE prices contributed to a further fall in R-HDPE prices. Coloured blow moulding pellet prices were €80/tonne down on September with black injection moulding pellet prices down by €60/tonne.

Recycled polypropylene (R-PP)

R-PP prices fell sharply in September due to weak demand, despite rising energy costs. Black copolymer pellet prices dropped by €100/tonne while black homopolymer pellet prices were €50/tonne lower. The inability of recyclers to raise prices sufficiently to cover higher energy costs has resulted in production cutbacks and the shutdown of several recycling facilities

The economic downturn has weakened demand for recyclate while material availability remained generally sufficient to fulfil contractual obligations.

R-PP prices continued to decline during October as weak demand more than offset production cutbacks. Both black homopolymer and black copolymer prices fell by €60/tonne.Recycled-prices -Flame-Retardant

Recycled high-impact polystyrene (R-HIPS)

R-HIPS prices crashed by up to €100/tonne in September in the face of weakening demand. A sharp reduction in virgin HIPS prices is also piling competitive pressure on recyclate prices. There was sufficient material available to meet contractual obligations.

-Eastman confirms offtake agreement with PepsiCo for third US chemical recycling site

Announced as part of the Q3 earnings release, Eastman has confirmed an offtake agreement with consumer goods giant PepsiCo for its third planned polyethylene terephthalate (PET) chemical recycling facility in the US, the location of which has not been announced.

While the exact volumes of the offtake agreement were not shared, Eastman did confirm that the third methanolysis facility will have a planned input capacity of 160,000 tonnes/year of hard to recycle PET waste and a planned output capacity of over 150,000 tonnes/year. Recycled-prices -Flame-Retardant

The facility is anticipated to be online by the end of 2026.

As stated in Eastman’s Q3 prepared remarks, “This definitive agreement is an important milestone for Eastman’s circular economy platform, and we are looking forward to making progress on this and our other two molecular recycling projects in the coming quarters as we continue to prove to the world what is possible.”

Per the call, this latest agreement has given Eastman the confidence in their baseload demand to beginning the engineering work on their third facility. While the location has not been announced, tax documents filed earlier this year suggest they are considering locations in Texas.

Also reiterated during their latest earnings call, Eastman’s first facility in Kingsport, Tennessee should be mechanically completed at the end of the first quarter of 2023, with a processing capacity of 110,000 tonnes/year of hard to recycled PET waste.

-Italy’s Marchi & Fildi unveil Gleaming line of metalloplastic yarns

The Gleaming line by Italy’s Marchi & Fildi group has launched reflective yarns, Reflex, used for the production of fabrics and tapes. The yarns can reflect light and ensure good visibility for people in low-light situations. It is augmented by new colour shades in addition to the traditional greys. The Gleaming line has a range of metalloplastic yarns.

In addition to uses in fashion and furnishings, for fancy yarns, decoration and accessories, an important application for the Gleaming collection is in the sector of technical clothing with high-visibility features.

The innovative reflective yarns in white, black, and light and dark multicolours offer new possibilities for tapes, external labels and accessories; technical fabrics for work clothing with specific safety standards; uniforms, sports clothing and accessories; and hosiery, gloves, bibs and hats for night use, for winter clothing and for northern markets, the company said in a press release. Recycled-prices -Flame-Retardant

The Reflex stretch yarn finds application in flat beds or circular knitting and sewing. Its particular composition makes it softer and more versatile in comparison to traditional reflectives. The Gleaming line, composed of articles which are mostly available in stock service, represents a completion of the range of yarns produced by the Marchi & Fildi. The Gleaming yarns are available in various thicknesses, widths and types in both metallised and transparent versions, and iridescent, reflective and phosphorescent effects. The offer also includes articles with particular features of resistance to chemical and dyeing treatments. Amongst the most recent innovations is the line of metalloplastic yarns in 100 per cent polyester obtained from post-consumer recycling with GRS (Global Recycle Standard) certification.

-Saudi green hydrogen production costs could be lowest in the world: KAPSARC

Given its resources, infrastructure and land, Saudi Arabia is placed at a very competitive position in the green hydrogen industry, especially in terms of cost and volume capacity of the product, according to Rami Shabaneh, a King Abdullah Petroleum Studies and Research Center researcher. Recycled-prices -Flame-Retardant

Global prices of hydrogen range between $2 and $7 per kg. The Kingdom falls at the lower end of the cost curve due to low natural gas and renewable electricity prices locally.

“In Saudi Arabia, it is much lower because of the low-cost resources and high capacity factors the electrolyzers can achieve. A recent study by KAPSARC shows that reaching $1 per kg is plausible in the long term,” Shabaneh told Arab News.

“Other countries can achieve a similar levelized cost of hydrogen production, but only a few can produce the volumes required to meet the decarbonization targets,” he added.

The cost of green hydrogen is highly sensitive to renewable electricity costs and electrolyzer load factors.

“The renewable energy prices in the Kingdom are some of the lowest in the world. An auction price accepted at $10.4 per MWh is a world record low right now,” he said.

KAPSARC analyzes the resource, export and cost reduction potential of Saudi Arabia’s hydrogen production.

According to Shabaneh, despite significant decreases in hydrogen costs, the world still needs supporting mechanisms for hydrogen to substitute for traditional fuels in some sectors.

He further pointed out that having fossil fuels in the Kingdom’s energy system does not necessarily mean more emissions.

“You can still use fossil fuels to make blue hydrogen with high capture rates of GHG emissions,” he said.

Saudi Arabia is building a $5 billion green hydrogen project in NEOM, powered by renewable energy, to supply 650 tons of carbon-free hydrogen daily. The plant will see its first production in 2026.

The project will export hydrogen in the form of liquid ammonia to the world market for use as a biofuel that feeds transportation systems.

The plant will need around 4.3 gigawatts of clean energy to power it, as ACWA Power, one of three project owners, plans to use solar during the day and wind at night to eliminate the need for batteries and expensive storage solutions.

Many experts agree that green hydrogen, a carbon-friendly nontoxic gas produced using renewable energy, can play a significant role in achieving a green gas-neutral economy by 2050, helping to combat global warming.

Saudi Arabia is developing policies and regulatory instru- ments to drive technologies in hydrogen development to commercial readiness. Recycled-prices -Flame-Retardant

-Portuguese textiles become international player

Shaken in the last 20 years by competition from Asia, Portugal’s textile industry has found its footing again and become a major player, supplying firms not just in Europe but also in the United States.

The industry has benefited from its flexibility and inexpensive labour along with a spirit of innovation focused on limiting damage to the environment.

Near Vila Nova de Famalicao, in the northern district of Porto, the Riopele factory hums with a deafening noise of nearly 200 state-of-the art weaving machines that run 24 hours a day six days a week.

The textile industry’s advantages are “reactivity and the capacity to adapt”, engineer Jose Rosas told AFP as he stood by a digital screen where he follows the massive workshop’s activity in real time. Recycled-prices -Flame-Retardant

One of the jewels in an industry anchored in the Ave valley, the company founded in 1927 and its thousand employees are struggling to meet orders after a respite during the Covid crisis.

Every day, the factory produces 40,000 metres of fabric, 98 per cent of which is earmarked for export.

Among its growing customers are Spain’s Inditex, which owns Zara, and France’s SMCP (Sandro, Maje, Claudie Pierlot and Fursac), according to Portuguese industry figures.

There is also increased demand from firms in Germany and Italy as well as in the United States such as Tommy Hilfiger.

Customers value a “capacity to be different” from foreign competition, Riopele group director Albertina Reis told AFP, citing her firm’s ability to use “new techniques” for sustainable output without compromising on aesthetics.

Alberto Paccanelli, who heads Brussels-based Euratex, which represents the European textile and clothing industry, paid tribute to Portugal’s sector.

“Portugal has the advantage of a workforce that remains competitive” by offering “quality products at reasonable prices,” according to the president of Euratex, which held its annual conference in Porto in mid-October.

Portugal’s textile sector has made a dramatic comeback.

Shaken by competition from companies relocating to Asia for cheaper production costs, the sector lost between the years 2000 and 2015 nearly 100,000 jobs out of a total of 235,000 recorded at the start of the era, according to the Portuguese Textile Association (ATP).

Riopele is one of Portugal’s biggest textile producers but there are many others, including JF Almeida and the TMG group. Recycled-prices -Flame-Retardant

-Ineos Olefins & Polymers Europe, Plastic Energy announce MOU

Ineos Olefins & Polymers Europe and Plastic Energy are joining forces to produce 100,000 tonnes per annum of recycled raw materials from plastic waste. The two companies have entered into a Memorandum Of Understanding that outlines their intentions to construct a commercial-scale plant based on the chemical recycling technology developed by Plastic Energy. The proposed plant will be sited in Köln and represents the largest use of Plastic Energy technology on the market.Recycled-prices -Flame-Retardant

“Our position is that advanced recycling has to be done at scale in order to make the process environmentally and commercially viable,” said Rob Ingram, CEO of Ineos O&P Europe North. Production is targeted for the end of 2026.

The announcement confirms the extension of a partnership between Ineos and Plastic Energy that dates back to 2020, when the companies first undertook to explore the construction of such a plant. Since then, the companies have processed Tacoil produced by pyrolysis process developed by Plastic Energy in the Ineos cracker at Köln, Germany, using this to produce virgin-quality polymers. Selected customers and brands have already used these in their processes to demonstrate the viability and demand for materials from chemical recycling.

Ineos said it was also investing in technology to process the Tacoil further before feeding it to their steam crackers, where it will replace traditional raw materials derived from oil.

Using a mass balance approach, an independent, third-party organisation such as ISCC or RSB will certify that fossil-based feedstocks have been substituted by the new, recycled materials and ensure that recycled benefits are being accounted for correctly.

Recycled-prices -Flame-Retardant