This content has been archived. It may no longer be relevant

SINGAPORE (ICIS)–Asia’s paraxylene prices are expected to be on a stable-to-bullish trend in the near-term on firm market fundamentals and bullish trading sentiment.

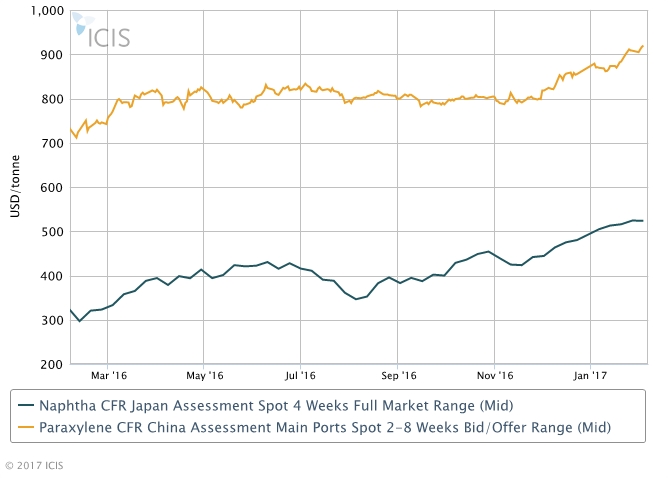

Prices are presently at a 19-month high with the start of spot trades for March and April shipments. Discussion levels have been moving up, diverging from the range-bound movement in crude oil futures at the $55-56/bbl range on Monday morning.

Bids for March-shipment PX cargoes were at $923-925/tonne CFR (cost and freight) Taiwan/China in early trade, against offers at $929/tonne CFR China/Taiwan.

For April-shipment cargoes, bids were at $931-932/tonne CFR Taiwan/China, while offers stood at $938/tonne CFR Taiwan/China.

The last time prices were at these levels was in June-July 2015, during the crude oil rout that started in the fourth quarter of 2014.Asia PX

Traders said demand from the downstream purified terephthalic acid (PTA) sector is expected to be stronger due to a seasonal pick-up in polyester demand, while supply is constrained by turnarounds and outages at refineries and plants in northeast Asia.

Consequently, traders have been bidding up prices for cargoes for March and April shipments. Buyers were continuing to cover their positions amid expectations of tighter supply, particularly, when idle PTA capacities restart in the key China market.

Chongqing Pengwei’s idled 900,000 tonne/year PTA line in southwestern China is expected to resume production this February, while Zhejiang Huabin’s 1.4m tonne/year No 4 PTA line is targeted to come back on stream sometime in the second quarter.

Most market players in China are just returning this week from their Lunar New Year holiday on 27 January to 2 February.Asia PX

PX supply is not particularly tight at this point, industry sources said, citing sufficient offers of physical cargoes in the market.

But there is more room for prices in the overall aromatics and polyester chain to continue moving up, given the current lofty benzene prices and bullish forward three-month outlook, they said.

Strong enquiries to move US-origin PX supply into China indicate a bullish market sentiment. There is an enquiry to move a 10,000-tonne PX parcel – for shipment on 15-28 February – from Pascagoula, Mississippi to China, market sources said.

A recent surge in naphtha prices have also been supporting PX values. The naphtha market, which is currently in a deep backwardation, is being buoyed up by recent refinery incidents and less arbitrage cargoes coming from Europe and the Middle East.

The naphtha-PX spread is currently at the $380-390/tonne level and is expected to remain this wide in the near term, market sources.

The PX market is trading at a contango, with prompt March-shipment prices lower than April shipments.

The onset of the summer driving season in the US and parts of Asia may support naphtha and aromatics prices further. An expected strong demand for gasoline-blending components like aromatics may pull toluene and xylenes into the blending pool, thus reducing the availability of raw material required for PX production.

The upcoming turnaround season at US refineries will also reduce the production of naphtha and aromatics, and consequently, PX.

Focus article by Paul Lim

Top photo: Photographer: GERHARD BUMANN / Action Press/REX/Shutterstock