BRIC Laggards: Brazil and Russia Beaten Down By Low Commodities And Crude Prices -Bric Brazil Russia India China Crude Oil - Arhive

Bric Brazil Russia India China Crude Oil Bric Brazil Russia India China Crude Oil Bric Brazil Russia India China Crude Oil

BRIC Laggards: Brazil and Russia Beaten Down By Low Commodities And Crude Prices

There’s a clear deviation between the economic performance of the BRIC (Brazil, Russia, India, and China) nations. While the latter two are still leaders in the pace of growth among major economies, Brazil and Russia have struggled due to the decline in commodities prices and crude oil prices, respectively.

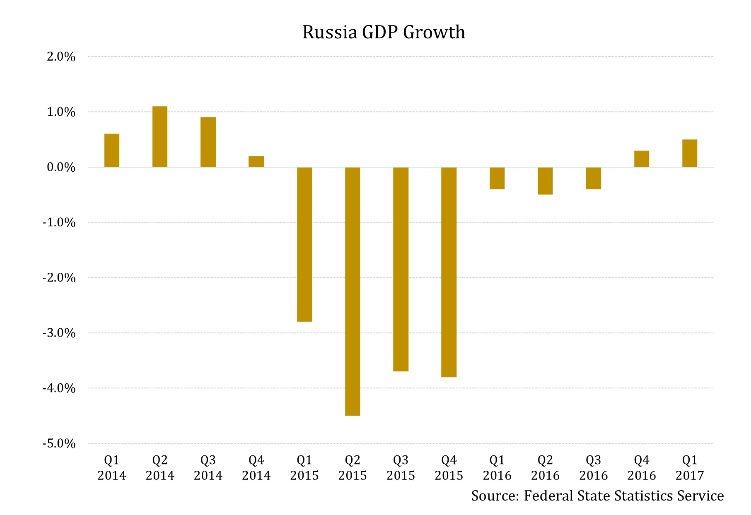

Economic growth graphs of the two nations show that Russia has shown signs of starting a growth cycle while Brazil remains in recession territory even though it is expected to turn the corner to growth in 2017.

Fortunes turn for Russian and Brazilian stocks

Brazilian and Russian equities were among the top three emerging market performers in 2016. But 2017 has been a different story.

The VanEck Vectors Russia ETF (RSX) is the largest ETF investing in stocks from the country traded on US exchanges. The fund is down 9.5% for the year so far. Meanwhile, the iShares MSCI Brazil Capped ETF (EWZ) is up by about 2%.

While the RSX has had a poor year, and at best, was up 4% towards the end of January 2017, the EWZ was having a stellar year as recently as mid-May, when the fund was up 21%. However, political developments have taken their toll on stocks.

Equity outlook for Russia and Brazil

The Bank of Russia, in its latest monetary policy report, stated that crude oil prices may decline to $25 a barrel by mid-2018. This will squeeze the revenues of energy firms in Russia, which is the largest producer of crude outside OPEC.

In a bearish scenario for the energy sector, among the three major ETFs focused on Russian equities, the RSX is better positioned than the SPDR S&P Russia ETF (RBL) and the iShares MSCI Russia Capped ETF (ERUS) due to its relatively lower exposure to stocks from the energy sector. This reflects in their comparative performance as well where the RSX has declined the least and the ERUS has decline the most.

Even though the RSX is more expensive than the other two funds, its portfolio is ready to weather a low crude price environment better than the other two funds.

On a broader level, due to the geopolitical situation, Russian equities are not attractive to many investors at this juncture even with much cheaper valuations than other emerging markets. However, if later in the year, crude oil prices appear to stabilize at a higher level than anticipated, stocks from the country may offer interesting opportunities.

As far as Brazilian equities are concerned, investors seem to be holding on. This is reflected by the performance of the EWZ even in face of economic and political turmoil. Given that Mexican equities are quite expensive, and other sizable emerging markets from Latin America are few and far between, Brazil continues to find interest.

However, another impeachment in Brazil or related political turmoil could seriously dent confidence. Coupled with the fact that countries like Peru have shown potential, investor interest in Brazil can still flow to other countries in Latin America. In the broader emerging market universe, Brazilian equities seem to offer little to be excited about at this time.

Bric Brazil Russia India China Crude Oil Bric Brazil Russia India China Crude Oil Bric Brazil Russia India China Crude Oil

Bric Brazil Russia India China Crude Oil Bric Brazil Russia India China Crude Oil Bric Brazil Russia India China Crude Oil