Pyrolysis catalysts – Indorama Ventures undergoes a restructuring of its operations 06-03-2024

PTA Market in February 2024 Faces Turmoil Amidst Weak Downstream Demand

The UK market for PTA (Purified Terephthalic Acid) had volatility in February 2024 where the month began on an upward trajectory due to increased transportation costs and ended on a stable note due to low downstream demand dynamics.

The force majeure of Alpek UK, impacting 220,000 tonnes of annual production, has caused a short-term surge in inquiries for European PTA producers as UK buyers seek alternative sources. However, this was expected to be a temporary phenomenon where prices for PTA remained unchanged during the last week of February 2024 to settle at USD 927/MT, PTA FD Southampton, UK. Pyrolysis catalysts

At Alpek’s Wilton facility (220kta), a hold period was necessary due to a PTA shortage brought on by the Red Sea delays. As per the market sources, it was revealed that Alpek had no choice but to shut down the plant for 30 days after experiencing production problems since restarting. Despite the initial supply hiccup, the bigger picture reveals a weak overall demand for PTA. Cautious buyers and slow downstream consumer demand limit the potential for sustained price increases which accounted for stability in the H2 of February 2024.

However, at the beginning of February, one factor influencing an upswing for the PTA market was the Red Sea crisis-related supply disruptions. Pyrolysis catalysts

The prolonged crisis has delayed the arrival of import shipments from the Middle East and Asia, which directly affects the availability of PTA on the European market. While the current situation has tightened spot availability, restocking remains limited due to the weak underlying demand. Even though the immediate shutdown has caused a temporary disruption, the underlying market fundamentals point towards returning to a more stable pricing environment.

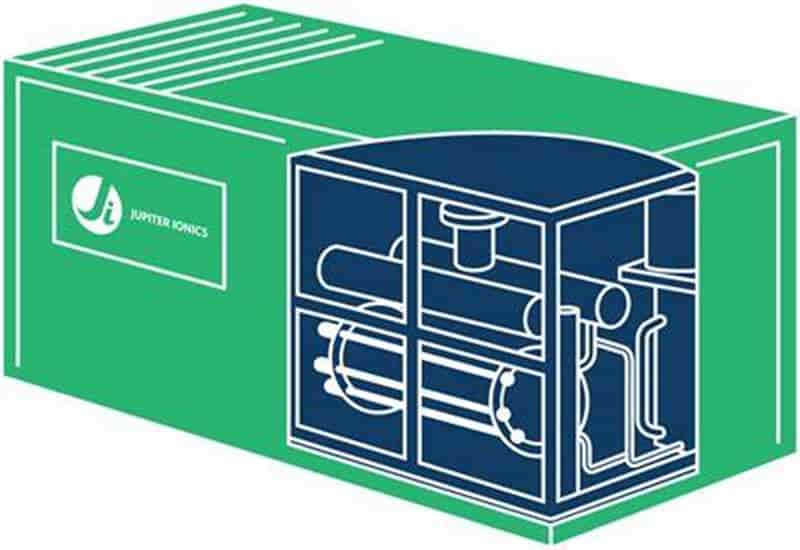

Advancement of Green Ammonia Sees Multimillion-Dollar Capital Raise

Jupiter Ionics’ recent $9 million capital raise propels their electrochemical green ammonia technology, advancing a more sustainable approach to global food production and the energy transition. Traditional ammonia production, highly carbon-intensive, faces disruption as Jupiter Ionics pioneers electrolysis for potential zero-carbon emissions.

Green Ammonia’s versatility promises a low-carbon future, serving as fuel, supporting international shipping, and storing hydrogen. The funding targets scaling up a comprehensive system utilizing water, air, and renewable energy to produce ammonia efficiently. Pyrolysis catalysts

CEO Dr. Charlie Day welcomes new investors – Wesfarmers Chemicals, Energy & Fertilisers, CIMIC Group, and Breakthrough Victoria – alongside original backers. Their support amplifies efforts toward a net-zero future by integrating technology into larger prototypes and expediting market entry.

CIMIC Group Executive Chairman Juan Santamaria emphasizes the significance of carbon-neutral ammonia for transport and renewable energy export, underlining the capital raise’s role in commercializing Jupiter Ionics’ electrochemical technology.

Alastair Hick, Monash University CCO and Jupiter Board member, highlights the urgency of scaling up green ammonia production, noting Jupiter Ionics’ global impact potential.

Grant Dooley, CEO of Breakthrough Victoria, echoes this sentiment, expressing enthusiasm for investing in sustainable ammonia production to decarbonize agricultural systems and bolster Australian sovereignty. Pyrolysis catalysts

This investment follows Jupiter Ionics’ recognition by prestigious international bodies like the Royal Society of Chemistry and the Nature Awards spinoff prize, affirming their technological prowess and global relevance.

Upcycling polyethylene into thermoplastic polyurethane

A groundbreaking plastics-recycling venture is underway in India with the inauguration of a pioneering pilot plant. Novoloop, based in Menlo Park, California, in collaboration with Aether Industries of Gujarat, India, is spearheading the development of an innovative pilot facility to upscale Novoloop’s Lifecycling technology. This technology represents a breakthrough in industrial processes as it transforms polyethylene (PE) waste into thermoplastic polyurethane (TPU) through controlled oxidation, a process diagrammed here. By oxidizing PE waste, Lifecycling yields diacid monomers that can substitute fossil-based adipic acid conventionally used in TPU production. Pyrolysis catalysts

According to Jennifer Le Roy, Novoloop’s chief technology officer, Lifecycling offers a superior alternative to pyrolysis, producing higher-value products within the petrochemical value chain rather than just oils for displacing fossil-fuel feedstocks. The scale-up initiative primarily targets various post-consumer PE waste sources, including challenging streams like heavily degraded and oxidized films, unsuitable for mechanical recycling or pyrolysis.

The versatility of the diacid monomers extends beyond TPU, finding utility in polyesters, polyamides, and other high-performance materials. By the close of 2024, Novoloop anticipates the pilot plant reaching a plastics-processing capacity of approximately 70 metric tons per year (m.t./yr). Pyrolysis catalysts

Nedim Hasanbegovic, Novoloop’s vice president of engineering, sees the integrated pilot plant as a significant stride towards commercial viability, marking a pivotal phase towards continuous, full-scale production.

Five factors to watch in US and Asian recycling

Following on the heels of Will Collins and Chloe Kinner’s plastic recycling blog (Five things to watch out for in Europe in 2024), Argus’ US and Asian plastic recycling experts outline some of the key issues to watch in their regions in the year to come.

New Jersey recycled content mandates

Extended producer responsibility (EPR) continues to be the fastest-moving legislation in the US for plastics recycling. Several states are considering new EPR schemes, although it’s been quite a few months since the latest EPR bill passed into law in Maryland. But a new law mandating recycled content in plastic packaging in New Jersey may be of particular interest for recyclers this year. Pyrolysis catalysts

New Jersey on 18 January introduced a 10pc minimum recycled content requirement for rigid plastic containers and 15pc for plastic beverage bottles, becoming the first east coast state, and the third overall after Washington and California, to have such legislation. New Jersey’s is the first mandate to extend beyond beverage containers and waste disposal bags to include rigid plastic containers.

Three of 50 states is a small percentage, although they are home to more than 15pc of the US population, and there is no sign of a nationally binding requirement to use recycled plastic at this stage. But the laws may have an impact outside of their immediate jurisdiction, with companies likely to align their regional or even national supply chains to the strictest legislation to streamline their operations. It will be interesting to see what impact the New Jersey legislation has on recyclate demand – for rPET and recycled polyolefins – during this year. Pyrolysis catalysts

Pyrolysis catalysts