Polyester-Filaments – Microbes 28-10-2022 - Arhive

Polyester-Filaments – Microbes

Crude Oil Prices Trend

Crude Oil Prices Trend Polyestertime

The joy of the plastics and rubber industry at finally being able to exchange ideas in person on a global level again after three years characterised K 2022 Düsseldorf and ensured an excellent mood among the 3,037 exhibitors. The companies reported good leads and a marked willingness to invest among trade visitors, mentioning promising new customer relations and the conclusion of numerous, in part, spontaneous business deals.

176,000 trade visitors from all continents travelled to the event in Düsseldorf. At over 70% the proportion of international guests at K 2022 remained at a constantly high level, say the organisers.

It was especially the wealth of new technology developments that raw materials producers, machine manufacturers and plastics processors presented for implementing the circular economy, resource conservation and climate protection that thrilled the trade visitors. Polyester-Filaments – Microbes

The trade visitors at this year’s K travelled from 157 nations to the Rhine. Next to Germany, those European countries strongly represented on the visitors’ part included the Netherlands, Italy, Turkey, France, Belgium, Poland and Spain. With 42% of visitors coming from overseas, the reach of K is as high as usual among the international trade audience, state Messe Düsseldorf. While visitors from the East Asian region, in particular, were less well represented than at K three years ago due to the currently more difficult conditions in those countries on account of quarantine regulations, numerous visitors from the USA, Brazil and India were welcomed at K 2022.

For around two thirds of all visitors polled machinery and plant construction ranked first in terms of interest. 57% and, hence 5% more than at K 2019, said they were interested in raw and auxiliary materials, with recyclates and bioplastics being particularly popular. For 28% semi-finished products and technical parts made of plastics and rubber were the main reason for coming (multiple responses possible). Over 70% of all visitors come from top and middle management.

Top marks were given by visitors to K 2022 for the completeness of its ranges and its mapping of the entire supply chain. 98% of all professionals stated they had fully achieved the goals associated with their visit.

During the eight trade fair days it became clear that this year’s K was right on target with its selection of hot topics, circular economy, climate protection and digitalisation. In terms of investment intentions, machinery and equipment for processing and recycling stood out at 43%. The focus was particularly on sustainability, but also on circular economy and energy/resource efficiency in production. Around 40% of decision-makers said they were looking into the topic of decarbonisation.

The K specials, which also focused on the three hot topics, were also well received. The official special show, ‘Plastics Shape the Future’, focused on the economic, social and ecological challenges and potential solutions around the K guiding topics in high-calibre discussions and lectures, and this show was well attended throughout. The Circular Economy Forum, where the VDMA and 13 of its member companies demonstrated the importance of technology in the implementation of the circular economy in the plastics industry, scored points with the international audience with live demonstrations and a great deal of well-founded knowledge as well as detailed information on the topic.

At this year’s K in Düsseldorf, there was also a lot of discussion about the global production language, OPC UA. This standard allows the processing parameters of the machinery and equipment involved to be coordinated more precisely and in a more targeted manner. This, in turn, is considered an important prerequisite for optimised circular management. 40 companies from eight countries participated in an OPC UA demonstration project at the trade fair. Polyester-Filaments – Microbes

-Vietnam’s trade may be hit as US, EU forecast to see recession: MoIT

Vietnam’s ministry of industry and trade (MoIT) expects import and export activities to face challenges during the last few months this year that will continue into the next. As several major economies like the United States and the European Union (EU) are projected to go into recession, Vietnam’s trade may get affected, according to Nguyen Cam Trang, deputy director of MoIT’s import-export department.

High inflation in export markets has reduced the demand for consumer goods like textiles, footwear and furniture. Polyester-Filaments – Microbes

BIDV Securities Joint Stock Company (BSC) offers two scenarios based on the possibility of a US recession. In the first, if the United States sees a recession this year, Vietnam could raise exports by 13.1 per cent and imports by 12.6 per cent.

In the second, if the United States faces a recession in 2023, Vietnam could increase exports by 18 per cent and imports by 17.3 per cent.

Experts at Rong Viet Securities (VDSC) forecast that industrial production and export growth will slow down in the fourth quarter in Vietnam, but the level of decline will be moderate, according to a report in a Vietnamese media outlet.

China maintaining strict measures to prevent and control the COVID-19 pandemic also affects export activities and the supply of raw materials, Trang said.

However, bilateral and multilateral free trade agreements may help the country limit export-related risks.

In the first nine months this year, the country’s export value increased by 17.2 per cent to $282 billion. As a result, the nation gained a trade surplus of over $6.8 billion.

However, in September, export growth slowed and the growth rate decreased by 14 per cent compared to the previous month, mainly in electronics, computers and phones.

-Teijin launches facility for producing Functional Polyester Filaments

Teijin Frontier Co., Ltd.the T Teijin Group’s fibers and products converting company, announced that its core base for polyester fiber manufacturing, Teijin Polyester (Thailand) Limited (TPL), launched a cutting-edge automated facility for the highly efficient production of polyester filaments. Operation began this month.

The new facility is equipped with multi-spindle spinning machines for polyester multifilament yarn and machines capable of adding functional agents. Teijin Frontier invested approximately JPY one billion to construct the facility, which is expected to produce 1,500 tons of polyester filaments annually by the fiscal year ending in March 2024.

The facility will enhance the added value of TPL including through extra-efficient spinning and an automated process for the uniform drying of multifilament. TPL will effectively use the new facility to produce Teijin Frontier’s proprietary polyester filaments for apparel and interior applications, such as the OctaTM highly modified hollow-core fiber and a water-absorbing quick-drying yarn

Teijin Frontier expects to expand the range and improve the functionality of its ECOPET® recycled polyester fibers by integrating the new facility with a separate facility that started operating at TPL in January to convert used plastic bottle flakes sourced in the Thai market into recycled polyester chips.

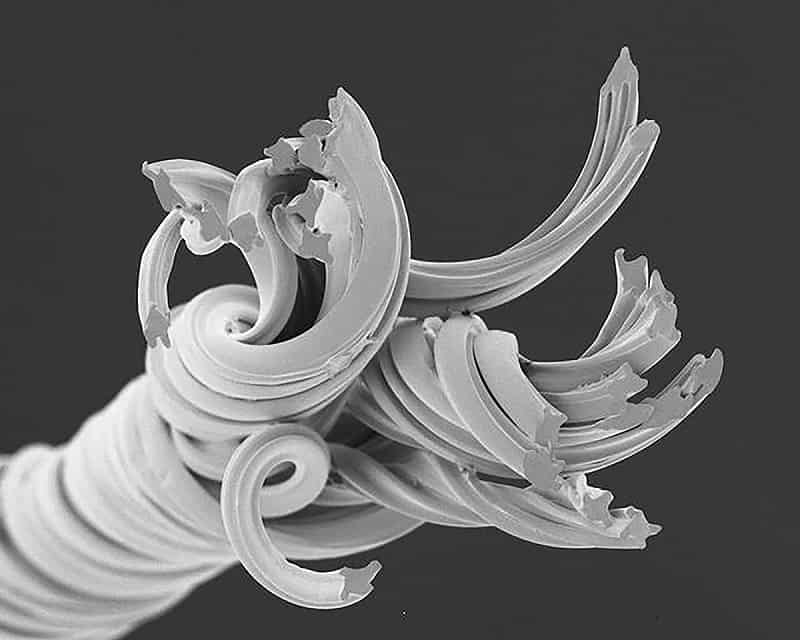

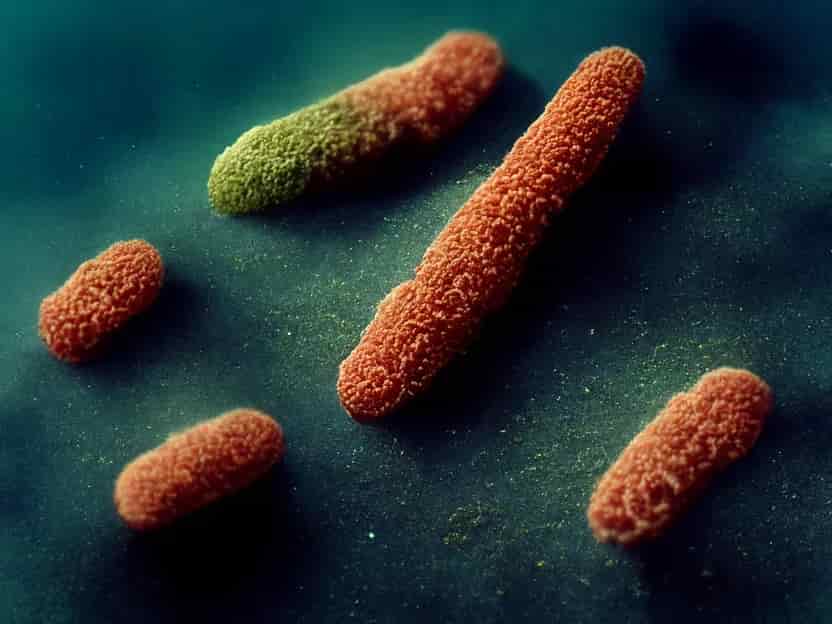

-Bringing custom microbes to the business of recycling plastic

Two-step chemical and biological process approach turns mixed plastic waste into valuable new materials

Scientists working on a solution for plastic waste have developed a two-step chemical and biological process to break down and upcycle mixed plastics into valuable bioproducts.

The project, which involves multiple institutions, draws on synthetic biology expertise at the Department of Energy’s Oak Ridge National Laboratory to engineer a microbe that converts deconstructed plastic waste into building blocks for next-generation materials.

The new process, described in the journal Science, would replace a system that now requires painstaking, costly sorting of materials, which has resulted in only about 5% of plastics being recycled in the United States. Polyester-Filaments – Microbes

The project is led by the National Renewable Energy Laboratory and also brings together scientists from the Massachusetts Institute of Technology, the University of Wisconsin-Madison and ORNL under the Bio-Optimized Technologies to keep Thermoplastics out of Landfills and the Environment, or BOTTLE, Consortium.

Different plastics contain different polymers, each with unique chemical building blocks. The BOTTLE researchers developed a process to convert mixed plastics to a single chemical product, working toward a solution that would allow recyclers to skip sorting.

The first step in the process relies on oxygen and catalysts to break down large polymer molecules into their smaller chemical building blocks. The process was applied to a mixture of three common plastics: polystyrene, or PS, used in disposable coffee cups; polyethylene terephthalate, or PET, used in single-use beverage bottles, polyester clothing and carpets; and high-density polyethylene, or HDPE, used in many common consumer plastics and often associated with milk jugs.

“This is a potential entry point into processing plastics that cannot be recycled at all today,” said Gregg Beckham, a senior research fellow at NREL and head of BOTTLE.

The oxidation process breaks down these plastics into a complex mixture of chemical compounds — including benzoic acid, terephthalic acid and dicarboxylic acids — that would require advanced and costly separations to yield pure products. That is where biology comes into play.

BOTTLE colleagues engineered a soil microbe, Pseudomonas putida, to biologically convert or “funnel” the mixture of small-molecule intermediates to single products: either polyhydroxyalkanoates, or PHAs, which are an emerging form of biodegradable bioplastics; or beta-ketoadipate, which can be used to make new performance-advantaged nylon materials.

The experiment built on a process developed by ORNL’s Adam Guss and colleagues at NREL to engineer the bacterium with desired traits from other organisms. The process, outlined in the journal Metabolic Engineering, converted deconstructed PET into building blocks for a superior nylon product that is more water- and heat-resistant — ideal for applications such as automotive parts. Polyester-Filaments – Microbes

“We took a combinatorial approach to pathway assembly, basically finding the best combination of genes from different organisms that allowed us to get robust utilization of PET in Pseudomonas putida,” Guss said. “ORNL specializes in modifying nonmodel microbes to add traits useful for biotechnology, tapping our deep expertise in synthetic biology as well as transcriptomics and proteomics to discover new metabolic pathways.”

“Biological funneling simply means we’ve engineered the metabolic network of a microbe to direct the carbon from a large number of substrates to a single product,” said NREL’s Allison Werner, a co-author on the Science paper. “To do this, we take DNA from nature — usually other microbes — and paste it into Pseudomonas putida’s genome. The DNA is transcribed into RNA, which in turn is translated into proteins that perform diverse biochemical transformations, forming a new metabolic network and ultimately enabling us to capture more carbon and to tune where it goes.”

Guss and colleagues have spent years perfecting P. putida to convert the plant biopolymer lignin, derived from bioenergy crops, into advanced bioproducts as part of DOE’s Center for Bioenergy Innovation and Agile BioFoundry. In 2020, Guss led a team that announced it had engineered the microbe to simultaneously digest five of the most abundant compounds of lignocellulosic biomass.

In the next steps for BOTTLE, “we’re continuing to expand the range of molecules that P. putida can eat as we work to break down more types of plastics and also more real-world plastics that have additional additives,” Guss said.

“Plastics are major environmental pollutants and are largely made using fossil carbon,” he said. Polyester-Filaments – Microbes

-Sipa sees PET challenging glass in wine market

In Italy, where wine is king, glass’ reign as a material of packaging choice since the dawn of alcoholic drinks could be threatened by PET.

With many technical hurdles overcome, PET is starting to become the new norm for wine packaging in Europe and elsewhere, according to Venice, Italy-based blow molding specialist Sipa SpA. At its K 2022 booth, the company showed off a large bottle of spumante, with the sparkling wine packaged in a warmer, curved PET container then the harder, colder glass bottle typically seen.

“It’s transparent and there’s no breakage,” said Sipa Area Sales Manager Yasar Yildiz of the bottle he held, called La Spumante. “PET has designs on glass and is making progress. Now we’re looking at other applications where we can expand into PET, and the next steps in the process.” Polyester-Filaments – Microbes

The company was at K 2022 touting its newest innovation, a four-station injection stretch blow molding machine with a rotational servo motor that can cut energy consumption as much as 500 kilograms by weight. The lower energy consumption on new blow molding equipment has also meant a dramatic reduction in costs than for glass in an age where energy prices are high and supply levels are perilously low, especially in Europe.

Sipa is highly invested in PET, managing all aspects of the bottle-making processes from injection molded preforms to blow molded bottles to mold making, of which the company is one of the largest global producers. Among its developments at K 2022 was a mold changing station that dropped the time to change a mold to 2.5 hours, Yildiz said.

The lower usage of energy in PET vs. glass has brought inroads in the use of PET for many applications, added Marco Brusadin, Sipa packaging development manager. Glass in particular has a difficult time: A great deal more energy is expended to produce a glass bottle than does a blow molded PET alternative. Transport of lighter-weight PET bottles also is much less costly in fuel usage than that of glass bottles, he added.

With energy prices high and supply low, there is also an economic incentive to consider PET, Brusadin said.

“These days, it’s all about carbon footprint,” Brusadin said. “Glass is much heavier and its LCA [life cycle assessment] is much higher than plastics. Customers want to keep costs as low as possible.”

All of which are making European wine producers and retailers take note of PET as a potential alternative to glass. PET wine bottle are growing in popularity in Italy and are also making inroads in Germany and France, among other locations, Brusadin said. The biggest surprise was that the first request that Sipa received for the development of a PET wine bottle came from Sweden, he said.

The trend line of PET replacement started in Europe with packaged jars, especially for jams and tomato sauce, he added. It is making incursions into the market for vinegar and olive oil, areas that the U.S. market is also seeing. And perfume fragrances also are migrating to PET, even though glass may convey more elegance and sophistication.

Iconic brand Louis Vuitton has launched perfume in plastic bottles, Brusadin said. A key draw is the advent of e-commerce and the sending of perfume by those means. “It’s not the eco-friendly system that is drawing cosmetics but e-commerce,” he said. “It is the weight of the box and the possibility of broken glass that is a problem in transport.”

To that end, Sipa is developing injection stretch blow molding machines with higher clamping force that can make bottles with sharp corners necessitated by many cosmetics producers, Yildiz said. Newer machines are producing bottles as small at 7.5 grams, he said. Polyester-Filaments – Microbes

The company is developing new solutions that also meet customer demands for recycling content in PET bottles.

-Nearly 17% of recycling is wasted due to contamination

New research by waste management company Biffa reveals that nearly one fifth (17%) of England and Wales’ waste (from both businesses and households) cannot be recycled due to contamination.

The experts analysed the latest available WRAP waste collection data between 2016 and 2020 to determine the contamination rate, based on the amount of non-target and non-recyclable materials that entered UK material recycling facilities (MRFs).

After a recent WRAP survey revealed that over four in five people recycle items they shouldn’t, Biffa’s examination of the waste itself shows the amount of ‘wishcycling’ (assuming an item is recycled) that happens.

Biffa’s analysis found that, in 2016, the average contamination rate of recycling waste was 13.4%, rising over four years to 17% by the end of 2020—more than 3% in as many years. Polyester-Filaments – Microbes

The data also showed that non-recyclable materials played a bigger part in contaminating recycling. In 2020, non-target materials (recyclable items that have been placed in the wrong bin) accounted for 6.5% of contaminated waste.

-EU ban on Russian plastics exacerbates food inflation

Inflation has become the most pressing issue for millions of households across the European Union, with food at the forefront. The recent EU ban on imports of Russian-made polymers – the key material in plastic food packaging – has created additional costs for companies and consumers – reports London Globe.

Inflation in the EU hit a record high of 10.9% in September, with prices for food, alcohol and tobacco rising even higher. Consumers can now buy fewer products on existing incomes and are forced to save by reducing consumption or waiting for government aid.

Food inflation is largely the result of two factors: rising prices for fuel, which is used in production and transportation, and rising prices for plastic used to make food packaging. Together, fuel and packaging constitute a large share of costs for certain food items, especially in the price of imported goods such as fruits and vegetables, which are often transported from afar and require reliable packaging to preserve their consumer properties and shelf life. Polyester-Filaments – Microbes

Russia’s armed conflict in Ukraine led fuel prices to spike, pushing up food prices around the world. But the EU’s response has made matters worse for its consumers. In addition to adopting a partial embargo on Russian oil imports, which pushed fuel prices higher, the EU from July banned imports of Russian polypropylene and other polymer products – the compounds from which most plastic packaging is made – and imposed further import restrictions this fall.

Prior to sanctions, Russia accounted for as much as 42% of European market imports forpolypropylene and its co-polymers, according to Gazprombank estimates. This includes biaxially oriented polypropylene (BOPP), a stretchable film widely used in packaging. Last year, Russia shipped about 334,000 tonnes of polypropylene and 222,000 tonnes of polyethylene to the EU. The bulk of this was supplied not by Kremlin-backed oil and gas firms, but by the non-state petrochemical company Sibur.

For the past 15 years, Sibur was headed by the Western-trained business executive Dmitry Konov, who stepped down in March 2022 after himself coming under sanctions. During his leadership, Sibur built state-of the-art production facilities for advanced and environmentally friendly polymers, becoming a large polymer producer and exporter on the global scale. Polyester-Filaments – Microbes

Sibur has been a reliable supplier of high-quality polymers to Europe, thanks to its efficient production model and access to raw materials. The EU ban has cut off a major source of polymer imports from Russian producers, making production in Europe more expensive. Moody’s Investor Services has argued that, as a result, packaging producers will pass higher costs onto their customers in food and other industries.

Packaging producers in Europe have also been hurting for some time. Prices for polyethylene and polypropylene have doubled since 2020, fueled by the energy crisis and supply chain disruptions during the Covid pandemic. Although prices have recently retreated from peak values, they remain extremely high, and the situation looks set to get worse. The European Plastics Converters (EuPC), a group representing about 50,000 companies that process plastic, said the industry is facing unprecedented challenges due to a sharp price increase and a shortage of raw materials for packaging.

-Demand restrained by worries over economy

Polymer prices report October 2022

The European standard thermoplastics market in October has seen a mixed picture in terms of price trends. For polyolefins, the picture is one of either rollover to small price increases. For polystyrene, PVC and PET, prices have continued to fall.

L/LDPE producers initially targeted price increases of up to €150/tonne, despite a €45/tonne reduction in ethylene costs. Weak demand and competitively-priced imports however meant that L/LDPE prices traded between a rollover and a small increase. HDPE prices gained up to €50/tonne as producers were able to factor in higher energy costs.

Polypropylene prices also increased following five consecutive months of price reductions. PP prices rose by €20/tonne despite a €50/tonne drop in the propylene reference price.

Polystyrene prices continued to fall even though the styrene monomer reference price increased by €9/tonne in October. Producers took account of lower energy costs and weak demand. PVC prices fell as a result of low demand and a growing inflow of cheaper imports. Bottle-grade PET contract prices also fell sharply in October as a result of aggressive import prices, lower costs and weak demand.

Weak demand

Polymer demand remained well below normal levels across all product classes in October. Converters are concerned about the deteriorating economic situation and worries about a possible recession. Polyester-Filaments – Microbes

European converters are also increasingly looking to meet more of their needs with cheaper imported material. Import prices are more competitive as a result of falling freight rates out of Asia, which are now at their lowest since 2020. There were however some signs that buyers are tentatively building stocks in anticipation of a stronger price upturn soon.

Packaging and pharmaceuticals demand is holding up fairly well, but demand from other sectors such as construction, consumer goods and furniture, is declining.

Supply low

European producers have trimmed production and brought forward plant maintenance programmes in response to the low demand. There is however sufficient material available to meet the needs of converters. Supply has also been supported by a steady inflow of imported material. The high price levels in Europe and lower freight rates are tempting sellers to divert more of their cargo to Europe.

A summary of the latest production issues is presented below:

The 350,000tonnes/year LDPE plant in Ruwais, Abu Dhabi run by Borouge is expected to resume operations by end 2022

Indorama Ventures declared force majeure on production of PTA and PET in Rotterdam, the Netherlands on 18th October

TotalEnergies has declared force majeure for PP throughout Europe after encountering “technical problems” at its two large Belgian polypropylene plants in Feluy

Trinseo is revisiting plans to shutter its 300,000tonnes/year loss-making styrene monomer plant in Böhlen, Germany

Borealis restarted propylene production on 1st October at its Belgium cracker

The LyondellBasell cracker in Berre, France, offline since a fire in August 2022, and will not go back onstream until early 2023

On 27th September, workers at eight refinery and petrochemical sites in France belonging to TotalEnergies began a three-day strike, aiming for a complete blockade of the group’s refineries and fuel depots

Major maintenance work on the OMV cracker in Burghausen, Germany is almost complete, and the plant is being gradually restarted.

November outlook

Polyolefin prices may follow a stable to firmer trend in November provided current market fundamentals hold. PVC, PET and styrenics markets, however, may well follow a stable to softer trend as price levels remain at historically high levels despite recent price decreases.

L/LDPE

At the beginning of October, European L/LDPE markets reversed direction following five consecutive months of strong price reductions. Despite a drop of €45/tonne in the ethylene contract price, producers originally called for prices to increase by €150/tonne, including a portion to cover the higher cost of energy. Buyers strongly resisted calls for such large price hikes and deals were generally settled between a rollover to a small price rise. Polyester-Filaments – Microbes

L/LDPE demand remains well below normal, although a small upturn after the holiday period was noted. Converters are concerned about the deteriorating economic situation and worries about a possible recession.

European producers have trimmed production in response to the low demand and material availability has also been impacted by strikes in France. A lively inflow of imports has however made up for the drop in local supply.

HDPE

At the beginning of October, European HDPE markets reversed direction following five consecutive months of strong price reductions. Despite a drop of €45/tonne in the ethylene contract price, producers originally called for prices to increase by €100/tonne, including a portion to cover the higher cost of energy. HDPE sellers pushed through a sizeable proportion of the planned cost rise with prices rising by €50/tonne.

HDPE availability is slightly tighter compared to L/LDPE following production cutbacks and the impact of strikes in France. There is however sufficient material available to meet the needs of converters.

Converters are concerned about the deteriorating economic situation and worries about a possible recession. Hence, HDPE demand remains below normal, although a small upturn was noted as converters started to slowly build up stocks in expectation of an imminent price upturn.

PP

European PP producers initially tabled planned price hikes of €50-100/tonne, including an energy surcharge, despite a €50/tonne lower propylene settlement. This follows five straight months of hefty drops. The initial hike requests were trimmed as underlying demand remained weak and energy surcharges could not be fully reflected on transactions. Settlements varied widely; from a rollover to price increases of up to €50/tonne.

PP demand remains at a low level, although it has been noted that some players are tentatively building up stock levels in anticipation of a price upturn soon.

PP producers have trimmed production run rates by 20-30% in recent months in an effort to achieve better market balance. Material availability has also been disrupted by strikes and planned and unplanned plant shutdowns. Supply has however been supported by a steady inflow of imported material.

PVC

PVC producers mostly began October prepared to accept slight price decreases in view of the subdued demand, competitive import costs and a fall in ethylene costs. Accordingly, base PVC prices fell by €25-30/tonne to hit a new year-low. Producers were reluctant to issue larger drops due to the high production costs in Europe when compared to the rest of the world.

Producers have reduced run rates in order to achieve a better demand-supply balance. Local supply gaps are more than adequately filled by competitively-priced imports from the USA and India. High European prices are tempting sellers to divert more of their cargoes to Europe. Polyester-Filaments – Microbes

Purchasing activity has slowed further in October across all end-use markets, with the exception of pharmaceuticals. Stock levels at converters are comfortable amid growing uncertainty about economic prospects going forward.

PS

Polystyrene prices dropped again in October despite a €9/tonne rise in the styrene monomer reference price. Producers took into consideration a reduction in energy costs and low demand. General-purpose polystyrene (GPPS) prices fell by €50/tonne with high-impact polystyrene (HIPS) prices down by €40/tonne. Further price discounts are expected later in the month.

PS supply is more than adequate to meet the subdued levels of demand despite production cutbacks and the declaration of force majeure by a major producer at a site in France.

Demand has fallen due to growing concerns about an economic downturn and inflation. While packaging demand has held up fairly well, purchasing activity from other end-use sectors such as consumer goods and furniture is declining. A downturn in the construction sector has also adversely affected demand for GPPS and expanded polystyrene (XPS).

PET

PET prices have fallen for the third consecutive month after reversing direction in August. PET contract prices were down by €80/tonne in October as a result of aggressive import prices, lower costs and weak demand. Polyester-Filaments – Microbes

European PET producers have been under growing pressure from aggressive import offers, mainly from Vietnam, India, South Korea and China. Import prices are more competitive as a result of falling freight rates out of Asia, which are now at their lowest since 2020. While PET demand for local product remains low. European converters are increasingly meeting more of their needs with cheaper Asia material.

PET producers, who are stuck between higher costs and weaker consumption, have lowered run rates or conducted maintenance shutdowns. However, this did little to support overall sentiment and prices are more likely to extend losses into November.

Polyester-Filaments – Microbes