Polymer Nanocomposites Automotive carpet PLA bioplastics Recycling Technology Nonwoven HDPE 23-12-2021 - Arhive

Polymer Nanocomposites Automotive carpet PLA bioplastics Recycling Technology Nonwoven HDPE

-Investigating the Advancement of Nanoclay Polymer Nanocomposites

A recent study published in the journal Polymers focuses on the preparation, properties, and industrial applications of polymer nanomaterials reinforced with nanoclay.

As a result of their remarkable qualities and their ever-increasing use in a wide range of applications, nanoclay-reinforced polymers have achieved significant global interest in both industrial and academic research in recent years.

What are Polymer Nanocomposites?

Polymer nanocomposites are an important class of inorganic-organic nanomaterials that have inorganic nanoparticles dispersed throughout the substrate of organic polymers. The interfaces between the fillers and the polymer matrices in nanocomposites are considerably larger than in traditional composite materials made of micrometer-sized additives, and thus these nanocomposites have far better material characteristics.

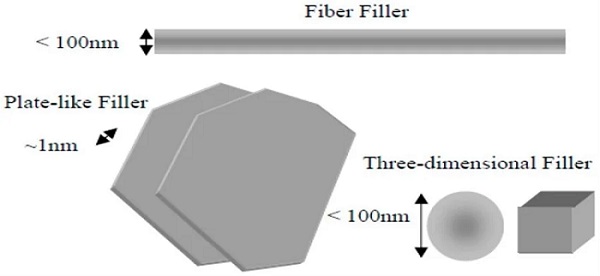

Although nanoparticles come in a range of forms and configurations, they may be classified into three broad categories. Nanoparticles in one dimension (1D), such as nanoclay and graphene, are stacked particulates with a diameter of 1 nm and a span of hundreds or even thousands of nanometers. Two-dimensional (2D) nanomaterials include carbon nanowires and nanotubes, which have a diameter of at least 100 nm and an area ratio of less than 100. Three-dimensional (3D) nanoparticles, such as hemispheric silicon, nano aluminum, and nano titanium oxide, are agglomerated nanoparticles having a maximum size of less than 100 nm.

Although many nanocomposites, including carbon nanotubes (CNTs) and graphene, have been examined for use as fillers, the most commonly used materials are clay-reinforced nanoparticles. This is because these nanoclay particles are abundant in nature and are extremely cost-effective.

Polymer Nanocomposites Automotive carpet PLA bioplastics Recycling Technology Nonwoven HDPE

Structure of Nanoclay

Nanoclay is composed of silica nanoparticles that include trace amounts of metal oxides such as rare metals, alkaline metals, limestone, metallic oxides, and organic materials. Clay components are classified into two categories depending on the arrangement of the overlapping sheets of silica and aluminum oxide units: (i) 2:1 clay (smectite and vermiculite); and (ii) 1:1 clay (kaolinite).

Smectite silicates have a high surface area owing to their distinctive deposition activity, which makes them especially valuable and effective as fiber reinforcements for polymeric nanocomposites.

-Boosting sustainable PLA bioplastics production

Sulzer Chemtech is delivering customised state-of-the-art production technology to NatureWorks’ latest biopolymer manufacturing facility, which will be located in Nakhon Sawan Biocomplex, Thailand.

Developed to support the increasing global demand for polylactic acid (PLA) bioplastics, the fully integrated plant will utilise Sulzer Chemtech’s advanced lactide purification and polymer production technology to produce 75 000 tpy of Ingeo polylactic acid (PLA) annually.

Polymer Nanocomposites Automotive carpet PLA bioplastics Recycling Technology Nonwoven HDPE

Selected to design and supply lactide purification, polymerisation and devolatilisation units at NatureWorks’ newest facility, Sulzer Chemtech will provide technology, engineering services and key equipment to design and supply fully customised production solutions meeting NatureWorks’ specific requirements.

The use of Sulzer Chemtech’s crystallization technology will deliver high-purity lactides suitable for Ingeo PLA grades, while the polymerisation and post-reaction train will convert lactide into the full portfolio of Ingeo grades. Extensive support during the project execution phases will also be provided to help NatureWorks begin its operations quickly and smoothly.

As part of the company’s global manufacturing expansion plan, the new facility will increase NatureWorks’ overall production capacity of lactic acid, lactides and advanced Ingeo PLA biopolymers. Made from renewable resources, these biomaterials have a lower carbon footprint than average petroleum-based plastics and support a wide range of applications, including compostable food packaging and serviceware, fibres, filaments for 3D printing, hygiene masks and household appliances. Polymer Nanocomposites Automotive carpet PLA bioplastics Recycling Technology Nonwoven HDPE

Steve Bray, Vice President of Operations and Project Program Manager at NatureWorks, said: “Sulzer Chemtech’s specialists have a proven track record delivering highly effective PLA units, and we are looking forward to this cooperation between two market leaders in PLA technology. Leveraging their expertise in process technologies for lactide and PLA products, NatureWorks will design and construct a state-of-the-art production facility that will increase the global availability of functional, high quality Ingeo biopolymers.”

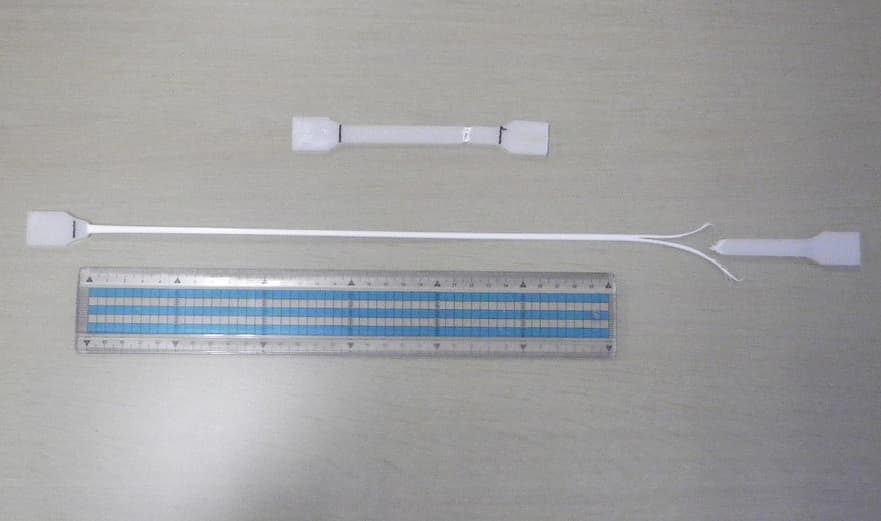

Green Science Alliance has received license agreement from Fukuoka University to carry out the revolutionary plastic waste recycling technology which can recover the mechanical strength especially in the toughness of plastic waste relatively simple and effectively.

Nowadays, plastic waste is causing serious environmental problems such as microplastic and nanoplastic pollutions. It is an urgent matter to do something about this issue. Plastic recycling is one of the technologies to decrease plastic pollution. Waste plastic recycling technology can be classified to 3 types; thermal recycling, material recycling, and chemical recycling. Thermal recycling is utilizing plastic waste as fuel by virtually burning them which is not considered as an ideal solution. Chemical recycling seems good; however, it is not a perfect circular system and its high cost is the main problem.

Professor Shigeru Yao from Fukuoka University, Japan has been researching plastic waste (especially now on PE and PP scraps, he may also research on other plastics in the future) from the polymer physics aspect of view. He has clarified that the deterioration of mechanical strength of plastic waste is not due to chemical break down of polymer main chain; however, it is caused by inner crystal structural changes within plastic.

Furthermore, he has elucidated that the mechanical strength especially toughness, can be recovered by optimizing the re-pelletizing process. In addition, he has theoretically and experimentally elucidated first time in the world that the mechanical strength of plastic waste can be regenerated as strong as new plastic pellet under certain processing conditions. He has also developed a new type of extruder which can reproduce this revolutionary plastic recycling technology with low cost but high efficiency. Polymer Nanocomposites Automotive carpet PLA bioplastics Recycling Technology Nonwoven HDPE

Freudenberg Performance Materials announces today a general upward adjustment of its prices for nonwoven performance materials for flooring and filtration applications in EMEA. This revision, effective January 1, 2022, has become necessary because of sustained and unprecedented surge in cost for raw materials, packaging, freight, consumables and energy combined with disruptions in our inbound supply chain.

Prices across all categories have by far outpaced our expectations and are forecasted to remain on high levels throughout 2022. This historic price trend has placed significant pressure on Freudenberg Performance Materials, and we understand in a similar way on our customers.

At this stage our business can no longer absorb the effects of such high price levels. We will therefore adjust our prices for all our Colback® and Lutradur branded nonwoven products for flooring and filtration application by double-digit increases depending on product types.

Freudenberg Performance Materials will continue to work hard on improving productivity to offset inflationary pressure to keep attractive price levels and to avoid further price adjustments. We will continue to monitor the market development and in case of sustained and unexpected downward trends we will adjust our prices accordingly. Polymer Nanocomposites Automotive carpet PLA bioplastics Recycling Technology Nonwoven HDPE

-Hyundai Chemical to start up new HDPE plant by end 2021

Hyundai Oilbank has announced that the company’s joint venture with Lotte Chemical Petrochemical is set to start up its high density polyethylene (HDPE) plant in Daesan, South Korea by the end of 2021, according to CommoPlast.

Thus, the plant, which will be able to produce 850,000 tons/year of HDPE at its two lines, will be operated by Hyundai Chemical.

The companies’ joint petrochemical project in Daesan that costs 2.7 trillion Korean Won (USD2.5 billion) also consists of a cracker with the capacity of 900,000 tons/year of ethylene and a polypropylene (PP) plant with the capacity of 500,000 tons/year.

As MRC reported earlier, Hyundai Chemical started to market cargoes from the new PP plant in Daesan in mid-November, 2021.

According to MRC’s ScanPlast report, October estimated HDPE consumption in Russia dropped to 107,120 tonnes from 124,600 tonnes a month earlier. Domestic producers reduced their output due to scheduled turnarounds, whereas exports increased. Overall HDPE shipments to the Russian market totalled 1,166,460 tonnes in the first ten months of 2021, up by 22% year on year. Production increased by 7%, whereas exports fell by 19%.

-Increasing demand from the automotive carpet application to drive the demand for industrial fabric

The global industrial fabric market size is expected to grow from USD 108.3 billion in 2020 to USD 162.9 billion by 2025, at a CAGR of 8.5% during the forecast period. Industrial fabric is extensively being used in the manufacturing of protective apparel for the chemical, sports, medical, and other end-use industries. The increasing demand for automotive vehicles supports the demand for industrial fabric in automotive carpet applications.

The automotive industry is the largest application industry in the industrial fabric market in terms of volume. Industrial fabric made using polyester, polyamide, aramid, and other fibers possess superior strength, outstanding durability, ultraviolet (UV) stability, and good permeability. These properties make it suitable for use in applications such as carpet backing, interior fabrics, roofing, airbags, belts, hoses, seat cover fabrics, door trims, door panels, window frames, and headliners in the automotive industry. Moreover, the stain resistance property and longer service life of industrial fabric make it the ideal choice for various applications in the automotive industry. Polymer Nanocomposites Automotive carpet PLA bioplastics Recycling Technology Nonwoven HDPE

To know about the assumptions considered for the study download the pdf brochure

Polyeaster fiber-baes industrial fabric comprise a major share of the industrial fabric market

The polyester resin-based industrial fabric s accounted for a larger share in the industrial fabric market. Polyester resins are less expensive and possess properties such as good corrosion resistance, fast curing, durability, tolerance to temperature, and low thermal expansion. The automotive industry is one of the major consumers of polyester industrial fabric as this fabric offers good UV and abrasion resistance, good tearing strength, and ease of cleaning. Toray, W. Barnet GmbH & Co. KG, and Johns Manville are some of the prominent polyester industrial fabric manufacturers.

The COVID-19 has resulted in reduced demand for vehicles in 2020. This has led to a temporary shutdown of various automobile manufacturing plants of Nissan, Volkswagen, and Ford. These factors are expected to reduce the demand for industrial fabric in automotive applications. Post-pandemic, the demand for polyester industrial fabric is expected to recover as industrial activities across the globe are expected to start, which will increase the consumption of polyester fabric.

APAC accounts for the biggest share of the global industrial fabric market. The Protective Apparel and automotive carpet application holds are major consumers in the region. The region is home to some of the major composite manufacturers such as ACP Composites and Owens Corning. Moreover, the China is a manufacturing hub of various commercial, military, private aircraft and one of the major automobile manuafacturer. Europe is the second major consumer of industrial fabric s. Marine, wind energy, and transportation are the major industries fueling the growth of the industrial fabric market in this region.

However, the COVID-19 outbreak has affected the demand for industrial fabric s in the region. On the positive side, support packages offered by governments of various countries will help to maintain the liquidity in industrial fabric market. Such initiatives coupled with recovery in the application industries will increase the demand for industrial fabric in North America.

The key players in the industrial fabric market include Forbo International SA (Switzerland), Ahlstrom-Munksjo (Finland), Habasit AG (Switzerland), Toray Industries Inc. (Japan), and ContiTech AG (Germany) are a few of the key players in the industrial fabric market. Cerex Advanced Fabrics, Inc. (France), W. Barnet GmbH & Co. Kg (US), Dupont (US), Johns Manville (India), Fitesa S.A. (Brazil), and G.R. Henderson Co. Textiles Ltd. (UK), and among others. These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the composites market. These players have taken different organic and inorganic developmental strategies over the past five years.

Polymer Nanocomposites Automotive carpet PLA bioplastics Recycling Technology Nonwoven HDPE