Post-consumer packaging – The demand for recyclable packaging is on the rise globally, particularly in developed nations 29-03-2024

Post-consumer packaging

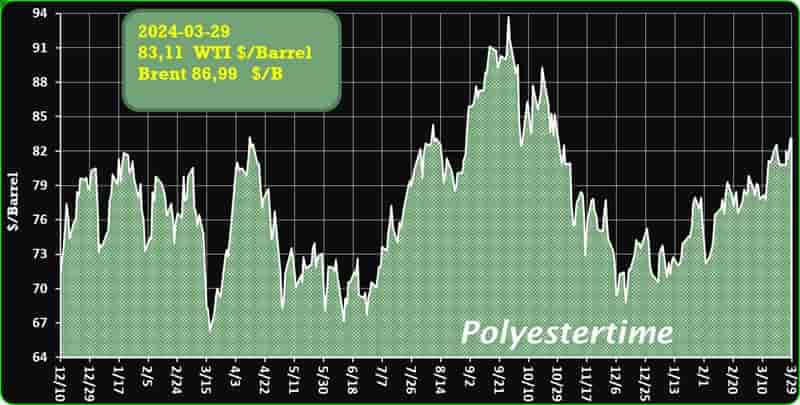

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

Graham Packaging reports recycling progress

Global plastics packaging producer, which runs its own recycling facility, also advocates for national clarity on recyclability messaging.

Lancaster, Pennsylvania-based Graham Packaging, within its 2023 environmental, social and governance (ESG) report, says the mechanical recycling plant it operates in York, Pennsylvania, reprocessed some 17,850 tons of high-density polyethylene (HDPE) plastic scrap last year.

“Our mechanical recycling facility is one of the largest plastic recycling plants in the United States,” the company says in its recently released report. Post-consumer packaging

The York-based Graham Recycling Co. (GRC) is focused on recycling No. 2 HDPE bottles into postconsumer resin (PCR) in an effort that has helped Graham to become a “leading supplier of bottle-grade recycled plastic containers in North America.”

“The GRC plays a critical role in our mission to create a circular economy by providing access to large volumes of recycled content for packaging production,” the company says. “It also represents Graham’s commitment to leadership in environmental responsibility—saving energy and natural resources while significantly reducing greenhouse gas emissions by diverting hundreds of millions of pounds of plastic from landfills.” Post-consumer packaging

At Techtextil Frankfurt, slated for late April 2024, Kelheim Fibres and Gebrüder Otto will jointly unveil a more sustainable and efficient concept for period underwear

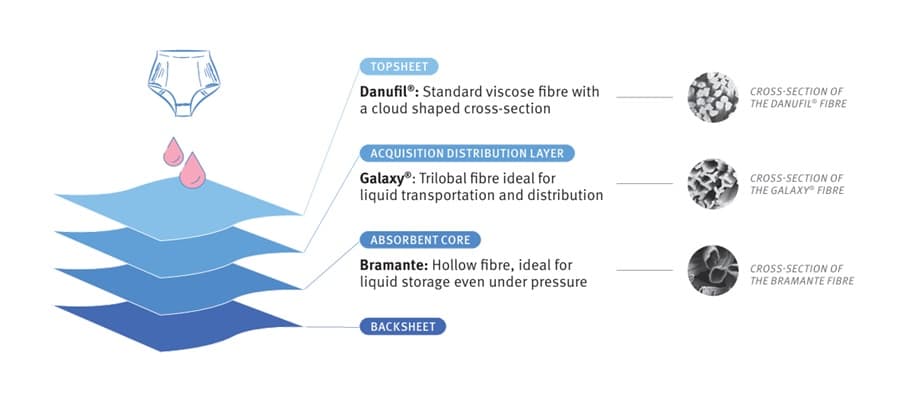

Positioned at the BW-i and IVGT joint stands in Hall 12.1, these innovation partners will showcase their solution crafted from biobased materials, featuring exceptional performance metrics. The specialized viscose fibers, provided by Kelheim, are skillfully spun by Gebrüder Otto into tailored compositions.

Women typically consume around 15,000 hygiene products in a lifetime, predominantly disposables notorious for generating substantial waste. These products, laden with plastic, endure decomposition times of up to 500 years, fragmenting into increasingly smaller pieces over time. The shift towards sustainable female hygiene products, spanning biodegradable disposables and reusable alternatives like washable period panties, has gained momentum. Post-consumer packaging

Kelheim Fibres and Gebrüder Otto intervene in this space, endeavoring to optimize the comfort, performance, and sustainability of period underwear. Crafting such garments resembles piecing together a complex puzzle, considering their multifaceted layers with distinct functions. For instance, the topsheet must swiftly absorb and redirect liquid away from the body, while the acquisition-distribution layer (ADL) ensures efficient liquid distribution within the absorbent core, which subsequently encloses the liquid to prevent potential leaks. This concerted effort aims to enhance both the sustainability and functionality of reusable products, aligning with evolving consumer preferences and ecological imperatives. Post-consumer packaging

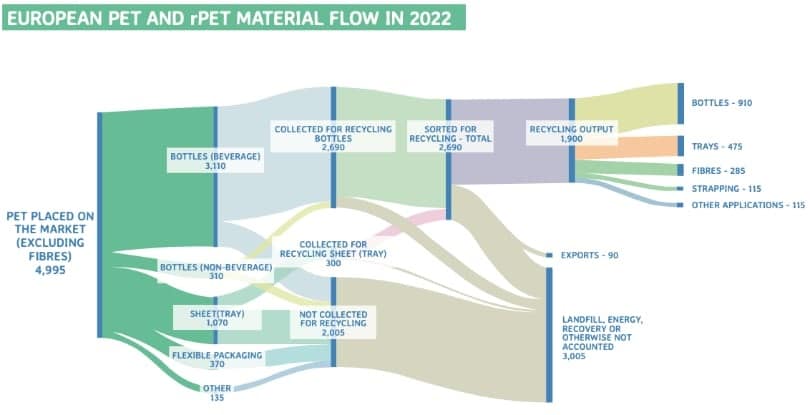

PET, production and recycling in Europe

An extensive report on packaging applications in Europe has been released jointly by ICIS and four supply chain associations, referencing data from 2022

ICIS, in collaboration with Plastics Recyclers Europe, Petcore Europe, Unesda, and NMWE, delved into the European PET market, covering production, transformation, recovery, recycling, and reuse of recycled materials, all within the scope of 2022. The study encompasses the 27 EU Member States along with Norway, Switzerland, and the United Kingdom.

Analysts report that in 2022, approximately 5 million tonnes of PET were introduced to the packaging market, with 3.1 million tonnes utilized for beverage bottles, and 2.69 million tonnes collected for recycling (30% via DRS systems), yielding roughly 1.9 million tonnes of rPET. Post-consumer packaging

Collection rates for PET packaging from consumption sources reached 60%, a significant increase from 40% in 2020. For bottles alone, the recycling collection rate surged to 75% from 61% two years prior.

The average recycled content in PET beverage bottles across the EU stands at 24%, falling short of the 2025 target, while for trays it reaches 44%. PET recycling capacities, estimated at 3 million tonnes, exceed short-term demand triggered by the SUP Directive, which is approximately 800,000 tonnes annually. To meet the new Packaging Regulation’s target of 65% recycled content by 2040, an additional 3.5 million tonnes of recycling capacity will be necessary. Post-consumer packaging

However, despite positive strides, the study highlights regional differences in collection rates and recycled content, emphasizing the importance of enhancing waste sorting and collection infrastructure to achieve long-term self-sufficiency in PET recycling.

Italy : Corepla and RES have joined forces in a partnership aimed at advancing the recycling of PET trays, focusing on post-consumer packaging recovery

The collaboration targets enhancing collection and recycling methods to notably elevate plastic packaging recovery rates.

RES will contribute its research center in Pozzilli (IS), featuring state-of-the-art equipment for characterizing polymeric materials and facilities for compounding and molding processes. This partnership signifies more than a mere agreement for Giovanni Bellomi, Corepla’s Director, who envisions it as a catalyst for addressing environmental challenges and promoting global waste management reform. By embracing a multifaceted approach to research and innovation, they aspire to bolster the circular economy’s principles, minimizing waste and maximizing material recycling while prioritizing environmental and social sustainability. Post-consumer packaging

Antonio Lucio Valerio, RES’s CEO, underscores their commitment to sustainable waste management practices, emphasizing their comprehensive approach from waste selection to transformation. Through investments in advanced technologies, RES aims to valorize waste materials, converting them into valuable resources. Their dedication to sustainability and innovation positions them to effectively turn waste into assets, contributing to a more environmentally conscious future.

SIBUR is shifting its business management approach from product-oriented divisions to an industry-centric model starting April 2024

This transformation aims to bolster sectors like polypropylene, polyethylene, and synthetic rubber. Departing from its current structure, the company will introduce industry-based segments including Agribusiness, Recycling, Flexible Packaging, Rigid Packaging, Engineering and Transportation Infrastructure, Healthcare, Oil & Gas Processing and Production, Consumer Goods, Construction, Transportation, E-commerce, and Partnerships. Post-consumer packaging

Since 2014, SIBUR has consistently expanded its capacity, with core product output more than doubling. In 2023 alone, it introduced 27 new petrochemical grades with an annual sales potential of 111,000 tons. The ongoing augmentation of the Amur Gas Chemical Complex and the forthcoming launch of the polypropylene production facility (DGP-2) in Tobolsk will further elevate Russia’s polymer consumption. These initiatives are expected to advance import substitution programs for products crafted from contemporary synthetic materials.

SIBUR envisions nurturing every petrochemical-consuming industry comprehensively, catering to escalating demands, and advocating for the utilization of cutting-edge materials. Post-consumer packaging

Businesses in Russia see no problem with banning some types of PET bottles

Russian businesses are largely unperturbed by the Industry and Trade Ministry’s suggestion to prohibit certain varieties of polyethylene terephthalate (PET) plastic bottles. However, there is apprehension that this initiative might expand to target other PET packaging types, according to the food industry association Rusprodsoyuz.

Dmitry Vostrikov, executive director of Rusprodsoyuz, stated that the proposed ban isn’t causing significant concern among businesses as it’s unlikely to disrupt food production processes, given the infrequent use of the targeted packaging materials. The Ministry’s draft resolution aims to ban specific PET packaging types deemed non-recyclable or difficult to recycle from September 1, 2024. Post-consumer packaging

The resolution, available on regulation.gov.ru, proposes banning semitransparent PET bottles of all colors except blue, green, and brown, as well as nontransparent PET bottles except white ones. Additionally, PET packaging with wrap-around PVC labels and multilayer PET bottles would be prohibited.

However, Vostrikov expressed discontent with the approach to imposing bans, warning of potential negative repercussions for the sector. He emphasized the need to enhance packaging material recycling technology rather than pursuing a ban-centric strategy.

Rusprodsoyuz, comprising over 450 stakeholders in Russia’s food industry, including farmers, processors, distributors, and technology suppliers, underscores the industry’s diverse concerns and perspectives. Post-consumer packaging

The demand for recyclable packaging is on the rise globally, particularly in developed nations

In response, US beverage manufacturers are increasingly transitioning from traditional PET bottles to recycled PET (rPET) bottles to reduce carbon emissions and promote a circular economy, reports GlobalData.

Consumer Analyst Mani Bhushan Shukla notes the US’s commitment to a circular economy, with targets set by the Environmental Protection Agency to achieve a 50% national recycling rate by 2030. Shifting to rPET packaging is seen as the most feasible way for consumer goods companies to meet sustainability goals. Post-consumer packaging

To meet these targets, beverage manufacturers are actively adopting rPET bottles. Major players like Coca-Cola, Pepsi, and Asahi have already introduced 100% rPET bottles for their popular brands, with Califia Farms joining in March 2024.

Shukla emphasizes the role of consumer interest in driving this shift, citing GlobalData’s consumer survey where 62% of US consumers considered recyclable packaging claims important in their purchasing decisions.

Looking ahead, Shukla predicts that companies will face increasing pressure from various stakeholders, including the government and environmentally conscious consumers, to further adopt rPET packaging. This adaptation will be crucial for long-term consumer attraction and retention. Post-consumer packaging

Post-consumer packaging