Recycled POM Chemical Recycling Turkey Economy Green Hydrogen Bioplastics rPET Production Carbon fibres 09-12-2021 - Arhive

Recycled POM Chemical Recycling Turkey Economy Green Hydrogen Bioplastics rPET Production Carbon fibres

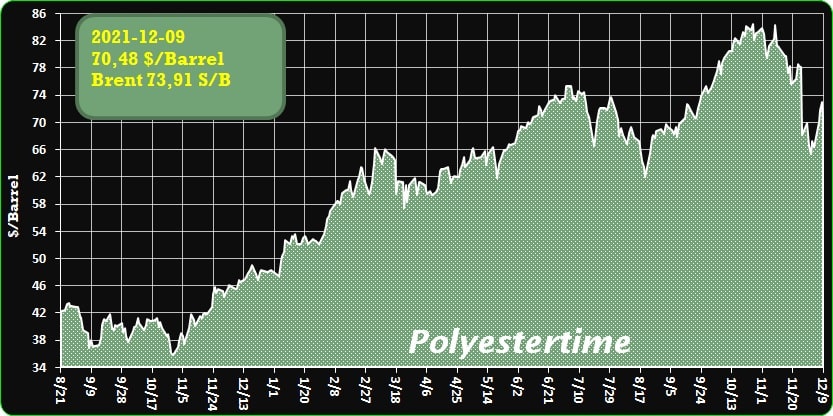

Crude Oil Prices Trend

-Carbon fibres sector chasing new highs

In a world striving to switch to cleaner energy and cut the weight of transport, demands are growing that the materials needed to create this future should, ultimately, be recycled. Will tech companies and recyclers respond in time?

Whether you are talking about the design of a new car, the latest aircraft, yacht or luxury apartment – they all have one thing in common: carbon fibre. Its use can decrease the weight of a Boeing Dreamliner by up to 20% and reduce fuel costs by at least 5% through aerodynamic advantages so it is unsurprising that it is a popular material for manufacturers.

Annual worldwide production of the composite is expected to reach almost 150 000 tonnes in the next few years, according to Frazer Barnes, chairman and chief technical officer of Gen 2 Carbon (formerly ELG Carbon Fibre). Two decades ago, output was barely 20 000 tonnes. Through partnerships with major brands, Gen 2 Carbon saves hundreds of tonnes of the material from becoming waste every year. ‘Our pyrolysis recycling method allows the carbon fibre to retain 90% of its tensile strength,’ Barnes asserts.

The entrepreneur has helped develop a closed-loop recycling scheme for carbon fibre waste streams from end-of-life aircraft. ‘Every tonne of carbon fibre from an aircraft that is transformed into new material saves around 20 tonnes of global warming potential CO2 equivalent with only 10% of the energy required to produce virgin carbon fibre.’

Up and up

Around 65 000 tonnes of unused end-of-life and carbon fibre production waste stacks up every year despite the high demand for the composite material, estimates researcher Sankar Karuppannan Gopalraj at LUT University in Finland. The value of the booming carbon fibres sector has reached a new peak of EUR 3.2 billion (US$ 3.8 billion) and that figure is expected to double within the next ten years.

Meanwhile, the global recycled carbon fibres industry was worth EUR 92 million in 2020, further building on strong momentum this year, according to market analysts. It’s expected the figure will surpass EUR 175 million by 2026, which represents a compound annual growth rate of 11.3%.

-Can green hydrogen compete on cost?

Cost reductions for low-carbon hydrogen are critical to enable a swift energy transition

The hydrogen boom is well underway, but not all hydrogen is created equal. A spectrum of hydrogen colours are in play – but the real gamechanger will come when low-carbon green hydrogen costs become competitive in major markets.

We explored the economics of green, grey, brown and blue hydrogen in Hydrogen costs 2021: getting ready to scale. Fill in the form for a complimentary extract and read on for an introduction.

Green hydrogen has some catching up to do – but the project pipeline is gathering pace

Green hydrogen – hydrogen created from the electrolysis of water using renewable energy – has a tiny share of the global energy market today. It is currently still largely uncompetitive against fossil-fuelled alternatives. However, the momentum behind net zero ambitions means that investors are betting on its long-term potential.

As a result, the hydrogen project pipeline has grown seven-fold since December 2020. We’re tracking more than 560 low-carbon projects in our database with a minimum of 180 GW total electrolyser capacity designation. Most projects are still at early development stage, with the bulk of new projects advanced through Q2 this year.

Hydrogen manufacturing companies are scaling up

Until 2019, global estimated electrolyser manufacturing capacity was just 200 MW. By the midway point of 2021 that had jumped to 6.3 GW of announced capacity, with 1.3 GW added in Q1 alone.

Now, as we reach the end of Q4, electrolyser manufacturers are dramatically expanding plans for gigawatt scale factories. In recent weeks, Ohmium, Clean Power Hydrogen, Green Hydrogen Systems, Sunfire and FFI have all announced large-scale factories, joining Cummins, Haldor Topsoe, ITM, Nel, McPhy, Siemens, Thyssenkrupp and Plug Power.

Recycled POM Chemical Recycling Turkey Economy Green Hydrogen Bioplastics rPET Production Carbon fibres

-Global bioplastics production will more than triple within the next five years

European Bioplastics presented today at the 16th EUBP Conference a very positive outlook for the global bioplastics industry. Production is set to more than triple over the next five years according to market data which was compiled in cooperation with the nova-Institute (Hürth, Germany).

“The importance of a more than 200 percent growth rate within the next five years cannot be overstated. Before 2026, the share of bioplastics in the total global production of plastics will pass the two percent mark for the first time. Our formular of success is a strong belief in the abilities of our industry, the aspiration for continuous innovation, and the courage to make the necessary financial investments”, explains François de Bie, Chairman of European Bioplastics.

The global bioplastics production capacity is set to increase significantly from around 2.4 million tonnes in 2021 to 7.5 million tonnes in 2026. Biodegradable PBAT (polybutylene adipate terephthalate), the production of which will almost quadruple, but also PBS (polybutylene succinate) and bio-based PAs (polyamides) are the main drivers of this impressive growth. The production of polylactic acid (PLA) will also continue to grow due to further investments in PLA production sites in Asia, the US, and in Europe. Production capacities of bio-based polyolefins, such as PE (polyethylene) and PP (polypropylene), increased as well.

Biodegradable plastics, including PBAT, PLA, and polybutylene succinate (PBS) currently account for slightly over 64 percent (1.5 million tonnes) of the global bioplastics production capacities. Bio-based, non-biodegradable plastics, including the drop-in solutions bio-based PE and bio-based PET (polyethylene terephthalate), as well as bio-based PA (polyamides), make up for almost 36 percent (0.8 million tonnes).

Packaging remains the largest field of application for bioplastics with almost 48 percent (1.2 million tonnes) of the total bioplastics market in 2021. The data also confirms that bioplastics materials are already being used in many other sectors, and the portfolio of application continues to diversify. Segments, such as consumer goods, fibre or agriculture and horticulture products, continue to increase moderately in their relative share.

Recycled POM Chemical Recycling Turkey Economy Green Hydrogen Bioplastics rPET Production Carbon fibres

-Firm on Chemical Recycling of Polyurethane Foam

Covestro and Eco-mobilier, a French eco-organisation and non-profit have extended producer responsibility (EPR) schemer for the collection and recycling of used furniture, aspire to generate enhanced value aiming at mattresses and upholsteries. Both parties want to further develop waste markets for foam used in such applications, to enable its use in chemical recycling processes with high efficiency at an industrial level. Furthermore, the parties underline their commitment through an agreement, which sets out a common understanding of strategic goals, projects and activities, forming the basis for a long-term cooperation between them.

Year after year, large quantities of used furniture are generated worldwide that have to be disposed off. Covestro and Eco-mobilier want to keep it out of landfill and minimise incineration, thus reduce its environmental impact and give it a new life. For this purpose, they want to combine their expertise and jointly develop a new solution and a business model for the chemical recycling of polyurethane foam from post-consumer mattresses and upholsteries.

Eco-mobilier has extensive experience in the collection, logistics and processing of used furniture, such as mattresses and upholsteries. This mainly concerns the dismantling of used furniture and pre-sorting materials in order to obtain pure foam parts as raw materials for recycling.

Recycled POM Chemical Recycling Turkey Economy Green Hydrogen Bioplastics rPET Production Carbon fibres

-Turkey’s economy expected to grow by 5% in 2022: Vice president Oktay

Turkey’s economy is expected to grow by 5 per cent in 2022, according to vice president Fuat Oktay, who told lawmakers on the first day of the 2022 budget debate that despite developments in the exchange rate and the overall level of prices at the global and domestic levels, the government is committed to stabilising the exchange rate and fighting inflation.

He asserted that the country will never compromise on the financial transparency that forms ‘the main backbone of accountability’.

“Our commitment to fiscal discipline continues in the same way today as it was before. Thus, public finance will continue to be the strongest anchor of the Turkish economy,” he was quoted as saying by a Turkish media report.

Budget expenditures have been projected at 1.750 trillion liras ($135.4 billion) and budget revenues at 1.472 billion liras ($113.9 million). The budget deficit for next year has been projected at 278 billion liras (nearly $21 billion).

The budget for 2022 will be the 20th of the AK Party government, which has been in power for nearly two decades.

Recent jumps in inflation and losses in the value of the Turkish currency, the lira, have led opposition parties to attack the government’s economic policy, including interest rate cuts.

Recycled POM Chemical Recycling Turkey Economy Green Hydrogen Bioplastics rPET Production Carbon fibres

-The journey to renewable, 100% recyclable and 100% circular

Stora Enso has long been a pioneer in sustainable packaging – we believe that everything made of plastic today can be made of a tree tomorrow. Now, we’re kicking off a new and even more concrete era with the introduction of our renewed sustainability ambitions for 2030 and 2050. For those of us in Innovation and R&D, that means working toward a packaging solution portfolio that’s renewable, 100% recyclable by 2030 and 100% circular by 2050.

At Stora Enso, we’re already using over 800,000 tons of recycled fiber a year, which goes mainly into container board used to make things like packaging for online shopping, so secondary packaging that doesn’t come into contact with the end product directly. Food packaging, however, is more demanding. We’re already working hard to innovate totally recyclable and ultimately circular food packaging solutions, based on both recycled and fresh fibers.

Towards even more efficient fiber use

Reaching the goal of a Stora Enso renewable packaging materials portfolio that’s 100% recyclable and ultimately 100% circular won’t always be easy, but it’s definitely achievable. We’re committed to continuing to reduce the non-fiber elements in our solutions to the absolute minimum and rethink how applications are designed. One of our key focus areas is barriers.

Barrier layers are important because they protect the food inside the package. They also allow us to create fiber-based packaging to uses that would otherwise have non-renewable materials like plastic since fibers alone are not fit for all requirements. Think about it – packaging ready-made soup in a paper box with no barrier just wouldn’t work. However, most of the barriers we use today are fossil-based and not very easy to recycle. And when there’s strong bonding between the paper and plastic layers, it’s essentially impossible for consumers to separate these layers by themselves. The Innovation and R&D team is very actively working on innovating barriers that are fully fiber-based or that have as little non-fiber content as possible. In addition, we’re innovating with partners across the value chain to improve the recycling infrastructure, making it easier for them to separate and handle the plastic in our barriers.

Recycled POM Chemical Recycling Turkey Economy Green Hydrogen Bioplastics rPET Production Carbon fibres

-Looking for rPET Success? Start Here

When considering rPET content for packaging, close attention to processing variables can help ensure commercial success.

With an increasing number of companies using or considering recycled PET (rPET) as part of the package composition, it’s important to understand the properties that are most likely to impact your molding processes and bottle qualities.

The first point to understand about rPET is that it remains PET. Even though it might have some altered aesthetics such as changes in color or clarity, rPET still retains the main, desirable physical properties of PET including tensile strength, barrier, impact resistance, thermal properties, and more.

And while the bulk of the properties are retained, the specifications are wider in recycled materials. For example, color shows the most variation, but there is also a wider specification in the solution viscosity that will affect how the material behaves during injection and blowmolding.

Most manufacturing facilities are used to dealing with slight variation when processing PET. However, with rPET, the variations/material specifications are broader. Therefore, the package may need to be designed to accommodate a wider processing window.

When we’re considering rPET content for a packaging application, it should be qualified like any other resin change. That typically means looking for changes in how the material processes in injection and blowing, and dimensional or performance changes in the resulting parts.

Be wary of those wider spec ranges.

Wider material specifications must be accounted for when qualifying rPET. This could be variation between different suppliers, for example, food-grade rPET resin from supplier A will be different from supplier B or from lot to lot. This will require additional effort during the qualification process; for example, larger sample sizes than are typically used for virgin resin will help to capture the true variation in appearance or performance due to the wider material specifications. The goal is to make sure the material’s impact on the container is properly understood during qualification.

Similar expectations will hold for incoming material inspection. The containers that are collected for recycling vary over time and with location, so wider specifications should be expected for the resin that is created from them. Monitoring of the material to ensure adherence to acceptable values is more important as rPET percentages increase.

Recycled POM Chemical Recycling Turkey Economy Green Hydrogen Bioplastics rPET Production Carbon fibres

-Celanese, Mitsubishi Chemical Collaborate on Recycled POM

Recycled content acetal option adds to Celanese offering of bio-based POM.

Celanese Corp. and Mitsubishi Chemical Advanced Materials (MCAM), a global manufacturer of high-performance thermoplastic materials in the form of semi-finished products and finished parts, have announced a joint collaboration to further develop mechanical recycling solutions for both post-industrial and post-consumer sources of polyacetal (POM) copolymer. The aim is to meet requests from customers seeking recycled content options and carbon dioxide reductions while maintaining product consistency, quality, and performance.

Celanese and MCAM plan to work together to assess options to convert waste streams into marketable, end-product formulations so that Celanese can offer its customers sustainable options for scrap or end-of-life waste with assurances of closed-loop material reuse.

In November 2020, Celanese introduced a sustainable polyacetal product offering known as POM ECO-B, a mass-balance, bio-based option that allows customers to realize a reduction in carbon dioxide emissions in their end-use products and advance toward renewable content goals. While POM ECO-B is commercially available now, not all customers or industries are ready to adopt bio-mass balance that comes with its carbon dioxide footprint reduction benefit.

The joint announcement with MCAM builds upon Celanese’s sustainable product offerings by initiating development of a recycled content option of the Celanese Hostaform/Celcon POM product that will be marketed as POM ECO-R. MCAM will conduct recycled feedstock collection, separation, and processing, while Celanese will provide the formulation, product technology, and production capability. Celanese expects to offer its POM ECO-R solution with up to 30% recycled content.

“Celanese is a leading, global producer of acetal copolymer, and our industrial-scale manufacturing capabilities for POM are ideally suited for helping customers in a range of industries — such as medical, automotive and consumer goods — to meet their strategic environmental goals,” said Tom Kelly, Celanese Senior Vice President, Engineered Materials. “Offering both bio-based POM content, which can be uniquely produced from waste products via bio-methane or from CO2 emissions, and recycled POM through a collaboration with MCAM, elevates the broad usability of POM as an ideal engineered material that can help our customers achieve their sustainability goals.”

Recycled POM Chemical Recycling Turkey Economy Green Hydrogen Bioplastics rPET Production Carbon fibres

Recycled POM Chemical Recycling Turkey Economy Green Hydrogen Bioplastics rPET Production Carbon fibres