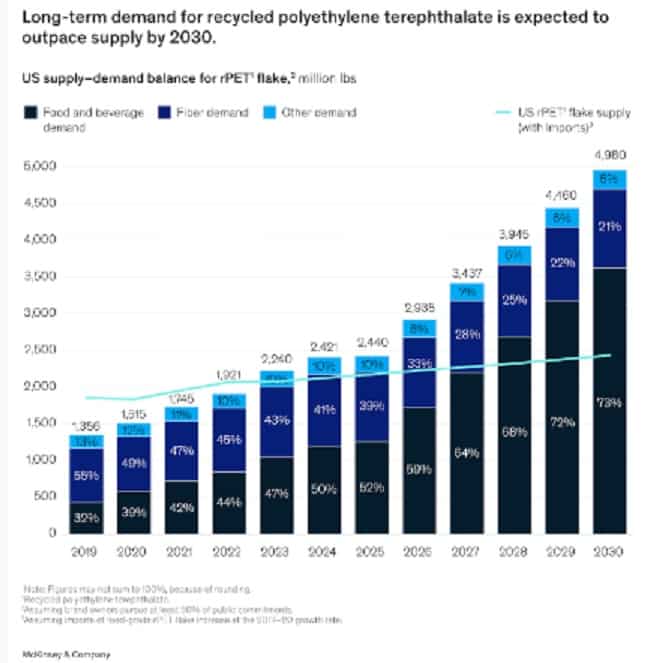

According to a study by McKinsey, high long-term demand for recycled content in packaging could lead to shortages of recycled packaging materials in the US. Brand owners that are aiming to introduce new packaging formats and establish innovative ways to boost product recyclability and levels of recycled content to meet their sustainable-packaging commitments, address consumer concerns, and adapt to rapidly rising regulatory pressure could face the very real risk that they cannot achieve their goals because of an anticipated shortage of recycled materials: collection levels of high-quality recycled material look set to remain almost flat, creating supply challenges for brand owners and packaging companies, says the study. Graphene plastic recycling

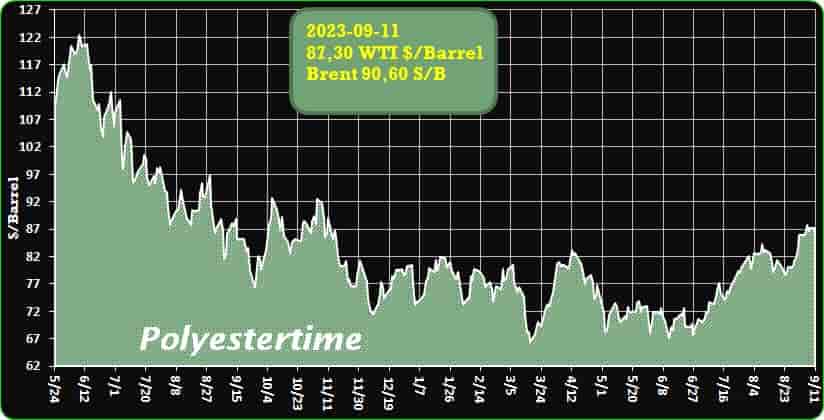

If brands with public recycled-content commitments follow through on their plans, the US demand for rPET in 2030 would outpace supply by about three times. As the supply-and-demand imbalance widens, the price premium between rPET and virgin PET has the potential to rise significantly over the next decade. The challenge for the industry moving forward will be to unlock additional rPET supply, the experts say and suggest three potential approaches, centered on boosting supply, ensuring access, and designing for circularity, that could also be applicable to other packaging substrates.

The experts have evaluated that today only about 27 per cent of PET bottles and about 18 per cent of all recyclable PET plastic waste is collected, the rest ends up in landfills. In recent years, the collection and sorting of PET has not improved significantly. As a result, rPET supply in North America grew only about 1 per cent per year in 2012-22. While there have been some new entrants in the recovery and reprocessing value chain, process losses have not been significantly reduced. This means that about 4.6 billion pounds of PET ends up in landfills every year.

Rapidly growing demand combined with stagnant supply could lead to a supply-demand imbalance for rPET in the future, the study outlines. Historically, rPET supply has only grown by about 1 per cent per year over 2012-22, while consumption has grown by about 4 per cent per year over the same period. If brands fully deliver on their recycled content commitments by 2030, demand for rPET is expected to grow by about 15 per cent per year between 2022 and 2030, the study says. Over the same period, supply is expected to continue to grow by only about 1 per cent, so that by 2030 demand will be three times higher than available supply. Graphene plastic recycling

In the future, ESG-driven use of rPET is expected to expand its market share and potentially lead to increasing price premiums as demand for rPET grows. In addition, brand owners may consider switching from other plastics – such as HDPE, PVC and PS – to rPET because it is more recyclable and considered more accessible compared to other plastics. This could lead to another supply shortage, the experts caution.

As future rPET availability will be determined by a combination of supply, demand and regulatory factors, packaging industry leaders should consider three meaningful ways to increase rPET availability, according to McKinsey:

Boost supply: With more than 80 percent of PET waste going unused, opportunities exist across the value chain to boost PET recovery, from collection through to sorting and processing. Given that recycling programs are often organized at the local level, there are opportunities to form public‒private partnerships to increase local collection rates in areas with underfunded or nonexistent curbside recycling. Graphene plastic recycling

The Recycling Partnership, for example, is an organization that makes private investments in public recycling programs, with the aim of increasing the supply of recycled plastics. At the same time, investments in advanced sortation equipment at material recovery facilities are an additional avenue to increasing rPET supply. McKinsey also note that in some countries (such as the Nordic countries), national and state-level policies such as extended producer responsibility or deposit-return schemes are having a measurable influence on rPET supply.

Plastic Omnium – In France, composite hydrogen tanks

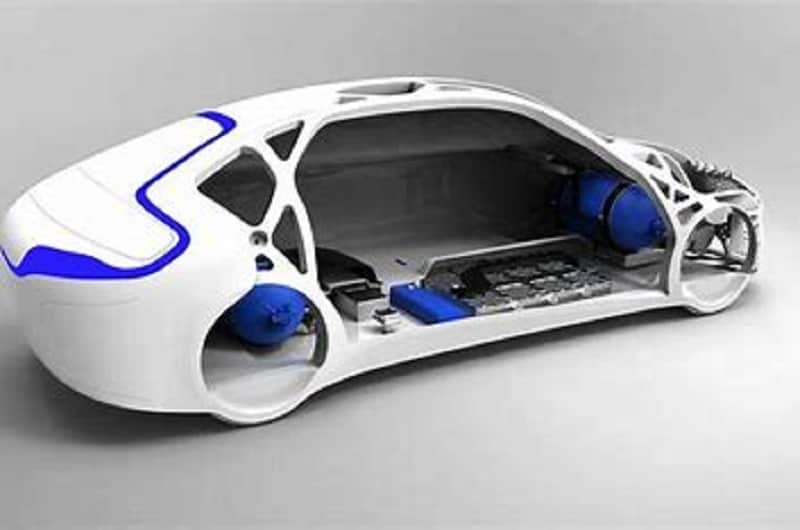

Plastic Omnium is building Europe’s largest plant for high-pressure tanks for trucks and buses. composite hydrogen tanks Plastic Omnium The French group Plastic Omnium has started construction work on a new plant for the production of high pressure tanks (type IV) in composite material with fiber in Lachelle, in the department of Oise (Northern France). of carbon for hydrogen storage, intended to be installed on industrial vehicles and buses. With an investment estimated at 150 million euros and an annual production capacity of 80 thousand tanks, obtained through filament winding, once completed it will be the largest European plant. It will supply vehicle manufacturers such as Stellantis and HYVIA, creating 150 to 200 new jobs. Graphene plastic recycling

The works will be completed by the end of 2024. The company created the new Plastic Omnium New Energies division early last year and currently has a pilot plant in Belgium. Two more tank factories will be launched by the group in Shanghai (China) in 2026 and in Michigan (United States) the following year. From 2015 to today, the French group has invested over 400 million euros in this segment. Type IV tanks are designed for pressures from 350 to 700 bar. They are produced by the French group starting from a blown liner in thermoplastic resin, subsequently wrapped with carbon fibers impregnated with resin. The result is a highly resistant and at the same time lightweight container.

Coperion and Herbold Meckesheim to present product and process solutions at Fakuma 2023

Coperion and Herbold Meckesheim will present product and process solutions that the company claims make both the compounding and the recycling of plastics markedly more efficient and increase the product quality achieved.

One eyecatcher at Fakuma booth 6312 in Hall A6 is the preconfigured ProRate, PLUS-S feeder. It serves as a representative of Coperion’s comprehensive technology and process expertise in all compounding tasks. Graphene plastic recycling

From raw material handling to conveying, feeding, melting, dispersing, homogenizing and devolatilizing up to pelletizing, Coperion delivers both high-efficiency individual components as well as complete systems.

The added value from the merger of Coperion and Herbold Meckesheim, specialist in mechanical recycling of plastics and plastic waste, is evident at the booth in a virtual PET recycling plant that both companies have created. This virtual plant presents one of the complete solutions for plastics recycling that Coperion, together with Herbold Meckesheim, is now making available from a single source. It demonstrates the entire process and at the same time allows a glimpse into numerous key components and their functions.

Moreover, rotors from Herbold Meckesheim granulators will be on display in several sizes and for various applications.

The rotor concept with the cutting geometry is a decisive reason for the high efficiency of Herbold Meckesheim’s granulators. Graphene plastic recycling

Plastics Recycling Plants from A Single Source

Along with individual components, Coperion and Herbold Meckesheim now build entire systems for plastics recycling. From mechanical processing – size reduction, washing, separating, drying and agglomerating of plastics – to bulk material handling as well as feeding and extrusion all the way to compounding and pelletizing, such plants cover the entire plastics recycling process chain. Since their merger, both companies have continued to develop and optimally attune their technologies for individual process steps so that entire systems excel in operation with extremely high efficiency.

Coperion and Herbold Meckesheim realize solutions for mechanical recycling of post-industrial and post-consumer waste, chemical recycling, solvent-based recycling, and deodorization, tailored to the type of plastic being processed. Representative of their expertise in these various plastics recycling processes, Coperion and Herbold Meckesheim will be showing a PET recycling plant simulation at Fakuma 2023. Booth visitors can look directly into all process steps and view the construction and functionality of key technologies. Graphene plastic recycling

Pivotal for the high efficiency of Herbold Meckesheim’s granulators are both the rotor concept and the cutting geometry, individually adapted for the task and the raw material. Herbold Meckesheim granulators work with true double cross cutting action: not only the rotor knives are mounted at an inclined angle, even the stator knives are creating a clean cut with a constant gap across the entire knife width. The end product is a regrind with very good flow characteristics, low fines percentage, and high bulk density that can be easily reintroduced into the process. Various rotors from Herbold Meckesheim granulators will be available to view at the booth.

Smart Solutions For More Efficiency In Classic Compounding Tasks

At Fakuma, Coperion will also present versatile and efficient uses of its ZSK and STS twin screw extruders as well as its feeding and conveying technologies in classic and forward-looking compounding tasks. Graphene plastic recycling

Coperion technologies are ideally suited for manufacturing demanding compounds such as bioplastics. Due to the number of possible base polymers and the variety of recipes, bioplastics manufacturing creates very high demands upon compounding technology. Coperion has already supplied numerous systems for the production of bioplastics. The company’s comprehensive process expertise is leveraged to design each process step such that the required mechanical properties of bioplastic end products are achieved.

Ampacet introduces PERMSLIP 1409, low COF permanent slip masterbatch solution

Global masterbatch leader Ampacet has introduced PERMSLIP 1409, a non-migrating permanent slip solution for trouble-free flexible packaging conversion.

Film and packaging manufacturers always look for efficient and trouble-free operability during film manufacturing and conversion. Conventional permanent slip additives face some limitations like the achievable slip performance and the transfer of the active agent on the opposite packaging side. Graphene plastic recycling

Ampacet PERMSLIP 1409 outperforms conventional permanent slip masterbatches by offering low and consistent slip behaviour with Coefficient Of Friction (COF) between 0.20 and 0.25. When film is under a roll form, the additive remains on the additivated side and has no influence on the properties of the opposite side after unwinding.

Ampacet PERMSLIP 1409 represents an excellent solution for trouble-free flexible packaging operability.

The Rising Tide of Battery Recycling: A Tale of Success and Opportunity

Something amazing is happening in the battery world: Battery recycling rates are steadily rising thanks to smart industry initiatives and growing consumer awareness. The lead-acid batteries used in cars, for example, boast a remarkable 99% recycling rate in the U.S., which is twice the recycling rate of aluminum cans. Lead car batteries have become the most recycled consumer product, with approximately 160 million batteries collected and recycled each year, preventing millions of tons of lead and plastic from ending up in landfills. This success story is a result of coordinated efforts between battery manufacturers, recyclers, and governments who have worked together to establish the necessary infrastructure and incentives for recycling. Graphene plastic recycling

As the world moves towards a future dominated by lithium-ion batteries (LiB) powering various devices, the achievements in lead battery recycling offer hope in an industry where LiB recycling rates currently languish around 5% to 15%. With the expected increase in electric vehicle adoption, LiB waste is projected to exceed 20 million tons per year by 2040. However, this also presents a significant opportunity if recycling efforts can be scaled up. Despite the challenges of collecting and transporting used batteries, the value recovered from these batteries is substantial.

Efforts are already underway to scale up LiB recycling. One notable example is the investment in Redwood Materials and their recycling infrastructure. Redwood Materials has received over $1 billion in Series D funding and a $2 billion loan from the Department of Energy, providing the company with the capital to expand its recycling capacity. While the journey to widespread LiB recycling may take time, the lead battery industry serves as a template and a source of inspiration. Graphene plastic recycling

Lead batteries exemplify the concept of recycling as a core principle rather than an afterthought. These batteries are designed to be recycled in a closed-loop system, with their three main components – lead, plastic, and acid – engineered for repeated recycling without any loss of performance. An average new lead battery comprises 80% recycled material, with 83% of the lead sourced from North America. The plastic casings also find new life, creating near-perfect loops of circulation.

The lead battery industry has built a network of manufacturing facilities, collection sites, and recyclers across the country that keeps lead in continuous circulation. It took time and persistence to establish this ecosystem, with industry groups playing a vital role in bringing stakeholders together and promoting responsible battery management practices. Beyond waste Graphene plastic recycling