PVC recycling – Indorama Ventures (IVL) : FY 2023 revenue down 17% as EBITDA shrinks by half / PET, Fibre assets undergo strategic review 29-02-2024

PVC recycling

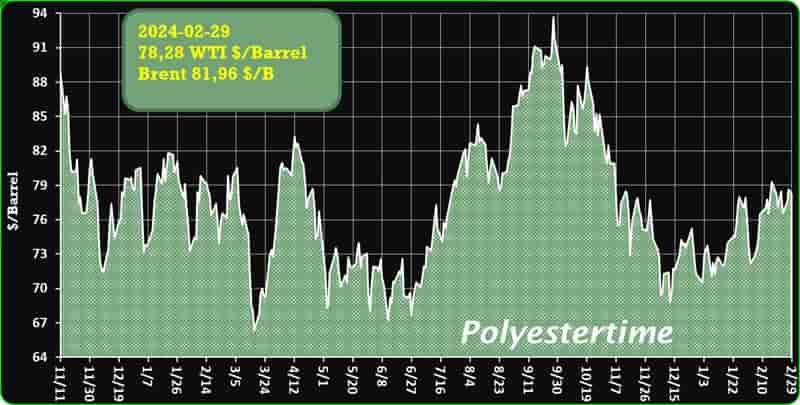

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

The Vinyl Institute has partnered with the Cyclyx Consortium to advance PVC recycling efforts

The Vinyl Institute (VI), representing leading manufacturers in the vinyl industry since its establishment in 1982, has recently joined the Cyclyx Consortium, an initiative by Cyclyx International aimed at elevating post-use plastic recycling from 10% to 90%. The inclusion of VI in this consortium marks a significant step forward in enhancing plastic recyclability.

The vinyl industry, encapsulated by VI, boasts a considerable presence in the United States, comprising 3,000 manufacturing facilities and providing employment for 350,000 individuals, with an economic valuation of $54 billion. VI champions vinyl material as indispensable across various sectors such as packaging, construction, water delivery, healthcare, and transportation. PVC recycling

Notably, the recycling potential of PVC (polyvinyl chloride), a key component of vinyl material, is substantial, with 1.1 billion pounds recycled annually in the US and Canada. Efforts by PVC manufacturers to divert pre-consumer scrap from landfills and the roofing industry’s recycling initiatives for post-consumer material contribute significantly to this recycling endeavor.

VI, alongside the vinyl industry, is steadfast in its commitment to recycling, particularly targeting installation scrap, post-use waste, and end-of-life materials. As a new member of the Cyclyx Consortium, VI aims to facilitate the recycling of 160 million pounds of post-consumer PVC by 2025. PVC recycling

Ned Monroe, CEO of VI, expressed optimism about leveraging the Cyclyx Consortium’s network to enhance post-consumer PVC recycling. Ron Sherga, Vice President of Membership and Engagement at Cyclyx, echoed this sentiment, anticipating collaborative efforts to collect vinyl materials from diverse industries, diverting them from landfills and bolstering recycling initiatives within the vinyl community.

SGT Makes €3 Million Investment in New Material Central Facility

SGT, a manufacturer specializing in PET and RPET preforms, proudly announces the installation and operational start-up of a new material central facility at its Reze site in Loire-Atlantique, France. This represents a major investment of €3 million12.

The material central facility streamlines the supply of PET and RPET pellets to the injection molding press park, operating autonomously since the beginning of the year. By eliminating the need for direct human intervention, it enhances efficiency while improving ergonomic conditions for employees, reducing strenuous tasks and repetitive movements associated with material transfers. PVC recycling

To optimize operational processes, four kilometers of pipes have been strategically installed to ensure a continuous supply of raw materials. The state-of-the-art computer system, deployed by MAT Techno-Logic, offers precise management of material mixtures for each preform injection press, enabling automatic management of diverse mixtures and enhancing production versatility.

François-Xavier Ollier, Production Manager of the SGT Group, emphasizes, “This modernization initiative aims to boost productivity, efficiency, and the quality of our preforms, aligning with our commitment to exceed customer expectations.”

The implementation of this advanced system brings several key benefits, including increased production efficiency, significant time savings, expanded storage capacity with 280 tons of transition storage, and enhanced supply chain security by minimizing risks associated with human errors. PVC recycling

Moreover, the new material central facility reinforces the company’s dedication to product traceability and environmental responsibility. Advanced tracking systems ensure the quality and origin of each product, meeting the strictest customer requirements and environmental standards1.

Indorama Ventures (IVL) : FY 2023 revenue down 17% as EBITDA shrinks by half / PET, Fibre assets undergo strategic review

In the fiscal year 2023, Indorama Ventures (IVL), a prominent PET producer based in Bangkok, Thailand, reported a significant decline in revenue, down by 17% to USD 15.6 billion (EUR 14.3 billion). This downturn was attributed to various factors, including a challenging macroeconomic environment exacerbated by the Ukraine war, inflation, high interest rates, and sluggish economic growth in key markets like Europe and China.

Alongside the drop in revenue, the company’s EBITDA plummeted by 53% to USD 1.12 billion, with sales volume contracting by 4% due to destocking activities. IVL experienced declines across all regions, particularly in Europe, the Middle East, and Asia, where it transitioned from a profit to an EBITDA loss compared to the previous year. This decline was attributed to both volume and margin pressures, as well as persistently high energy prices. PVC recycling

Furthermore, IVL recorded a non-cash impairment of USD 308 million for its Corpus Christi assets in the fourth quarter, citing escalating project costs, labor shortages, and reduced fair market value. Consequently, the project is currently on hold pending the development of an optimized execution plan to control costs.

In response to regional disparities in aromatics pricing and increasing cost pressures, particularly in the West, IVL announced a strategic review of its PET and Fiber assets, aiming to make informed decisions regarding production optimization and geographical rebalancing, primarily towards Asia. These reviews are expected to conclude in the first half of 2024. PVC recycling

Within its Combined PET (CPET) segment, revenues declined by 18% to USD 9.43 billion, while EBITDA contracted by 61% to USD 553 million, primarily due to volume declines and import pressures in the EMEA region. Despite these challenges, the Packaging division demonstrated resilience, with growing volumes and EBITDA, signaling potential growth opportunities in emerging markets.

What Causes Polypropylene Prices to Rise in Europe but not in the US and Asia, Feb 2024

In a continuation of the stable trend observed over the past three weeks, the US Polypropylene (PP) market has maintained unwavering stability, with prices remaining unchanged during the last week of February 2024. This trend is particularly evident in the PP Copolymer Grade DEL Houston segment, emphasizing a sustained period of equilibrium and pricing steadiness. The average price for this grade over the week was recorded at USD 1106/MT, indicating a balanced market where the interplay of supply and demand has led to minimal fluctuations in Polypropylene prices. PVC recycling

Contrary to the global stability, the European region experienced a notable 3% increase in PP prices this week. The driving force behind this upward trend was the adjustment in production costs, notably the rise in the price of feedstock Propylene by approximately 2% since the commencement of the new year. Despite stable demand within the region, the supply remained categorized as low to moderate. The effects of the Red Sea crisis diminished during this period, yet a scarcity of the product persisted, leading to an average price of USD 1310/MT for PP Injection Moulding FD Hamburg over the week.

In the Chinese market, even though Chinese industry participants have not fully resumed their work routines following an extended holiday, the PP markets have officially reopened, showcasing new cost-driven price increases domestically. PVC recycling

Elevated energy prices provide a solid cost foundation, enabling sellers to increase their offers compared to the pre-holiday period. Simultaneously, the trading atmosphere remains cautious due to a slower-than-anticipated demand recovery and prevailing supply pressures domestically, adding pressure to market sentiment and constraining potential PP price increases.

Study finds byproducts in recycled food packaging warrant review

Researchers at Iowa State University recently highlighted the necessity of monitoring for nonintentionally added substances in recycled plastics used in food-contact applications.

Understanding the risks posed by nonintentionally added substances (NIAS) in recycled polyolefin materials used as food contact materials (FCMs) in packaging is necessary to safeguard public and environmental health, according to a recently published study.

Researchers at Iowa State University recently highlighted the necessity of monitoring NIAS contaminants and aligning them with regulations to limit the use of potentially harmful additives in plastics. PVC recycling

NIAS are not added into polymers to impart technical benefits but often are byproducts of degradation or manufacturing or are created during consumer use. More monitoring would enhance the safe recycling and disposal of plastic, which is key to building a more circular economy. Properly evaluated, reusing plastics also reduces environmental waste and landfill accumulation.

Food packaging is one of the most important sectors of the plastic industry, comprising almost 40 percent of the total plastic demand. According to the U.S. Environmental Protection Agency, 14.5 million tons of plastic containers and packaging were produced in the USA in 2018, yet the proportion of this material that is being recycled has held steady or even declined over the past few years. PVC recycling

CCL Industries unveils the inauguration of its sustainable sleeve label hub in Austria

CCL Industries, a renowned global leader in specialty label, security, and packaging solutions, proudly announces the official inauguration of its sustainable sleeve label hub in Dornbirn, Austria. This milestone marks the completion of its relocation from the former site in Hohenems.

Representing a substantial €50 million investment, the new facility boasts more than double the capacity of its predecessor, spanning nearly 10,000 square meters. It features cutting-edge amenities including a state-of-the-art production area and a fully automated warehouse equipped with intelligent software for optimal space management and intra-logistics automation. PVC recycling

Günther Birkner, a member of CCL’s management team, highlights the advancements: “The move brings significant enhancements, offering a modern workplace and utilizing state-of-the-art technology. Designed with modern sustainability principles, our aim is to further reduce our carbon footprint.”

At the Dornbirn facility, CCL specializes in the latest sustainable shrink sleeve technology, known as EcoFloat™, crafted from low-density polyolefin material. These sleeves facilitate efficient recycling by easily separating from primary containers during the sorting process.

Jens Winkler, General Manager, expresses pride in serving both local and international clientele with innovative solutions and reliable technical support. Notable achievements include collaborations with global brands like Henkel AG, showcasing CCL’s commitment to future-proof packaging. PVC recycling

In its holistic sustainability approach, CCL emphasizes “reduce, reuse, recycle” principles, actively supporting recycling initiatives. Energy efficiency measures include utilizing recovered heat from production machinery for heating and implementing a solar photovoltaic system with over 2,000 panels on the roof, contributing to substantial CO2 savings.

Bernd Schmidle, Production Manager at CCL Dornbirn, underscores the company’s commitment to sustainability through meticulous planning and implementation of advanced technologies in the new facility.

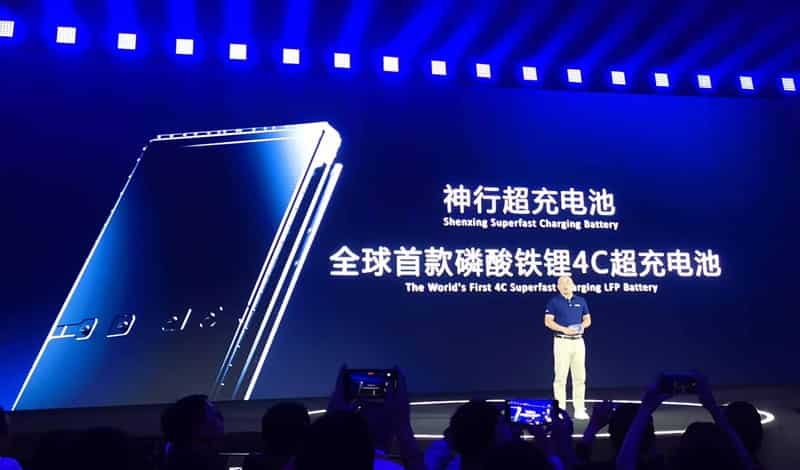

CATL, the world’s leading battery manufacturer, is poised to revolutionize the electric vehicle industry by slashing the cost of lithium-iron-phosphate (LFP) cells by 50% by mid-2024. As reported by CnEVPost, CATL’s ambitious plan aims to reduce the cost per kWh, making electric cars more affordable for consumers worldwide. The new square cells, boasting dimensions of 148 mm x 26.5 mm x 91 mm and a capacity of 173 Ah, meet Vda specifications and can be fully charged in under 30 minutes. These cutting-edge cells are set to be distributed to various electric vehicle manufacturers at an average price of 400 RMB/kWh (approximately $56.47/kWh or 51 euros). PVC recycling

This significant cost reduction marks a substantial shift from the mid-2023 average price range of RMB 800 to RMB 900 per kWh for LFP battery square cells. The projected decrease means that a 60 kWh battery pack’s cost could plummet from $6,776 to $3,388 within just a year, translating to savings of over $3,000 per vehicle for manufacturers. Consequently, consumers can anticipate the emergence of compact electric cars at highly competitive prices.

Leapmotor’s CEO, Cao Li, anticipates even further price drops, suggesting that CATL’s cells could potentially reach 320 RMB/kWh, equivalent to approximately 41 euros. Confirmation of these developments would undoubtedly mark a pivotal moment in the proliferation of electric vehicles, promising a more accessible and sustainable future for transportation.

PVC recycling