Asian styrene driving downstream ethylene margin despite PE/MEG falls – Solid styrene demand in Asia is lending support to downstream ethylene margins against the backdrop of falling polyethylene and monoethylene glycol margins – Asian styrene ethylene PE MEG - Arhive

Asian styrene ethylene PE MEG Asian styrene ethylene PE MEG Asian styrene ethylene PE MEG Asian styrene ethylene PE MEG Asian styrene ethylene PE MEG Asian styrene ethylene PE MEG Asian styrene ethylene PE MEG

Asian styrene driving downstream ethylene margin despite PE/MEG falls

Singapore (Platts)-

Solid styrene demand in Asia is lending support to downstream ethylene margins against the backdrop of falling polyethylene and monoethylene glycol margins, market data showed Thursday.

Solid styrene demand in Asia is lending support to downstream ethylene margins against the backdrop of falling polyethylene and monoethylene glycol margins, market data showed Thursday.

Styrene margins on Thursday were calculated by S&P Global Platts at plus $192/mt, down $10.20 day on day but still hovering at around their highest since September 2017.

On Thursday, the FOB Korea styrene monomer maker was assessed up $5 day on day at $1,429/mt as prompt demand for styrene emerged strongly this week ahead of end-month futures clearance, market sources said.

Chinese SM prices soared to a year-to-date high on inventory data released on Wednesday, with trader stocks estimated at just 26,000 mt Wednesday, plunging 51.9% week on week to hit a fresh year-to-date low.

Market participants said that with prompt styrene supply already tight because of several turnarounds in East China, traders that took up short positions previously had no choice but to come out buying over the past two days, especially if they are short delivering into the domestic Huaxicun Commodity Exchange’s contracts.

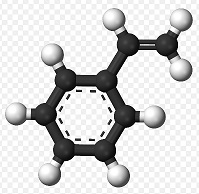

Production of 1 mt of styrene monomer typically requires 0.8 mt of benzene and 0.3 mt of ethylene, industry sources said.

Despite a bullish SM market, both downstream PE and MEG markets were bearish, with LLDPE and MEG CFR prices falling, Platts data showed.

MEG CFR China prices, relative to ethylene CFR NE Asia, had a negative spread of $54/mt Thursday, the lowest since March. Similarly, the spread between LLDPE butene and ethylene was negative, at minus $160/mt Thursday, the lowest since April.

On Thursday, the CFR China MEG price rose $5 day on day to be assessed at $905/mt, while the CFR Far East Asia LLDPE price was assessed unchanged from Wednesday at $1,180/mt Thursday.

Despite downstream margin pressures, the ethylene cash margin remains at a high, with the spread between naphtha and North East Asia ethylene prices at $677.75/mt Wednesday, the highest since the end of April.

On Thursday, the ethylene-naphtha spread dropped $7.62 day on day to be calculated at $670.13/mt, Platts data showed.

Looking ahead, this may increase further as ethylene supply is expected to tighten in June.

Japan’s JXTG Nippon Oil & Energy will will shut one of its steam crackers in Kawasaki over June 8-19 to conduct repair work, sources close to the company said Wednesday. The company has two steam crackers in Kawasaki. The cracker to be shut in June is able to produce 404,000 mt/year of ethylene.

Added to this is Formosa’s Mailiao naphtha fed steam cracker going offline over June 6-July 17. The cracker has a capacity of 700,000 mt/year, and will result in 18% of cracker capacity in Taiwan going offline during the period.

However, sources said that requirements for naphtha could continue to be supported as most naphtha-fed steam crackers are operating at high run rates.

Physical naphtha raced to an over three-year high of $702.375/mt, CFR Japan, on May 22, before falling back to $662.25/mt at the Asian close Wednesday.

On Thursday, the CFR Japan naphtha price rose $7.63 day on day to be assessed at $669.88/mt.

Sources said the recent slip in naphtha prices combined with the movements on the underlying crude markers. Front-month ICE Brent futures saw a similar parallel dip to $75.47/b at Platts 16:30 Singapore time Asian close Wednesday from a near-four-year high of $79.82/b on May 22.

On Thursday, front-month ICE Brent futures were assessed at $77.25/b.

–Daved Chohan, daved.chohan@spglobal.com

–Sue Koh, sue.koh@spglobal.com

–Frank Zeng, frank.zeng@spglobal.com

–Edited by Jonathan Dart, jonathan.dart@spglobal.com