CO2 into ethylene

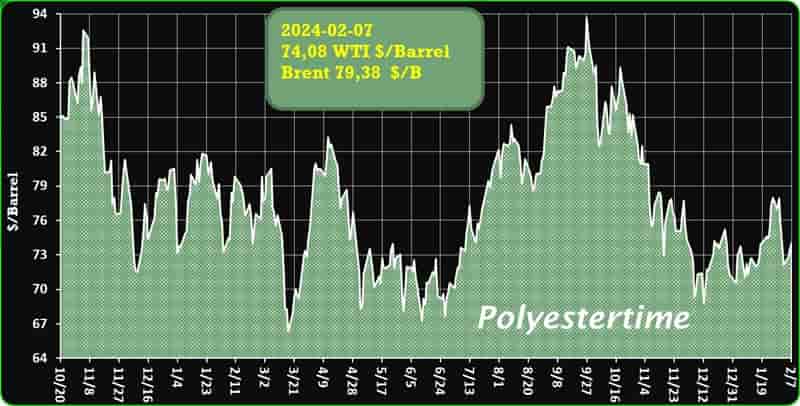

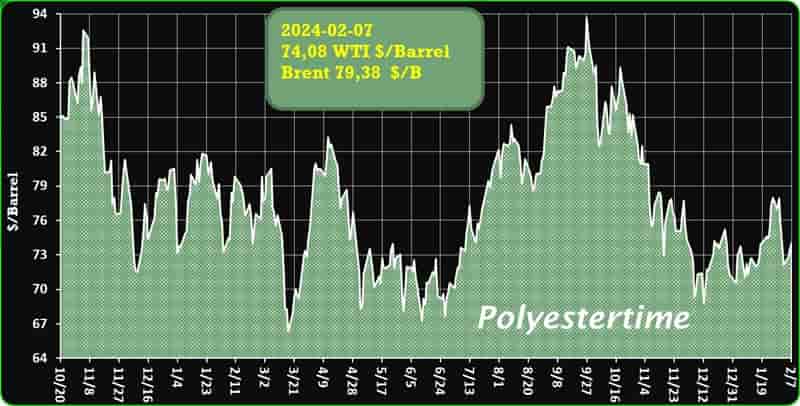

Crude Oil Prices Trend

Crude Oil Prices Trend by Polyestertime

CO2 into ethylene – High-Efficiency Carbon Dioxide Electroreduction System for Carbon Neutrality

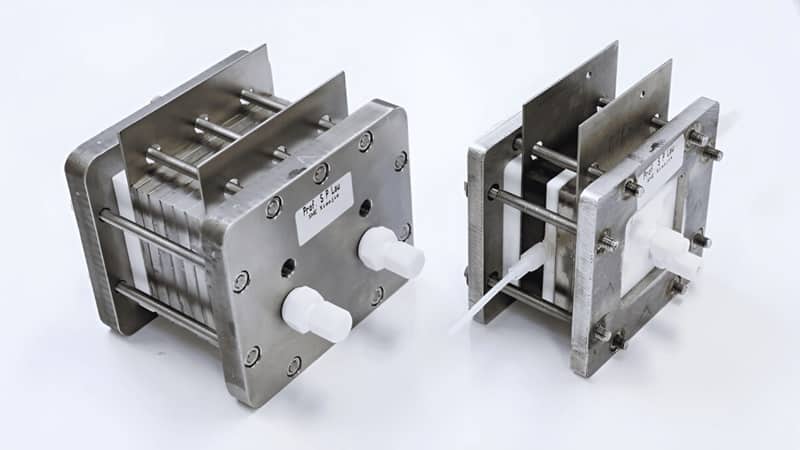

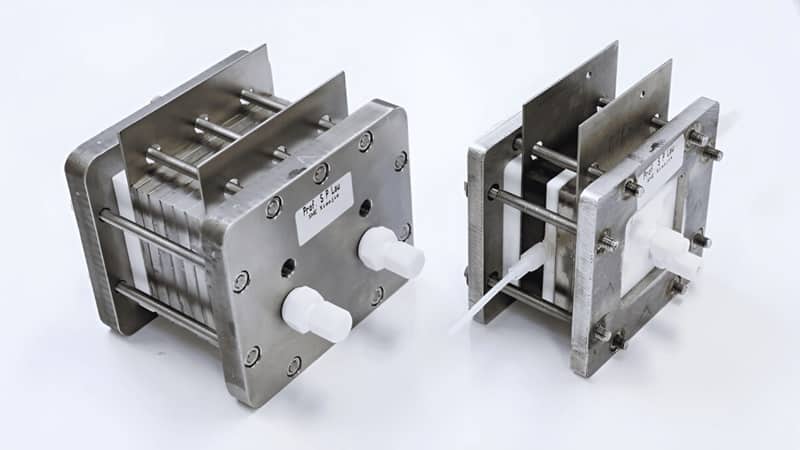

In response to the pressing need to mitigate global warming and achieve carbon neutrality goals, researchers at The Hong Kong Polytechnic University (PolyU) have developed a groundbreaking carbon dioxide (CO2) electroreduction system. This system, featured in a recent publication in Nature Energy and honored with a Gold Medal at the 48th International Exhibition of Inventions Geneva, offers a durable, highly selective, and energy-efficient solution for converting CO2 into ethylene.

Ethylene (C2H4), a vital industrial chemical, is predominantly derived from petrochemical sources, contributing significantly to carbon emissions. CO2 into ethylene

However, PolyU’s electrocatalytic CO2 reduction method, led by Prof. Daniel LAU, promises a more sustainable alternative. By utilizing green electricity and a specially designed APMA system (Anion-Proton Metal-free Assembly), the process achieves a remarkable 50% specificity in ethylene production and operates continuously for over 1,000 hours at an industrial scale.

The key to this success lies in the unique electrocatalyst, composed of nano-scale copper spheres with rich surface textures and defects that promote the desired reaction. Unlike previous systems, the APMA design prevents electrolyte loss and minimizes the formation of undesired by-products, ensuring efficient and stable operation.

Looking ahead, Prof. Lau emphasizes ongoing efforts to enhance product selectivity and seeks collaboration opportunities with industry partners. This collaborative endeavor, involving institutions like the University of Oxford and Jiangsu University, holds the promise of revolutionizing ethylene production, reducing carbon emissions, and advancing the journey towards carbon neutrality. CO2 into ethylene

Titan-Polymer, located in the Moglino special economic zone, has achieved a significant milestone with the successful commissioning of its second production line dedicated to BOPET (biaxially oriented polyethylene terephthalate) films

General Director Kirill Neretin announced the completion of commissioning, emphasizing the stable production process and capacity increase to meet orders for film thicknesses ranging from 8 to 35 microns.

This accomplishment propels Titan-Polymer towards its maximum design capacity of 72 thousand tons per year, highlighting the plant’s commitment to expanding production capabilities and meeting growing demand across various industries. The automated BOPET film production process ensures operational efficiency and product consistency, catering to applications in the food industry, medicine, and electrical engineering due to the films’ versatility and durability. CO2 into ethylene

Prior to the second production line’s launch, Titan-Polymer’s specialists conducted a meticulous preparatory phase, ensuring seamless integration and adherence to quality standards. With an augmented capacity and stable production process, the plant is well-positioned to effectively meet diversified demand for BOPET films, contributing to their availability for industrial applications.

The industry-wide surge in BOPET film production, in alignment with sector growth trends, reflects the resilience and adaptability of companies. Titan-Polymer’s expansion not only benefits the Moglino special economic zone’s economic development but also strengthens its market position as a reliable and innovative player.

The successful completion of the second production line underscores Titan-Polymer’s dedication to maintaining high standards of quality and efficiency in the dynamic landscape of BOPET film manufacturing. CO2 into ethylene

Cost a key challenge to low-carbon polyethylene production

The challenges posed by plastic waste, emissions, and climate/environmental issues are anticipated to intensify until effective policies and actions are implemented to reverse the trend.

The plastic value chain is grappling with the trilemma of security, sustainability and affordability, placing substantial pressure on stakeholders. As a result, there is an increasing demand for the industry to address and alleviate the adverse environmental effects of plastic consumption, including polyethylene.

Low cost, versatility and weatherability are PE’s major advantages, with applications in household and food containers, toys, food and nonfood packaging film and sheet, retail and trash bags, geomembranes, pipes, house wrap, pails, totes, crates, caps, closures and plastic bottles. CO2 into ethylene

Polyethylene constituted a third of the world’s polymer market in 2022, according to S&P Global Commodity Insights. However, the global PE market is currently contending with surplus capacity, subdued demand growth and diminishing profit margins. The polyethylene sector is also undergoing a phase of transformation and innovation, driven by the need to address environmental concerns, particularly since ethylene production ranks among the largest sources of CO2 emissions in the chemical industry.

Sustainability goals by brand owners, converters and producers are currently driving efforts to produce low-carbon polyethylene.

For example, it is estimated that using bioethanol-based ethylene would translate into a carbon emissions reduction of approximately 60%, while the use of hydrogen in the cracking furnace together with carbon capture and storage, like what petrochemical giant Dow is considering for its plant in Fort Saskatchewan, Canada, has essentially net-zero carbon emissions. CO2 into ethylene

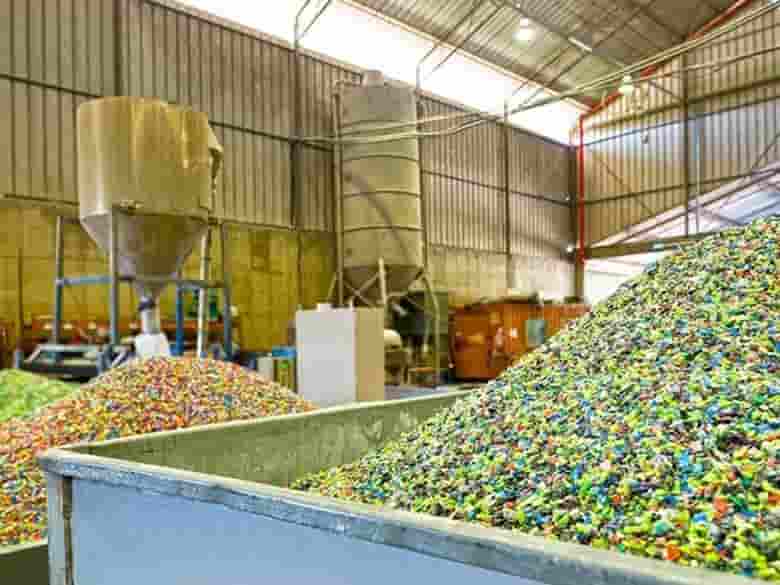

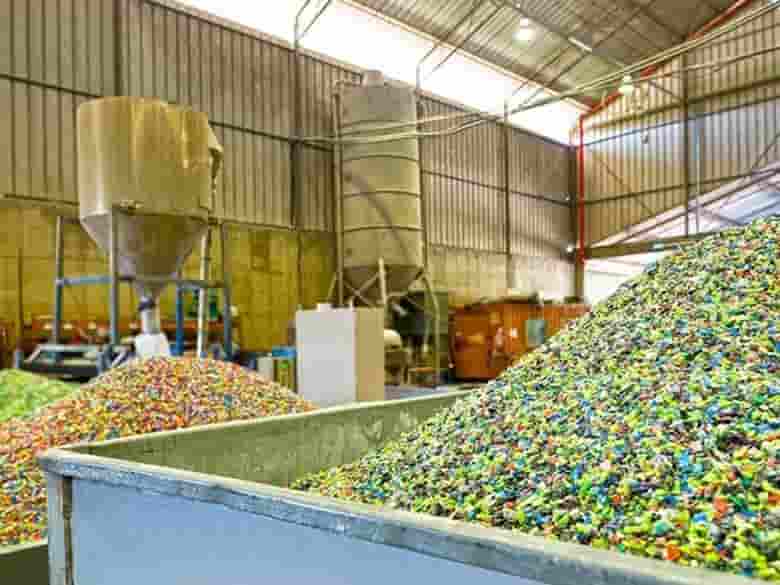

Technologies such as the use of sustainable feedstocks like bioethanol and the production of polyethylene from mechanical recycling, using pure polyethylene waste stream, can also contribute to the decarbonization of polyethylene production.

Other emerging recycling technologies such as the pyrolysis of plastic waste are not being developed with the idea of reducing carbon emissions as this pathway is too energy intensive, but with the goal of reducing plastic waste that ends up in landfills and handling plastic waste that is difficult to recycle via mechanical processes.

More…

Growth in China projected to slow to 4.6% in 2024, 3.5% in 2028: IMF

- China’s growth is projected to slow to 4.6 per cent this year amid the property sector weakness and subdued external demand, and further to about 3.5 per cent in 2028 amid headwinds from weak productivity and population aging, the IMF has noted.

- Inflation is expected to increase gradually to 1.3 per cent this year. Uncertainty surrounding the outlook is high. CO2 into ethylene

Growth in China is projected to slow to 4.6 per cent this year amid the ongoing weakness in the property sector and subdued external demand, according to the International Monetary Fund (IMF), whose executive board concluded the 2023 Article IV Consultation with the country last month.

Over the medium term, growth is projected to gradually decline further and is projected at about 3.5 per cent in 2028 amid headwinds from weak productivity and population aging.

While inflation fell last year, largely on account of lower energy and food prices, it is expected to increase gradually to 1.3 percent this year as the output gap narrows and the base effects of commodity prices recede, IMS said in a release.

Uncertainty surrounding the outlook is high, particularly given the existing large imbalances and associated vulnerabilities, it noted. CO2 into ethylene

Greater-than-expected weakening of external demand, tightening of global conditions and increased geopolitical tensions also pose considerable downside risks.

On the upside, decisive policy action could boost confidence and lead to a better-than-expected rebound in private investment.

More…

Plentiful and cheap virgin plastic is undercutting the price of recycled plastic

Europe’s plastics recyclers are under financial pressure, and some are closing plants. Industry experts cite a surge in cheap virgin plastic being imported into the region and a lack of regulation requiring the use of recycled material.

A global excess of ethylene supplies and of other raw materials for plastics has lowered the cost of virgin plastic, making it cheaper than recycled plastic in Europe.

“The recycling market will be unprotected for a while as it comes under pressure from the cheaper virgin prices,” says Husam Taha, principal analyst for plastics sustainability at Wood Mackenzie. CO2 into ethylene

Global ethylene production capacity is about 225 million metric tons (t) per year, while demand is closer to 180 million t, according to data compiled by S&P Global. Spot prices for virgin high-density polyethylene (HDPE), a widely recycled plastic used in products such as shopping bags and food packaging, have dropped from above $1,500 per metric ton in 2021 to less than $1,000 today, according to S&P.

The recycling market will be unprotected for a while as it comes under pressure from the cheaper virgin prices.

Imports of cheap recycled plastic into Europe are exacerbating the issue, Ton Emans, president of the industry group Plastics Recyclers Europe, says in a press release.

Prices for virgin plastics could stay low for some time to come, according to analysts at ChemOrbis. “China and USA are planning big new plants for polyethylene, for example, in the next 3–4 years,” says Ezio Filippi, chief representative for ChemOrbis in Italy. “The effect on prices, with demand still being subdued globally, is obvious.” Unless new regulations are introduced to enforce the use of recycled plastics, cheaper virgin polymers will continue to displace them, Filippi says. CO2 into ethylene

More…

Corbion seeks growth by restructuring

Reorganizing at Corbion will involve simplifying the company’s structure into two business units from three business units and reducing its workforce by about 200, which will include closing a fermentation plant in Peoria, Ill. Executives gave details Jan. 31 in Amsterdam during a capital markets update for analysts and investors.

Corbion executives also gave unaudited financial results for 2023 fiscal year. Sales in fiscal 2023 totaled €1.44 billion ($1.57 billion), down from €1.46 billion in fiscal 2022, while adjusted EBITDA was €192 million ($208 million), up from €184.4 million. Audited results for the fiscal year will be released March 1. CO2 into ethylene

Corbion seeks growth by restructuring

Reorganizing at Corbion will involve simplifying the company’s structure into two business units from three business units and reducing its workforce by about 200, which will include closing a fermentation plant in Peoria, Ill. Executives gave details Jan. 31 in Amsterdam during a capital markets update for analysts and investors.

Corbion executives also gave unaudited financial results for 2023 fiscal year. Sales in fiscal 2023 totaled €1.44 billion ($1.57 billion), down from €1.46 billion in fiscal 2022, while adjusted EBITDA was €192 million ($208 million), up from €184.4 million. Audited results for the fiscal year will be released March 1.

Food, biochemicals and the polylactic acid (PLA) businesses will make up the functional ingredients and solutions business unit. Nutrition, pharmaceuticals and biomedical polymer capabilities will make up the health and nutrition business unit. Corbion’s previous business units were sustainable food solutions, lactic acid and specialties, and algae ingredients. CO2 into ethylene

More…

Oil next year – Enzyme found in laundry detergent could help recycle plastic 06-02-2024

CO2 into ethylene