This content has been archived. It may no longer be relevant

Heimtextil-2023 – Bioplastics – CPL

In order to help visitors find everything they are looking for, the fully booked Interpack 2023 features a concept for the 18 trade fair halls that is based on clear focal points for each industry. These target groups include food, beverages, confectionery and baked goods, pharmaceutical products, cosmetics, non-food and industrial goods.

Around 2,700 companies from around the world will meet in Düsseldorf from 4 -10 May, 2023, to present cutting edge technologies and packaging trends from along the entire value chain, demonstrate chances for growth and respond to the challenges of the industry.

Confectionery and baked goods

Visitors will find processes and machines for packaging confectionery and baked goods especially in halls 1, 3 and 4 of interpack. As in many other sectors, concerning the packaging of confectionery, baked goods, snacks and cereals, much has changed over the recent years. One important issue are sustainable solutions. Mechanical engineering companies, for example, are adapting their portfolio to include packaging made from mono material or novel materials. Digital technology is another focus – as it is for the entire industry. Heimtextil-2023 – Bioplastics – CPL

Food, beverages, non-food and industrial goods

The food sector is among the most favoured target groups of visitors to Interpack, and this shows in the breadth of their presentation. The global demand for packaged foods is increasing. In saturated markets with strong incomes, conscious consumption and consumer behaviour also shifts towards sustainability, regional produce, organic food or fair trade, and this includes packaging. Like the current challenges posed by energy management and conservation of resources, this causes a process of transformation within the sector. A similar observation can be made for beverages and non-food products, which are presented together with the food sector in halls 5 and 6, as well as in 11 and 14. Around 20 per cent of visitors to interpack are especially interested in solutions for industrial goods. These, too, are to be found in the same halls.

Halls 11 and 14, which are ideally suitable for a walk, will host exhibitors like Omori Machinery, Mettler-Toledo (hall 11), Extend Great International, Rovema and Haver & Boecker (hall 12), KHS, Krones, Aetna Group, Sidel and ProMach (hall 13), as well as Gerhard Schubert Verpackungsmaschinen, Ishida Europe Limited, Loesch-Hastamat and tna solutions (hall 14).

In hall 13, there is a special focus on bottling and packaging solutions for the beverages sector.

Pharmaceuticals and cosmetics

In light of global demographic changes, the industry’s development opportunities are excellent. Increasing requirements within drug development result in a parallel increase in those within systems and machine technology concerning packaging and bottling of medicines. The pharmaceutical companies need universal solutions, and these are found in halls 15 to 17 at Interpack, where the focus is on presenting processes and machines for packaging pharmaceuticals and cosmetics. Heimtextil-2023 – Bioplastics – CPL

Packaging materials and packaging

Halls 7 and 7a, 8a, 9 and 10 of Interpack are of the highest importance for the sector. This is where visitors can view at least a third of all exhibitors with all their materials and their finished packaging products. This presentation, which is not only for users, of packaging, packaging materials and packaging aids is already the largest packaging trade fair in the world. Here is where all packaging materials are represented and there is a high number of innovations in the field of sustainability and conservation of resources, for example in using new materials, sustainable raw materials, or increasing the amount of recyclates used in packaging.

Labelling, marking, finishing

Inform, decorate, customise – packaging carries information. How to implement this for different products and requirements, is presented by the exhibitors in halls 8a and 8b. Here, there are machines for labelling and marking technology, for example at Bluhm Systeme, Langguth, Domino Printing Sciences, Videojet Technologies, Herma or Possehl. This offer is completed by solutions from packaging production and integrated packaging printing. Here you can visit companies like Starlinger, Totani, Fujifilm Europe, the Brückner Group or HP Germany.

Components

“Every part counts” is the motto of the components trade fair, which takes place parallel to Interpack as its own event. This is where you find companies offering technology for drives, control units and sensors, products for industrial imaging, handling technology, industrial software and communication as well as comprehensive automation systems for the packaging industry. There are also machine parts, components and equipment, peripheral devices as well as components and aids for packaging. The temporary hall 18, situated between halls 10 and 16, makes the trade fair accessible from a central location, and visitors to Interpack have direct access to the components fair and vice-versa.

Visit Interpack

More..

-Bu Ali Sina Petrochem company’s annual output to reach 2m tons

Bu Ali Sina Petrochemical Company in Mahshahr, Khuzestan Province, seeks to increase annual output to 2 million tons of products this year (March 2022-23), managing director of the company said.

“The current production capacity of the complex is close to 1.7 million tons and with the help of development plans, the output will increase by about 20%,” the Oil Ministry’s news agency Shana also quoted Seyyed Mohamad Ahmadzadeh as saying.Regarding the paraxylin production unit, construction of which is near completion, he said the unit will definitely become operational by the end of the current year (March 2023).

The paraxylene unit has been built by local specialists and its launch can increase the profit of the complex by more than $50 million annually.

The products of the new unit will be used as feedstock in Shahid Tondgouyan Petrochemical Plant to produce polyethylene terephthalate (PET).Paraxylene is an aromatic hydrocarbon used as feedstock to produce industrial chemicals.

It is produced by catalytic reformation of petroleum naphtha and used in the production of polymers and terephthalic acid for polyesters such as PET.Referring to the rise in the output and sales of the complex in the first seven months of the current year, Ahmadzadeh said the company’s output increased by 5% and sales by 35% increase year-on-year.

“The company also experienced a 38% increase in exports and considering the rise in prices, its profit had a significant increase of 85% in the period as it earned a profit of over $100 million between March and October,” he added.A subsidiary of the Persian Gulf Petrochemical Industries Company, Bu Ali Sina Petrochemical Company stretches over 36 hectares on the northwestern flank of the Persian Gulf.Founded in 1998, the company processes gas condensate as feedstock to produce various aromatic products, including heavy naphtha, light naphtha and benzene. Heimtextil-2023 – Bioplastics – CPL

Sold in local and international markets, heavy naphtha is used in the production of gasoline, kerosene and industrial solvents. Light naphtha, a hydrocarbon liquid, is supplied to domestic and foreign markets as a feed for olefin units.

A part of the light naphtha is also converted to LPG and C5 raffinate.The rise in the plant’s benzene output has helped make the country self-reliant in its production. Iran no longer needs to import benzene and can even export the valuable product now.

The chemical is used in the production of detergents and hygiene products, which are needed worldwide.The sanctions-battered country had difficulty importing benzene in the past, but with Bu Ali Sina Company on fast track, detergent manufacturers can better meet their raw material needs and increase output.

Besides its use in the production of detergents, some industries use benzene to make chemicals used in the manufacture of plastics, resins, nylon and synthetic fibers. It is also used to make lubricants, rubber, dyes, drugs and pesticides.

BSPC’s products are sold to Imam Khomeini Port, Shahid Tondgouyan, Amir Kabir, Pars and Karoun petrochemical companies, and a portion is also exported to the Middle East, Southeast Asia and Europe.Bu Ali Sina’s exports include major products such as benzene, reformate and diesel. (ICE TEHERAN)

More..

-ExxonMobil doubles polypropylene production at Baton Rouge

ExxonMobil announced the successful startup of its new polypropylene production unit at the Polyolefins Plant in Baton Rouge, Louisiana.

The unit increases polypropylene production capacity along the Gulf Coast by 450,000 metric tons per year, meeting growing demand for high-performance, lightweight and durable plastics, particularly for automotive parts that can improve fuel efficiency and reduce vehicle emissions. Polypropylene, a polymer with several applications, is also used to improve the safety and efficiency of everyday products like medical masks and food packaging. Heimtextil-2023 – Bioplastics – CPL

“With the startup of this new production unit, we are well positioned to responsibly meet the growing global demand for these high-performance polymers,” said Karen McKee, president of ExxonMobil Product Solutions. “The ingenuity of our people and our investments in technology enable us to produce high quality products that are essential to daily life.”

ExxonMobil maintained its investments in this advantaged project through the COVID pandemic and related economic downturn. The total capital investment was more than $500 million. ExxonMobil’s extensive mega-project management experience and unrivaled technology capability enabled the unit to start up according to planned cost and schedule.

ExxonMobil’s integrated operations in Baton Rouge include a more than 500,000 barrel-per-day refinery, as well as chemical, lubricants, polyolefins and plastics manufacturing.

More..

-Germany’s Heimtextil 2023 to exhibit fibres, yarns in hall 4.0

At the upcoming Heimtextil 2023, which will be held from January 10–13, 2023 in Frankfurt am Main, Germany, manufacturers and weavers will be offered a global range of fibres and yarns for decorative and upholstery fabrics, from the preliminary stage to textile finishing, for the first time in a compact and centrally located separate area—hall 4.0.

Already established suppliers from the fibre and yarn segment will be bundled with new exhibitors in hall 4.0. “With this compact product range, we are responding to an increasing need among manufacturers and retailers: being enabled to shape product development as early as the preliminary stage. A holistic view in the design process is becoming increasingly important—especially for upholstered furniture, which is subject to ever more sustainable as well as functional demands, starting with the fibre,” Bettina Bar, director Heimtextil for the home textiles sector, said in a press release by organiser Messe Frankfurt. Heimtextil-2023 – Bioplastics – CPL

One highlight of hall 4.0 is the Trevira CS joint stand. “We are pleased that we will once again be present with a large Trevira CS joint stand featuring 16 Trevira CS customers. Here we will show the wide range of possibilities that Trevira CS fabrics offer in the textile design of interiors. The focus will be on the functions and properties that Trevira CS fabrics offer in addition to their flame retardancy. These will be addressed in our special show Textile Talents by Trevira CS. Aspects of sustainability will be another theme of our stand,” said Anke Vollenbroker, director marketing and business development Trevira CS.

Other leading suppliers in the area include Korteks and Reliance, as well as new exhibitors such as Turkish manufacturer Bulut Tekstil. Also in hall 4.0, architects, hotel decisionmakers and designers will find a high-quality range of outdoor fabrics, technical textiles for the contract sector, and imitation leather, including a large number of Spanish outdoor and contract specialists such as Atenzza Outdoor, Cabanes & Ortuno, Citel, Fernando Cerda Blanes e Hijos, Exit Fabrics, Pyton, and Recasens.

Italian manufacturer Tendaggi Paradiso, as well as leather and imitation leather suppliers such as Turkish brand Flokser and German companies mah-ATN and Vowalon, will also showcase their new products. The range will be rounded off by exhibitors Ambienta, Futura Leathers, Gebruder Munzert, Gruppo Mastrotto, and Indetex, who will be presenting their high-quality fabrics for contract business directly on the boulevard in the form of selected complete stands.

“We are looking forward to taking off in new markets at Heimtextil. We have completely changed the finishing of our fabrics to reduce the environmental impact and are presenting new designs with thicker textures that the market is demanding. The next Heimtextil is the right platform to show these novelties to a large number of professionals from different parts of the world in just four days. At the same time, through face-to-face exchanges, we get a direct feel for what customers want and receive immediate feedback,” said Citel’s marketing department, delighted to be taking part in Heimtextil 2023.

More..

-Global bioplastics production regains growth momentum

At the European Bioplastics Conference today, Managing Director of European Bioplastics Hasso von Pogrell gave the traditional update of the bioplastics market together with a brief summary of some of the key figures.

He then took advantage of the speaking time to talk about the proposed revisions of the Plastic Packaging and Waste Regulation and the implications for the bioplastics industry.

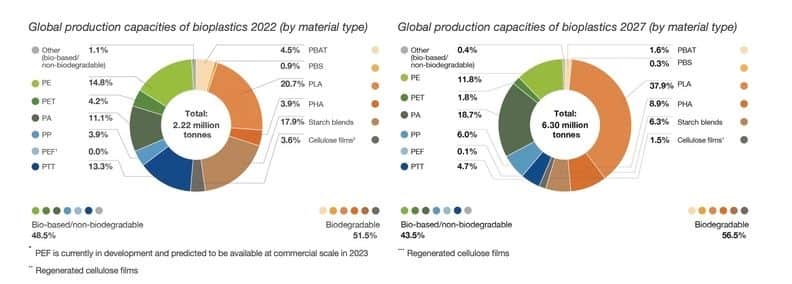

First, the good news: After a period of stagnation in 2020, mainly due to the effects of the Covid-19 pandemic, global bioplastics production capacities are once again on the rise. According to the latest figures, compiled in collaboration with the Hürth, Germany-based research institute nova Institute, these are set to increase significantly from around 2.23 million tonnes in 2022 to approximately 6.3 million tonnes in 2027.

“Once again, this shows the resilience and importance of our industry”, noted von Pogrell.

Bioplastic alternatives exist for almost every conventional plastic material and corresponding application. Due to a strong development of polymers, such as PHA (Polyhydroxyalkanoates), polylactic acid (PLA), biobased PAs (polyamides) as well as a steady growth of biobased Polypropylene (PP), the production capacity will continue to increase significantly and diversify within the next 5 years.

While bioplastics are increasingly finding application in numerous sectors, the main application is still packaging, which accounts for 48 percent (1 million tonnes) of the total bioplastics market in 2022. Nonetheless, their application in industries such as automotive and transport, agriculture and horticulture, and electrics and electronics will gradually expand as well in the coming years. Heimtextil-2023 – Bioplastics – CPL

In geographical terms, the focus continues to shift eastward. Although currently, one-fourth of production capacity is located in Europe, this is expected to dwindle to one-fifth by 2027, with Asia set to play a leading role in this space. Already a major production hub, manufacturing over 40 percent of today’s bioplastics production, it is expected to account for over 60 percent by 2027.

“We will see an impressive increase in bioplastics production over the next years. However, the big question is, does Europe still want to play a significant role in the world league of bioplastics or does it give up its leadership in the field of innovative sustainable materials? Investment into infrastructure as well as research requires the right political and economic framework conditions,” said von Pogrell. “Therefore, the European policymakers should make use of the many initiatives related to the European Green Deal to clearly acknowledge and promote biobased and compostable plastics.”

He spent the second part of his talk addressing the impact of the proposals put forward by the European Commission for the Plastic Packaging and Waste Regulation, and the ‘misinformation’ on which some – in relation to biobased plastics – are based. The new proposals, for example, state that biomass used to produce biobased plastics must be sustainably sourced, with no harm to the environment and in respect of the ‘cascading use of biomass’ principle: producers should prioritise the use of organic waste and by-products as feedstock.

It is a stance endorsed by European Bioplastics, but, as von Pogrell pointed out, the land used to grow the renewable feedstock for the production of bioplastics is estimated to be 0.8 million hectares in 2022 and continues to account for only just over 0.01 percent of the global agricultural area of 5 billion hectares. Along the estimated growth of global bioplastics production in the next five years, the land use share for bioplastics will increase to still below 0.06 percent.

“In relation to the available agricultural area, this share is still minimal. Thus, there is no competition between the renewable feedstock for food and feed and the production of bioplastics” says von Pogrell, “Over 90 percent of the global agricultural area is used for pasture, feed, and food. This is also of crucial importance in the political debate regarding land used for biobased industries.”

He ended by pointing to the effects of the implicit pushback by the EC bio-based plastics: “It doesn’t need rocket science to figure out what the impact of poor legislation would have on the already observed migration of protection capacities from Europe to Europe to Asia; to know how investments into R & D and the jobs that go with it are certain to follow suit.” Heimtextil-2023 – Bioplastics – CPL

More..

-Argentinian recycler Reciclar processes up to 600 million plastic bottles per year

The Argentinian plant, with a surface area of more than 22,000 m2, features the latest generation of Tomra equipment.

For 28 years, the plant, founded by Marcelino Casella, has collected, sorted, and recycled waste. Only recently has Reciclar added two new Autosort Flake units to its operation to produce crystal, green or light blue PET flakes and HDPE flakes of different sizes and colours.

Using Tomra’s PET bottle and PET packaging sorting equipment and technology, the Argentinean company has reached a processing capacity of 600 million plastic bottles and a production of 18,000 tons of plastic pallets per year, becoming the leading company in Argentina in PET waste processing. Heimtextil-2023 – Bioplastics – CPL

Reciclar’s main focus is the recovery of post-consumer material. About 95% of its operations are dedicated to the recycling of PET and HDPE recovered from waste originating from different parts of the country. Its advanced sorting and recycling processes allow Reciclar S.A. to produce secondary raw materials with virgin-like qualities. This, in turn, allows the company to satisfy the needs of its most demanding customers both locally and internationally, including those in the United States, China, Europe, and other Latin American countries.

Five years ago, Reciclar levelled up its business by updating its existing line with the next-generation equipment from Tomra to expand its offering. Since then, the plant has additionally sorted caps, safety rings, and labels made of different materials.

Reciclar diverts about 2,500 tonnes of recyclables from landfills or nature every month. The benefits are twofold: on the one hand, fewer materials are lost. On the other hand, more materials are available for further processing and recycling. Reciclar makes profits from three Autosort sorting systems from Tomra. These advanced sorting systems carry out accurate and advanced detection and separation of plastic bottles in the pre-sorting stage. Further down the sorting line, Three Autosort Flake conduct a final purification step and sorts plastic flakes by both colour and material.

In Argentina, Reciclar is the only company capable of producing food-grade recycled pellets, an achievement empowered by Tomra’s sophisticated sorting units that allow for the recovery of high-quality recyclables.

Source: Tomra Recycling

More..

-Caprolactam decline to year-to-date low, yet still weak

After mid-November, CPL market continued weakening down. By the end of November, the RMB spot price of CPL had fallen to 11,500yuan/mt, the year-to-day lowest in 2022. From the perspective of market mentality and current analytical logic, CPL market is expected to keep bottoming down.

CPL supply-demand structure deteriorates continuously

In terms of supply and demand, the operating rate of CPL plants has not been kept below 75% in the year. In recent two weeks, Baling Hengyi has cut production to 50%, and Risun Cangzhou’s old line shuts accidentally in glitch, but the market is still depressed, as sales are still not smooth. The core reason is downstream production reduction.

In early November, the low chip prices of North China CPL-nylon 6 integrated factory continued to press down the sales of non-integrated chip plants in Zhejiang and Jiangsu (East China), who saw a continued inventory accumulation since then. Under rising stock pressure, many chip factories chose to reduce production, but the degree of reduction varied, and generally no pipelines were completely shut down. This effort did not achieve expected result, and the pressure continued. Heimtextil-2023 – Bioplastics – CPL

Till late November, although CPL and chip prices have fallen to the year-to-date lowest, downstream buyers are still not convinced to build stocks, and chip inventory kept rising. Therefore, non-integrated chip factory production reduction expanded, as plants including Yichen, Yongtong, Chang’an, Fangyuan, Hangzhou Juheshun and other factories have arranged pipeline shutdown. According to statistics, the average operating rate of nylon 6 chip has dropped to less than 65%, as the average run rate of industrial-grade chip (CS chip) declined to 60% only. This led to an evident contraction in consumption for CPL.

In addition, as nylon 6 textile filament plants’ operating rate has dropped continuously, especially in Zhejiang, Jiangsu and Fujian. The pressure will be gradually transmitted to upstream HS chip, and may lead to further production cut among HS chip plants.

As downstream demand reduces continuously, CPL supply is expected to increase in December. Dongming Risun (300kta, running at 50%) and Baling Hengyi (450kta, running at 50% are going to recover normal production in Dec, and Lanhua Sci-tech (140kta, shutdown) may also restart around mid-Dec. CPL sellers will feel rising pressure then.

CPL-benzene price spread, the major price gauge for CPL market, has lowered to around 5,000yuan/mt by end-November. However, most insiders consider this margin could be further compressed and thus most of them have taken a bearish outlook.

In terms of benzene, new production capacity has been continuously put into the market recently, although most of them are equipped with downstream styrene and phenolone production, but they are still relatively difficult to be fully digested. A longer supply is certain. So benzene industry chain is under pressure as a whole.

More..

Heimtextil-2023 – Bioplastics – CPL

Hydrogen – PVC – rPET – Recycling 08-12-2022