Industry chain profit reallocation PX PTA strong - Arhive

Industry chain profit re-allocation; PX-PTA to remain strong

SOURCE :![]()

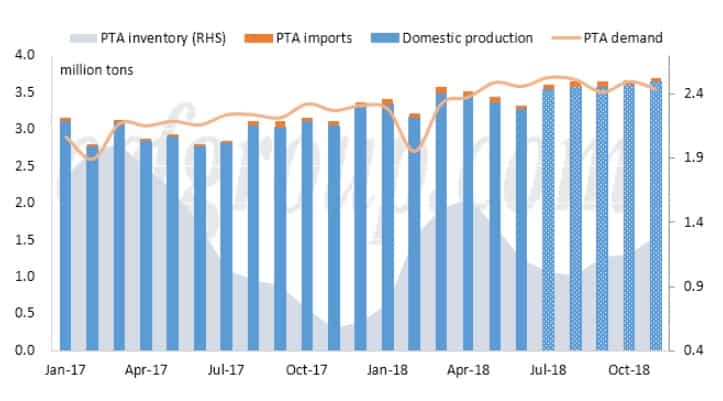

PTA supply and demand structure may change under high PTA-PX spread.

PTA supply and demand structure may change under high PTA-PX spread.

With the sharp increase in PTA price, the PTA-PX spread has expanded to more than 2,000yuan/mt. Some small units that have been shut for long time are scheduled to restart such as Fujian Jialong and Yangzi Petrochemical.

In addition, some PTA producers have delayed the turnaround plans. In the case of shortage of domestic supply, the PTA imports from Taiwan and South Korea during July and September have increased. Therefore, the short-term PTA supply is expected to be revised up somewhat.Industry chain profit reallocation PX PTA strong

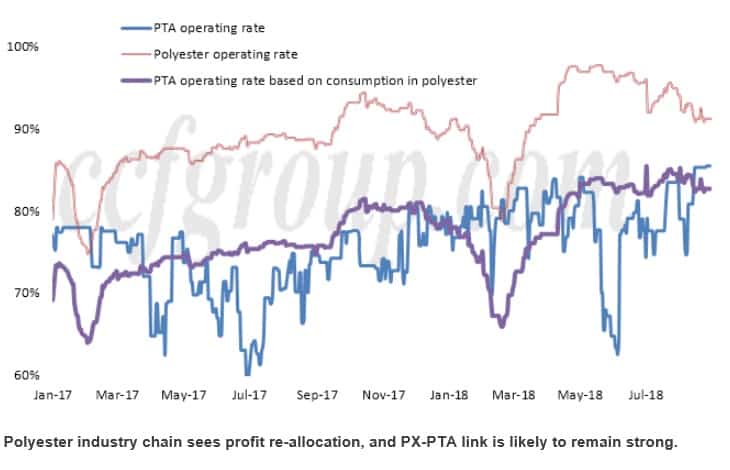

Under high costs and reduced profit, PET fiber chip, polyester staple fiber and some bottle chip plants have cut production since August and the polymerization rate has fallen to around 91% as of last Friday.Industry chain profit reallocation PX PTA strong

In September, some PET bottle chip plants may continue to lower the operating rate. Therefore, the monthly average polymerization rate in September is revised down to around 90%. The support of downstream demand for PTA is expected to weaken.

On the whole, the PTA supply and demand structure change may appear around September, ahead of the previous forecast(October-November), and the inventory may increase in the fourth quarter.Industry chain profit reallocation PX PTA strong

According to short-term data, after the restart of Hengli’s PTA unit in mid-August, PTA-polyester supply/demand balance appeared to loosen. Coupled with the demand from non-polyester fields, PTA supply and demand are basically in balance in mid-to-late August.

Profit re-allocation is driven by sharp increase in PTA futures and spots since July. The rise in PTA spots has directly squeezed the profitability of polyester products which were lucrative before. As of now, profits of polyester products, except for POY, are at break-even level or negative territory.Industry chain profit reallocation PX PTA strong

The reduction of profits is the major cause to PET fiber chip, PSF and PET bottle chip plants’ curbing production and cutting operating rates since August.

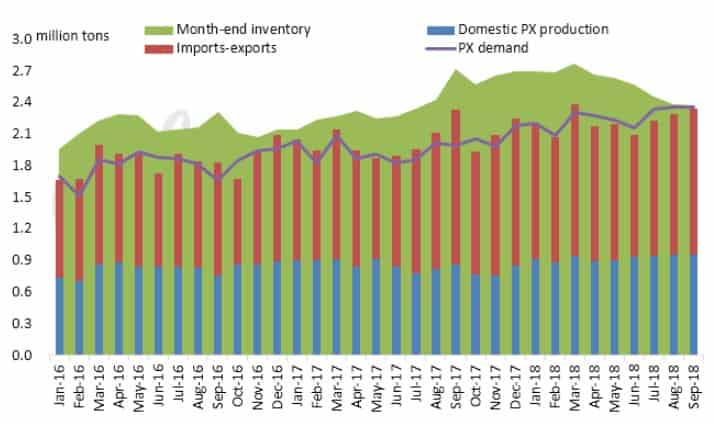

It is widely expected that the profits in polyester industry chain will move from polyester to PTA link in the future. However, CCFGroup believes that the advancing momentum for PTA-PX spread may weaken around the fourth quarter, but PX-naphtha spread is more likely to widen.Industry chain profit reallocation PX PTA strong

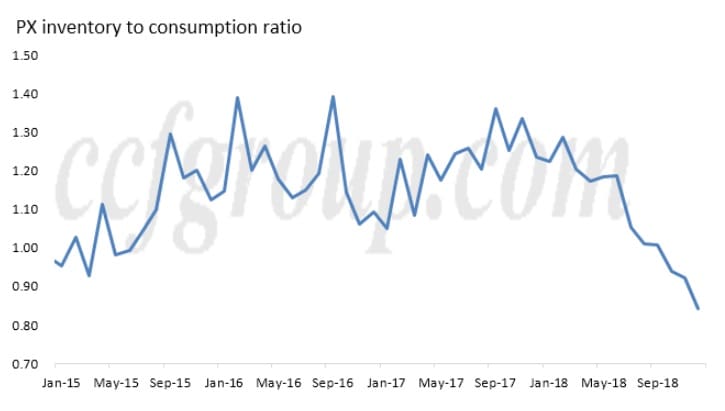

First of all, from the perspective of supply and demand in the future, the PTA supply-demand structure change may come earlier than previously forecast as we analyzed above and PTA stock may increase in the fourth quarter. In terms of PX, demand is healthy because of high operating rates of polyester and PTA plants. In addition, domestic PX production and imports will not grow fast in near term. Therefore, PX stock may decrease persistently in the next few months, which is similar to the situation of PTA stock reduction in May-August.Industry chain profit reallocation PX PTA strong

Secondly, demand will affect PTA and PX. Demand for PTA may weaken with polyester plants cutting operating rates in Oct, as PTA spot price has been rising too fast.

Although polymerization rate has dropped from 96% to 91%, it does not have the slightest negative impact on the bullish PTA.Industry chain profit reallocation PX PTA strong

In October, however, the supportive factors to PTA may wane, and a second round of drop in polymerization rate could impact capital availability and subdue PTA market.

In terms of PX, concerns on demand is relatively moderate, as PTA supply expectation is good in the next few months. Attention should be paid to the restarts of Fuhaichuang’s PX and PTA plants.Industry chain profit reallocation PX PTA strong

In a conclusion, PX-naphtha and PTA-PX spreads are expected to sustain high, while the profits of polyester will undoubtedly get squeezed and profits of the industry chain will move upstream.Industry chain profit reallocation PX PTA strong

Separately, PX-naphtha spread could get enlarged in the future, but PTA-PX spread will lose momentum as soon as supply-demand structure alters. Yet it is too early to go short on PTA as supply is currently tight.