PET bottle chip process - Arhive

PET bottle chip detailed developing process: from excessive profit to loss PET bottle chip process

Source : CCFGroup

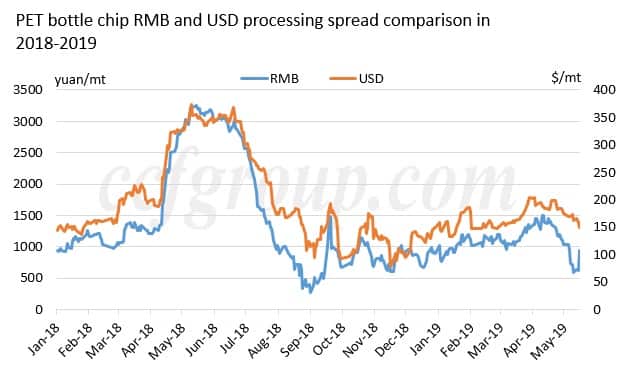

PET bottle chip spot value has created new low in 2019, and still has sign of declining. Cash flow once squeezed to negative. Feedstock plunge is a major donor to price fall, while slacker demand in and abroad is the deep roots for the squeezed profit. PET bottle chip process

We shall recognize the fact that overseas supply shortage has turned to supply surplus, because the closed units gradually resumed working, and the restart of long-term shut plants plus new capacity also functioned on supply.

EU and Middle East markets are the most affected, while the specific data needs to be confirmed by the data released by the Customs later on.

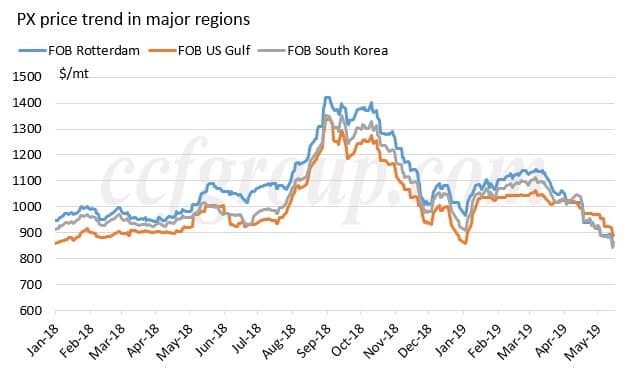

China PET resin exports to EU market grew quite fast in past two years. But since the beginning of 2019, EU local raw materials price was once $200/mt cheaper than China level (which typically hovers around $150/mt), and Asian PX price was relatively high. Apart from that, South Korea-EU’s zero tariff policy and low-pricing promotion of newly online capacity in Middle East are both eating up China’s share. Flanked by above competitors, it’s barely possible for Chinese producers to open up the market.

Middle East: since EIPET based in Egypt successfully restarted and Indian PET bottle chip producers further strengthened their exports, most demand in Middle East was locked by them, which also to some degree lowered price to EU and Africa market. After China price hike post Spring Festival holiday, some of China’s market share was taken, which may challenge future order intake.

Why did large overseas plants and China downstream build stock in advance since Q4 2018? PET bottle chip process

H1 2019 demand was largely digested in last Q4 and Q1 2019. On one side, PET bottle chip price was volatile in 2018, hence some downstream plants that make budget ahead of time have to choose whether to secure delivery in prior or to preserve profits first. Thus, with China materials way cheaper than other regions, overseas order boomed, with Nov export order intake even hitting 400kt high. Meanwhile, large downstream plants in China also restocked PET bottle chip to guarantee peak season delivery.

On the other side, most contracts are implemented from H2 2018 to H1 2019, which means summer delivery is not completely guaranteed, while feedstock market has seen violent fluctuations in Q3 in recent two years. Therefore, despite slack order intake in Q2, still a spate of downstream plants are negotiating forward deals during the downturn, primarily preparing for Q3-Q4 delivery.

For trader part, the frequent and volatile price trend is unfavorable for them to gain profit. Many traders were trapped on the top of the mountain as they built stock end Mar-early Apr when price increased. Some were conscious of selling part of the goods in advance, but didn’t win the market. A number of traders suffered severe loss recently. Of course, some traders that bore larger pressure or continuously held bearish views need to sell short for a while. It’s heard that one trader’s stock in hand could be comparable to over half month stock of a large PET producer.

Actual profit of PET bottle chip producers is tolerable as a whole, since orders are taken in ahead of time and RMB is depreciating recently. But new order intake remains a problem to be tackled with. Downstream bid constantly declines, not only RMB price for forward goods breaches below 7000yuan/mt but also export bidding level is heard at $950-980/mt FOB.PET bottle chip process

If China PET bottle chip price doesn’t regain advantage and feedstock uncertainty increases further, PET bottle chip traders may face worse situation. Output cut and closure news may increase later.