Petrochemicals Biomaterials Polyethylene 04-08-2021 - Arhive

Petrochemicals Biomaterials Polyethylene

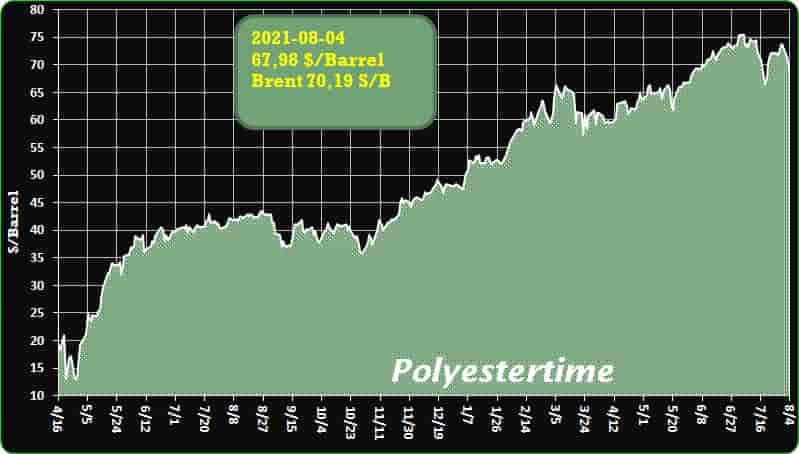

Crude Oil Prices Trend

-Erema Group joins Chemical Recycling Europe

The Austrian machine and plant manufacturer has been committed to better networking and intensive cooperation in the plastics industry for many years.

In order to achieve the European Union’s targets for plastics recycling and the use of recyclates, the technical possibilities of mechanical recycling must be 100 percent exploited through the expansion of the corresponding collection, sorting and recycling infrastructure as well as through the further development of technologies and end applications. For material flows in which this recycling route is reaching its limits, it is important to establish and use additional processes. Chemical recycling could become a useful addition to recycling a maximum of plastic waste overall, the Erema Group justifies joining the Chemical Recycling Europe association.

“In many cases, mechanical processes are at the beginning of the process chain for chemical recycling in order to process input flows and ensure a reliable, continuous and energy-efficient material supply,”

-PepsiCo backs recycling push in Latin America

Beverage maker’s Latin American president says plastic recycling is a priority in the region.

United States-based PepsiCo is paying attention to and investing in recycling in Latin America, according to an interview with the company’s regional president by Santiago, Chile-based business information service provider BNamericas.

In the online interview, Erick Scheel, president of PepsiCo Latin America Beverages, says his organization is “incorporating more recycled content, making our packaging recyclable, compostable or biodegradable and streamlining packaging material” in Central and South America.

The BNamericas article notes that Chile has become the first country in the region to pass an extended producer responsibility (EPR) law that extends to several different types of packaging. Scheel adds that in addition to its plastic recycling efforts, PepsiCo is examining plastic and glass reusable container options.

Scheel does not identify aluminum as a reason, but also tells BNamericas, “In Latin America Beverages, 93 percent of the materials we use in our packaging are recyclable, and we continue working on solutions for the 7 percent that is not. By 2025, 100 percent of our packaging will be recyclable. We are also incorporating more recycled polyethylene terephthalate (rPET) content into our bottles across the portfolio.”

Italy’s Eni raised its near-term oil price outlook July 30 as the market rebound fueled strong second quarter earnings despite lower production volumes and negative refining margins, reported S&P Global.

Eni said it is now assuming a near-term Brent price of USD65/b, up from USD60/b previously, to reflect a firming oil market scenario which helped its adjusted earnings more than treble from the previous quarter.

Hydrocarbon production in the second quarter slipped 5% on the year to average 1.6 million boe/d due to higher maintenance activity in Norway, Italy and the UK, lower activity in Nigeria and mature fields declines. In the first half, start-ups and ramp-ups added 50,000 boe/d mainly due to the Merakes gas field in Indonesia, Berkine in Algeria, Agogo in Angola, and the Mahani gas project in the UAE’s Sharjah Emirate.

It reiterated plans to keep output stable at 1.7 million boe/d for this year as a whole, with production in the current quarter expected to average 1.68 million b/d.

“Eni delivered exceptional results in the second quarter of the year, continuing the upward trend of the last three quarters and beating market expectations across all of its business segments with an improved macro backdrop and energy market fundamentals,” CEO Claudio Descalzi said.

-Who’s in trouble, the US dollar or emerging economies?

Fed’s upcoming moves and success against the virus will determine the answer

The U.S. dollar has surged on the country’s steep economic rebound, in a trend that threatens emerging economies struggling with the resurgent COVID-19 pandemic.

The theoretical value of the dollar noticeably fell after the U.S. government began to write checks to help Americans through the pandemic, causing its debt to swell. But the market changed direction earlier this year.

The U.S. economy, as measured by gross domestic product, expanded at an annualized rate of 6.5% in the April-June period from the preceding quarter. The fast pace came thanks to sharp increases in personal consumption and private-sector capital spending, which bounced back to pre-pandemic levels. Although the risk of another COVID-19 wave remains, economic barometers are generally solid. It now takes about 109 yen to buy a dollar, up from the 103-yen level at the start of this year.

The U.S. Federal Reserve’s upcoming moves will greatly affect the dollar’s outlook. The Federal Open Market Committee expects interest rates to begin rising in 2023 rather than in or after 2024 as earlier forecast.

-Chemical recycling – snapshot of a technology everybody talks about

Chemical recycling is also an option for bio-based plastic

Chemical recycling has gained increased attention as a promising recovery technology, especially for post-consumer plastic waste. It is seen as a complementary solution to mechanical recycling, being better suited for difficult to recycle plastics like multi-layer solutions or heavily contaminated plastics. Yet, its availability at commercial scale is currently still limited, and a legislative framework at European level still needs to be established.

The term chemical recycling, also known as feedstock or tertiary recycling, comprises different varying technologies that convert plastic waste into an upstream feedstock resulting in secondary raw materials that have the same quality as virgin materials. This recovery technologies provide an opportunity for plastic waste streams that generally are not mechanically (or otherwise) recycled. In this way, waste is directed away from landfill or energy recovery towards higher quality recycling. However, chemical recycling is still facing economic and technical challenges, which have an effect on their potential for commercial development in Europe.

-Spandex market expected to sustain strong in August

Price of spandex was till under uptrend. The price increment of spandex 20D-40D was at 50,000-69,000yuan/mt or 178%-206% since late-Aug, 2020. Current spandex price has been the highest level since Apr 2008. May-Jul are traditional slack season on spandex market, while downstream demand for spandex was hot this year. The production of some autumn and winter fabrics has been ahead of schedule. Price of spandex 40D increased by 14,000yuan/mt with tight supply.

Most spandex producers and dealers saw low inventory. How will spandex market fare in Aug as spandex price has surged to high level?

Rising production of spandex will mainly come from the release of new capacity in Aug. Huahai’s 30kt/year new unit that started operation in Jul saw gradually ascending run rate. Huafon Chongqing’s 50kt/year spandex unit is expected to commission production in end-Aug. There are some points to be concerned: The engineering connection of old units and new units and the influence on the operating rate of spandex plants, as well as the progress of new units.

PE market is volatile recently, with a period of continuous rise, and then an endless decline at the end of this month. Downstream buying interest is not high, and most of them purchase to cover their rigid demand. Some are resistant to the current high prices, and some are cautious about the current market and uncertain prospects. The upward trend of LLDPE futures has been hindered to some extent, some of which have been suppressed by the collapse of crude oil and the concentrated outbreak of negative sentiment in the entire international financial market, but it is more dragged down by spot demand. Of course, although spot prices cannot go up, it seems that the downward space is limited, which is mainly supported by the cost side. The prices of crude oil and ethylene are still high and supply is tight. PE, as its downstream products, has been obviously supported.

From the perspective of the market and transactions, when futures prices fall, spot price is still strong, petrochemical plants keep their price firm and downstream buying intention would be promoted; and when futures rise, the rising trend of spot prices is not as obvious as futures, and downstream prefer procure at need-to-basis.

-ProAmpac buys Ireland-based packaging supplier Euroflex

The deal helps ProAmpac serve a growing base of multinational customers.

In a move that aims to expand its customer base in Europe, flexible packaging maker ProAmpac has acquired Euroflex, a family-owned business based in Ireland that produces a broad portfolio of flexible printed film, lamination, and pouching packaging solutions.

The financial terms of the deal have not been disclosed.

The move helps ProAmpac serve “a growing base of multinational customers,” the Cincinnati-based company said in a July 27 news release.

-Evonik Acquires Biomaterials Company JeNaCell

The startup’s biomaterials are used in medical procedures involving wounds and burns as well as in hydro-active skincare treatments.

vonik announced today that it has acquired German biotech company JeNaCell, expanding its biomaterials portfolio with the startup’s biotechnologically derived cellulose. JeNaCell’s biomaterial is used in medical procedures involving wounds and burns as well as in hydro-active skincare treatments.

Evonik first invested in JeNaCell in 2015 through its venture capital arm. With this acquisition, JeNaCell’s portfolio will be integrated into Evonik’s healthcare business, which is shifting from a nutrition and care focus toward system solutions and an expanded division-wide technology platform of natural materials for medical technology. Evonik plans to increase the share of system solutions in its Nutrition & Care division from the current 20% to more than 50% by 2030.

-Indian conglomerate Adani Group to diversify into petrochemicals

India’s Adani Enterprises Ltd has incorporated a wholly-owned petrochemicals subsidiary to mark its foray into the business.

The subsidiary called Adani Petrochemicals Ltd (APL) will “carry on business of setting up refineries, petrochemicals complexes, specialty chemicals units, hydrogen and related chemical plants and other such similar units,” Adani in a regulatory filing to the Bombay Stock Exchange (BSE) over the weekend.

APL has yet to become operational.

In January 2019, Adani had signed an agreement with German chemical company BASF to set up a chemical complex at Mundra in western Gujarat state.

In October 2019, the deal was expanded to include UAE’s Abu Dhabi National Oil Company (ADNOC) and Austria’s Borealis.

Total investment for the planned chemical complex was estimated at around $4bn.

Petrochemicals Biomaterials Polyethylene