Polymer prices rise despite plastic ban domestic demand - Arhive

Polymer prices rise by 13% despite plastic ban, hit domestic demand Polymer prices rise despite plastic ban domestic demand

Prices of plastic raw materials are linked with crude oil price variations in the global markets

Dilip Kumar Jha | Mumbai

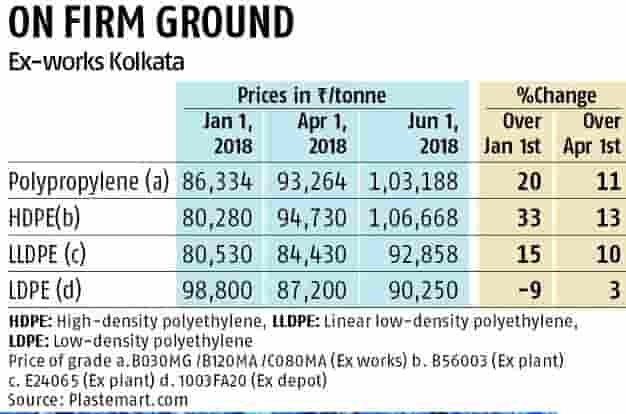

Data compiled by plastemart.com showed, prices of the benchmark B56003 grade high density polyethylene (HDPE) jumped by 13 per cent to Rs Rs 106,668 a tonne for delivery in Kolkata compared to Rs 94730 a tonne effective June 1. Trade sources said that the major polymer producers have raised their product prices further by Rs 1000-1500 a tonne effective July 1.

Prices of plastic raw materials are linked with crude oil price variations in the global markets. Rising polymer prices, following crude oil price rise, have reduced its demand from domestic-centric plastic industry despite export centric value added plastic manufacturers continued to perform well. Demand of polymer products was also hit because of ban on certain grade of plastics in major consuming states like Maharashtra. Apart from Maharashtra, six other states including Karnataka have banned manufacturer, distribute, sale and use of low grade of plastics.

“Polymer prices have jumped in the domestic markets due to a sharp increase in crude oil prices. While polymer demand has been impacted a bit due to plastic ban in Maharashtra and other states, its consumption continues from export oriented plastic industries of value added products,” said Pradip Thakkar, Vice Chairman of Mechemco Industries, one of India’s largest producers and exporters of value added plastic products.Polymer prices rise despite plastic ban domestic demand

While comparing polymer prices from January 1, HDPE prices have surged phenomenally by upto 36 per cent. Prices of other varieties of polymers including polypropylene, low density polyethylene (LDPE), linear low density polyethylene (LLDPE) and polyvinyl chloride (PVC) have also risen albeit slower that HDPE so far this financial and calendar years.Polymer prices rise despite plastic ban domestic demand

According to The Plastics Export Promotion Council (Plexconcil) data, India’s export of plastics products posted a growth of 17.1 per cent at $8.8 billion during the financial year 2017-18 as against $7.56 billion in 2016-17, registering a faster pace of growth than the overall merchandise export growth from India. The merchandise exports from India touched $303.3 billion, registering a growth of 9.9 per cent in 2017-18 (provisional) vis-a-vis $275.9 billion in 2016-17.Polymer prices rise despite plastic ban domestic demand

“India’s plastics exports during the year were primarily boosted by higher shipment of plastic raw materials and value-added plastic products including Woven sacks/FIBC, Plastic sheets/films/plates, Optical items, Laminates, Packaging items, and Medical disposables to the European Union, North America, Latin America & Caribbean, and North-East Asia. India’s plastic product exports to the United States were valued at US$ 1.11 billion during the year,” said A K Basak, Chairman, Plexconcil.

United States, China and the United Arab Emirates (UAE) were top-3 destinations for India’s plastic products during 2017-18. These three countries accounted for 25.7 per cent of India’s plastic product exports, by value. Indian exporters are now targeting to achieve the US$ 1 billion export mark to the United States in FY18. Plastics contribute 2.92 per cent in overall merchandise exports from India.Polymer prices rise despite plastic ban domestic demand

Meanwhile, polymer prices are likely to remain firm in near future also on expectations of an upsurge in crude oil prices and firm demand from user industries.

“Banned products contribute less than 5 per cent of the entire plastic industry in India. Demand for other than banned products has been increasing consistently over the last several years. For banned products also, the government must focus on irresponsible disposal of used plastics instead of a blanket ban on certain grades of plastic products,” said Thakkar.

Crude oil prices, however, have jumped by 10 per cent and 14 per cent this financial and calendar year respectively to trade currently at $78.04 a bbl.