Recycling – Polyester – CO2 31-08-2022 - Arhive

Recycling – Polyester – CO2

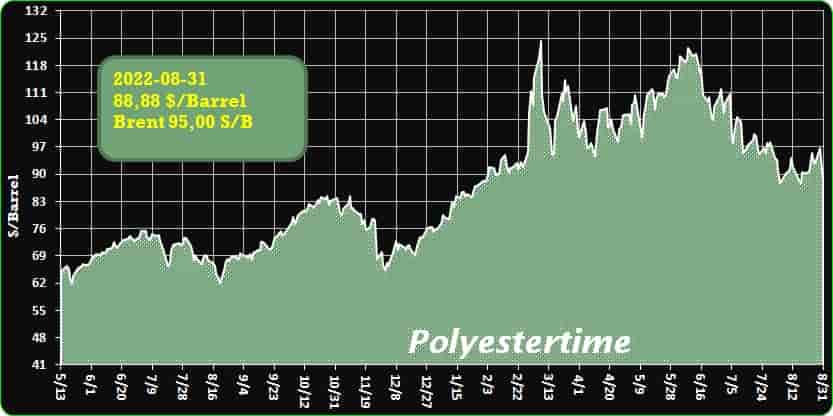

Crude Oil Prices Trend

-Reliance announces massive investment in yarn and fibre; to double PET recycling

India’s corporate giant, and raw material to retail company, Reliance Industries Ltd.is all set to invest Rs. 75,000 crore in the next five years to expand petrochemical capacity.

The investments, notably, will be utilised to set up a PTA plant, and expand polyester capacity.

Speaking at the company’s annual general meeting (AGM), Mukesh Ambani, Chairman, RIL, also informed about tripling the capacity of vinyl chain and a chemical unit in UAE.

He said that “in the polyester value chain, we will build one of the world’s largest single-train PTA plant of 3 MMTPA capacity at Dahej. We will also invest in a 1 MMTPA PET plant at Dahej.”

Both PTA and PET will be targeted for completion by 2026.

“We will also reinvest in Polyester Filament Yarn (PFY) and Polyester Staple Fibre (PSF). Polyester expansion with capacity of over 1 MMTPA will be completed in phases by 2026,” he said. Recycling – Polyester – CO2

He also highlighted the sustainability focus of the RIL and said that Reliance has championed the cause of sustainability through circular economy and is India’s leader in recycling of polyesters and plastics, adding “We will strengthen our leadership position in PET recycling by more than doubling our bottle recycling capacity to 5 billion bottles a year.”

Isha Ambani, Leader of Reliance Retail business, informed that the company’s fashion and lifestyle business has the widest physical reach with nearly 4,000 stores in over 1,000 towns.

“Last year, we sold over 43 crore garments, which is enough to clothe the entire population of the US and Canada. We further strengthened our product portfolio by entering categories such as lingerie, saree and home furnishing, and have quickly scaled to establish significant positions in each of them. Our strong design and sourcing ecosystem has enabled us to grow our own brands across apparel and footwear. Our own brands contribute to over 65 per cent of overall revenues,” she said.

AJIO, integrated omni channel platform of the company, is one of the most loved fashion destinations, with 80 per cent of purchases from repeat customers. AJIO Business, Reliance’s new commerce initiative, works with merchant partners across 3,500 towns, giving them access to a collection of over 8,000 regional and national brands and a wide portfolio of our own brands.

-Guenther Klammer new CTO of Next Generation Recyclingmaschinen GmbH (NGR)

As of August 16, 2022, Dipl.-Ing Guenther Klammer is responsible for the research and technical developments of Next Generation Recyclingmaschinen GmbH as the new technical manager (CTO). With this reinforcement in the management, the team of plastics recycling machine specialists will ensure the technical progress of products and services also in the future and further expand their position as a technological pioneer.

Guenther Klammer studied general mechanical engineering at the TU Wien. For the new position at NGR, he brings his profound technical expertise as well as many years of industry experience in plastics recycling. “Implementing innovative and sustainable solutions in plastics recycling is my passion, and I am looking forward to the new tasks at NGR,” says Klammer, who intends to continue driving the Feldkirchen-based mechanical engineering company’s growth course at the highest technical level.

Professionally, the creative tinkerer with management expertise has worked at Cincinnati Milacron, Erema, and as CEO of MAS Maschinen- und Anlagenbau Schulz GmbH, among others. Most recently, he headed the Plasticising Systems & Recycling division at Engel Austria GmbH and was responsible for numerous patent applications during his career. In his private life, the enthusiastic mountain and water sportsman is the father of three grown-up children. Recycling – Polyester – CO2

“In recent years, NGR has made a steady progress from a start-up to an internationally successful machine builder, not least due to technically innovative products,” explains Josef Hochreiter, CEO of the Next Generation Group. “But we certainly don’t want to rest on this success. Because the requirements in plastics recycling are becoming more and more complex worldwide. In order to meet precisely these increased requirements and to continue to offer one step ahead solutions, we have once again strengthened our forces.”

-To remove CO2 from the atmosphere, imagine the possibilities

(Nanowerk News) In an effort to reduce the risks from climate change, NIST scientists have set out to discover new materials that can draw planet-warming carbon dioxide (CO2) out of the atmosphere, a technique called “direct air capture.”

Direct air capture materials already exist, but they either cost too much money or consume too much energy to be deployed on a global scale. NIST scientists are using computer simulations to rapidly screen hypothetical materials that have never been synthesized but that might have just the right physical properties to make this technology scalable. Recycling – Polyester – CO2

“The traditional way of screening materials is to synthesize them, then test them in the lab, but that is very slow going,” said NIST chemical engineer Vincent Shen. “Computer simulations speed up the discovery process immensely.”

Shen and his colleagues are also developing new computational methods that will accelerate the search even more.

“Our goal is to develop more efficient modeling methods that extract as much information out of a simulation as possible,” Shen said. “By sharing those methods, we hope to speed up the computational discovery process for all researchers who work in this field.

Direct air capture is important because humanity has already profoundly altered Earth’s atmosphere — one third of all the CO2 in the air got there as a result of human activity. “Carbon capture is a way to reverse some of those emissions and help the economy become carbon neutral more quickly,” said NIST chemist Pamela Chu, who leads the agency’s recently launched carbon capture initiative.

Once CO2 is captured, it can be used to manufacture plastics and carbon fibers or combined with hydrogen to produce synthetic fuels. These uses require energy but can be carbon neutral if powered by renewables. Where renewable energy isn’t available, the CO2 can be injected into deep geological formations with the goal of keeping it trapped underground. Recycling – Polyester – CO2

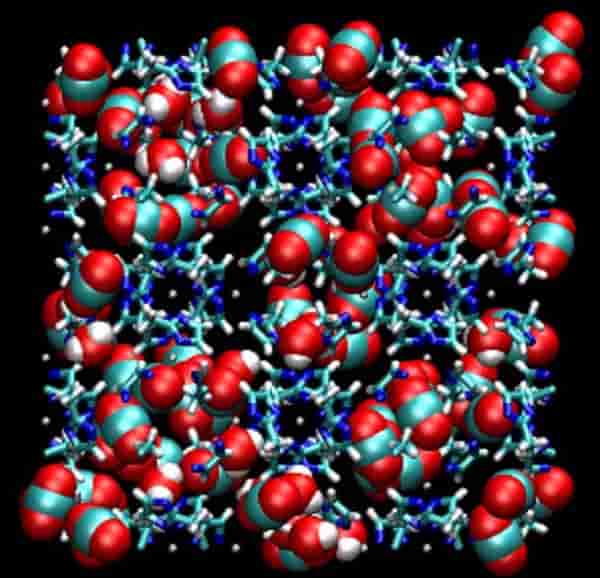

NIST scientists use computer simulations that calculate a potential capture material’s affinity for CO2 relative to other gases in the atmosphere. That allows them to predict how well the capture material will perform. The simulations also generate images that show how carbon capture works on a molecular scale.

Porous crystalline materials show particular promise for capturing CO2. These materials are made up of atoms arranged in a repeating three-dimensional pattern that leaves voids between them. In this conceptual illustration, the gray bars represent a crystalline material, and the red spheres are the voids.

-Nylon value chain may remain positive in coming months

Nylon value chain is expected to remain positive in the coming months as the upstream products may bottom out very soon. Plant closures for maintenance will also support the entire value chain. However, demand trend is very crucial as this juncture as raw materials and nylon yarn have noted downward in recent past due to poor demand and easy availability. Recycling – Polyester – CO2

According to Fibre2Fashion’s market insight tool TexPro, nylon chips (imported HS chip) is currently priced at $2252.16 per ton in Asian market which can improve to $2308.46 per ton. It may further go up to $2336.62 per ton in October 2022. Nylon filament yarn (FDY 70D/24F) may touch $2.73 per kg in Asian market. The price is ruling at $2.68 per ton in this month and it may reach $2.72 per kg.

As per market information from TexPro, the prices of caprolactam, a raw material of nylon, are likely to bottom out in the coming weeks as Ube Industries is set to shut plant for maintenance in mid-September. Another company, Hubei Sanning Chemical, has already shut its plant in the beginning of this month. Both companies are the major producer of the raw material. Caprolactam noted downward trend in last fortnight and was quoted at $1,760-1,770 per ton in Asian market.

Benzene prices decreased on the back of dull buying sentiments during the last fortnight. A fall in downstream SM rates further pressured prices down in Asia. Benzene prices in Korea were quoted $990-1,000 per ton during the last fortnight.

In Southeast Asia, nylon chips prices fell due to sluggish demand and lower upstream energy value during the last fortnight. The prices were noted between $2,220-2,230 per ton in Southeast Asia. “Nylon chips may continue downward trend in short term,” according to TexPro. Recycling – Polyester – CO2

-New setup for Schur Flexibles

Green light from the EU antitrust for the transfer of control of the Austrian manufacturer of flexible packaging to the private equity firm Apollo Capital Management.

The European Commission has given the green light to the proposed acquisition of Schur Flexibles by a consortium led by the private equity firm Apollo Capital Management.

The Austrian flexible packaging manufacturer had returned to Austrian hands last year following the acquisition of a majority stake in Lindsay Goldberg’s stake by the Austrian holding company B&C Group (see article). Recycling – Polyester – CO2

Based in Wiener Neudorf, Austria, Schur Flexibles Group specializes in the production of flexible high barrier packaging for the food, pharmaceutical and ‘aroma protection’ industries, operating in an integrated cycle from extrusion to converting. With a turnover of around 540 million euros (2020), it employs 2,200 people in 23 plants in eleven European countries, including Italy, where last year it took over the company Sidac, active in the production of flexible packaging and labels. , with headquarters and factory in Forlì (read article).

The company recently completed a debt refinancing and recapitalization operation for a total of € 150 million underwritten by banks and investors, including Apollo Capital Management, Capital Four, Guggenheim and Palmer Square.

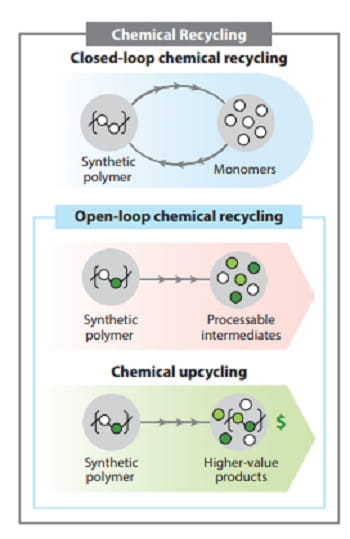

-The critical role of process analysis in chemical recycling and upcycling of waste plastics

There is an urgent need for new technologies to enable circularity for synthetic polymers, spurred by the accumulation of waste plastics in landfills and the environment and the contributions of plastics manufacturing to climate change.

Chemical recycling is a promising means to convert waste plastics into molecular intermediates that can be remanufactured into new products.

Given the growing interest in the development of new chemical recycling approaches, it is critical to evaluate the economics, energy use, greenhouse gas emissions, and other lifecycle inventory metrics for emerging processes, relative to the incumbent, linear manufacturing practices employed today. Recycling – Polyester – CO2

Here we offer specific definitions for classes of chemical recycling and upcycling and describe general process concepts for the chemical recycling of mixed plastics waste. We present a framework for techno-economic analysis and life cycle assessment for both closed- and open-loop chemical recycling. Rigorous application of these process analysis tools will be required to enable impactful solutions for the plastics waste problem.

Abstract

There is an urgent need for new technologies to enable circularity for syn[1]thetic polymers, spurred by the accumulation of waste plastics in landfills and the environment and the contributions of plastics manufacturing to climate change.

Chemical recycling is a promising means to convert waste plastics into molecular intermediates that can be remanufactured into new products.

Given the growing interest in the development of new chemical recycling approaches, it is critical to evaluate the economics, energy use, greenhouse gas emissions, and other life cycle inventory metrics for emerging processes relative to the incumbent, linear manufacturing practices employed today. Here we offer specific definitions for classes of chemical recycling and upcycling and describe general process concepts for the chemical recycling of mixed plastics waste. We present a framework for techno-economic analysis and life cycle assessment for both closed- and open-loop chemical recycling.

Rigorous application of these process analysis tools will be required to enable impactful solutions for the plastics waste problem. Recycling – Polyester – CO2

-India’s Polyester yarn market revenue to grow 20 per cent this fiscal

Healthy demand from end user industries, and increased blending with cotton yarn due to decadal high prices of cotton, will drive revenue growth of 18-20 per cent this fiscal for polyester yarn manufacturing sector, according to capital market company CRISIL.

Operating profitability of polyester yarn segment is also expected to increase by 100 basis points to about 11 per cent this fiscal, driven by continued high-capacity utilisation (over 90 per cent) due to demand growth and healthy polyester yarn spread (difference between prices of polyester yarn and its raw materials).

Better profitability and expected modest capital spending will improve credit profiles of polyester yarn manufacturers, shows an analysis of 24 players that account for about 40 per cent of the sector’s revenues. Recycling – Polyester – CO2

Polyester yarn is used mostly in athletic and leisure wear, home textiles and garments. Recovery in demand from these end-user segments and multiple price hikes had led to a revenue growth of 60 per cent last fiscal, though on a low base, with sales volume picking up 15 per cent. Demand is seen to remain healthy this fiscal too, with garments and home textiles segments expected to grow at 16-18 per cent and 12-13 per cent in fiscal 2023 respectively, driven by recovery in domestic demand and moderate growth in exports, CRISIL said.

The continued wide price differential between cotton yarn and polyester yarn will result in higher blending among downstream players, further spurring demand for polyester yarn.

Gautam Shahi, director, CRISIL Ratings, said “Polyester yarn is cost effective to blend with cotton yarn, and since cotton yarn prices have risen by 25 per cent over the past year, higher blending has increased the demand for polyester yarn. With increased differential between cotton and polyester yarn prices to sustain, we expect 4-5 per cent of cotton yarn demand to shift to polyester yarn. This shift is expected to continue for most part of this fiscal as end user segments operate in a price competitive environment.”

Purified terephthalic acid (PTA) and mono-ethylene glycol (MEG), both crude derivatives, account for 80 per cent of raw material cost for polyester yarn manufacturers. Their prices have increased sharply due to supply chain issues arising from the Russia-Ukraine conflict.

However, buoyant demand and timely pass-through have supported the polyester yarn spreads vis-à-vis its key raw materials. The average spreads rose to a five-year high of ₹29 per kg last fiscal from ₹22 per kg in the previous fiscal and should sustain at ₹28-29 per kg this fiscal. Recycling – Polyester – CO2

-China’s LLDPE demand weakness continues as net import prospects weaken

So, let me arbitrarily start with the good news in the chart below. It is that the January-July data suggest full-year 2022 linear-low density polyethylene (LLDPE) demand growth in China will be no worse than what the January-June numbers indicated.

As with January-June, we look to be heading for a 4% decline in consumption (Scenario 2 in the above chart). This would leave the market at around 14.6m tonnes versus last year’s actual consumption of 15.2m tonnes.

As usual, I’ve provided you with two other scenarios. Scenario 1 assumes a strong recovery in demand over the remainder of this year, leaving demand at 14.9m tonnes, only 2% less than last year. Recycling – Polyester – CO2

For the sake of all out doom and gloom, Scenario 3 involves economic conditions getting worse. This would see demand fall by 6% to just 14.5m tonnes.

The bad news is that even with a decline of only 2%, this year would still be the second-worst year for growth since 2000. The worst year would be 2012 when demand fell by 3%.

You might argue that a cool-down in growth was inevitable in 2022 given that demand in 2020 grew by an eye-wateringly high 13% . But consider the chart below. Sorry for being maniacal about this, but spreads don’t lie.

Recycling – Polyester – CO2