Prices of five large-volume commodity resins generally were trending flat-to-down in April and into May and possibly this month—except for PET, which was on the way up in May. In the case of PET, higher crude-oil prices had driven PET feedstock prices up. As for the other four resin families, key drivers were improved supply; a drop in feedstock costs—dramatic in the case of ethylene; and, in some cases, domestic and export demand that didn’t meet expectations due to weather and other issues through much of the second quarter. Prices of PP could also buck the trend somewhat, as suppliers aimed for margin-expansion increases after a double-digit price decline.

Prices of five large-volume commodity resins generally were trending flat-to-down in April and into May and possibly this month—except for PET, which was on the way up in May. In the case of PET, higher crude-oil prices had driven PET feedstock prices up. As for the other four resin families, key drivers were improved supply; a drop in feedstock costs—dramatic in the case of ethylene; and, in some cases, domestic and export demand that didn’t meet expectations due to weather and other issues through much of the second quarter. Prices of PP could also buck the trend somewhat, as suppliers aimed for margin-expansion increases after a double-digit price decline.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; CEO Michael Greenberg of the Plastics Exchange in Chicago; and Houston-based PetroChemWire (PCW).

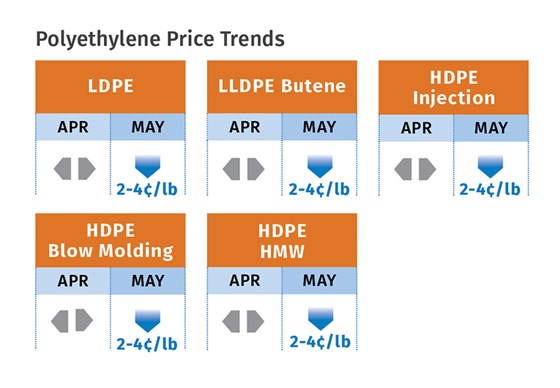

PE PRICES FLAT OR LOWER

Polyethylene prices were flat in April and were largely expected to remain flat or go lower. Suppliers pushed unsuccessfully to implement their March 3¢/lb price hike in April, with at least one delaying it to May 1, while there was market talk of lower prices last month. Mike Burns, RTi’s v.p. of client services for PE, ventured that May PE prices would likely drop 2-4¢/lb.

PCW reported PE spot prices as flat to lower and characterized supply as balanced for most grades, except for certain LDPE and HMWPE film resins. PCW also reported that domestic spot buyers were inactive, but that underlying dem and was good. The Plastics Exchange’s Greenberg put it this way: “Buyers were quiet, sensing no real threat of rising prices as suppliers pushed off their April increase, shedding doubt on any success in May.”

Both PCW and Burns noted that PE plants were operating at good rates—low 90% range—with inventories building as a result. “I don’t think a price hike can be achieved for the rest of the year, barring oil prices spiking significantly, meaning 10-15% or $7-10/bbl above current prices—or false demand in the third quarter due to pre-hurricane season, or actual hurricane-related production disruptions.” He also noted that there will be a noticeable improvement in resin availability beginning in the third quarter. “Most suppliers will have caught up from hurricane Harvey disruptions and post-hurricane unplanned outages.”

Oil prices, which have driven PE pricing trends, have increased 30% or $15/bbl in the past year. Natural gas prices were 10% lower during the same time period. Spot ethylene prices hit a new low of 13¢/lb by the end of April, after three straight weeks of prices near 10-year lows, according to Burns. Meanwhile, since July of last year, processors with contract negotiation opportunities saw their prices increase 5-7¢/lb, and for others, as much as 11¢/lb. Burns ventures that PE suppliers’ margins grew to about 30¢/lb as their costs didn’t go up.

PP PRICES BOTTOM OUT

Polypropylene prices in April generally were flat to down 1¢/lb in step with propylene monomer contracts. Though some industry sources reported a 1¢/lb margin expansion increase at some accounts, RTi’s v.p. of PP markets Scott Newell maintained that such occurrences were not widespread, and said he saw April PP prices dropping by 1¢ with the monomer in most cases.

PCW reported that spot PP prices were higher amid tight supply and healthy demand. Similarly, Greenberg reported high activity at the end of April, venturing that buyers were recognizing upward pressure on contract pricing and aimed to secure material beyond their current needs. All three sources reported that spot monomer prices began to move up due to planned and unplanned outages that have kept supply snug. Newell ventured that May monomer contracts had the potential to settle 1-2¢/lb higher.

For PP, Greenberg said some of the 3-5¢/lb margin-expansion increase will likely take hold in the second quarter, despite a steady flow of fresh offers on the spot market. Newell ventured that in addition to the potential monomer increase, PP suppliers could get a 1-2¢ margin expansion in May. “When I look at the PP market fundamentals, I don’t see the market supporting an increase. So far this year, demand as been flat to slightly down. In fact, we have had an eight-month run of below-average demand.” While he expected fairly decent demand for May, Newell rejected industry reports that the market is very snug: “The market is not loose but it’s not too tight either—and the numbers simply do not show the purported tightness.” Plant operating rates in first quarter were only 84-85%, yet there was a supplier inventory buildup of 70 million lb. PP imports have been above average since Hurricane Harvey, which accounts for a piece of the lost domestic demand. Newell saw about 1.2% negative domestic growth in the first quarter. He noted that supplier inventories are a well-balanced 31.3 days.

PS PRICES DOWN

Polystyrene prices were flat in April and several suppliers notified customers of 2-4¢/lb decreases for May 1, according to RTi’s Kallman. Both Kallman and PCW attribute the downward trend to a couple of key drivers. First, feedstock prices had dropped significantly—on the order of 6¢/lb. Benzene contract prices dropped from a peak of $3.30/gal in December to $2.93/gal in May. Ethylene spot prices plummeted from around 27¢/lb in early January to 13¢/lb in the last week of April. Late-settling ethylene contracts were expected to be down by 2¢/lb. And styrene monomer spot prices had returned to early January levels by May, according to PCW. Moreover, the strongest season for PS consumption saw weather-related delays while supply was well balanced. For this reason, Kallman ventured that PS prices this month, following the May decreases, were likely to be flat, and suppliers need to share more of the lower feedstock costs with the market.

PVC PRICES DOWN TO FLAT

PVC prices were reported by one industry index to have dropped by 2¢/lb in April—nixing out the March increase, though it appeared to be somewhat of a mixed bag, more like flat-to-down, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS and PVC.

Kallman predicted PVC prices in May would be flat-to down and to stabilize this month, as seasonal demand for PVC was expected to be robust. Both Kallman and PCW cited ample supply, lower feedstock costs, particularly ethylene, and a drop in exports through the second quarter for the soft pricing trend.

However, Kallman noted that PVC suppliers’ operating rates are up in the 90% range since March due to low feedstock costs and are expected to remain there, with both domestic and export demand strengthening.

PCW reported that pipe converters had supported both the February and March price hikes in the expectation that it would allow them to push up pipe prices. In contrast, those not in the pipe side of the business felt the March 2¢/lb increase should never have been implemented, as both ethylene prices and PVC export prices were dropping in March.

PET PRICES UP

PCW reported that domestic bottle-grade PET resin prices in April were steady at March levels of about 73¢/lb truckload and railcar delivered Midwest. At the same time, higher crude-oil prices in April pressured PET feedstock prices higher. This was expected to result in domestic PET prices rising 2-3¢/lb in May—especially for monthly contracts tied to average feedstock costs.

Meanwhile, U.S. PET import prices stood at 70-71¢/lb delivered duty-paid (DDP). These prices were also rising by the end of April, due to antidumping (AD) duties imposed on PET imports from Brazil, Indonesia, South Korea, Pakistan, and Taiwan—which accounted for about 40% of PET imports in 2017.

The U.S. Commerce Dept. announced on May 1 that it had imposed these AD “margin” rates as follows: Brazil, 24.09-226.91%; Indonesia, 13.16%; South Korea, 8.81-101.41%; Pakistan, 7.75%; Taiwan, 9.02-11.89%. Cash deposits equaling the assigned percentage of the value of a given load must be posted with U.S. Customs and Border Enforcement before being cleared for entry.

Related Topics

-Plastics plant is a $100 million headache for U.S., Texas companies – Plastics plant US Texas

-Financial woes endanger $1 billion plant – Mossi Ghisolfi dollars 1 billion plant

-Alpek cutting off M&G over unpaid bills – Alpek Mossi Ghisolfi

-M&G to cease production at US PET plant in W Virginia – Mossi Ghisolfi US PET West Virginia

–Contractor releases workers from M&G US PET project – Mossi Ghisolfi M G US PET project

-Alpek cutting off M&G over unpaid bills – Alpek Mossi Ghisolfi

-Shares in Mexico’s Alpek drop amid payment issues with client – Mexico Alpek Mossi Ghisolfi