Heat-resistant-PET-sheet 16-08-2022 - Arhive

Heat-resistant-PET-sheet

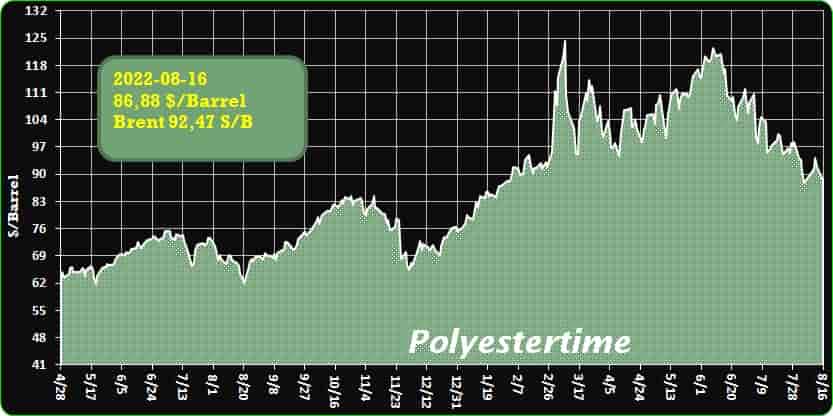

Crude Oil Prices Trend

-PetroChina, Sinopec to delist from NYSE

Five major Chinese companies including two of the country’s largest oil producers will delist from the New York Stock Exchange, said Ndtv.

Sinopec and PetroChina — two of the world’s biggest energy firms — will apply for “voluntary delisting” of their American depositary shares, the companies said in separate statements. The Aluminum Corporation of China, also known as Chalco, as well as China Life Insurance and a Shanghai-based Sinopec subsidiary, announced similar moves on Friday.

The delisting plans come as tensions between Beijing and Washington climb over US House Speaker Nancy Pelosi’s visit last week to Taiwan, which China claims as part of its territory. Beijing has raged against the visit, staging unprecedented military drills around the self-ruled island and suspending cooperation with the United States on issues ranging from climate change to fighting drug smugglers.

The five companies are on a list of firms published by the US Securities and Exchange Commission that faced delisting from Wall Street if they did not comply with new audit requirements. All five companies said in separate statements that they expected to stop trading on the NYSE by early September.

The new requirements came into effect late last year, at a time when Chinese authorities were expressing reservations about China-based companies listing in the United States. The five companies on Friday all pointed to the costs of maintaining the US listings as well as the burden of complying with reporting obligations as factors behind the decision.

China’s securities regulator on Friday said the moves were made by the companies “out of their own business considerations”. The delistings “will not affect the companies’ continued use of domestic and foreign capital markets for financing and development”, the regulator said in a statement.

Shortlisted in the ‘Recyclable Packaging’ category of our Sustainability Awards 2022, Starligner viscotec’s rPET100 sheet material is made from 100% recycled content and is fully recyclable itself while being heat-resistant up to 100 °C. We spoke to the company about the solution, which is aimed at enabling closed-loop recycling for thermoformed plastic packaging.

You’re a finalist in the Sustainability Awards 2022. Congratulations! To start off, could you summarise your entry, rPET100 sheet material, in less than 50 words?

rPET100 sheet material is the first packaging material which is made from 100% recycled content, 100% recyclable in food-grade quality, and heat-resistant up to 100 °C at the same time. This makes it the environmentally sustainable alternative to single-use cups, tubs, and trays made from polyolefins. Heat-resistant-PET-sheet

Why do you think the judges were impressed with your entry? Tell us about what is innovative about your project and/or about its impact on packaging sustainability.

The unique benefit of the packaging material is: it is designed for recycling, and it is made from recycled PET (rPET). New markets and new applications like dairy packaging can be served, thanks to the heat-resistant of the rPET100 material compared to amorphous rPET. rPET100 packaging solutions have an unbeatably small CO2 footprint since they can be recycled from cup to cup, or from tray to tray in a closed loop.

How has your innovation/initiative been received?

The new material got a lot of attention in the packaging industry as well as from recyclers and converters, not only in Europe but across the globe. It is attractive to produce rPET100 sheet material because production builds on existing recycling technology and the material is thermoformable in a single-stage process like conventional PET, polypropylene, or polystyrene. Heat-resistant-PET-sheet

-Oil giant Saudi Aramco: Company makes $700 million in profit every single day

The second most-valuable company in the world made an eye-watering $700 million in profit every single day as oil prices surged.

Oil giant Saudi Aramco made an astonishing $700 million in profit every single day, the biggest quarterly profit of any publicly listed company in history.

The Saudi Arabian petroleum and gas company reported an eye-watering $68 billion (US$48.4 billion) of profit in the second quarter of 2022.

Its earnings were boosted by surging demand as Covid-19 restrictions were dropped around the world — and pushed even higher by Russia’s invasion of Ukraine.

Net income leapt 90 per cent year-on-year for the world’s biggest oil producer, which clocked its second straight quarterly record after announcing $55.46 billion (US$39.5 billion) for Q1.

Aramco’s massive Q2 windfall was the biggest quarterly adjusted profit of any listed company worldwide, according to Bloomberg.

The state-owned Saudi firm heads a list of oil majors raking in massive sums after ExxonMobil, Chevron, Shell, TotalEnergies and Eni also revealed multi-billion-dollar profits in Q2.

US President Joe Biden blasted ExxonMobil earlier this year as inflation surged, stating it made “more money than God”.

And the future looks bright for Saudi Aramco.

“While global market volatility and economic uncertainty remain, events during the first half of this year support our view that ongoing investment in our industry is essential,” Aramco president and CEO Amin Nasser said.

“In fact, we expect oil demand to continue to grow for the rest of the decade,” he added.

Net income rose 22.7 per cent from Q1 in “strong market conditions”, Aramco said.

Half-year profits were $123.41 billion (US$87.9 billion), up from $66.27 billion (US$47.2 billion) for the same period of 2021.

-Korea’s Lotte Chem paints gloomy petchem outlook for 3Q

South Korean petrochemical producer Lotte Chemical plans to continue investing in various production capacities, including chemical recycling, even as it predicts a gloomier outlook for the petrochemical industry in this year’s third quarter.

This comes after its basic chemicals unit reported a loss of 8bn South Korean won ($6.13mn) in the second quarter, down from a profit of W326bn a year ago.

The loss was because of weak global demand and a sharp rise in feedstock costs, the firm said last week. Heat-resistant-PET-sheet

Lotte Chemical also conducted maintenance at its 1.2mn t/yr cracker in Yeosu from 9 May to 23 June, which weighed on production during April-June, it said.

Lotte Chemical expects a gloomier third-quarter outlook despite lower feedstock costs resulting from falling naphtha prices. It predicts that global demand will weaken further because of inflation and a resurgence of Covid-19 cases.

But this is not deterring the firm from making production investments.

The producer is investing W77bn in a polyethylene terephthalate (PET) chemical recycling plant in Ulsan, with an expected capacity of 45,000 t/yr for Bis (2-hydroxyethyl) terephthalate (BHET) and 110,000 t/yr for chemically recycled PET. The plant will come on line in the second half of 2024, Lotte Chemical said.

Lotte Chemical is also investing W60bn to build a 100,000 t/yr carbon capture and utilisation (CCU) facility in Daesan, which is planned to come on line in the second half of 2023. It plans to use the captured CO2 as a feedstock to manufacture high-purity ethylene carbonate and dimethyl carbonate, which are electrolyte solvents for electric vehicle batteries, as well as sell the CO2 for use as dry ice and as a raw material for semiconductor cleaning solutions. Heat-resistant-PET-sheet

The firm, along with five other South Korean companies including SK Energy and private-sector firm GS Energy, recently signed an initial agreement with Malaysian state-owned energy firm Petronas to develop a cross-border carbon capture and storage project.

-Concerns about chemicals and plastics

A large number of chemicals are used in the production of plastic materials such as polyethylene, polycarbonates, polystyrene or PVC, ranging from the monomers that make up the plastic polymer itself, to a wide range of additives used, for example to soften plastic, colour it or make it less flammable. Heat-resistant-PET-sheet

Plastics and Endocrine Disrupting Chemicals (EDCs)

CHEM Trust has over a decade of expertise of working on the environment and health impacts of Hormone (or Endocrine) Disrupting Chemicals (EDCs), several of which are used in the manufacture of plastic products. Many EDCs are well-known contaminants in the environment and are also found in human tissues.

EDCs are chemicals that can interfere with the endocrine system – the body’s sensitive chemical messaging system. In humans, EDCs have been linked to infertility & reproductive problems, obesity & diabetes, heart disease, and hormone related cancers, such as breast cancer, prostate cancer and testicular cancer.

CHEM Trust has campaigned for many years for the restriction of two particular groups of EDCs which are found in plastic products: bisphenols (including BPA) and phthalates.

Bisphenols

Bisphenols are a group of chemicals used in the manufacture of polycarbonate (a clear and rigid plastic) and epoxy resin (a plastic adhesive used for the lining inside food and drink cans).

Most of the discussion about bisphenols has focussed on bisphenol A (BPA). Plastic products often made with BPA include: Babies’ feeding bottles (this use is now banned in Europe); bottles in water dispensers; plastic tableware; lenses for glasses; plastic sheeting for glazing and more.

Because of the EU’s restrictions on BPA in baby bottles and thermal paper, some companies are now replacing BPA with other bisphenols (BPS, BPF) that are equally worrying – see our report ‘Toxic Soup’ for details.

Phthalates

Phthalates are a group of chemicals, several of which are used as plasticisers to make the hard plastic PVC soft. Typical uses of such PVC include packaging, cables, flooring and roofing and more.

A number of phthalates, including DEHP, are partially restricted in Europe and require an authorisation under REACH for many uses.

Recycling contaminants

Another process potentially exposing consumer to hazardous chemicals in plastics is the recycling of old plastics into new ones, where the old plastic may contain chemicals that are already restricted or banned.

This is a particular issue for phthalates in PVC plastics, and flame retardants in plastic toys and black plastics made using recycled electronics – see our Chemicals and the Circular economy page for more details. Heat-resistant-PET-sheet

Chemicals in food contact materials

Plastic food contact materials – such as pipes in food factories or packaging – are also a concern. As CHEM Trust has been highlighting, chemicals can be identified as being of very high concern in the main EU chemicals law REACH, yet their use in food contact applications is unaffected – see our Chemicals in Food Contact Materials page for more details.

-Volumes impacted at Avgol’s site in Russia

Despite record earnings of $758 million for Indorama Ventures (IVL) in the second quarter 2022, the company’s Fibres business is currently experiencing significant market turbulence.

Combined PET (CPET), the largest of IVL’s three business segments, achieved earnings (EBITDA) of $431 million, up 35% year on year, while the Integrated Oxides and Derivatives (IOD) segment’s earnings were $250 million, up 98% on the same period of 2021 Heat-resistant-PET-sheet

Sales for Indorama’s Fibres segment, however, fell by 15% year on year, and by 35% compared to the first quarter of 2022.

This segment consists of three vertical businesses – Lifestyle, Hygiene and Mobility.

The Lifestyle vertical was impacted by lower demand as a result of the China lockdown while higher freight rates restricted exports.

Meanwhile, the Hygiene vertical was impacted by disruption in spunmelt volumes at Avgol’s Russia site, along with higher polypropylene prices.

IVL’s Hygiene Division primarily serves the nonwovens markets for disposable absorbent hygiene products (AHPs) including baby and adult diapers, femcare articles and wipes and now consists of the following major fibre producers with global operations:

- Auriga Polymers (headquartered in Spartanburg, South Carolina, acquired by IVL in 2011)

- FiberVisions (Duluth, Georgia, acquired in 2012)

- Indorama Asia (IVL’s proprietary polyester plants in China, India Indonesia, and Thailand)

- Trevira (headquartered in Bobingen, Germany, acquired in 2017)

- Wellman International (headquartered in Rosehill, Ireland, acquired in 2011)

IVL also entered the spunbond nonwovens business for AHPs by acquiring a 65% stake in Avgol in May 2018.

Avgol has six production sites globally in Israel, the USA, China and India, as well as Russia, with a combined production capacity of 203,000 tons per annum and employs 900 people worldwide. As a result, there are now IVL products in one out of every two of the 185 billion diapers produced every year, Heat-resistant-PET-sheet

-Continental to harness bio-attributed PVC for automotive interior surface materials

Continental is to use Biovyn, a bio-attributed PVC, from supplier Inovyn in the production of technical and decorative surface materials for its automotive customers. Continental says the move will help reduce its carbon footprint and meet customer demand for sustainable bio-based products. Heat-resistant-PET-sheet

Biovyn is a new generation of PVC grades certified by the Roundtable on Sustainable Biomaterials (RSB). It is a ‘drop-in’ product that is made from a 100% renewable raw material, avoiding fossil-based feedstocks. This product enables more than 70% greenhouse gas savings compared with conventional PVC production.

“Major automotive manufacturers are now demanding more sustainable raw materials such as biobased polymers,” explained Dr Dirk Leiß, who leads Continental’s surface solutions business area.

-How long can PET bottle chip market sustain low stock and high O/R

Since Jul, PET bottle chip factory delivery has become increasingly tight, and the average factory inventory is now less than a week. Under supply shortage, the average operating rate of PET bottle chip industry rose to 103.5%, hitting record high, and plants sustained this high run. Can the factories continue to operate at such a high rate in Aug-Sep? Will PET total inventories drop again?

First, from the point of view of orders, sales pressure of several major bottle chip factories in the third quarter is not big, and orders to be delivered are very sufficient, but delivery is a headache. Therefore, factories may not take the initiative to arrange maintenance before the end of September, and the maintenance plans may be postponed to the end of the year, from which we can infer that in the absence of policy or other external factors, the high O/R of the PET bottle chip plants is likely to continue until the eve of the fourth quarter.

At present, most factories have sold out August goods, and only few is available for sale, and more than half of Sep goods have been sold out. In terms of export, major bottle chip manufacturers have shifted to October goods, and some factories can still sell September materials, but the quantity is not much left. Some factory is reported to have no supply of goods for sale in the second half of the year. Because some export orders were delayed for a month due to the epidemic, and some spot goods were repeatedly oversold during this period, under the influence of intensive delivery in Jul-Aug, market supply tightened further. Traders who had been shorting all the way in the early days were heard have some disputes due to the implementation of shipments.

Heat-resistant-PET-sheet