PEF – Plastics-waste-recycling 01-09-2022 - Arhive

PEF – Plastics-waste-recycling

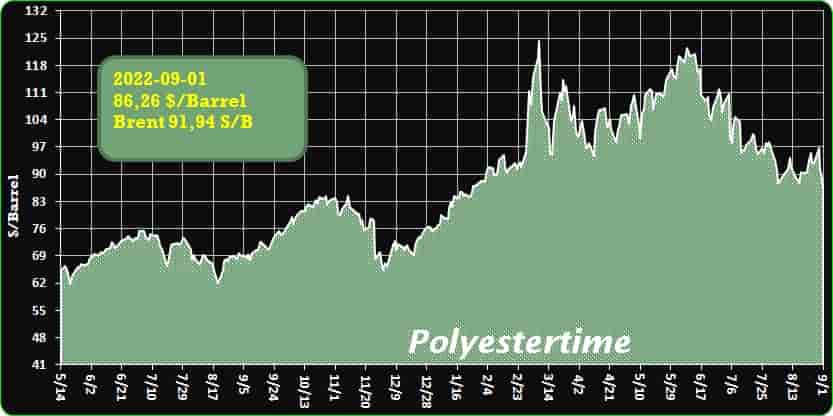

Crude Oil Prices Trend

-Anellotech demos direct route to light olefins and BTX from mixed plastic waste

In the United States (US), sustainable technology company Anellotech Inc. has announced that it has, for the first time, continuously processed solid, post-consumer plastic waste into light olefins and aromatics using its “Plas-TCat” catalytic pyrolysis technology.

According to a statement, the processing trial took place at Anellotech’s “TCat-8” fully automated, 30-meter-tall pilot plant near Houston, Texas (TX).

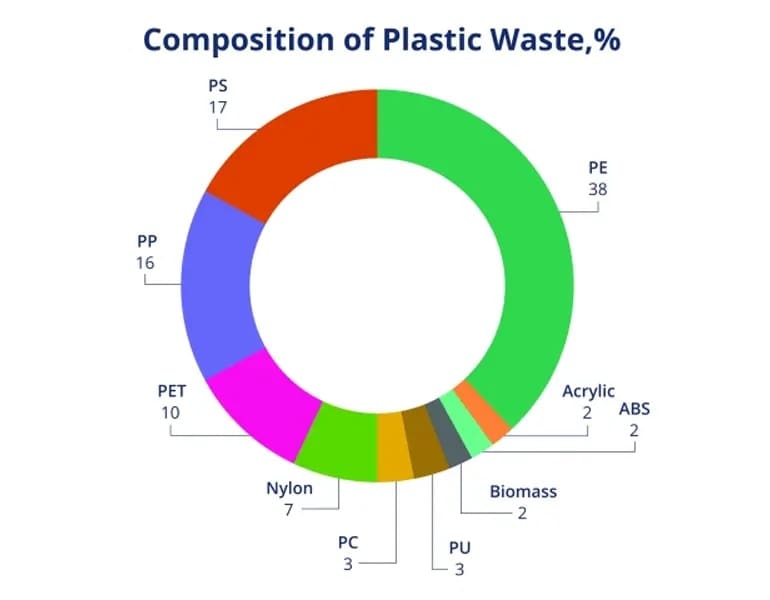

The waste consisted of a mixture of all major plastic types, with the exception of polyvinyl chloride (PVC).

The plant’s nameplate capacity is 0.5 tonnes per day, and Plas-TCat’s scalable fluidized bed (FB) reactor design provides a path to larger commercial production plants capable of addressing substantial global recycling goals.

Feedstock flexible

Plas-TCat employs one thermal catalytic reactor to convert a broad range of mixed waste plastics into the same valuable chemical feedstocks used today to make virgin plastics.

These include benzene, toluene, and xylene (BTX) as well as ethylene, propylene, and butylene (light olefins). PEF – Plastics-waste-recycling

Based on a proprietary catalyst and fluid bed reactor-regenerator system, Plas-TCat provides a new, direct route to light olefins and aromatics from heterogeneous plastic waste streams—without the need for steam cracker furnaces.

Plas-TCat is advantageous due to its high olefin and aromatic hydrocarbon selectivity, high scalability, broad feedstock tolerance, as well as its substantial carbon dioxide emissions savings compared to industrial steam crackers, said David Sudolsky, President and CEO of Anellotech.

The technology can effectively process a wide range of waste plastics, alone or within composites. This includes polyolefins, polyamides (nylon), polyethylene terephthalate (PET), polycarbonate, and polystyrene (PS).

With the completion of these continuous process runs Plas-TCat is now at Technology Readiness Level (TRL) 6. Trials planned for later in 2022 will be run to confirm promising laboratory yields for Plas-TCat.

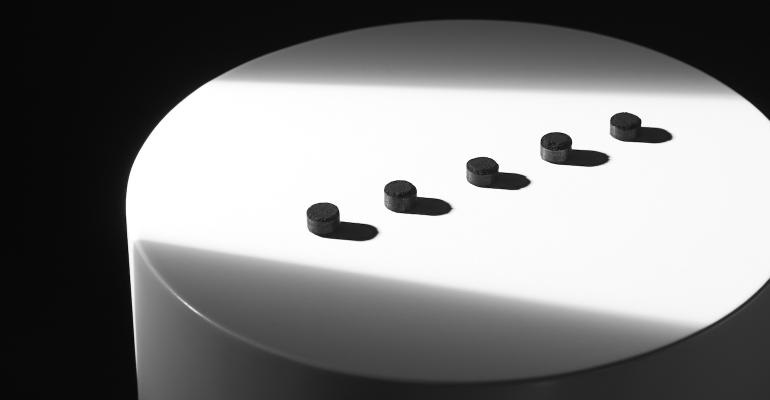

-LG Chem to Build Fourth Carbon Nanotube Plant

The new 3,200-tonnes/year plant is slated to begin operation in 2024. Carbon nanotube demand has been growing rapidly, particularly for electric vehicle battery materials.

LG Chem is expanding its investment in carbon nanotubes (CNT) with the construction of the world’s largest single-line CNT manufacturing plant. The new plant is part of LG Chem’s initiative to gain a more competitive edge in the rapidly growing global CNT market focused on electric vehicle (EV) battery materials.

The new facility will be LG Chem’s fourth CNT plant, following its 1,200-tonnes/year Plant 3, whose construction commenced early this year with start-up slated for 2023, and 1,200-tonnes/year Plant 2, which has been operational since 2021. The new plant will be built in LG Chem’s Daesan Complex, located 80 kilometers southwest of Seoul, with construction commencing in the first half of next year and operation beginning in the second half of 2024. PEF – Plastics-waste-recycling

CNT is a next-generation material offering the equivalent level of electricity and thermal conductivity as copper and diamond and 100 times the strength of steel. Due to its excellent properties that surpass existing materials, CNT has a range of applications in batteries, semiconductor wafer trays, automotive components, and surface heating elements.

Structural composites among growth areas

The global CNT conductive additive market is expected to grow by 30% to $2.3 billion, with CNT demand increasing from 5,000 tonnes in 2021 to 70,000 tonnes by 2030. The overall multiwall CNT market is forecast to grow from $5.25 billion in 2021 to $10.74 billion in 2028, according to market analyst Insight Partners. Structural composites and concrete additives are among the applications earmarked for growth in its report, Multi-Walled Carbon Nanotubes Market Forecast to 2028 – COVID-19 Impact and Global Analysis by Application.

The 3,200 tonnes of CNT to be produced annually at Plant 4 will contribute to LG Chem’s total carbon nanotube production capacity of 6,100 tonnes/year across four plants. LG Chem has been operating CNT plants since 2017, starting with the 500-tonnes/year CNT Plant 1, and has been constructing new plants every year since 2020 to meet growing demand.

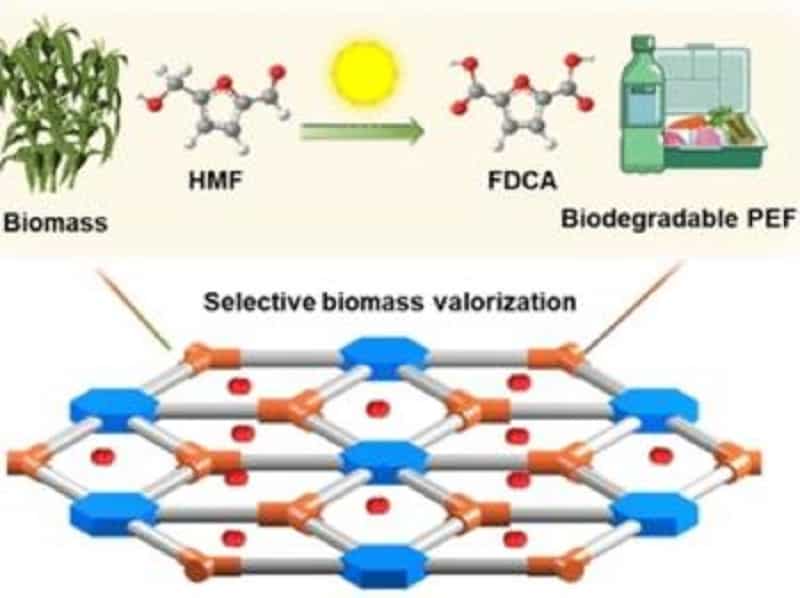

Efficient titanium-based catalyst used to produce PEF, the biobased alternative to PET

One possible replacement for drink containers made from PET is polyethylene furandicarboxylate (PEF), made from renewable resources. However, the production of the raw material for PEF from biomass is still rather inefficient. A new titanium-based photocatalyst could be about to change this, making it more economical to access the raw material for PEF from biomass, as a team of researchers report in the journal Angewandte Chemie.

In the valorization of biomass, the key chemical 5-hydroxymethylfurfural (HMF) is first obtained from the mix of natural substances. PEF is a recyclable plastic that can be produced from HMF. As PEF has very similar properties to PET, the most commonly used material for plastic bottles, it is used as a biobased replacement. However, the production of PEF is still expensive, due in large part to the difficulty in producing the raw material for PEF from HMF.

To produce the raw material for PEF, HMF must be oxidized, and this step is inefficient for two reasons. First, unwanted byproducts are formed during oxidation with atmospheric oxygen. In addition, the titanium-oxide-based catalysts available to date require UV light. Since UV light only makes up a small portion of the spectrum of sunlight, the efficiency of this photocatalytic reaction is low, making the process expensive.

A group of researchers headed by Ya-Qian Lan and Yifa Chen of the South China Normal University (SCNU) in Nanjing, China, have now developed a titanium-based photocatalyst that overcomes both obstacles. PEF – Plastics-waste-recycling

A titanium component in conjunction with an organic oxidizing group forms flat, crystalline nanosheets from an organometallic framework. By chemically linking the titanium with the organic components, the light absorption shifts from the UV to the visible range, considerably increasing efficiency, say the team.

The reaction is also highly selective, as relatively few reaction partners are required and virtually no waste is formed.

Original publication

Austrian textile giant Lenzing’s new €400 million factory in Prachinburi, Thailand, is the world’s largest production plant for the eco-friendly so-called “miracle fabric” lyocell.

The start of operations at European textile giant Lenzing’s recent opening of the world’s largest production plant for the eco-friendly fibre lyocell exemplifies Thailand’s status as a hub for green and sustainable investments, according to an article pub-lished on the Thailand Board of Investment (BOI) website.

Like numerous other foreign investors, Lenzing in part chose Thailand for its strategic location and connectivity at the heart of Asia. But the Austrian multinational with op-erations on four continents also decided to build its euro 400 million (around THB 1 billion) factory there because of Thailand’s commitment to sustainable growth through a model known as the Bio-Circular-Green Economy, or BCG, the article said.

Thailand has become a land of sustainability for environment-conscious businesses. In 2021, foreign and local investors committed to 149.5 billion baht ($4.2 billion) worth of BCG-related investments in Thailand – more than double the figure for the previous year, according to official data.

In the first half of 2022, the trend continued, with inves-tors pledging a further 80 billion baht. The BOI offers generous tax breaks and other incentives to companies aligned with the BCG goals in sectors such as food pro-cessing, biofuel, bioplastics, biotechnology, renewable energy and recycling. PEF – Plastics-waste-recycling

The article cited as an example the French – Dutch joint venture Total Corbion PLA, which opened in 2018 in Thailand’s Eastern Economic Corridor a $250 million plant that converts local cane sugar into polylactic acid (PLA), a renewable and biodegrada-ble alternative to polystyrene and other oil-based polymers. In 2021, the partners an-nounced the venture has upped annual production from 75 to 100 million tonnes to meet demand.

Lenzing, which targets to cut its greenhouse gas emissions by 50 percent by 2030, is recognised as the leading producer of lyocell, a wood-based fibre that’s 100 percent biodegradable and compostable, requires no harmful chemicals and recycles 99.5 percent of solvent used in its production through an innovative circular closed-loop process. The new factory, which opened in March 2022 in Prachinburi, 140 kilometres east of Bangkok, runs on green biogenic energy and relies on sustainable water sup-ply to produce 100,000 tonnes of lyocell every year.

“Thailand with its commitment to sustainability fitted with our clear long-term vision,” the BOI article quoted Lenzing Vice President and Senior Project Director Ismail Ab-dullah as saying. “Here we will be able to transform our manufacturing and support our ambitious climate targets. For Lenzing, this project represents a very important step towards a carbon-free future.”

-‘Fast tech’ is unsustainable: The circular economy is the smart answer for growth

Designing durable, reusable, and recyclable products helps tech companies challenge the reign of ”fast tech”

With the pace of innovation ever increasing, technology can feel antiquated, fast. Consumers, as well as businesses, have become accustomed to upgrading devices regularly and discarding “outdated” tech. But what happens to last year’s laptops, mobile phones and tech accessories? PEF – Plastics-waste-recycling

According to the United Nations, the world produces more than 50 million tons of electronic waste per year. Much like the fashion industry has had to come to terms with the dark side of so-called “fast fashion”—cheap, environmentally damaging clothing created quickly to mimic runway trends—the tech industry must reckon with the environmental implications of “fast tech.”

Whether knowingly or unknowingly, some tech companies are feeding into the idea of planned obsolescence — creating less-durable products for the sake of introducing new ones on a regular basis. There is a better way, and it lies in the circular economy.

Unlike the linear economy, in which companies mine natural resources to make products that are designed to be discarded, the circular economy closes the loop. Materials and products are designed to be more durable, reusable, repairable, and recyclable, thereby extending product life cycles and curbing waste. This approach can make a tremendous impact on the environment. A study published in Science found that plastic use can be reduced by nearly 80% in the next 20 years, in part, by adopting circular economy practices across the supply chain.

Circular Economy benefits, and barriers

While companies in various sectors can reduce waste by adopting a circular economy model, tech companies have a significant opportunity to create change by rethinking product design and inspiring consumers to expect more from their devices. But, doing so is not simple. Sustainable processes and materials typically cost more than those used in a linear economy approach. Furthermore, adopting circular economy practices requires operational changes as well as the subject matter expertise to implement them correctly. Product design can also be a barrier. PEF – Plastics-waste-recycling

-China’s industrial performance recovers despite dip in profits: NBS

China’s industrial activity levels have stayed on their path to recovery in spite of profits falling a bit due to several reasons, according to the country’s National Bureau of Statistics (NBS). Industrial business firms, which had an annual business revenue of a minimum of 20 million yuan or around $2.92 million, had their profits down by 1.1 per cent year-on-year from January to July 2022, touching 4.89 trillion yuan.

However, the collective earnings of the industrial firms went up by 8.8 per cent year-on-year to 76.57 trillion yuan. It was found that 16 out of 41 major industries witnessed a rise in profits in the first seven months of 2022 and 14 of them declared growth of more than 5 per cent. The profits of the equipment manufacturing industry grew by 6.8 per cent year-on-year in July 2022, which is 2.7 percentage points higher than the growth reported in June 2022. PEF – Plastics-waste-recycling

“As China took stronger steps to ensure the energy supply, the expansion of the coal and crude oil output, as well as energy production, has driven up the profit growth of related industries,” NBS senior statistician Zhu Hong was quoted as saying by Chinese media reports. The country’s coal mining sector showed that profits during the January-July 2022 period went up 1.05 times when compared to the corresponding period from the previous year, which added to the 10.3-percentage-point growth of the gains of big industrial firms.

-PET recycling company starts regular operations

A sneak-peek into production: The new recycling line (Photo: Herbold Meckesheim)

Turkish recycling company Futurapet (Düzce; www.futurapet.com.tr) has invested an undisclosed amount in a new PET recovery plant, which was recently put into operation. Futurapet is a spin-off of Turkish consumer goods group Engin Grup (Istanbul; www.engingrup.com). The agreement with German machine maker Herbold Meckesheim (Meckesheim; www.herbold.com) on the construction of the recycling line also marked the founding of Futurapet in 2020. PEF – Plastics-waste-recycling

According to information from Meckesheim, the “largest single-line recycling system” that the machinery manufacturer has installed to date is designed for a daily output of 90 t/d, the equivalent of an annual production volume of more than 30,000 t/y of PET recyclate, which can then be used for producing both films and bottles.

Engin Grup describes its plastics waste recycling spin-off in Düzce, some 200 km east of Istanbul, as an “important investment”.

-Pricing, supply of PE, PP remain hard to predict

For resin market knowledge, it’s hard to top Kathy Hall and David Barry.

Hall and Barry have been covering resin markets for more than a decade for PetroChem Wire, which now operates as PCW by OPIS and is a unit of Dow Jones. Hall — who founded PCW in 2007 — serves as the unit’s executive director, while Barry is associate director.

The pair recently took some time to share some insights on current resin markets, which are being pushed and pulled by many factors surrounding the global economy.

Q: What have been the biggest growth markets for polyethylene, polypropylene and other commodity resins so far in 2022?

Hall: I think the demand pattern of most significance in 2022 is that the segments that saw tremendous growth in 2020 and 2021 have abated. For example, plastic goods related to home improvement projects were flying off the shelves during a steady spate of lockdown-inspired DIY projects. PEF – Plastics-waste-recycling

But how many times a year does one remodel? Appliances, plastic decking, doors, windows and floors are not annual purchases, and their pull on resins has certainly lessened.

Barry: I agree that a lot of the pandemic-driven boom in personal protective equipment (PPE) packaging and bottled soaps and sanitizers has faded, along with plastic decking and lawn furniture businesses that benefited from people wanting to spend more time in their backyards. However, with the pandemic winding down and stimulus funds still in the bank, we heard about a revival of municipal infrastructure projects. Infrastructure spending, along with high energy prices, has made PE pipe a strong growth market this year.

Q: What impacts are these markets seeing from inflations and higher interest rates?

Barry: A couple of observations here. Higher interest rates make it more expensive for processors to carry inventory, whether that’s resin or finished goods, which may have contributed to the destocking trend we heard saw this summer. Also, inflation has caused the average consumer to opt more for the less expensive store brands and less for the premium brands and discretionary goods. I don’t know how much this has affected PE demand in aggregate, but it has caused some market share shift at the retail level.

Q: What impact will new PE (Shell) and PP (Heartland) capacity have?

Hall: As with any project, the new supply does get baked into the demand forecast and much of the new product is typically contracted before the project is even through with the investment decision process. That said, the new capacity will take several years before overall demand catches up with it. PEF – Plastics-waste-recycling

This is why when such massive amounts of new product begin to be produced, the entire market feels it, and exports play a key role in balancing supply. This could prove challenging in this environment of shipping delays and ports already clogged with inventory, and the only alternative to balance the market is to throttle back production.

Q: Expectations for 2023? Do you see markets stabilizing?

Hall: If we knew the future with certainty, we’d play the lottery! But we do always have a solid indicator of sentiment from the monomers’ futures markets. Right now, ethylene’s forward curve is in a slightly backward-dated shape, meaning that prices in August and September are slightly higher than they are in the months to come. Ethylene’s forward curve flattens in early 2023, which indicates either a lack of belief that prices will change much or that there is a profound lack of interest in trading that market at this time.

PEF – Plastics-waste-recycling