Petrochemicals Nylon66 AdipicAcid 22-08-2020 - Arhive

Petrochemicals Nylon66 AdipicAcid

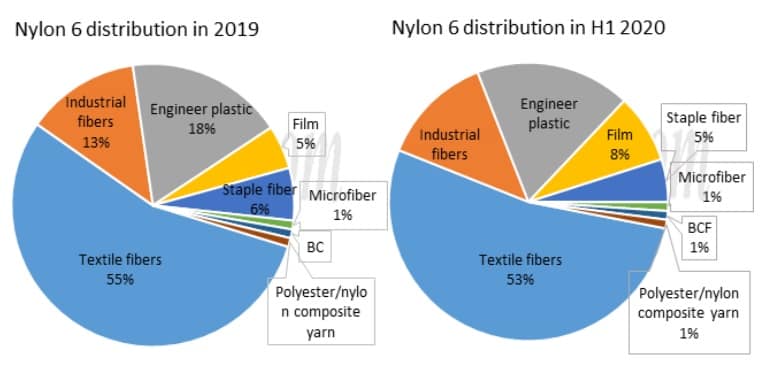

-Shifts of nylon 6 demand distribution in H1 2020

In 2020, affected by the global spread of the COVID-19 pandemic, demand in many fields has shrunk. But the actual CPL production in the first half of the year has increased by 1% year-on-year, and the supply of nylon 6 has not shrunk. How is the production of PA6 distributed in the first half of the year?

Demand in nylon downstream sectors in H1 2020

Of all the various downstream fields of nylon, consumption of nylon films was the only one that grew significantly in the first half of 2020. This was mainly driven by surging demand for convenient and fast food at the early stage of the pandemic around the world, which drove the demand for nylon film. Particularly in March and April, when the pandemic was spreading fast outside, nylon film exports surged. The output of nylon film grew 35% year-on-year, and the proportion of nylon distribution to film grew 3 percentage from 5% in 2019 to 8% in H1 2020.

-Crude prices fall amid gloomier global recovery outlook

Crude oil futures dipped on Aug. 14 as a wave of reports last week painted a gloomier economic outlook with slower demand recovery as the coronavirus pandemic continued to take its toll, reported S&P Global. Petrochemicals Nylon66 AdipicAcid

Despite more bullish US news this week in the form of weaker crude production and falling storage volumes, the global picture remained more bearish, with forecasts of lower-than-expected worldwide demand as the OPEC+ alliance increases its output, more US shale producers reverse curtailments and more tankers unload their stored oil.

NYMEX September WTI fell by 23 cents and settled at USD42.01/b, while ICE October Brent dipped by 11 cents to reach USD44.85/b. Crude prices have remained tightly rangebound since late June.

-Polyester market witnesses improving performance and stabilizing mindset in Aug

Market atmosphere on polyester market has improved in Aug compared with Jul, exerting active influence on the whole industry.

Recovery from low price was a major reason for this wave of uptrend.

PFY, which suffered huge losses before, increased the most among polyester products. That meant lower price was relatively safer. Improvement of PSF was limited, and PET bottle chip market remained in doldrums. Petrochemicals Nylon66 AdipicAcid

Operating rate of twisting units and fabric mills gradually ascended since late-Jul. Meanwhile, stocks of grey fabric descended with better orders. However, diversified performances were seen in various regions. Orders for knitted fabric were relatively better, especially warp knitting fabric in Haining. Water-jet fabric mills in Shengze witnessed weak appearance, and some plants were still bothered by high stocks. Overall run rate of downstream market was rising now.

-US, China to hold trade talks ‘in coming days’: Beijing

China and the US have agreed to hold trade talks in the coming days, China’s commerce ministry said today.

The brief comments were made in response to a question at the ministry’s regular press conference and did not include any further details. Petrochemicals Nylon66 AdipicAcid

The status of trade talks between the two countries has been plunged into confusion in recent days, after US President Donald Trump said he had postponed talks to review the phase-one trade deal because of his anger over China’s handling of the Covid-19 outbreak. A senior US administration official later said no talks had been scheduled.

-Shell uses plastic waste to produce resin feedstocks

Shell’s ambition is to use one million tonnes of plastic waste a year in its global chemical plants by 2025.

Shell says that it has successfully made “high-end” chemicals using a liquid feedstock made from plastic waste using a pyrolysis process that is considered a breakthrough for hard-to-recycle plastics. The initiative advances Shell’s ambition to use one million tonnes of plastic waste a year in its global chemical plants by 2025.

Atlanta-based Nexus Fuels LLC recently supplied its first cargo of pyrolysis liquid to Shell’s chemical plant in Norco, LA, where it was made into chemicals that are the raw materials for everyday items. Shell Chemicals manufactures ethylene, propylene, and butadiene at the site. Petrochemicals Nylon66 AdipicAcid

Injection moulding company Denroy Plastics has poured its expertise into aviation, medical and automotive thermoplastics, for the design and manufacture of clinical grade PPE, and has already supplied more than a million units of its HeroShield visors to UK NHS frontline staff. Petrochemicals Nylon66 AdipicAcid

Designing and developing their own tooling, Denroy have produced the recyclable visor at their Northern Ireland manufacturing site. Manufactured from PP and PETG sheet. HeroShield is a light, clear, antifog visor that protects the whole face.

-US ethylene margins recover to February levels on buoyant demand

US ethylene margins have recovered to February levels following a March-May plunge caused by rising feedstock costs and muted demand.

Margins have more than tripled since mid-May, after dropping 73% during the preceding three months. Petrochemicals Nylon66 AdipicAcid

US ethane steam cracking margins

Ethylene margins faced compression in the first half of the year as a wave of new cracking capacity and delayed derivative start-ups stranded supply.

The onset of the coronavirus crisis in the US amplified the supply-demand imbalance as certain derivatives had demand curbed by containment efforts.

-Investing in High-Quality PET Plastic Recycling Machinery

Have you and your colleagues been planning to invest in quality PET plastic recycling equipment? Companies across the recycling industry count on Twinsburg, Ohio’s PlastiWin Capital Equipment, LLC for leading plastic processing equipment purchasing and sales, along with a variety of other services. Petrochemicals Nylon66 AdipicAcid

With this in mind, you can learn more about the PlastiWin Capital Equipment, LLC team, and its work by visiting the company website.

-Fraunhofer develops upcycling process for post-consumer PLA waste

Designed for performance and durability, plastics have become an indispensable part of everyday life. However, poor waste management has led to the accumulation of plastic in the environment. Petrochemicals Nylon66 AdipicAcid

In order to solve this issue, the European Union has embarked on a transition to a circular system in which plastics are reused, repaired and recycled plastics. It also aims to produce plastics that are made from renewable resources (bio-based plastics). Polylactic acid (PLA) is one of the most promising and frequently used polyesters in this category.

Flexible and versatile, PLA is used in applications ranging from disposable cutlery and degradable sutures to rigid packaging and extrusion coatings, although the dominant market for PLA is food packaging.

-PEF as a multilayer barrier technology: a sustainable way to enable long shelf life in PET bottles

Performance of PET/PEF/PET multilayer bottles

Avantium Renewable Polymers, a 100% subsidiary of Avantium, plans to build a flagship plant for the production of FDCA (furandicarboxylic acid), a monomer for high performance polyesters such as PEF (polyethylene furanoate). Petrochemicals Nylon66 AdipicAcid

The plant, which is aimed to be on-stream at the start of 2023, will have a nameplate capacity of 5 metric kilotons per year and be located in Delfzijl, the Netherlands.

Petrochemicals Nylon66 AdipicAcid