Petrochemicals Synthetic Fabrics Polylactic 26-03-2020 - Arhive

Petrochemicals Synthetic Fabrics Polylactic

Crude Oil Prices Trend

Natrellis™ package for refrigerated, frozen and prepared foods launching in April with PRIMAL KITCHEN®

Sonoco (NYSE: SON), recently named to Barron’s 100 Most Sustainable Companies, in partnership with Tellus®, a packaging company based in Belle Glade, Fla. and jointly owned by Florida Crystals Corporation and Sugar Cane Growers Cooperative of Florida, today announced the introduction of its first, 100% U.S. sourced, sugarcane-based fiber bowl for refrigerated, frozen and prepared foods.

Branded as Natrellis™, the fiber bowl is dual-ovenable, PFAS-free, and provides an alternative to more traditional rigid plastic packages used by the majority of refrigerated and frozen food products on the market.

-Ethanol cutbacks keep pressure on corn prices

Corn futures continue to flirt with contract lows as ethanol producers curb production amid tumbling oil prices.

May corn futures fell by 2¢/bushel today toclose at $3.42/bushel, about 2pc above the contract low reached on 18 March, and they are poised for further price headwinds as demand from ethanol producers wanes. Petrochemicals Synthetic Fabrics Polylactic

Traders today said ethanol producers have curtailed output to mitigate losses stemming from plunging oil prices. Ethanol producer margins fell further into the red after oil prices plunged following the breakdown in the Opec+ supply negotiations earlier this month.

-China’s LLDPE prices fall to lowest since 2008

Prices of linear low-density polyethylene (LLDPE) film in China have fallen close to a 12-year low on the back of weak demand amid the coronavirus pandemic.

Argus data showed that LLDPE film prices in China, on a midpoint basis, were at $780/t, the lowest since 28 November 2008.

Low crude oil prices are weighing on buying sentiment for polymer resins.

Polymer plants in China are increasing production to 80-90pc after weeks of reduced operations.Petrochemicals Synthetic Fabrics Polylactic

-Direct-spun PSF plants partly operate by futures mode

Affected by the epidemic, the market kept falling after Spring Festival holiday. Especially crude oil price slumped close to $20/b, followed by polyester feedstock.

Direct-spun PSF decreased a bit more slowly, so its cash flow was considerable.

Upon high cash flow of direct-spun PSF, downstream buying interest was thin though the price has declined below 6,000yuan/mt. At present, downstream expected the price to move down to about 5500yuan/mt.Petrochemicals Synthetic Fabrics Polylactic

However, direct-spun PSF plants did not show strong willingness to undersell with low inventory.

In addition, as crude oil and polyester feedstock rebounded and tended stable, downstream plants more intended to go bottom fishing, but with adequate stocks of raw materials and high spot price, operation by futures mode appeared.

-Asia polymers face more weakness as virus cuts demand

Polymer prices in Asia are coming under further pressure because of a lack of resin demand as the region grapples with the coronavirus pandemic.

Polypropylene (PP) and polyethylene (PE) prices have steadily declined since the coronavirus outbreak worsened in January, and the search for a bottom continues.

Spot prices of linear low-density PE (LLDPE) film in China fell close to a 12-year low last week, while PP raffia prices slumped to a four-year low.Petrochemicals Synthetic Fabrics Polylactic

Argus assessed LLDPE film prices in China at $770-790/t cfr and PP raffia prices at $800-830/t cfr on 19 March.

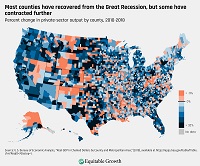

-Coronavirus Pandemic Losses Exceeded Damage from 2008 Financial Crisis

Losses from the coronavirus pandemic have already exceeded the damage from the global financial crisis of 2008 and from the terrorist attacks of September 11, 2001, Interfax reports with reference to an interview with the BBC broadcaster, Jose Angel Gurria, Secretary General of the Organization for Economic Cooperation and Development (OECD)

“Even if there is no global recession, we will get either zero or negative growth in many countries of the world, including the largest.

Because of this, global growth will not only be low this year, but will also be restored for a long time,” Gurria said.Petrochemicals Synthetic Fabrics Polylactic

-Europe benzene March spot prices crash over 50% since Monday

Europe benzene spot prices for March have halved in value in less than 24 hours on the back of collapsing demand.

March was valued at $150-170/tonne on Tuesday afternoon, which is a $185-190/tonne decrease over values seen on Monday.

April traded earlier at $150/tonne and at $180/tonne, and twice for H1 April at $175/tonne. Petrochemicals Synthetic Fabrics Polylactic

“Demand in Europe is bad,” a trader said, adding that consumers were selling.

On Monday, benzene for April traded at $300/tonne.

European Bioplastics (EUBP), the association representing the interests of the bioplastics industry, has elected a new board with François de Bie of Total Corbion PLA as its chair.

EUBP’s new Vice Chairpersons, Mariagiovanna Vetere (NatureWorks) and Lars Börger (Neste), will lead the association’s continuous support towards achieving a circular economy.Petrochemicals Synthetic Fabrics Polylactic

De Bie said: “It is a pivotal time for our industry as the European Union is serious in developing from a linear to a circular economy. This provides us with a unique opportunity.

-S&P Global Ratings expects US GDP to contract at least 12% YOY in Q2

Washington — S&P Global Ratings expects US GDP to contract at least 12% year over year in the second quarter due to the impact of the actions taken by the national and local governments and businesses to limit the spread of the coronavirus.

The rating agency’s previous estimate was for a 6% decline in growth.

“It’s now clear that the hit to global economic activity from the measures to slow the spread of the coronavirus pandemic will be massive,” S&P Global Ratings said, warning that downside risks to its forecasts continue to grow.Petrochemicals Synthetic Fabrics Polylactic

-Coronavirus, Industry, market

The car market is in free fall, as a result, more and more manufacturers are stopping production. The situation is no different for household appliances, fashion, textiles, construction and all related industries. Petrochemicals Synthetic Fabrics Polylactic

In addition, the staff are reduced to the bone. These are why even without many government decrees, factories are destined to stop.

In general, almost all sectors not related, even indirectly, to food and health, will soon be forced to close. The food producers themselves have difficulties in collecting the products (lack of staff) and in selling them (people prefer canned or long-life products).

UK Liverpool : Empty supermarket shelves

Petrochemicals Synthetic Fabrics Polylactic